|

市場調查報告書

商品編碼

1627211

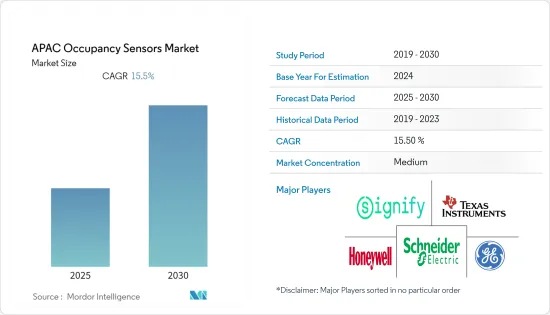

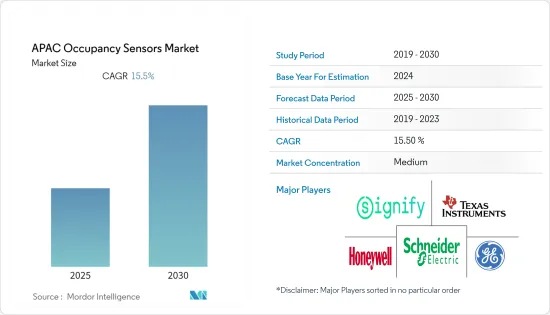

亞太地區佔用感測器:市場佔有率分析、產業趨勢和成長預測(2025-2030)APAC Occupancy Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太地區佔用感測器市場預計在預測期內複合年成長率為 15.5%

主要亮點

- 佔用感測器使用各種技術,例如被動紅外線、超音波和雙技術來指示空間中是否存在居住者。被動紅外線感測器需要感測器和居住者之間存在視線。

- 此外,為了減少能源浪費,大多數能源法規都要求以某種方式根據時間表或占用情況在不使用時自動關閉燈光。佔用感測器是一種照明控制設備,可以關閉無人區域的燈光,透過消除能源浪費來降低能源成本。此外,該地區的各個供應商都安裝了超音波感測器,透過向周圍區域發射超音波並測量他們返回的速度來檢測人員的存在。

- 另外值得注意的是雙技術感測器,它使用被動紅外線和超音波技術來檢測居住者的存在,只有當兩種技術檢測到居住者的存在時才會啟動燈光。這種配置實際上消除了錯誤照明的可能性,並且由於需要一種或另一種技術來保持燈亮,所以錯誤熄滅的可能性也大大降低。

- 私人公司與供應商合作提高能源效率。例如,Larsen & Toubro Infotech (LTI) 與 75F 合作,消除低效率照明的挑戰。 75 實施了公司的高級照明解決方案,以改善租戶體驗。結果,LTI 實現了 55% 的節能。

亞太地區佔用感測器市場趨勢

住宅用途預計將大幅成長

- 智慧建築技術的引入現在為設施管理人員提供了強大的工具來獲取有關空間佔用的準確資訊,而不是依賴估計和近似值。佔用感測器還收集空間使用資料,並幫助最佳化該地區的空間管理決策。

- 此外,從傳統照明控制系統切換到智慧照明控制系統可以實現無線甚至非接觸式照明控制,並具有運轉率感應、時間安排和語音控制功能。這為照明控制專家提供了為家庭提供靈活解決方案的新機會。

- 此外,光電紅外線 (PIR) 感測器是檢測建築物內居住者存在的當前標準。智慧恆溫器使用感測器根據居住條件控制暖氣和冷氣。一個重要的問題是這些 PIR 感測器只能偵測正在移動的人。

- 此外,居住感測器和智慧插座參考設計將幫助家庭自動化設備製造商和開發商加快上市時間,同時降低系統成本和複雜性。開發人員可以利用這些新的承包設計來加速他們的設計,包括經過認證的無線電技術、開放原始碼硬體設計文件、行業標準軟體堆疊和經過驗證的測試設置製造方法,您可以快速從概念轉向最終產品。

預計印度市場佔有率龐大

- 技術先進的佔用感測器在各種應用中的使用越來越多,增加了對提供方便用戶使用且可靠服務的安全存取系統的需求。此外,包括IT公司、企業和資料中心在內的各種商業設施正在實施門禁系統,以記錄員工進出的時間,並防止人員和資料外洩。

- 對節能設備的需求不斷成長預計將推動該國的發展。佔用感測器在降低能耗方面發揮重要作用。這是透過根據運作條件關閉設備和其他設備的感測器來實現的。這些感測器有助於減少光污染,可用於室內和室外空間。

