|

市場調查報告書

商品編碼

1628799

美國佔用感測器:市場佔有率分析、行業趨勢和成長預測(2025-2030)US Occupancy Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

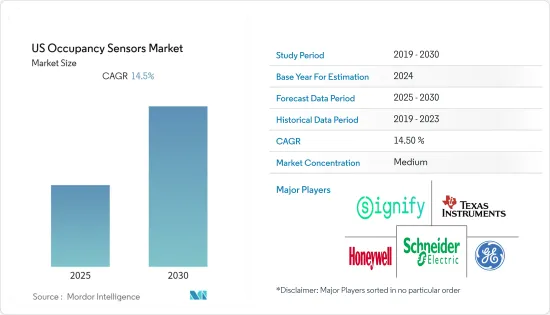

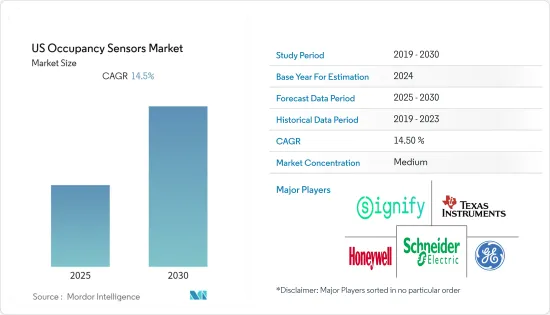

美國佔用感測器市場預計在預測期內複合年成長率為 14.5%

主要亮點

- 佔用感測器擴展的主要驅動力之一是都市化趨勢。整個家庭和辦公室對能源效率的需求不斷成長。根據聯合國經濟和社會事務部預測,到2050年,68%的人口將居住在都市區,從而增加永續能源的使用。

- 對節能設備的需求不斷成長預計將成為該國的驅動力。佔用感測器在降低能耗方面發揮重要作用。這是透過感測器根據佔用情況關閉設備和其他設備來實現的。這些感測器有助於減少光污染,可用於室內和室外空間。

- 由於被動紅外線成本低廉、對節能設備的需求以及低功耗要求,預計該國對被動紅外線的需求將持續。它具有多種應用,包括照明、光譜儀、氣體和火災偵測系統。被動紅外線感測器的主要優點是精確的運動偵測、可靠的觸發和成本效益。例如,自動販賣機設計人員現在將 PIR 感測器整合到他們的產品中,以便只有當有人站在裝置前面或在面板前揮手時顯示器才會亮起。

- 全球參與者的夥伴關係和進入預計也將塑造未來的市場前景。最近,總部位於奧地利的 Loxone 以智慧家庭自動化控制產品進入美國市場,該產品擁有超過 150 個 SKU,包括佔用感測器、溫度和濕度感測器。

美國佔用感測器市場趨勢

預計住宅將出現顯著成長

- 智慧建築技術的引入現在為設施管理人員提供了一個強大的工具,可以獲取有關空間運轉率的準確資訊,而無需依賴估計和近似值。此外,運轉率感測器收集有關空間使用情況的資料並幫助最佳化空間管理決策。

- 此外,從傳統照明控制系統切換到智慧照明控制系統,可透過運轉率感應、時間安排和語音控制實現無線甚至非接觸式照明控制。這些為專業照明控制公司提供了為家庭提供靈活解決方案的新機會。

- 此外,光電紅外線 (PIR) 感測器是檢測建築物內居住者存在的當前標準。智慧恆溫器使用感測器根據居住條件控制暖氣和冷氣。一個重要的問題是這些 PIR 感測器只能偵測正在移動的人。

- 此外,居住感應器和智慧插座參考設計可協助家庭自動化設備製造商和開發商加快上市時間,同時降低系統成本和複雜性。開發人員可以利用這些新的承包設計來加速他們的設計,包括經過認證的無線電技術、開放原始碼硬體設計文件、行業標準軟體堆疊和經過驗證的測試設置製造方法,您可以快速從概念轉向最終產品。

暖通空調領域預計將顯著成長

- 商務用空調的需求正在成長。例如,Comfort Systems USA 是一家著名的暖氣、通風和空調 (HVAC)、管道、管道和控制等機械服務提供商,由總部位於德克薩斯州的 Walker TX Holdings 及其附屬子公司擁有。正式收購協議此外,政府有關能源效率和環保冷媒的法規預計將在預測期內為市場創造機會。

