|

市場調查報告書

商品編碼

1628741

北美服務機器人:市場佔有率分析、產業趨勢與成長預測(2025-2030)North America Service Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

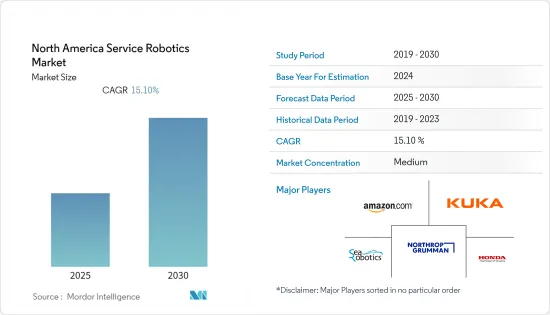

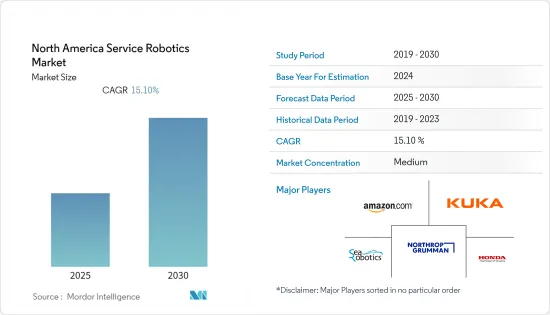

北美服務機器人市場預計在預測期內複合年成長率為15.1%

主要亮點

- 美國是北美地區現場機器人、物流、建築等服務機器人市場的領導者。機器人在該地區的應用多種多樣,也用於專業清潔。

- 在服務機器人的專業用途中,軍事用途最受歡迎。在國防方面,有人和無人兩種類型的機器人都被使用。對於無人用途,無人機非常常見。多年來,戰場上無人機使用的投資一直在增加。無人機用於情報、監視和偵察任務,幫助地面或遠處的士兵規劃下一步。

- 用於復健和非侵入性治療的機器人數量呈指數級成長,使該應用成為數量最多的醫療機器人。根據IFR統計,約75%的醫療機器人供應商位於北美和歐洲,27%的服務機器人供應商位於北美。

- 此外,該地區的勞動力短缺是 COVID-19 大流行期間服務機器人使用的促進因素之一。例如,丹麥紫外線消毒機器人製造商UVD Robotics已向中國和歐洲的醫院運送了數百台機器人。

北美服務機器人市場趨勢

醫療保健領域對服務機器人的需求不斷成長支持市場成長

- 北美服務市場正在快速成長。服務機器人擴大應用於醫療保健領域。它在醫療保健領域有多種用途,特別是支援患者護理業務。

- 該地區的醫療保健行業因國家而異。美國的大多數醫療保健提供者都屬於私營部門。根據AHA醫院統計,2021年,超過57%的醫院是非營利的,只有約18%是政府所有的,其餘都是營利性的。 2019年美國醫療保健支出成長4.6%,達到3.8兆美元,即人均11,582美元。醫療費用佔國內生產總值的比例為17.7%。

- 在加拿大,醫療保健部門主要由公共資助,幫助公民獲得基本和高級醫療保健。這個巨大的醫療保健市場正在擴大,未來對機器人的需求可能會增加。在該地區,美國市場的需求比例高於加拿大市場。

- 此外,社會老化和護理人員短缺也增加了老年人照護的需求。隨著技術的進步,臨床醫生和科學家正在轉向機器人和其他基於感測器的技術來幫助看護者為老年人提供適當的護理服務。

美國擴大引入服務機器人

- 急於引進機器人是北美公司為滿足強勁需求而增加投資的一部分。

- 同時,許多公司正在努力讓因疫情而失業的工人重返崗位,並將機器人視為在組裝上增加人力的替代方案。

- 美國的研發投資正在為所有工業領域的服務機器人市場的發明做出貢獻。新興國家的服務機器人產業極大地受益於先進的感測器網路以及人工智慧和機器學習能力。

北美服務機器人產業概況

北美服務機器人市場隨著需求增加而穩定發展,市場集中度適中。

- 根據產業組織自動化推進協會2021年11月編製的資料,工廠等工業用戶的機器人訂單數量較去年同期成長37%,達到2.9萬台,金額14.8億美元。這表明該地區對服務機器人的需求正在增加。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場趨勢

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業政策

- 市場促進因素

- 市場限制因素

- COVID-19 市場影響評估

第5章市場區隔

- 按類型

- 個人機器人

- 家庭機器人

- 調查

- 娛樂

- 其他

- 商務用機器人

- 田間機器人(農林/其他)

- 國防/安全(消防)

- 醫療(輔助機器人、診斷/檢修系統)

- 無人機無人機

- 其他

- 個人機器人

- 按領域

- 航空

- 土地

- 水下

- 按成分

- 感應器

- 致動器

- 控制系統

- 軟體

- 其他

- 按最終用戶產業

- 軍事/國防

- 農業、建築、採礦

- 運輸/物流

- 衛生保健

- 政府機構

- 其他

- 按國家/地區

- 美國

- 加拿大

第6章 競爭狀況

- 公司簡介

- Amazon Inc.

- KUKA AG

- Northrop Grumman Corporation

- Robobuilder Co. Ltd.