- 由於被動紅外線成本低廉、對節能設備的需求以及低功耗要求,預計該國對被動紅外線的需求將持續。它具有多種應用,包括照明、光譜儀、氣體和火災偵測系統。被動紅外線感測器的主要優點是精確的運動偵測、可靠的觸發和成本效益。例如,自動販賣機設計人員現在將 PIR 感測器整合到他們的產品中,以便只有當有人站在裝置前面或在面板前揮手時顯示器才會亮起。

- 此外,市場上正在出現各種創新。例如,2021 年 10 月,總部位於印度海得拉巴的智慧家庭科技公司 Wothert 宣布推出一款旨在與 Apple HomeKit 配合使用的產品。 Sense Pro 多感測器的功能與居住感光元件類似,同時也包含一些其他功能。 Sense Pro 使用組合方法(稱為 TrueOccupancy),包括熱成像和內建 AI,透過放置在房間入口上方的感應器來確定房間是否有人,以及人員何時進入或離開房間。

亞太地區佔用感測產業概況

亞太地區佔用感測器市場競爭適中。產品探索、研發、聯盟和收購是該地區公司保持競爭力的關鍵成長策略。

- 2021 年 7 月 - 私募股權公司 Arcline Investment Management 宣布購買 Dwyer Instruments 的多數股權。該公司是一家為製程自動化、暖通空調和建築自動化市場設計和製造感測器和儀器解決方案的供應商。該公司擁有 93 項有效且正在申請的專利以及超過 40,000 個可配置 SKU 的廣泛套件,幾乎可以滿足客戶所需的任何應用。

- 2021 年 1 月 - Eyeris Technologies, Inc. 在 2021 年消費性電子展 (CES) 上宣布與德克薩斯(TI) 合作。 Eyeris DNN 旨在滿足功能安全標準,實現靈活的相機放置,並在低功耗邊緣處理器上高效運作。 Eyeris 的車載感測人工智慧演算法組合包括符合全球 NCAP 標準的駕駛監控系統 (DMS) 和乘員監控系統 (OMS) 功能。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 節能設備的需求不斷成長

- 低成本和高能效對被動紅外線的需求

- 市場挑戰

- 與無線網路系統相關的交換器故障和不一致問題

第6章 市場細分

- 依網路類型

- 有線

- 無線的

- 依技術

- 超音波

- 被動紅外線

- 微波

- 按用途

- 燈光控制

- 空調

- 安全和監視

- 依建築類型

- 住宅

- 商業設施

- 按國家/地區

- 中國

- 日本

- 印度

- 其他亞太地區

第7章 競爭狀況

- 公司簡介

- Schneider Electric SE

- Eaton Corp PLC

- Signify Holding BV

- Honeywell Inc

- Dwyer Instruments Inc

- Johnson Controls Inc

- General Electric Co

- Legrand SA

- Analog Devices Inc

- Texas Instruments Inc

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 51098

The APAC Occupancy Sensors Market is expected to register a CAGR of 15.5% during the forecast period.

Key Highlights

- Occupancy sensors indicate the presence or absence of occupants in a space using various technologies such as passive infrared, ultrasonic, and dual-technology. Passive-infrared sensors necessitate a line of sight between the sensor and the space's occupants.

- Further, to reduce energy waste, most energy codes require some method of automatically turning off lights when they are not in use, either on a schedule or based on occupancy. Occupancy sensors are lighting controls that turn off lights in unoccupied areas, lowering energy costs by reducing energy waste. Also, various vendors in the region are introducing Ultrasonic sensors to detect the presence of people by emitting ultrasonic sound waves into the environment and measuring the speed with which they return.

- Also, there is an increasing focus on Dual-technology sensors that use both passive infrared and ultrasonic technologies to detect the presence of occupants and activate the lights only when both technologies detect the presence of occupants. This configuration virtually eliminates the possibility of false-on problems, and requiring either technology to keep the lights on significantly reduces the possibility of false-off problems.

- Private companies are partnering with vendors to become energy efficient. For instance, Larsen & Toubro Infotech (LTI) partnered with 75F to eliminate challenges related to inefficient lighting. 75 installed its Advanced Lighting Solution to improve occupant experience. As a result, LTI achieved an energy saving of 55%.

APAC Occupancy Sensor Market Trends

Residential Expected to Witness Significant Growth

- With the introduction of smart building technologies, facility managers now have access to robust tools to access accurate information about space occupancy rather than relying on estimates and approximations and occupancy sensors aiding in collecting data about space usage and optimizing space management decisions in the region.

