|

市場調查報告書

商品編碼

1628833

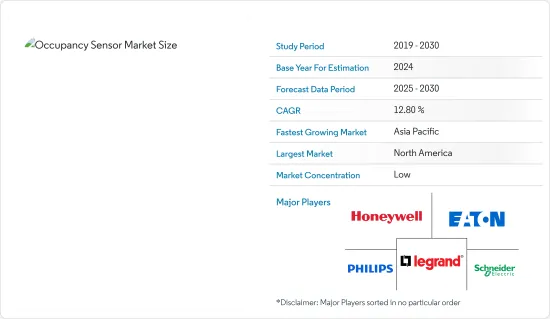

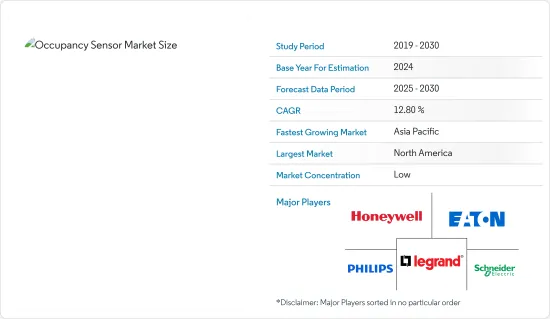

佔用感測器 -市場佔有率分析、行業趨勢/統計、成長預測 (2025-2030)Occupancy Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

佔位感測器市場預計在預測期內複合年成長率為 12.8%

主要亮點

- 全球佔用感測器市場正在迅速擴大並將繼續如此。佔用感測器是室內運動偵測器,可偵測人員的存在並自動啟動照明、溫度和通風系統。透過關閉無人區域的燈來減少能源費用,以避免浪費能源。

- 此外,佔用感測器使調度變得困難,使其成為需要微控制的任務的理想選擇。佔用感測器通常用於安全目的,例如防止故意破壞、盜竊和竊盜。它也用於自動控制、適應建築條件和節能。

- 對節能設備的需求不斷成長預計將推動市場發展。佔用感測器在降低能耗方面發揮重要作用。這是透過根據運作條件關閉設備和其他設備的感測器來實現的。這些感測器有助於減少光污染,可用於室內和室外空間。

- 由於被動紅外線成本低廉、對節能設備的需求以及低功耗要求,預計對被動紅外線的需求將持續下去。它具有多種應用,包括照明、光譜儀、氣體和火災偵測系統。被動紅外線感測器的主要優點是精確的運動偵測、可靠的觸發和成本效益。

- 儘管大肆宣傳,居住感測器的發展程度仍不及動作感測器等其他照明技術。準確預測居住者入住率的困難阻礙了這一點。佔用感測器的性能受到使用者佔用、照明控制模式和感測器選擇的影響。此外,佔用感測器被認為是昂貴的,佔用感測器的成本效益在很大程度上未被認知到。這是佔用感測器市場的一個障礙,因為它影響了新興經濟體和不已開發經濟體的滲透率。

- 在 COVID-19 爆發期間,市場出現了整個供應鏈的生產停頓和中斷,削弱了工業產出成長並減少了主要製造地的居住感測器輸出。隨著新住宅和建築物建設的加速,預計製造業將在預測期內達到新冠疫情前的水平。

- 疫情影響了建築業,導致對居住感測器的需求疲軟。住宅和商業領域的新建築是支持市場成長的關鍵機會領域。政府的限制影響了多個國家的所有建設活動和大多數商業活動。

佔用感測器市場趨勢

智慧城市推動佔用感測器市場成長

- 全球都市化趨勢不斷增強,根據聯合國經濟和社會事務部預測,到2050年,60%的人口將居住在都市區。隨著越來越多的人口遷移到都市區,世界各地的城市都傾向於發展智慧城市,這有可能促進市場成長。

- 透過在城市內安裝感測器並建構資訊共用平台,智慧城市可以為公共機構和市政工作人員創建高效、智慧的服務配送平臺。該平台允許不同的感測器系統擁有一個通用的資料倉儲來儲存其資訊。一個真正的智慧停車系統不僅要能夠了解每個停車場的運作狀態,還能夠引導使用者前往停車場。

- 汽車交通堵塞是世界範圍內令人擔憂的問題,而且呈指數級成長。物聯網感測器和超音波感測器等佔用感測器可以在邊緣運算和交通模式的幫助下發揮重要作用,可以幫助非常有效地管理交通問題。

- 西班牙桑坦德市擁有超過 12,000 個嵌入式感測器,可以測量從容器中的垃圾數量到停車位數量和人群規模等各種資訊。洛杉磯推出了智慧交通解決方案來控制交通流量。道路感測器和封閉式攝影機向中央交通管理平台提供交通流量的即時更新。

