|

市場調查報告書

商品編碼

1629795

亞太地區振動感測器:市場佔有率分析、產業趨勢、統計和成長預測(2025-2030)APAC Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

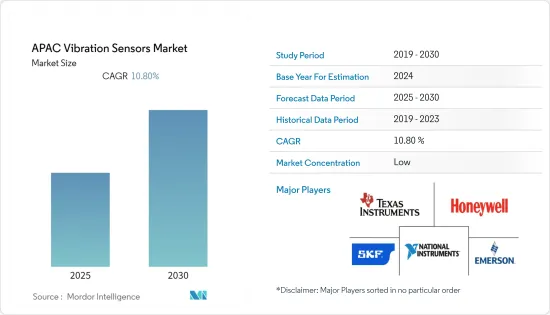

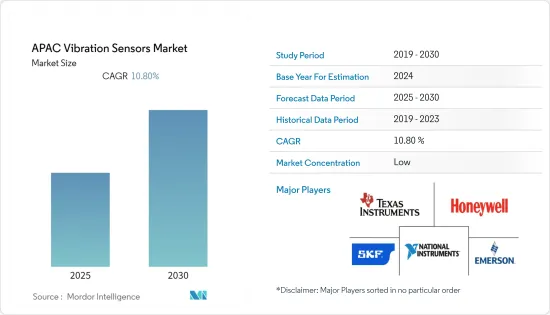

亞太地區振動感測器市場預計在預測期內複合年成長率為 10.8%

主要亮點

- 航空業中能夠減少湍流的感測器的改進正在迅速進展。振動感測器市場在尺寸、負載能力和頻率範圍方面都是高度客製化的。

- 該感測器旨在查明引擎問題並快速消除不必要的引擎拆卸,其感測功能及其使用方式會根據最終用戶的應用而降低。由於訊號負載較大,無法偵測分析振動時的反應時間。亞太地區經濟在金融危機中得以維持。

- 技術創新和發展改善了機器功能並提高了生產力。這樣,機器狀態監測對於提高機器性能發揮重要作用。

- 近年來,對振動感測器的需求一直在成長,但相容性問題被認為是影響市場的主要挑戰,特別是對於舊設備而言。

- 隨著能源需求的增加,對能源效率的需求也越來越大,這只能透過供電機器的最佳化維護來實現。

- 最近的 COVID-19 爆發擾亂了全球供應鏈和多種產品的需求。此外,2020年2月至3月,由於中國停產,多個產業出現了多種產品的供不應求。然而,市場上的供應商正在努力為該行業提供服務,這有助於他們賺取收益。

亞太地區振動感測器市場趨勢

航太及國防終端用戶佔比較大

- 提高情境察覺以推動營運、具有成本效益的維護以及提高資產利用率是推動飛機健康監測系統需求的一些關鍵因素。

- 歐洲以及英國和德國等其他主要航空市場的客運量和飛機起降量都在成長,預計這將在預測期內推動市場發展。

- 渦輪引擎故障是機械故障的主要原因,這會增加成本。因此,用戶擴大轉向預測健康管理 (PGM) 系統來防止這些損失並降低維護成本。由於振動是航太引擎產業最常見的健康監測參數,因此 PHM 系統的發展很可能對振動感測器的成長產生直接影響。

消費性電子產品呈現顯著成長

- 對智慧電子產品的偏好增加、中階的壯大、消費者可支配收入的增加、生活方式偏好的改變等是推動消費性電子產品需求的主要因素,其中振動感測器的成長對成長產生間接影響。

- 這些感測器用於家用電器中檢測振動,以實現降噪和維護目的。振動和衝擊感測器用於在筆記型電腦跌落時保護 HDD 上的資料。

- 此感測器用於檢測方向變化、螢幕旋轉以及檢測三個方向的移動。振動感測器擴大應用於家用電器中,因為它們用於校準位置、運動和加速度,並且可以了解行動電話方向和螢幕旋轉、影像以及各種功能的變化以供用戶使用。

