|

市場調查報告書

商品編碼

1627212

歐洲振動感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

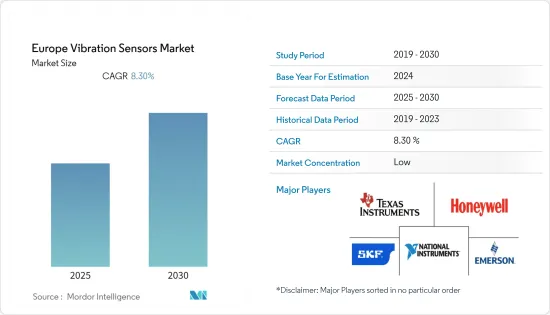

歐洲振動感測器市場預計在預測期內複合年成長率為 8.3%

主要亮點

- 振動感測器在尺寸、負載能力和頻率範圍方面變得越來越客製化。振動感測器旨在找出引擎問題並快速消除不必要的引擎拆卸。

- 感測器及其應用的感測能力會因最終用戶的應用而降低。由於訊號負載較大,無法偵測分析振動時的反應時間。

- 歐洲振動感測器市場在過去十年中經歷了重大發展,催生了各種創新且技術先進的產品。

- 在過去的五年裡,隨著汽車變得越來越複雜,對執行多種功能的各種感測器的需求也隨之增加。由於對增強駕駛員資訊、增強安全控制以及更複雜的引擎管理系統以提高燃油效率和減少排放氣體的需求不斷成長,預計該市場將繼續成長。歐洲振動感測器市場主要由全球主要公司組成,很少有小參與企業該市場。

歐洲振動感測器市場趨勢

航太及國防終端用戶佔比較大

- 提高情境察覺以推動營運、具有成本效益的維護以及提高資產利用率是推動飛機健康監測系統需求的一些關鍵因素。

- 歐洲和英國和德國等其他主要航空市場的客運量和飛機起降量都在成長,預計這將在預測期內推動市場發展。

- 渦輪引擎故障是機械故障的主要原因,這會增加成本。因此,用戶擴大轉向預測健康管理 (PGM) 系統來防止這些損失並降低維護成本。由於振動是航太引擎產業最常見的健康監測參數,PHM系統的發展將直接影響振動感測器的成長。

歐洲擴大工業IoT的採用

- 在過去的十年中,物聯網解決方案擴大用於最佳化離散製造產品和環境。離散製造商(汽車、工業機械)與流程製造商一起面臨激烈的競爭。這導致對新技術的投資增加,這些新技術利用物聯網、雲端和巨量資料分析功能來增強創新能力,從而最大限度地提高收益。

- 隨著工業 4.0 的到來,工業IoT(IIoT)、智慧製造、智慧工廠、預測製造、工業機器人和感測器等趨勢使物聯網成為這些離散和流程製造環境的核心支柱,實現遠端監控和遠端監控,支援工廠車間設備的連續掃描功能、即時分析和預測性維護等新功能。

- 工業4.0支持從遺留系統向智慧組件和機器的過渡,促進向數位工廠甚至連網型工廠和企業生態系統的過渡。

- 隨著智慧工廠計畫的實施,企業開始專注於預測性維護和製造,這有望降低維護成本並提高產能。據美國能源局稱,預測性維護具有成本效益,與預防性維護相比可節省約 8% 至 12%,與糾正性維護相比可節省高達 40%。因此,許多製造商正在將基於狀態(預測)的維護方法添加到其維護策略中,以提高製造安全性和效能。

