|

市場調查報告書

商品編碼

1640654

北美專業雲端服務:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)North America Professional Cloud Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

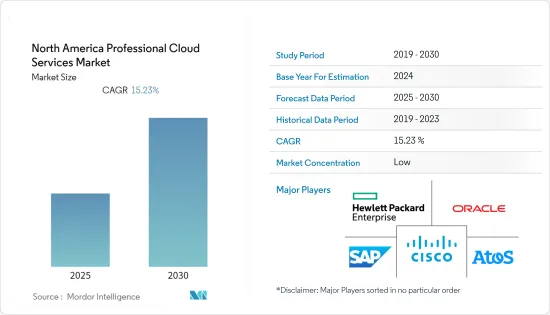

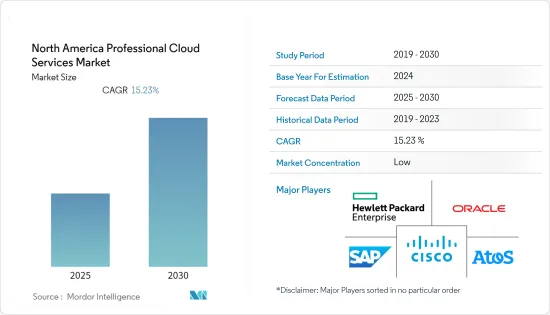

預計預測期內北美專業雲端服務市場複合年成長率將達到 15.23%。

主要亮點

- 專業的雲端服務使消費者能夠部署不同類型的雲端服務。雲端是 IT 轉型的催化劑,讓您可以靈活地將您首選的雲端與現有的內部部署基礎架構按照最適合您工作負載的比例結合。

- 在新冠肺炎疫情期間,許多企業被迫改變法規和政策以確保員工安全。如前所述,業務中斷的最大原因是無法調動勞動力和調整人員。無法旅行、跨境和保持社交距離迫使企業改變目前的運作方式並重新考慮其業務選擇。

- 採用雲端的關鍵促進因素是減少資本支出、降低 IT 管理複雜性以及快速部署新應用程式的能力。這些因素正在推動企業採用雲端基礎的平台。現代多租戶雲端平台服務允許成千上萬的客戶存取相同的資源。這可以大大節省勞力和相關成本。

- 最成功的雲端營運商谷歌的存在證明了從雲端交付大規模基於網路的應用程式的可行性。微軟目前正在雲端基礎的平台上提供服務,是北美該市場的主要推動力之一。

- 與效能相關的問題和資料安全問題是該行業面臨的主要挑戰。然而,最近的技術進步正在努力糾正這些問題,並使公司能夠專注於其核心競爭力。

北美專業雲端服務市場趨勢

混合雲端預計將在市場中實現高成長

- 混合雲端將公共雲端供應商(例如 Google Cloud 或 Amazon Web Services)與私有雲端結合在一起。隨著運算需求和成本的變化,混合雲端允許工作負載在公共雲端雲和私有雲端之間移動,從而為企業在部署資料方面提供了更大的靈活性和更多的選擇。

- 該地區的公司正在推出新產品和服務以獲得競爭優勢。例如,惠普企業推出了 HPE GreenLake 混合雲,旨在協助客戶管理和最佳化其內部部署和外部部署雲端。 HPE GreenLake 混合雲跨領先的雲端解決方案(包括 Microsoft Azure、AWS 和 Azure Stack)提供對客戶環境的持續管理和最佳化。

- 此外,各種規模的組織都在從傳統商業模式轉變為數位商業模式。這種轉變催生了混合雲端市場,因為它具有降低整體擁有成本(TCO)、提高安全性、靈活性和敏捷性等優勢。 IBM 表示,89% 的 IT 領導者希望將業務關鍵型工作負載轉移到雲端,這一切都源自於數位化程度的提升。

- 該地區混合雲端的採用正在增加,包括本地和外部部署。根據政府新聞和分析公司 MeriTalk 的一項調查,2021 年,92% 的聯邦 IT 經理同意混合雲端是彈性政府的最佳營運環境。此外,超過三分之二(67%)的受訪者表示,COVID-19 使其組織採用混合雲端的速度加快了一年或更長時間。

- 此外,思科預測,到 2021 年,73% 的雲端工作負載和運算執行個體將駐留在公共雲端資料中心,高於 2016 年的 58%(五年複合年成長率為 27.5%)。