- 例如,2021 年 6 月,Fluke Corporation 旗下公司 Fluke Reliability 發布了其最新產品 Fluke 3563 分析振動感測器系統。振動監控可協助維護團隊減少非計劃性停機並防止災難性故障的發生。

亞太地區振動感測器產業概況

亞太地區振動感測器市場高度分散。由於新參與企業在接觸消費者方面面臨挑戰,市場上擁有知名品牌形象的全球感測器製造商的出現預計將對競爭對手之間的競爭產生重大影響。品牌形像在決定購買行為方面發揮重要作用。因此,知名度較高的公司相對於同一市場的其他公司具有顯著的優勢。主要公司包括德克薩斯(TI)、Honeywell)和艾默生 (Emerson)。

- 2020 年 6 月 - 美國國家儀器 (NI) 宣布更新品牌標識,包括新標誌、視覺標誌、增強的數位體驗和品牌宣傳活動。該公司現在簡稱為 NI,透過將豐富的軟體傳統與新的雲端和機器學習功能相結合,實現測試和測量行業的現代化。

- 2020 年 4 月 - 艾默生收購主要企業American Governor。美國州長公司的加入增強了艾默生在可再生能源和電力行業的技術力和專業知識。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對機器監控和維護的需求不斷增加

- 振動感測器壽命長、自發電能力強、頻率範圍寬

- 市場限制因素

- 與舊機器的兼容性

- 對環境造成重大且危險的影響

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 替代產品和服務的威脅

- 供應商的議價能力

- 買方議價能力

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

第5章技術概況

- 依技術類型

- 感應式

- 壓電

- 磁的

- 電容式

- 光纖感測器

第6章 市場細分

- 依產品

- 加速計

- 接近探頭

- 轉速表

- 其他

- 按行業分類

- 車

- 衛生保健

- 航太/國防

- 家用電子產品

- 石油和天然氣

- 金屬/礦業

- 其他

- 按國家名稱

- 中國

- 日本

- 印度

- 其他

第7章 競爭格局

- 公司簡介

- SKF AB

- National Instruments Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Rockwell Automation Inc.

- Emerson Electric Co

- Honeywell International Inc.,

- NXP Semiconductors NV

- TE Connectivity Ltd.

- Hansford Sensors Ltd.,

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第8章 投資展望

第9章亞太振動感測器市場未來前景

The APAC Vibration Sensors Market is expected to register a CAGR of 10.8% during the forecast period.

Key Highlights

- There is a rapid improvement in sensors in the airline industry where turbulence can be reduced. Customization in the vibration sensors market is growing with respect to size, load capacity, and frequency range.

- Designed to pinpoint engine problems and eliminate unnecessary engine removals quickly, the sensing capabilities with respect to sensors and their usage reduce with their end-user applications. The response time in analyzing vibrations cannot be detected due to the heavy signal load. The Asia Pacific region was able to sustain its economy during the financial crisis.

- The innovations and developments in technology led to better functioning and improved the productivity of machines. Thus, machine condition monitoring plays an important role in improving the machine's performance.

- Although the demand for vibration sensors has been on the rise for the last few years, compatibility concerns, especially in the case of old equipment, have been identified as major challenges affecting the market.

- With the increasing energy demand, there is an increasing need for energy efficiency, which can only be obtained from the optimal maintenance of the electricity supply machinery.

- Owing to the recent COVID-19 outbreak, the global supply chain and demand for multiple products have experienced disruption. Moreover, due to the production shutdown in China, multiple industries have observed a shortage of supply of various products during February and March 2020. Vendors in the market are, however, trying to provide services to industries, which is helping them in getting revenues.

APAC Vibration Sensors Market Trends

Aerospace & Defense End User to Hold Significant Share

- An increase in situational awareness to drive operations, cost-effective maintenance, and increase in asset utilization are some of the key factors driving the demand for aircraft health monitoring systems.

