|

市場調查報告書

商品編碼

1627184

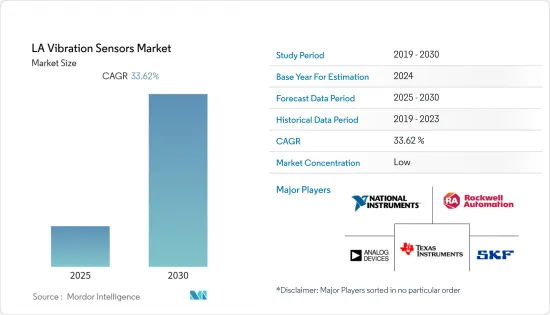

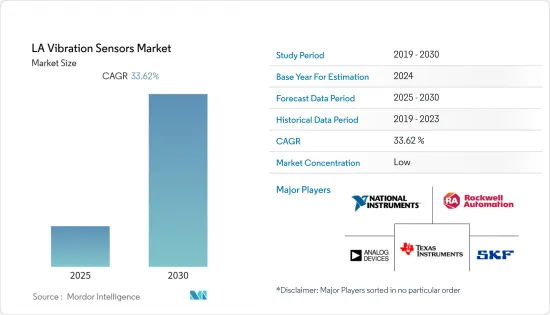

拉丁美洲振動感測器:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)LA Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

拉丁美洲振動感測器市場預計在預測期內複合年成長率為33.62%

主要亮點

- 拉丁美洲的成長主要由巴西和阿根廷等新興經濟體推動。巴西正致力於在消費性電子、石油和天然氣、風電、航太和汽車等多個行業實施和普及智慧技術。

- 巴西等國家的消費性電子產業,尤其是智慧型手機,前景黯淡。例如,2019年,巴西智慧型手機市場儘管銷量下降了6%,但收益卻出現成長。

- 在石油和天然氣行業,它們用於處理10 Hz至10 kHz高頻範圍內的齒輪和渦輪機的速度旋轉,進一步增加了需求。總部位於英國倫敦的石油和天然氣公司 BP PLC 估計,未來五年巴西石油產業可能吸引價值約 220 億美元的投資。因此,到 2025 年,產量預計將增加至約 370 萬桶/日。因此,新計劃有擴張的潛力。這些統計數據突顯了該領域對振動感測器不斷成長的需求。

- 而且,由於風電產業所使用的感測器針對風扇低速旋轉(頻率低於1Hz)的能力,國內部署範圍較高。風電產業是全國最大的舉措,也是能源矩陣中的第二大來源。據巴西風力發電協會ABEEolica稱,到2020年上半年,該國風電裝置容量將達到16吉瓦,安裝約637個風電場和7,738風力發電機。

- 2020年8月,新能源部長達裡奧·馬丁內斯宣布了一項促進石油和天然氣生產的計劃,以擴大出口。這些努力正在推動主導領域對振動感測器的需求。但COVID-19大流行已經威脅到該國的水力壓裂計劃,使阿根廷政府在是否繼續支持巴塔哥尼亞龐大的瓦卡穆爾塔油氣天然氣田陷入兩難境地。

拉丁美洲振動感測器市場趨勢

家用電子產品顯著成長

- 對智慧電子產品的偏好增加、中階的壯大、消費者可支配收入的增加、生活方式偏好的改變等都是推動消費性電子產品需求的主要因素,這也對振動感測器的成長產生間接影響。

- 這些感測器用於家用電器中檢測振動以減少噪音和維護。振動和衝擊感測器用於在筆記型電腦掉落時保護 HDD 上的資料。

- 此感測器用於檢測姿勢變化、螢幕旋轉以及檢測三個方向的移動。振動感測器用於校準位置、運動和加速度,其在家用電器中的應用正在增加,因為它們可以了解行動電話方向和螢幕旋轉、影像以及各種功能的變化以供用戶使用。