- 此外,在亞特蘭大,三星暖通空調公司宣布將透過創建、培訓和支援授權分銷商、經銷商和安裝商網路來擴大商務用空調業務。該公司還宣布擴展其用於輕型商業解決方案的無風高級冷卻車型。暖通空調需求的激增預計將推動該國佔用感測器的成長。

- 該國正在重點發展智慧城市以提高能源效率。新澤西州紐瓦克市選擇Honeywell實施節能控制解決方案,該解決方案融合了該市的 HVAC,包括房間佔用感測器和建築系統的多點控制。這是該市永續性行動計劃的一部分。這些措施預計將顯著節省能源營運並大幅擴大市場需求。

- 市場擴張的另一個主要驅動力是對佔用感測器創新和進步的關注,例如影像處理佔用感測器 (IPOS)、智慧佔用感測器 (IOS) 和麥克風。例如,Panasonic推出了10.9毫米薄型PIR動作感測器,廣泛應用於暖通空調系統、智慧家庭和監控系統。

美國佔用感測器產業概況

美國市場競爭溫和。將產品引入新興國家、增加研發成本、聯盟和收購是國內企業維持激烈競爭的主要成長策略。

- 2021 年 7 月 - 私募股權公司 Arcline Investment Management 宣布購買 Dwyer Instruments 的多數股權。該公司是一家為製程自動化、暖通空調和建築自動化市場設計和製造感測器和儀器解決方案的供應商。該公司擁有 93 項有效且正在申請的專利以及超過 40,000 個可配置 SKU 的廣泛套件,幾乎可以滿足客戶所需的任何應用。

- 2021 年 1 月 - Eyeris Technologies, Inc. 在 2021 年消費性電子展 (CES) 上宣布與德克薩斯(TI) 合作。 Eyeris DNN 旨在滿足功能安全標準,實現靈活的相機放置,並在低功耗邊緣處理器上高效運作。 Eyeris 的車載感測人工智慧演算法組合包括符合全球 NCAP 標準的駕駛監控系統 (DMS) 和乘員監控系統 (OMS) 功能。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 節能設備的需求不斷成長

- 低成本和高能效對被動紅外線的需求

- 市場挑戰

- 與無線網路系統相關的交換器故障和不一致問題

第6章 市場細分

- 依網路類型

- 有線

- 無線的

- 依技術

- 超音波

- 被動紅外線

- 微波

- 按用途

- 照明控制

- 空調

- 安全和監視

- 依建築類型

- 住宅

- 商業設施

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Eaton Corp PLC

- Signify Holding BV

- Honeywell Inc

- Dwyer Instruments Inc

- Johnson Controls Inc

- General Electric Co

- Legrand SA

- Analog Devices Inc

- Texas Instruments Inc

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 54504

The US Occupancy Sensors Market is expected to register a CAGR of 14.5% during the forecast period.

Key Highlights

- One of the major driving factors for the expansion of occupancy sensors is the trend of urbanization. There is a growing demand for energy efficiency across homes and offices. According to the United Nations Department of Economic and Social Affairs, 68% of the population will be living in cities by 2050, which will augment sustainable energy use.

- The rising demand for energy-efficient devices is expected to drive the country. Occupancy sensors play a vital role in reducing energy consumption. This is achieved through the sensors, which shut down devices and other equipment based on occupancy. These sensors help reduce light pollution and can be used for indoor and outdoor spaces.

- The demand for passive infrared is expected to continue in the country due to the low cost, demand for energy-efficient devices, and less power requirement. It has a range of applications, such as lighting, spectrometers, gas, and fire detection systems. Some of the significant benefits of passive infrared sensors are accurate movement detection, reliable triggering, and cost-efficiency. Vending machine designers, for instance, are now incorporating PIR sensors into their products so that their displays only light up when someone is standing in front of the unit or maybe waving their hand in front of a panel, which saves on operating costs.

- Partnerships and entry by global players into the country are also expected to shape the market landscape in the future. Recently, Austria-based Loxone entered the US market with a smart home automation control offering that features more than 150 SKUs of products, including occupancy sensors, temperature and humidity sensors.

US Occupancy Sensors Market Trends

Residential Expected to Witness Significant Growth

- With the introduction of smart building technologies, facility managers now have access to robust tools to access accurate information about space occupancy rather than relying on estimates and approximations and occupancy sensors aiding in collecting data about space usage and optimizing space management decisions in the country.