- 具有即時資料擷取和分析功能的基於視覺的佔用感測系統比 PIR 和視訊系統具有顯著的優勢。因此,其計算模型可以幫助新興市場發展智慧城市。

北美佔據主要市場佔有率

- 與其他地區相比,北美對商業建築和住宅居住感測器的需求更高。這是因為該地區居住感測器行業的價值鏈組織良好且監管良好。這簡化了訂購和安裝過程。新產品的進步和各製造商的合作正在幫助北美佔領居住感測器市場並在 2025 年之前保持領先地位。

- 此外,北美的需求主要是由對佔用感測器的創新和進步的高度興趣驅動的,例如影像處理佔用感測器(IPOS)、智慧佔用感測器(IOS)和顫噪技術。

- 由於該地區建築業的顯著成長,居住感測器最大的行業是住宅和商業建築業。技術憑藉具有成本效益的矩陣在這一領域發揮著重要作用。

- 美國市場的領先地位歸功於各個細分市場的發展和無線網路基礎設施的增加。同樣,美國地區對暖通空調系統不斷成長的需求預計也將在該市場中發揮重要作用。

佔用感測器產業概述

佔用感測器市場高度分散,同一市場中的大多數參與企業都在採取措施,透過專注於產品多樣化來擴大其市場佔有率。每個參與企業都專注於採取新產品開發、夥伴關係、併購和收購等多種策略,以加強產品系列併贏得與其他參與企業的競爭。研究市場的主要企業是霍尼韋爾國際公司、伊頓公司和羅格朗公司。

- 2021 年 12 月 - Aqara 宣布下一代佔用感測器 Aqara 人體存在感測器 FP1 的銷售計畫。此感測器檢測人體的準確度比常規 PIR(被動紅外線)感測器高得多。住宅可以使用 60GHz 毫米波技術更準確地了解居住情況。

- 2021 年 10 月 - 印度智慧家庭科技公司 Wothert 宣布推出旨在與 Apple HomeKit 連接的最新產品。 Sense Pro 多感測器的設計具有與佔用感測器類似的性能,但也提供許多其他功能。熱成像重點關注房間內居住者發出的熱量,而不是他們的運動,因此即使他們坐著一動不動,也會被識別為在房間內。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 利用市場促進和市場約束因素

- 市場促進因素

- 節能設備的需求不斷成長

- 低成本和高能效對被動紅外線的需求

- 市場限制因素

- 與無線網路系統相關的交換器故障和不一致問題

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章技術概況

第6章 市場細分

- 依網路類型

- 有線

- 無線的

- 依技術

- 超音波

- 被動紅外線

- 微波

- 依建築類型

- 住宅

- 商業設施

- 按用途

- 照明控制

- 空調

- 安全與監控

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Honeywell International

- Eaton Corporation

- Schneider Electric

- Legrand Inc.

- Leviton Electronics(Dongguan)Co. Ltd

- Philips Ltd

- Hubbell Building Automation Inc.

- ohnson Controls GmbH

- Pammvi Group

- Lutron Electronics, Inc.

- General Electric

- Texas Instruments Incorporated

第8章投資分析

第9章市場的未來

The Occupancy Sensor Market is expected to register a CAGR of 12.8% during the forecast period.

Key Highlights

- The global occupancy sensor market is expanding rapidly and will continue to expand in the near future. An occupancy sensor is an indoor motion detector that detects the presence of a person in order to operate lights, temperature, or ventilation systems automatically. It turns off lights in empty areas, lowering energy expenses by reducing energy waste.

- Furthermore, as scheduling becomes difficult with occupancy sensors, these are ideal for tasks requiring micro-control. Occupancy sensors are generally used for security purposes, such as preventing damage, burglary, and stealing. These are also utilized to give automatic control, conform with construction requirements, and conserve energy.

- The rising demand for energy-efficient devices is expected to drive the market. Occupancy sensors play a vital role in reducing energy consumption. This is achieved through the sensors, which shut down devices and other equipment on the basis of occupancy. These sensors help in reducing light pollution, and they can be used for indoor and outdoor spaces.

- The demand for passive infrared is expected to continue in the future due to the low cost, demand for energy-efficient devices, and less power requirement. It has a range of applications, such as lighting, spectrometers, gas and fire detection systems, etc. Some of the major benefits of passive infrared sensors are accurate movement detection, reliable triggering, and cost efficiency.

- Despite significant advertising, occupancy sensors are less developed than other lighting technologies, such as motion sensors and vacancy sensors. It is hampered by the difficulty of precisely forecasting the occupant's occupancy. An occupancy sensor's performance is affected by user occupancy, lighting control patterns, and sensor selection. Furthermore, it is regarded as expensive, and there is little awareness of the cost-related benefits of occupancy sensors. This is a barrier to the occupancy sensor market since it has an impact on penetration rates in developing and undeveloped economies.

- During the outbreak of COVID-19, the market witnessed a halt in production and disruption across the supply chain, leading to weakened growth of industrial output and the decline of the occupancy sensor output across significant manufacturing hubs. Manufacturing is anticipated to reach pre-COVID levels over the forecast period as construction of new homes and buildings picks pace.