- 例如,2021 年 6 月,Fluke Corporation 旗下公司 Fluke Reliability 發布了其最新產品 Fluke 3563 分析振動感測器系統。振動監控可協助維護團隊減少非計劃性停機並防止災難性故障的發生。

加速計保持最大市場佔有率

- 加速計或加速感應器主要用於測量行動裝置和系統中的加速度和振動。使用的加速計主要有兩種:壓電加速計和MEMS加速計。壓電加速計可靠、用途廣泛,且在頻率和振幅範圍方面無與倫比。 MEMS感測器是半導體,具有較低的頻率和幅度精度,但功耗有所提高。

- 加速計用於測量行動裝置和系統中的加速度和振動。由於在航太和國防、工業、消費性電子、汽車以及醫療保健和能源等其他最終用戶產業等各種最終用戶領域的應用,加速計的採用不斷增加。

- 智慧型手機、穿戴式裝置、智慧型家用電器以及使用加速計的植入式或攝入式醫療設備等智慧型裝置的日益普及預計將在預測期內推動振動感測器市場的成長。

- 2020 年 4 月,義法半導體宣布推出一款新型 3 軸 MEMS加速計計元件,專為智慧維護應用中的振動感測應用而設計。 IIS3DWB 振動感測器和配套的 STEVAL-STWINKT1 多感測器評估套件旨在加速狀態監測系統的開發。

- 此外,ROHM 集團旗下公司 Kionix 也推出了 KX132-1211 和 KX134-1211加速計非常適合工業設備和家用穿戴市場中的高精度、低功耗運動感測應用。

- MEMS 技術的發展和採用導致了採用微製造和微加工技術的機械和電子機械感測器以及半導體的小型化。這一趨勢進一步加速了加速感應器在行動裝置中的快速採用,因為它們以小尺寸提供了高加速感應器。

拉丁美洲振動感測器產業概況

拉丁美洲振動感測器市場競爭激烈。從市場佔有率來看,目前該市場由幾家大型企業主導。然而,憑藉創新和永續的包裝,許多公司正在透過贏得新合約和開發新市場來擴大其市場佔有率。

- 2020 年 3 月 TE Connectivity Ltd 完成了對 First Sensor AG 的收購要約。 TE 目前持有First Sensor 71.87% 的股份。 First Sensor 和 TE 產品組合的結合將使 TE 能夠提供更廣泛的產品基礎,包括創新感測器、連接器和系統,從而支援 TE 的感測器業務和 TE Connectivity 的整體成長策略。

- 2020 年 8 月,Hansford Sensors Ltd. 推出了 HS-173I,這是一款採用 PUR 電纜和導管的優質本質安全型三軸加速器。電纜和導管組合具有優異的壓縮、衝擊和拉伸強度。 HS-173I PUR 電纜和導管還具有圓頂設計,可作為 HS-173IR 訂購。所有這些本質安全三軸電纜均經過歐洲、美國和澳洲認證,可在危險環境中使用。它的密封等級為 IP68,並提供多種選項,包括從 10mV/g 到 500mV/g 的一系列操作靈敏度以及各種安裝螺紋。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場分析

- 市場概況

- 市場促進因素

- 對機器監控和維護的需求不斷增加

- 振動感測器壽命長,自發電功能,頻率範圍寬

- 市場限制因素

- 與舊機器的兼容性

- 對環境造成重大且危險的影響

- 產業吸引力—五力分析

- 新進入者的威脅

- 替代品的威脅

- 供應商的議價能力

- 買方議價能力

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

第5章技術概況

- 依技術類型

- 感應式

- 壓電

- 磁的

- 電容式

- 光纖感測器

第6章 市場細分

- 依產品

- 加速計

- 接近探頭

- 轉速表

- 其他

- 按行業分類

- 車

- 醫療保健

- 航太/國防

- 家電

- 石油和天然氣

- 金屬/礦業

- 其他

- 按國家/地區

- 巴西

- 墨西哥

- 阿根廷

- 其他

第7章 競爭格局

- 公司簡介

- SKF AB

- National Instruments Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Rockwell Automation Inc.

