|

市場調查報告書

商品編碼

1627205

軟性OLED -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Flexible OLED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

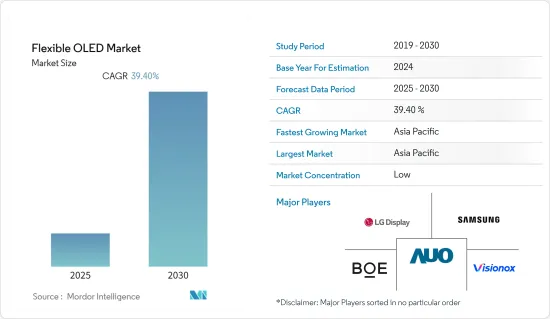

預計軟性OLED市場在預測期內複合年成長率為39.4%

主要亮點

- OLED 是一種新型顯示技術,可實現美觀、高效的顯示器和照明面板。 OLED 已用於許多行動裝置和電視,下一代面板將具有軟性和可彎曲性。 OLED 是顯示器產業最新一代的技術,與傳統 LED 和 LCD 相比,具有卓越的性能和增強的光學特性。

- 軟性顯示器技術在智慧型手機和平板電腦設備中的使用似乎有點模糊,因為用戶接受度、保護和成本效益等外部因素是智慧型手機公司需要應對的一些重大挑戰。

- 最近,三星顯示器公司正計劃建造一條新的第 6 代軟性 OLED 生產線。這條新生產線將取代 SDC 牙山工廠目前用於生產電視的 LCD 生產線。新線建設成本將約為3兆韓元(約27億美元),月產能為3萬片晶圓。這將使三星顯示器的AMOLED產能達到每月195,000片。

- 同樣在 2021 年 11 月,三星 Display 以一款適用於筆記型電腦的新型高更新率顯示器進入中型 OLED 市場。三星顯示器的軟性 OLED 螢幕可折疊、捲起和滑動。與競爭對手相比,它具有高亮度、HDR10+內容播放、低折疊半徑(R1.4)和更好的螢幕保護(UTG)。此顯示器可折疊超過20萬次,相當於五年內每天折疊式和展開100次。

- 此外,市場正見證技術創新。軟性有機發光二極體(OLED)顯示器的客製化3D列印是由美國明尼蘇達大學雙城分校的團隊於2022年1月開發出來的。這項突破性技術使用有機材料層將電轉化為光,並可能為手持和穿戴式電子設備帶來更便宜的 OLED 顯示螢幕,這些設備可以在家中使用 3D 列印機製造。

- COVID-19 對市場產生了負面影響,一些城市關閉了營運,破壞了行動電話和顯示器生產的供應鏈,並減少了全球智慧型手機銷售。隨著世界各國政府收緊更嚴格的措施,導致經濟活動停止的封鎖預計將在不久的將來產生更嚴重的影響。由於長期封鎖措施,工廠暫時關閉,生產和貨物運輸受到干擾。

軟性OLED市場趨勢

行動和電視將大幅成長

- 隨著智慧型手機在全球的普及,對高清超高清顯示器的需求正在快速成長。包括蘋果和三星在內的許多公司都在其旗艦機型中使用 AMOLED 顯示螢幕,其他公司也在效仿。

- 儘管如此,軟性 OLED 仍具有多項優勢,包括比玻璃顯示器更輕、更薄、更耐用,尤其是在行動裝置中。這些已被證明是行動電話製造商的重要資產,因為它們提供更好的性能、耐用性和減輕的重量。

- 例如,2022 年 5 月,LG Display 宣布將在加州聖荷西舉行的 2022 年資訊與顯示協會 (SID) 會議上參展下一代 OLED 解決方案。這包括從 OLED.EX 到可彎曲和可折疊 OLED 面板的所有內容。這項創新預計將鞏固該公司在受調查市場的 OLED 領導地位。

- 此外,2022年1月,該公司宣布準備在2024年之前為蘋果iPad供應OLED面板。該公司計劃在 2024 年提高產量,首款 OLED iPad 預計將在此之前生產。

- 此外,各公司正在發布配備軟性顯示器的智慧型手錶,以在競爭中保持領先地位。 2020 年 7 月,努比亞手錶發布,配備軟性 AMOLED 螢幕並相容於 eSIM。此顯示器為 4.01 吋(960x192 像素)軟性可彎曲 OLED 顯示螢幕,像素密度為 244ppi。

亞太地區成長率最高

- 印度、中國等主要國家經濟不斷成長,消費者可支配所得不斷增加。因此,他們傾向於採用曲面電視、高階智慧型手機等高階電子產品。因此,它正在推動該地區軟性OLED市場的發展。

- 例如,2021 年 6 月,三星宣布開發出軟性 OLED 顯示螢幕,這對於未來可貼在皮膚上並貼合其表面的穿戴式設備可能很有價值。為了製造軟性顯示器,三星創建了單獨的 OLED 像素,這些像素本身凸起並放置在軟性合成橡膠體表面上。 OLED 之間的連接以及連接顯示器和驅動系統的走線均由軟性材料製成。