- SeaRobotics Corporation

- Honda Motors Co. Ltd.

- iRobot Corporation

- Hanool Robotics Corporation

- Iberobtoics SL

- Gecko Systems Corporation

- RedZone Robotics

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 52717

The North America Service Robotics Market is expected to register a CAGR of 15.1% during the forecast period.

Key Highlights

- The United States is a leader in the service robotics market for field robotics, logistics, and construction within North America. The usage of robotics in this region is varied and is also used in professional cleaning.

- The military application of service robotics is high in the professional use of service robotics. In defense, both manned and unmanned types of robots are used. In unmanned use, drones are very common. Investment in the use of drones has increased in the battlegrounds for a few years. They are being used for intelligence, surveillance, and reconnaissance missions and have helped the soldiers on the ground and sitting far away to plan their next move.

- A tremendously growing number of robots for rehabilitation and non-invasive therapy make this application the largest medical one in terms of units. About 75% of medical robot suppliers are from North America and Europe, while 27% of total service robot suppliers are from North America as per IFR.

- Moreover, the labor shortage in the region is one of the driving factors for the use of service robots during the COVID-19 pandemic. For instance, UVD Robots, Danish manufacture of ultraviolet-light-disinfection robots, shipped hundreds of its machines to hospitals in China and Europe.

North America Service Robotics Market Trends

The Growing Demand of Service Robots in Healthcare Sector Aids in Market Growth

- The North America Service market is growing at a fast pace. Service robotics is increasingly in use in the healthcare sector. They are used for a variety of reasons in healthcare, especially to assist in the operations of taking care of patients.

- The healthcare sector in this region varies in different countries. The majority of the healthcare providers in the USA belong to the private sector. According to AHA Hospital Statistics, 2021 edition, more than 57% of the hospitals are non-profit, and only around 18% are government-owned, and the rest is for profit. U.S. health care spending grew 4.6 % in 2019, reaching USD 3.8 trillion or USD 11,582 per person. As a share of the nation's Gross Domestic Product, health spending accounted for 17.7 %.

- In Canada, the majority of the healthcare sector is publicly funded, which is helpful for the citizens to get access to basic and advanced healthcare. This huge healthcare market is increasing, and the demand for robotics will increase in the period to come. The USA market has a higher percentage of demand compared to the Canadian market in this region.

- Moreover, the growth in the aging population and nursing staff shortage is driving the need for the provision of care for the elderly. As technology advances, clinicians and scientists are looking to robotics and other sensor-based technologies to aid caregivers in providing decent care services for older adults.

United States to Witness High Adoption of Service Robots

- The rush to add robots is part of a larger upswing in investment as companies in North America seek to keep up with strong demand, which in some cases has contributed to shortages of key goods.

- At the same time, many firms have struggled to lure back workers displaced by the pandemic and view robots as an alternative to adding human muscle to their assembly lines.

- Investment in research and development in the United States is aiding the invention of the service robot market amongst all sectors of industries. The service robot industry in the country is largely benefited by the developed sensor network and AI and machine learning capabilities of industries.

North America Service Robotics Industry Overview

The North America Service Robot market has a medium market concentration as the market is in developing steadily with rising demand.

- November 2021: According to data compiled by the industry group the Association for Advancing Automation, the factories, and other industrial users ordered 29,000 robots, 37% more than during the same period last year, valued at USD 1.48 billion. This points to an increase in the demand for service robots in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Trends

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Policies

- 4.5 Market Drivers

- 4.6 Market Restraints

- 4.7 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Personal Robots

- 5.1.1.1 Domestic Robots

- 5.1.1.2 Research

- 5.1.1.3 Entertainment

- 5.1.1.4 Others

- 5.1.2 Professional Robots

- 5.1.2.1 Field Robots (Agriculture, Forestry and Others)

- 5.1.2.2 Defense and Security (Fire Fighting)

- 5.1.2.3 Medical (Assistive robots, diagnostic and overhauling systems)

- 5.1.2.4 UAV Drones

- 5.1.2.5 Others

- 5.1.1 Personal Robots

- 5.2 By Areas

- 5.2.1 Aerial

- 5.2.2 Land

- 5.2.3 Underwater

- 5.3 By Components

- 5.3.1 Sensors

- 5.3.2 Actuators

- 5.3.3 Control Systems

- 5.3.4 Software

- 5.3.5 Others

- 5.4 By End-User industries

- 5.4.1 Military and Defense

- 5.4.2 Agriculture, Construction and Mining

- 5.4.3 Transportation & Logistics

- 5.4.4 Healthcare

- 5.4.5 Government

- 5.4.6 Others

- 5.5 By Countries

- 5.5.1 United States

- 5.5.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Inc.

- 6.1.2 KUKA AG

- 6.1.3 Northrop Grumman Corporation

- 6.1.4 Robobuilder Co. Ltd.

- 6.1.5 SeaRobotics Corporation

- 6.1.6 Honda Motors Co. Ltd.

- 6.1.7 iRobot Corporation

- 6.1.8 Hanool Robotics Corporation

- 6.1.9 Iberobtoics S.L

- 6.1.10 Gecko Systems Corporation

- 6.1.11 RedZone Robotics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219