- Also, switch from a traditional lighting control system to a smart lighting control system, which allows for wireless and even touchless lighting control through occupancy sensing, time scheduling, and voice control. All of this has opened up new opportunities for professional lighting control companies, which provide flexible solutions to homes.

- Further, Photoelectric infrared (PIR) sensors are the current standard for detecting occupancy presence in buildings. Smart thermostats use sensors to control heating and cooling based on occupancy. One significant issue is that these PIR sensors only detect individuals moving.

- Additionally, occupancy sensor and smart outlet reference designs help home automation device makers and developers accelerate time to market while lowering system cost and complexity. Developers can quickly advance from design concept to final product by leveraging these new, turnkey reference designs, including pre-certified wireless technology, open-source hardware design files, industry-standard software stacks, and proven test setups manufacturing methods.

India Expected to Witness Significant Market Share

- The initiation of technically sophisticated occupancy sensors for various applications fuels security and access systems demand by providing a user-friendly and reliable service. Aside from that, various commercial establishments such as IT companies, enterprises, data centers are implementing access control systems to protect personnel and data breaches, to record employee's entry and exit timings.

- The rising demand for energy-efficient devices is expected to drive the country. Occupancy sensors play a vital role in reducing energy consumption. This is achieved through the sensors, which shut down devices and other equipment based on occupancy. These sensors help reduce light pollution and can be used for indoor and outdoor spaces.

- The demand for passive infrared is expected to continue in the country due to the low cost, demand for energy-efficient devices, and less power requirement. It has a range of applications, such as lighting, spectrometers, gas, and fire detection systems. Some of the significant benefits of passive infrared sensors are accurate movement detection, reliable triggering, and cost-efficiency. Vending machine designers, for instance, are now incorporating PIR sensors into their products so that their displays only light up when someone is standing in front of the unit or maybe waving their hand in front of a panel, which saves on operating costs.

- Further, the market is witnessing various innovations. For instance, in October 2021, Wozart, a Smart Home tech company based in Hyderabad, India, announced a product designed to work with Apple HomeKit. The Sense Pro multi-sensor is intended to function similarly to an occupancy sensor while including several other features. The Sense Pro uses a combination of methods (dubbed TrueOccupancy), including thermal imaging and built-in AI, to determine whether people are in a given room and whether a person has entered or exited the room with the sensor designed to sit above the room's entrance.

APAC Occupancy Sensor Industry Overview

The Asia Pacific Occupancy Sensors Market is moderately competitive in nature. Product launches, high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- July 2021 - Arcline Investment Management, a private equity firm, announced purchasing a majority stake in Dwyer Instruments. The company is a provider in designing and manufacturing sensor and instrumentation solutions for the process automation, HVAC, and building automation markets. The company has 93 active and pending patents and an extensive suite of over 40,000 configurable SKUs, allowing it to service nearly all customer-required applications.

- January 2021 - Eyeris Technologies, Inc. announced a collaboration with Texas Instruments (TI) on an industry-first in-cabin sensing AI solution at the Consumer Electronics Show (CES) 2021, utilizing TI's JacintoTM TDA4 processors and 2D RGB-IR image sensors. Eyeris DNNs are designed to meet functional safety standards, allow for flexible camera placement, and perform efficiently on low-power edge processors. Eyeris' AI algorithm portfolio for in-cabin sensing includes driver monitoring system (DMS) and occupant monitoring system (OMS) features that meet global NCAP standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Energy Efficient Devices

- 5.1.2 Demand for Passive Infrared Due to Low Cost and High Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

6 MARKET SEGMENTATION

- 6.1 By Network Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Technology

- 6.2.1 Ultrasonic

- 6.2.2 Passive Infrared

- 6.2.3 Microwave

- 6.3 By Application

- 6.3.1 Lighting Control

- 6.3.2 HVAC

- 6.3.3 Security and Surveillance

- 6.4 By Building Type

- 6.4.1 Residential

- 6.4.2 Commercial

- 6.5 By Country

- 6.5.1 China

- 6.5.2 Japan

- 6.5.3 India

- 6.5.4 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Eaton Corp PLC

- 7.1.3 Signify Holding BV

- 7.1.4 Honeywell Inc

- 7.1.5 Dwyer Instruments Inc

- 7.1.6 Johnson Controls Inc

- 7.1.7 General Electric Co

- 7.1.8 Legrand SA

- 7.1.9 Analog Devices Inc

- 7.1.10 Texas Instruments Inc

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219