- The pandemic affected the construction industry, which led to a slump in demand for occupancy sensors, as the newly constructed buildings in the residential and commercial sectors are primary areas of opportunity that support the market's growth. Owing to the restrictions put in place by the governments, all construction activities and most business activities across multiple countries have been affected.

Occupancy Sensor Market Trends

Smart City to Increase the Growth of the Occupancy Sensor Market

- The trend of urbanization is growing worldwide, and according to the United Nations Department of Economic and Social Affairs, 60% of the population will be living in cities by 2050. With more people shifting to urban areas, cities across the world will be on a trend to develop smart cities, which may enhance the growth of the market.

- A smart city can create an efficient and smart service delivery platform for public and municipal workers by installing sensors in the city to create platforms that allow the sharing of information. The platform can have a common data warehouse where different sensor systems store their information. A truly smart parking system should be not only aware of the occupancy status of each parking space but also be able to guide the user to it.

- Traffic congestion caused by vehicles is an alarming problem on a global scale, and it has been growing exponentially. Occupancy sensors, like IoT sensors and ultrasonic sensors, play a major role with the help of edge computing, where traffic patterns may help in managing traffic problems very efficiently.

- Santander, the Spanish city, is embedded with more than 12,000 sensors that measure everything from the amount of trash in containers to the number of parking spaces available to the size of crowds. Los Angeles implemented a smart traffic solution to control traffic flow. Road-surface sensors and closed-circuit television cameras send real-time updates about the traffic flow to a central traffic management platform.

- A vision-based occupancy sensing system with real-time data capture and analysis offers major advantages over PIR and video systems. Thus, this may help the smart city development in the growing occupancy sensor market due to its computing model.

North America to Account for a Significant Market Share

- North America has a higher demand for occupancy sensors for commercial and residential buildings than other regions. This is due to the region's well-organized and regulated value chain for the occupancy sensors industry. This streamlines the ordering and installation procedure. New product advancements and alliances formed by various manufacturers have assisted the North American occupancy sensor market in gaining and maintaining the lead till 2025.

- Additionally, the demand in North America is mainly driven by a higher focus on innovations and advancements in occupancy sensors, such as image processing occupancy sensors (IPOS), intelligent occupancy sensors (IOS), and micro-phonics.

- The largest industry for occupancy sensors is the residential and commercial building industry due to massive growth in the construction sector in this region. Technology has a major role to play in this sector due to its cost-effective matrix.

- The United States is leading the market, owing to the developments in various sectors and the increase in the rise of wireless network infrastructure. Similarly, the growing demand for HVAC systems in the US region is anticipated to play a crucial role in this market.

Occupancy Sensor Industry Overview

The Occupancy Sensor Market is significantly fragmented, and the majority of the players functioning in the market are taking steps to raise their market footprint by concentrating on product diversification. The players are focusing on strengthening their product portfolio with the adoption of several strategies, including new product developments, partnerships, mergers, acquisitions, etc., to gain a competitive edge over other players. Key players in the market studied are Honeywell International, Eaton Corporation, and Legrand Inc.

- December 2021 - Aqara announced plans to market its next-generation occupancy sensor, the Aqara Human Presence Sensor FP1. This sensor can detect humans with significantly greater accuracy than a normal PIR (Passive Infrared) sensor, which relies on sensing infrared light emitted by objects in its range of vision. The homeowner is provided a more precise picture of occupancy by using 60GHz millimeter wave technology.

- October 2021 - Wozart, an India-based Smart Home tech business, introduced its latest product designed to connect with Apple HomeKit. The Sense Pro multi-sensor is designed to perform similarly to an occupancy sensor while also providing a number of other features. Thermal imaging focuses on the heat emitted by inhabitants in the room rather than motion, so you can sit motionlessly and still be recognized as being in the room.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Demand for Energy-efficient Devices

- 4.3.2 Demand for Passive Infrared Due to Low Cost and High Energy Efficiency

- 4.4 Market Restraints

- 4.4.1 False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Network Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Technology

- 6.2.1 Ultrasonic

- 6.2.2 Passive Infrared

- 6.2.3 Microwave

- 6.3 By Building Type

- 6.3.1 Residential

- 6.3.2 Commercial

- 6.4 By Application

- 6.4.1 Lighting Control

- 6.4.2 HVAC

- 6.4.3 Security and Surveillance

- 6.4.4 Other Applications

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.2.4 Italy

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 South Korea

- 6.5.3.4 Australia

- 6.5.3.5 Rest of Asia Pacific

- 6.5.4 Latin America

- 6.5.4.1 Mexico

- 6.5.4.2 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International

- 7.1.2 Eaton Corporation

- 7.1.3 Schneider Electric

- 7.1.4 Legrand Inc.

- 7.1.5 Leviton Electronics (Dongguan) Co. Ltd

- 7.1.6 Philips Ltd

- 7.1.7 Hubbell Building Automation Inc.

- 7.1.8 ohnson Controls GmbH

- 7.1.9 Pammvi Group

- 7.1.10 Lutron Electronics, Inc.

- 7.1.11 General Electric

- 7.1.12 Texas Instruments Incorporated