- 此外,去年北維吉尼亞的資料中心淨吸收量在美國主要資料中心市場中最高,達到 303.3 兆瓦。資料中心部署的這種趨勢預計將加速專業雲端服務市場的成長。

預計美國將成為最大市場

- 雲端服務市場由美國主導。該地區是雲端運算服務的早期採用者。此外,該地區已表現出在各個領域採用雲端服務技術的強烈意願。

- 根據Stormforgein在2021年4月發布的報告,18%的北美受訪者表示其組織的雲端運算支出在每月10萬至25萬美元之間。此外,44% 的受訪者預計未來一年雲端運算支出將小幅增加,另有 32% 的受訪者預計其組織的雲端運算支出將在未來一年大幅增加。

- IT 部門已經開始接受這項技術。北美雲端運算服務的一個新興領域是醫療保健產業。該技術已經超越了資料存儲服務,現在的重點是如何利用該技術來改善和個性化患者照護,同時降低成本。

- 大規模採用的關鍵促進因素是組織對基於 SaaS 的服務的傾向以及對數位化商務策略的採用。此外,預計在研究期間對資料和基於隱私的雲端服務的需求將持續成長,從而使主要供應商能夠享受更多的市場成長機會。

北美專業雲端服務產業概況

市場競爭格局較分散,主要企業如下:思科系統公司、甲骨文公司、Atos SE、SAP SE 和惠普企業公司。

2022 年 8 月,IBM 宣布與 VMware 合作提供混合雲端解決方案。此次合作是雙方共同打造的雲端服務,旨在幫助金融服務、醫療保健和公共部門等行業的公司降低在混合環境中部署關鍵任務工作負載的成本和風險。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 市場促進因素

- 市場限制

- COVID-19 市場影響評估

第5章 市場區隔

- 依部署類型

- 民眾

- 私人的

- 混合

- 按服務模式

- Platform-as-a-Service

- Software-as-a-Service

- Infrastructure-as-a-Service

- 按最終用戶產業

- 衛生保健

- 零售

- 娛樂和媒體

- 政府及公共機構

- BFSI

- 資訊和通訊技術

- 其他最終用戶產業

- 按國家

- 美國

- 加拿大

第6章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- Cognizant

- Accenture PLC

- Dell EMC

- Microsoft Corporation

- Fujitsu Limited

- Capgemini SE

- Infosys Limited

- Nippon Data Systems Ltd

- HCL Technologies Limited

- Oracle Corporation

- NTT Data

- Atos SE

- SAP SE

第7章投資分析

第8章 市場機會與未來趨勢

The North America Professional Cloud Services Market is expected to register a CAGR of 15.23% during the forecast period.

Key Highlights

- Professional cloud services allow consumers to deploy various types of cloud services. Cloud acts as a catalyst for IT transformation, delivering the flexibility to combine the preferred clouds and existing on-premises infrastructure in the ratio best suited for the workload.

- Maintaining employees' safety during COVID-19 forced many corporations to change their regulations and policies. As stated earlier, the foremost cause of the business disruption was the inability to move the workforce and coordinate HR. The inability to travel and cross borders and social distancing forced businesses to change their current ways of functioning and reconsider operational choices.

- The primary drivers for cloud adoption are reducing capital expenditure spending, IT management complexity, and the ability to deploy new applications faster. These factors are helping companies adopt cloud-based platforms. Modern, multi-tenant cloud platform services enable thousands of customers to use the same resources. This results in saving a lot of the workforce and the expenses involved.

- The presence of Google, the most successful cloud operator, has proven the viability of large-scale, web-based applications provided from the cloud. Microsoft, currently moving to offer its services on a cloud-based platform, is one of the core drivers of this market in North America.

- Performance-related issues and data security concerns are the significant challenges faced by the industry. However, recent technological advancements are striving to rectify these problems and ensure that companies can concentrate on their core competencies.

North America Professional Cloud Services Market Trends

Hybrid Cloud is Expected to Have High Growth in the Market

- A hybrid cloud combines a public cloud provider, such as Google Cloud and Amazon Web Services, with a private cloud, i.e., designed to be used by a single organization. By allowing workloads to move between public and private clouds as computing needs and costs change, the hybrid cloud has led businesses to achieve greater flexibility and more data deployment options.