- Also, switch from a traditional lighting control system to a smart lighting control system, which allows for wireless and even touchless lighting control through occupancy sensing, time scheduling, and voice control. All of this has opened up new opportunities for professional lighting control companies, which provide flexible solutions to homes.

- Further, Photoelectric infrared (PIR) sensors are the current standard for detecting occupancy presence in buildings. Smart thermostats use sensors to control heating and cooling based on occupancy. One significant issue is that these PIR sensors only detect individuals moving.

- Additionally, occupancy sensor and smart outlet reference designs help home automation device makers and developers accelerate time to market while lowering system cost and complexity. Developers can quickly advance from design concept to final product by leveraging these new, turnkey reference designs, including pre-certified wireless technology, open-source hardware design files, industry-standard software stacks, and proven test setups manufacturing methods.

HVAC Segment is Expected to Witness Significant Growth

- The demand for air conditioning in the commercial industry is growing. For instance, Comfort Systems USA, a prominent provider of mechanical services, including heating, ventilation, air conditioning (HVAC), plumbing, piping, and controls, announced that it has entered into a definitive agreement to acquire Walker TX Holding Company Inc. and its related subsidiaries headquartered in Texas. In addition, government regulations about energy efficiency and environment-friendly refrigerants are expected to create opportunities for the market over the forecast period.

- Additionally, In Atlanta, Samsung HVAC announced that it would expand its commercial air conditioning business by building, training, and supporting a network of specifying representatives, distributors, and installers. The company also announced expanding its Wind-free advanced cooling models for light commercial solutions. The surge in demand for HVACs is expected to drive the growth of occupancy sensors in the country.

- The country is focusing on smart city development to improve energy efficiency. The city of Newark, New Jersey, has onboarded Honeywell to install energy-efficient control solutions that incorporate the city's HVAC, like room occupancy sensors and multi-location control of building systems. This is a part of the city's Sustainability Action Plan. Initiatives such as these are expected to deliver significant savings in energy operations and hence drive exponential market demand.

- Another major driving factor for market expansion is a focus on innovation and advancements in occupancy sensors such as image processing occupancy sensors (IPOS), intelligent occupancy sensors (IOS), and micro-phonics. For instance, Panasonic introduced Low Profile Type PIR Motion Sensors offering a 10.9 mm profile alternative widely used in HVAC systems, smart homes, and surveillance systems.

US Occupancy Sensors Industry Overview

The United States Occupancy Sensors Market is moderately competitive in nature. Product launches, high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- July 2021 - Arcline Investment Management, a private equity firm, announced purchasing a majority stake in Dwyer Instruments. The company is a provider in designing and manufacturing sensor and instrumentation solutions for the process automation, HVAC, and building automation markets. The company has 93 active and pending patents and an extensive suite of over 40,000 configurable SKUs, allowing it to service nearly all customer-required applications.

- January 2021 - Eyeris Technologies, Inc. announced a collaboration with Texas Instruments (TI) on an industry-first in-cabin sensing AI solution at the Consumer Electronics Show (CES) 2021, utilizing TI's JacintoTM TDA4 processors and 2D RGB-IR image sensors. Eyeris DNNs are designed to meet functional safety standards, allow for flexible camera placement, and perform efficiently on low-power edge processors. Eyeris' AI algorithm portfolio for in-cabin sensing includes driver monitoring system (DMS) and occupant monitoring system (OMS) features that meet global NCAP standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Energy Efficient Devices

- 5.1.2 Demand for Passive Infrared Due to Low Cost and High Energy Efficiency

- 5.2 Market Challenges

- 5.2.1 False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

6 MARKET SEGMENTATION

- 6.1 By Network Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Technology

- 6.2.1 Ultrasonic

- 6.2.2 Passive Infrared

- 6.2.3 Microwave

- 6.3 By Application

- 6.3.1 Lighting Control

- 6.3.2 HVAC

- 6.3.3 Security and Surveillance

- 6.4 By Building Type

- 6.4.1 Residential

- 6.4.2 Commercial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Eaton Corp PLC

- 7.1.3 Signify Holding BV

- 7.1.4 Honeywell Inc

- 7.1.5 Dwyer Instruments Inc

- 7.1.6 Johnson Controls Inc

- 7.1.7 General Electric Co

- 7.1.8 Legrand SA

- 7.1.9 Analog Devices Inc

- 7.1.10 Texas Instruments Inc

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219