- The passenger traffic in Europe and other major aviation markets, such as the United Kingdom and Germany, have witnessed growth in terms of the number of passengers and aircraft movements, which is expected to drive the market during the forecast period.

- Turbine engine failures are the primary cause of mechanical failures, which is increasing the costs; hence, users are increasingly turning to prognostic health management (PHM) systems to prevent these losses and to reduce maintenance costs. As vibration is the most common health monitoring parameter in the aerospace engine industry, the development of PHM systems is likely to have a direct impact on the growth of vibration sensors.

Consumer Electronics to Show Significant Growth

- The rise in preference toward using smart electronic devices, growing middle-class, rising disposable income of consumers, and changing lifestyle preferences are some of the major factors driving the demand for consumer electronics, which has an indirect impact on the growth of vibration sensors.

- These sensors are used in consumer electronics for vibration detection to reduce noise and maintenance. When a PC Notebook falls, vibration and shock sensors are used to protect the data of HDDs.

- The sensors are used to detect changes in orientation and screen rotation and detect motion in three directions. The application of vibration sensors in consumer electronics is increasing as the sensors are used to calibrate the position, motion, and acceleration, with which the orientation of the phone and the changes in the screen rotation, images, and various features can be known for user purposes.

- For instance, in June 2021, Fluke Reliability, an operating company of Fluke Corporation, is proud to announce its newest product, the Fluke 3563 Analysis Vibration Sensor system. Vibration monitoring helps maintenance teams reduce unplanned downtime and prevent potentially catastrophic failures from occurring, but it has been difficult or cost-prohibitive to monitor every tier of an asset.

APAC Vibration Sensors Industry Overview

The Asia Pacific vibration sensor market is highly fragmented. The presence of global sensor manufacturers with established brand identities in the market is expected to have a profound influence on the intensity of competitive rivalry, as new entrants face challenges in reaching out to consumers. Brand identity plays a strong role in determining buyer behavior. Therefore, well-known companies have a considerable advantage over other players in the market. Some of the key players are Texas Instruments, Honeywell, and Emerson.

- June 2020 - National Instruments Corporations unveiled an updated brand identity, including a new logo, visual identity, enhanced digital experiences, and a brand campaign. Now known simply as NI, it is modernizing the test and measurement industry by coupling its rich software heritage with new cloud and machine learning capabilities.

- April 2020 - Emerson acquired the leading hydroelectric turbine controls company, American Governor Company. The addition of the American Governor Company builds on Emerson's technology capabilities and expertise in the renewable and power industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Machine Monitoring and Maintenance

- 4.2.2 Longer Service Life, Self Generating Capability and Wide Range of Frequency of Vibration Sensors

- 4.3 Market Restraints

- 4.3.1 Compatibility With Old Machinery

- 4.3.2 Critical and Hazardous Implication on the Environment

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Threat of Substitute Products or Services

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Bargaining Power of Buyers

- 4.4.5 Intensity of competitive Rivalry

- 4.5 Industry Value Chain Analysis

5 Technology Snapshot

- 5.1 Type of Technology

- 5.1.1 Inductive

- 5.1.2 Piezoelectric

- 5.1.3 Magnetic

- 5.1.4 Capacitive

- 5.1.5 Optic Fiber Sensor

6 Market Segmentation

- 6.1 Product

- 6.1.1 Accelerometers

- 6.1.2 Proximity Probes

- 6.1.3 Tachometers

- 6.1.4 Others

- 6.2 Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Consumer Electronics

- 6.2.5 Oil And Gas

- 6.2.6 Metals and Mining

- 6.2.7 Others

- 6.3 Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 Others

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 SKF AB

- 7.1.2 National Instruments Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Emerson Electric Co

- 7.1.7 Honeywell International Inc.,

- 7.1.8 NXP Semiconductors N.V.

- 7.1.9 TE Connectivity Ltd.

- 7.1.10 Hansford Sensors Ltd.,

- 7.1.11 Bosch Sensortec GmbH (Robert Bosch GmbH)