- Emerson Electric Co

- Honeywell International Inc.,

- NXP Semiconductors NV

- TE Connectivity Ltd.

- Hansford Sensors Ltd.,

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第8章 投資展望

第9章拉丁美洲振動感測器市場未來性

簡介目錄

Product Code: 50447

The LA Vibration Sensors Market is expected to register a CAGR of 33.62% during the forecast period.

Key Highlights

- Latin America's growth is mainly attributed to the developing economies in the region, such as Brazil and Argentina. Brazil is involved in adopting and promoting smart technology in various industries, such as consumer electronics, oil and gas, wind power, aerospace, and automotive, among others.

- The consumer electronics industry, especially smartphones, in countries like Brazil is exhibiting a moderate outlook. For instance, in 2019, the smartphone market in Brazil witnessed a boost in revenue, despite a 6% decline in the number of units sold.

- Their application in the oil and gas industry to handle the speed rotation of gears and turbines in high frequency ranges from 10 Hz to 10 kHz augments the demand further. BP PLC, an oil and gas company based out of London, United Kingdom, estimates that Brazil could attract about USD 22 billion worth of investment in the oil sector in each of the next five years. Owing to this, production is expected to increase to around 3.7 million BPD by 2025. This provides the scope for expansion, possibly in new projects. Such statistics highlight the rising demand for vibration sensors in the sector.

- Besides, owing to the ability of the sensor to be used in the wind power industry for slow rotation of turbines (1 Hz or less frequency), the scope of deployment is high in the country. The wind power sector is the largest initiative in the country and is the second-largest source in the energy matrix. According to ABEEolica (the Brazilian Wind Energy Association), the installed capacity of wind power in the country reached 16 GW, with about 637 wind farms and 7,738 wind turbines, by the first half of 2020.

- In August 2020, Dario Martinez, new energy secretary, announced the plan to promote oil and natural gas production in the country with a view to increasing exports. Such initiatives drive the demand for vibration sensors in the dominant sector. However, the COVID-19 pandemic has threatened the fracking project in the country and left the government of Argentina in a dilemma whether or not to continue support for the vast Vaca Muerta oil and gas fields in Patagonia.

LA Vibration Sensors Market Trends

Consumer Electronics to Show Significant Growth

- The rise in preference toward using smart electronic devices, growing middle-class, rising disposable income of consumers, and changing lifestyle preferences are some of the major factors driving the demand for consumer electronics, which has an indirect impact on the growth of vibration sensors.

- These sensors are used in consumer electronics for vibration detection to reduce noise and maintenance. When a PC Notebook falls, vibration and shock sensors are used to protect the data of HDDs.

- The sensors are used to detect changes in orientation and screen rotation and detect motion in three directions. The application of vibration sensors in consumer electronics is increasing as the sensors are used to calibrate the position, motion, and acceleration, with which the orientation of the phone and the changes in the screen rotation, images, and various features can be known for user purposes.

- For instance, in June 2021, Fluke Reliability, an operating company of Fluke Corporation, is proud to announce its newest product, the Fluke 3563 Analysis Vibration Sensor system. Vibration monitoring helps maintenance teams reduce unplanned downtime and prevent potentially catastrophic failures from occurring, but it has been difficult or cost-prohibitive to monitor every tier of an asset.

Accelerometers to Hold Maximum Market Share

- Accelerometers or acceleration sensors are primarily used to measure the acceleration or vibration of a moving device or system. The two main types of accelerometers used are Piezoelectric and MEMS accelerometers. The piezoelectric accelerometer is reliable, versatile, and unmatched for frequency and amplitude range. A MEMS sensor is a semiconductor that offers lower accuracy on frequency and amplitude but with improved power consumption.