- 此外,中國企業正爭相建立大規模生產基地來生產OLED。京東方目前正在中國西南部的重慶興建一座小型OLED生產工廠。這條OLED生產線是中國最大的單體工廠,每年將生產1.15億片面板。

- 科技巨擘蘋果也正在投資折疊式行動電話的開發,並計劃在印度建立一家高階 iPhone組裝廠。隨著這家工廠的啟動,該公司的行動電話將以比國內更便宜的價格出售。因此,該需求預計將推動該地區軟性OLED市場的成長。

軟性OLED產業概況

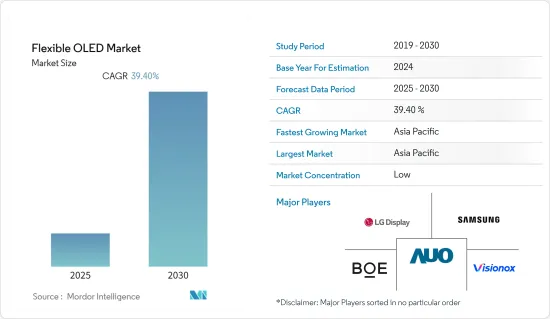

全球軟性OLED市場競爭激烈。由於有大大小小的參與企業,市場很集中。所有主要公司都佔有重要的市場佔有率,並致力於擴大其在全球的消費群。市場的主要企業包括LG Display、三星電子、友達光電、京東方科技集團、錸寶科技、Universal Display Corporation和維信諾公司。公司正在透過建立多個夥伴關係關係並投資於新產品發布來增加市場佔有率,以在預測期內贏得競爭。

- 2022 年 6 月 - LG Display 與全球建築設計公司 Gensler 合作,發布了下一代透明 OLED 隔間 Maars M923。 Maars M923 採用有機發光二極體技術,在開放性和私密性之間實現了獨特的平衡,提供透明或明亮的顏色選擇,以提高空間和視覺清晰度,而無需單獨的電視或顯示器重新定義演示的尺寸。

- 2022 年 6 月 - 三星電子收購 Cynora Gmbh。 Cyonara 正在利用 TADF(熱激活延遲螢光)技術開發一種用於 OLED 顯示器的新型有機發光材料。這項技術使該公司能夠率先推出最受 OLED 顯示器製造商追捧的高效能藍光材料。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 對軟性 OLED 市場的影響

第5章市場動態

- 市場促進因素

- 智慧型手機面板 OLED 需求增加

- 顯示市場的技術進步

- 市場問題

- 與 LED 相比,OLED 的可接受性較低

第6章 市場細分

- 依技術

- AMOLED

- PMOLED

- 按用途

- 手機和平板電腦

- 顯示器和電視

- 穿戴式的

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- LG Display Co. Ltd

- Samsung Electronics Co., Ltd.

- AUO Corporation

- BOE Technology UK Limited

- Ritdisplay Corporation

- Universal Display Corporation

- Visionox Company

- WiseChip Semiconductor Inc.

- Royole Corporation

第8章投資分析

第9章市場的未來

The Flexible OLED Market is expected to register a CAGR of 39.4% during the forecast period.

Key Highlights

- OLED is an emerging display technology that enables beautiful and efficient displays and lighting panels. OLEDs are already being used in many mobile devices and TVs, and the next generation of these panels will be flexible and bendable. OLEDs are the latest generation technology in the display industry and provide superior performance and enhanced optical characteristics compared to older LED and LCDs.

- The usage of flexible display technology in smartphones and tablets looks a bit unclear as with external factors such as user acceptability, protection and cost-effectiveness being some of the major challenges to be met by the smartphone companies, but it can find its wide usage in other industry such as automobiles and transportation.

- As of the recent developments Samsung Display plans to build a new 6-Gen flexible OLED line. The new line will replace a current LCD line that is used to produce TVs at SDC's Asan plant. The new fab, will cost around KRW 3 trillion or around USD 2.7 billion and will have a monthly capacity of 30,000 monthly substrates. This will increase Samsung Display AMOLED production capacity to 195,000 monthly substrates.

- Also, in November 2021, Samsung Displays, entered the medium-sized OLED market with the new high-refresh-rate displays for laptops. Samsung Display's flexible OLED screens can be folded, rolled, or slid. It feature high brightness, HDR10+ content playback, a low folding radius (R1.4), and better screen protection (UTG) compared to products from rival firms. The displays can be folded more than 200,000 times, equivalent to 100 folds and unfolds every day for five years.

- Further, the market is witnessing innovation. In January 2022, the customized 3D printing of a flexible organic light-emitting diode (OLED) display has been developed by a team from the University of Minnesota Twin Cities in the United States. The breakthrough, which is based on the conversion of electricity into light using an organic material layer, could lead to inexpensive OLED displays for handheld or wearable electronics made at home using 3D printers.