- Companies in the region are launching new products or services to gain a competitive advantage. For instance, Hewlett Packard Enterprise launched HPE GreenLake Hybrid Cloud, designed to help customers manage and optimize their on- and off-premise clouds. HPE GreenLake Hybrid Cloud provides ongoing management and optimization of customers' environments in leading cloud solutions like Microsoft Azure, AWS, and Azure Stack.

- Moreover, many organizations of different sizes are transforming from traditional to digital modes of business. This transformation creates a hybrid cloud market because of the benefits, like reduced total cost of ownership (TCO), high security, flexibility, and agility. IBM stated that 89% of IT leaders expect to move business-critical workloads to the cloud, and the growth in digitization drives all.

- The region is witnessing an upswing in hybrid on and off-premises cloud use. According to MeriTalk, research from a government news analysis organization, in 2021, 92% of federal IT managers agreed that a hybrid cloud is the best operating environment for a resilient government. In addition, more than two-thirds (67%) said that COVID-19 accelerated hybrid cloud adoption in their organizations by a year or more.

- Moreover, Cisco had predicted that by 2021, 73% of the cloud workloads and compute instances would be in public cloud data centers, up from 58% in 2016 (CAGR of 27.5% in five years).

- Furthermore, in last year, Northern Virginia had the highest data center net absorption among the leading data center markets in the United States, amounting to 303.3 megawatts. Such trends in the adoption of data centers are expected to accelerate the growth of the professional cloud services market.

United States is Anticipated to Hold the Largest Market

- The United States dominates the cloud services market. The region has been the early adaptor of cloud computing services. In addition, this region has shown its willingness to embrace cloud services technology in every sector.

- According to a report published by Stormforgein in April 2021, 18% of respondents from North America stated that their organization has a monthly cloud spend of between USD 100,000 and USD 250,000. Furthermore, 44% of respondents expected cloud spending to increase somewhat over the next 12 months, while another 32% indicated that they expected their organization's cloud spending to increase significantly over the next 12 months.

- The IT sector has already adopted this technology. The emerging sector for cloud computing services in the North American region is the healthcare sector. The technology has moved beyond data storage service, and the focus is currently on how this technology is being used to improve and personalize patient care while lowering costs.

- The primary factors for large-scale adoption are the inclination of organizations toward SaaS-based offerings and the adoption of digital business strategies. Moreover, the ongoing increase in demand for cloud services based on data integrity and privacy is further expected to increase in the study period and enable leading vendors with more opportunities to grow in the market.

North America Professional Cloud Services Industry Overview

The competitive landscape of the market is fragmented, with major players such as Cisco Systems Inc., Oracle Corporation, Atos SE, SAP SE, and Hewlett Packard Enterprise Company. The market has been experiencing several market launches due to the increasing use of on-premises and private cloud for personal and organizational purposes.

In August 2022, IBM announced its partnership with VMware to offer hybrid cloud solutions. The partnership will offer co-engineered cloud solutions aimed at helping companies in industries such as financial services, healthcare, and the public sector to reduce the cost and risk of placing mission-critical workloads in a hybrid environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type of Deployment

- 5.1.1 Public

- 5.1.2 Private

- 5.1.3 Hybrid

- 5.2 By Type of Service Model

- 5.2.1 Platform-as-a-Service

- 5.2.2 Software-as-a-Service

- 5.2.3 Infrastructure-as-a-Service

- 5.3 End-user Industry

- 5.3.1 Healthcare

- 5.3.2 Retail

- 5.3.3 Entertainment and Media

- 5.3.4 Government and Public Sector

- 5.3.5 BFSI

- 5.3.6 Information and Communication Technology

- 5.3.7 Others End-user Industries

- 5.4 Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Hewlett Packard Enterprise Company

- 6.1.3 Cognizant

- 6.1.4 Accenture PLC

- 6.1.5 Dell EMC

- 6.1.6 Microsoft Corporation

- 6.1.7 Fujitsu Limited

- 6.1.8 Capgemini SE

- 6.1.9 Infosys Limited

- 6.1.10 Nippon Data Systems Ltd

- 6.1.11 HCL Technologies Limited

- 6.1.12 Oracle Corporation

- 6.1.13 NTT Data

- 6.1.14 Atos SE

- 6.1.15 SAP SE