- 此外,據 Vollenhaupt 稱,低維護策略可使公司的產能減少多達 20%。機械調節器是識別和預防問題的最有效的維護工具之一。

- 預測性維護的推廣正在推動支持它的技術、零件和設備的發展,從而加強振動感測器市場。

歐洲振動感測器產業概況

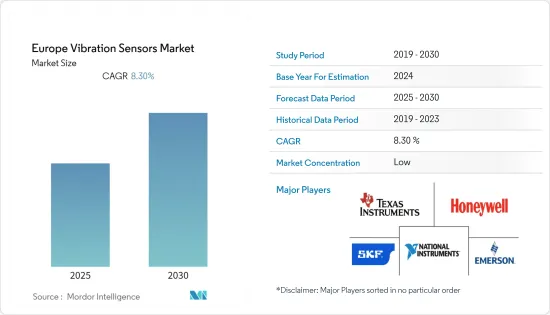

歐洲振動感測器市場高度分散。由於新參與企業在接觸消費者方面面臨挑戰,擁有知名品牌形象的全球感測器製造商的出現預計將對競爭對手之間的競爭產生重大影響。品牌形像在決定購買行為方面發揮重要作用。因此,知名度較高的公司相對於同一市場的其他公司具有顯著的優勢。主要公司包括德克薩斯(TI)、Honeywell)和艾默生 (Emerson)。

- 2020 年 6 月 - National Instruments 推出了更新後的品牌標識,包括新標識、視覺標識、增強的數位體驗和品牌宣傳活動。該公司現在簡稱為 NI,透過將豐富的軟體傳統與新的雲端和機器學習功能相結合,實現測試和測量行業的現代化。

- 2020 年 4 月 - 艾默生收購主要企業American Governor Company。美國州長公司的加入增強了艾默生在可再生能源和電力行業的技術力和專業知識。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場分析

- 市場概況

- 市場促進因素

- 對機器監控和維護的需求不斷增加

- 振動感測器壽命長,自發電功能,頻率範圍寬

- 市場限制因素

- 與舊機器的兼容性

- 對環境造成重大且危險的影響

- 產業吸引力—五力分析

- 新進入者的威脅

- 替代品的威脅

- 供應商的議價能力

- 買方議價能力

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

第5章技術概況

- 依技術

- 感應式

- 壓電

- 磁的

- 電容式

- 光纖感測器

第6章 市場細分

- 依產品

- 加速計

- 接近探頭

- 轉速表

- 其他

- 按行業分類

- 車

- 醫療保健

- 航太/國防

- 家電

- 石油和天然氣

- 金屬/礦業

- 其他

- 按國家/地區

- 英國

- 德國

- 法國

- 其他

第7章 競爭格局

- 公司簡介

- SKF AB

- National Instruments Corporation

- Texas Instruments Incorporated

- Analog Devices Inc.

- Rockwell Automation Inc.

- Emerson Electric Co

- Honeywell International Inc.,

- NXP Semiconductors NV

- TE Connectivity Ltd.

- Hansford Sensors Ltd.,

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第8章 投資展望

第9章歐洲振動感測器市場未來性

The Europe Vibration Sensors Market is expected to register a CAGR of 8.3% during the forecast period.

Key Highlights

- The customization in the vibration sensor is growing with respect to its size, load capacity, and frequency range. They are designed to pinpoint engine problems and eliminate unnecessary engine removals quickly.

- The sensing capabilities with respect to sensors and it's usage reduce with its end-user application. The restraints are technical; response time in analyzing the vibration can't be detected due to heavy signal load.

- The European vibration sensor market has experienced important developments over the past decade resulting in a wide variety of innovative and technologically superior products.

- There has been an increase in demand for a variety of sensors to perform a multitude of functions as vehicles have become more complex over the last five years. Continued growth is anticipated for this market, propelled by enhanced demand for greater driver information, tighter safety controls, and more sophisticated engine management systems to improve fuel economy and reduce emissions. The Europe Vibration Sensors market is comprised of mostly large global corporations with few small market participants.

Europe Vibration Sensors Market Trends

Aerospace & Defense End User to Hold Significant Share

- An increase in situational awareness to drive operations, cost-effective maintenance, and increase in asset utilization are some of the key factors driving the demand for aircraft health monitoring systems.

- The passenger traffic in Europe and other major aviation markets, such as the United Kingdom and Germany, have witnessed growth in terms of the number of passengers and aircraft movements, which is expected to drive the market during the forecast period.

- Turbine engine failures are the primary cause of mechanical failures, which is increasing the costs; hence, users are increasingly turning to prognostic health management (PHM) systems to prevent these losses and to reduce maintenance costs. As vibration is the most common health monitoring parameter in the aerospace engine industry, the development of PHM systems is likely to have a direct impact on the growth of vibration sensors.