- COVID-19 has had a detrimental influence on the market as a result of several cities being shut down, causing damage to the supply chain for phone and display production, and reducing smartphone sales around the world. With more strict measures being imposed by governments throughout the world, the lockdown, which has brought economic activity to a halt, is projected to have a stronger impact in the near future. A lengthy lockdown has resulted in the temporary closure of factories, causing production and shipping of commodities to be hampered.

Flexible OLED Market Trends

Mobiles and Televisions to Witness Significant Growth

- With increased smartphone adoption globally, the demand for high-definition ultra-high displays is growing quickly. With many companies, such as Apple and Samsung employing AMOLED displays in their flagship models, other companies are following the trend.

- But still, a flexible OLED provides several advantages, especially in mobile devices, such as lighter, thinner, and more durable displays than glass-based displays. These proved to be an important asset for mobile phone manufacturers, as they provided better performance, durability, and a reduction in weight.

- For instance, in May 2022, LG Display Co. Ltd announced bringing its next-generation OLED solutions to the 2022 Society for Information Display (SID) conducted in San Jose, California. The products included OLED.EX to Bendable and Foldable OLED panels. This innovation is expected to solidify the company's OLED leadership in the market studied.

- Additionally, in January 2022, the company announced to be preparing to supply OLED panels for the apple iPad by 2024. The company is planning to ramp up production in 2024, and it is expected that the first OLED iPad will undergo manufacturing before that.

- Further, various companies have been releasing smartwatches with flexible displays to stay ahead of the competition. In July 2020, the Nubia watch was released with a flexible AMOLED screen and eSIM support, among other features. The display is a 4.01-inch (960x192 pixels) flexible, bendable OLED display with 244ppi pixel density.

Asia-Pacific to Witness the Fastest Growth Rate

- The economies of major countries like India and China are growing, leading to an increase in the disposable incomes of consumers. Hence, moving toward adopting high-end electronic products, such as curved televisions and premium smartphones. Thus, driving the flexible OLED market in the region.

- For instance, in June 2021, Samsung announced the development of a flexible OLED display that could be invaluable to future wearable devices that can be stuck to the skin and conform to its surface. To create a flexible display, Samsung created individual OLED pixels that themselves are ridged and sit on a flexible elastomer surface. Connections between the OLEDs are made using a flexible material, as are the traces that connect the display to the driver system.

- Moreover, Chinese companies are moving quickly to set up large-scale production bases to churn out OLEDs. BOE is constructing a production plant for smaller OLEDs in the southwestern Chinese city of Chongqing. The OLED production line is the largest for a single factory in China, producing 115 million panels annually.

- Also, the Tech giant, Apple Inc., is investing in developing its foldable phone and has planned to start the assembly plant in India for premium iPhones. The commencement of this plant will make its phones available at cheaper rates than it is in the country. Hence, the demand will drive the growth of the flexible OLED market in the region.

Flexible OLED Industry Overview

The Global Flexible OLED Market is very competitive in nature. The market is concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world. Some of the significant players in the market are LG Display Co. Ltd, Samsung Electronics Co., Ltd., AU Optronics Corp., BOE Technology Group Co Ltd, RiTdisplay Corp, Universal Display Corporation, Visionox Company, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

- June 2022 - LG Display has teamed up with the global architecture and design firm Gensler to introduce the Maars M923., a next-generation Transparent OLED partition. By applying the OLED technology, the Maars M923 offers a unique balance of openness and privacy, redefining space and the dimensions of visual presentations with the option of either transparency or vivid colours without the need for a separate TV or monitor.

- June 2022 - Samsung electronics co ltd acquired Cynora Gmbh. Cyonara is developing a new type of organic emitting materials for OLED displays based on TADF (Thermally Activated Delayed Fluorescence) technology. With this technology, the company will be able to commercialize the first high-efficiency blue emitting material on the market, which is the most sought-after material by OLED display makers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Flexible OLED Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for OLED in Smartphone Panels

- 5.1.2 Technological Advancements in Display Market

- 5.2 Market Challenges

- 5.2.1 Lower Acceptance of OLED Compared to LED

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 AMOLED

- 6.1.2 PMOLED

- 6.2 By Application

- 6.2.1 Mobiles and Tablets

- 6.2.2 Monitors and TVs

- 6.2.3 Wearables

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LG Display Co. Ltd

- 7.1.2 Samsung Electronics Co., Ltd.

- 7.1.3 AUO Corporation

- 7.1.4 BOE Technology UK Limited

- 7.1.5 Ritdisplay Corporation

- 7.1.6 Universal Display Corporation

- 7.1.7 Visionox Company

- 7.1.8 WiseChip Semiconductor Inc.

- 7.1.9 Royole Corporation