- Accelerometers are used to measure the acceleration or vibration of a moving device or system. The adoption of accelerometers is increasing due to their applications in various end-user segments, such as aerospace and defense, industrial, consumer electronics, automotive, and other end-user industries, such as health care and energy.

- The increasing adoption of smart devices, such as smartphones, wearables, smart appliances, implantable or ingestible medical devices, among others that use accelerometers, is expected to drive the growth of the vibration sensors market over the forecast period.

- In April 2020, STMicroelectronics introduced a new 3-axis MEMS accelerometer device specially designed for vibration-sensing applications in smart maintenance applications. The IIS3DWB vibration sensor and the supporting STEVAL-STWINKT1 multi-sensor evaluation kit are designed to quicken the development of condition-monitoring systems.

- Also, ROHM Group company Kionix recently introduced a new set of accelerometers, KX132-1211 and KX134-1211, ideal for high accuracy, low power motion sensing applications in the industrial equipment and consumer wearable markets.

- The evolution and adoption of MEMS technology have resulted in the miniaturization of mechanical and electro-mechanical sensors and semiconductors using micro-fabrication and micro-machining techniques. This trend has further accelerated the rapid adoption of accelerometers in portable devices, as they offer enhanced capabilities in small unit sizes.

LA Vibration Sensors Industry Overview

The Latin America Vibration sensor market is highly competitive. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- Mar 2020: TE Connectivity Ltd has completed its public takeover of First Sensor AG. TE now holds 71.87% shares of First Sensor. In combination with First Sensor and TE portfolios, TE will be able to offer a broader product base, including innovative sensors, connectors, and systems, that supports the growth strategy of TE's sensors business and TE Connectivity as a whole.

- Aug 2020: Hansford Sensors Ltd launched a premium intrinsically safe triaxial range is the HS-173I Accelerometers, with PUR cable and conduit. The cable and conduit combination offers impressive compression, impact, and tensile strength. The HS-173I PUR Cable and Conduit is also available with round top design, available to order as HS-173IR. These Intrinsically Safe Triaxials are both certified for use in hazardous environments with European, the United States, and Australian approval. Sealed to IP68 and are available with a choice of options, including a range of operating sensitivities from 10mV/g to 500 mV/g and different mounting threads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dyanmics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Machine Monitoring and Maintenance

- 4.2.2 Longer Service Life, Self Generating Capability and Wide Range of Frequency of Vibration Sensors

- 4.3 Market Restraints

- 4.3.1 Compatibility With Old Machinery

- 4.3.2 Critical and Hazardous Implication on the Environment

- 4.4 Industry Attractiveness - Porter's 5 Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Threat of Substitute Products or ervices

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Bargaining Power of Buyers

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

5 Technology Snapshot

- 5.1 Type of Technology

- 5.1.1 Inductive

- 5.1.2 Piezoelectric

- 5.1.3 Magnetic

- 5.1.4 Capacitive

- 5.1.5 Optic Fiber Sensor

6 Latin America Vibration Sensors Market Segmentation

- 6.1 By Product

- 6.1.1 Accelerometers

- 6.1.2 Proximity Probes

- 6.1.3 Tachometers

- 6.1.4 Others

- 6.2 By Industry

- 6.2.1 Automotive

- 6.2.2 Helathcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Consumer Electronics

- 6.2.5 Oil And Gas

- 6.2.6 Metals and Mining

- 6.2.7 others

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

- 6.3.4 Others

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 SKF AB

- 7.1.2 National Instruments Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Emerson Electric Co

- 7.1.7 Honeywell International Inc.,

- 7.1.8 NXP Semiconductors N.V.

- 7.1.9 TE Connectivity Ltd.

- 7.1.10 Hansford Sensors Ltd.,

- 7.1.11 Bosch Sensortec GmbH (Robert Bosch GmbH)

8 Investment Outlook

9 Future of Latin America Vibration Sensors Market

02-2729-4219

+886-2-2729-4219