Growing Adoption of Industrial IOT in Europe Region

- Over the last decade, IoT solutions have been increasingly adopted for optimizing discrete manufacturing products and environments. Discrete manufacturers (in automotive, industrial machinery), along with process manufacturers, face intense competition. Hence, they are increasingly investing in new technologies that leverage the capabilities of IoT, cloud, and Big Data analytics to enhance their ability to innovate maximize return on their assets.

- With the advent of Industry 4.0, trends, like Industrial IoT (IIoT), smart manufacturing, smart factory, predictive manufacturing, industrial robots, sensors, have made IoT the central backbone of these discrete and process manufacturing environments enabling remote monitoring, continuously scanning capabilities from the equipment on the factory floor, real-time analysis, and supporting new capabilities, such as predictive maintenance.

- Industry 4.0 is aiding the industries' transition from having legacy systems to smart components and smart machines, facilitating digital factories, and later, to an ecosystem of connected plants and enterprises.

- With the smart factory concept coming into force, companies focus on predictive maintenance and manufacturing, which is anticipated to reduce maintenance costs and enhance production capacities. According to the US Department of Energy, predictive maintenance is highly cost-effective, saving roughly 8% to 12% over preventive maintenance and up to 40% over reactive maintenance. Therefore, to improve manufacturing safety and performance, many manufacturing organizations have added condition-based (predictive) maintenance approaches to their maintenance strategies.

- Moreover, according to Wollenhaupt, low maintenance strategies can reduce a company's production capacity by as much as 20%. To identify the problems and prevent them, machine conditioning equipment is one of the most effective maintenance tools.

- This drive for predictive maintenance has driven the technologies, components, and equipment supporting it, thereby augmenting the market's vibration sensors.

Europe Vibration Sensors Industry Overview

The European vibration sensor market is highly fragmented. The presence of global sensor manufacturers with established brand identities in the market is expected to have a profound influence on the intensity of competitive rivalry, as new entrants face challenges in reaching out to consumers. Brand identity plays a strong role in determining buyer behavior. Therefore, well-known companies have a considerable advantage over other players in the market. Some of the key players are Texas Instruments, Honeywell, and Emerson.

- June 2020 - National Instruments Corporations unveiled an updated brand identity, including a new logo, visual identity, enhanced digital experiences, and a brand campaign. Now known simply as NI, it is modernizing the test and measurement industry by coupling its rich software heritage with new cloud and machine learning capabilities.

- April 2020 - Emerson acquired the leading hydroelectric turbine controls company, American Governor Company. The addition of American Governor Company builds on Emerson's technology capabilities and expertise in the renewable and power industry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition'

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dyanmics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Machine Monitoring and Maintenance

- 4.2.2 Longer Service Life, Self Generating Capability and Wide Range of Frequency of Vibration Sensors

- 4.3 Market Restraints

- 4.3.1 Compatibility With Old Machinery

- 4.3.2 Critical and Hazardous Implication on the Environment

- 4.4 Industry Attractiveness - Porter's 5 Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Threat of Substitute Products or services

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Bargaining Power of Buyers

- 4.4.5 Intensity of competitive rivalry

- 4.5 Industry Value chain analysis

5 Technology Snapshot

- 5.1 Type of Technology

- 5.1.1 Inductive

- 5.1.2 Piezoelectric

- 5.1.3 Magnetic

- 5.1.4 Capacitive

- 5.1.5 Optic Fiber Sensor

6 Europe Vibration sensors market segmentation

- 6.1 By product

- 6.1.1 Accelerometers

- 6.1.2 Proximity Probes

- 6.1.3 Tachometers

- 6.1.4 Others

- 6.2 By Industry

- 6.2.1 Automotive

- 6.2.2 Helathcare

- 6.2.3 Aerospace & Defence

- 6.2.4 Consumer Electronics

- 6.2.5 Oil And Gas

- 6.2.6 Metals and Mining

- 6.2.7 others

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Others

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 SKF AB

- 7.1.2 National Instruments Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Emerson Electric Co

- 7.1.7 Honeywell International Inc.,

- 7.1.8 NXP Semiconductors N.V.

- 7.1.9 TE Connectivity Ltd.

- 7.1.10 Hansford Sensors Ltd.,

- 7.1.11 Bosch Sensortec GmbH (Robert Bosch GmbH)