|

市場調查報告書

商品編碼

1639382

服務機器人:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Service Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

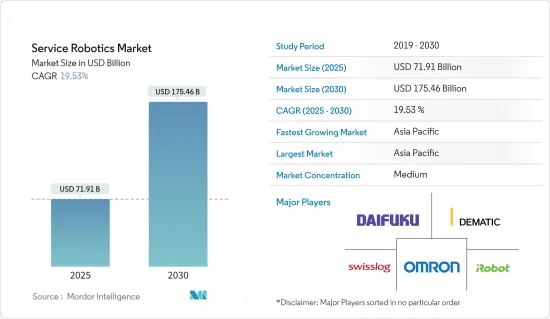

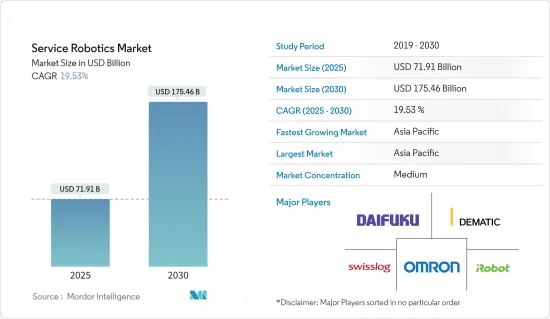

服務機器人市場規模在 2025 年預計為 719.1 億美元,預計到 2030 年將達到 1754.6 億美元,預測期內(2025-2030 年)的複合年成長率為 19.53%。

服務機器人具有提供準確、高品質的服務、幫助用戶減少人為錯誤和營運成本等特點,因此對它們的需求日益增加。此外,由於技術創新而導致的服務機器人的快速應用也是推動市場成長的主要因素之一。

主要亮點

- 服務機器人既可用於個人(家庭、娛樂等),也可用於商務用(國防、安全、醫療援助等),隨著技術的進步和價格實惠的機器人的發展,它們正越來越廣泛地應用於公眾。國際機器人聯合會(IFR)的資料顯示,2021年商務用服務機器人的銷售量成長了約37%。

- 感知、互動和操作方面的創新使服務機器人更具吸引力。技術和其他零件供應商一直在推動機器人生態系統的發展。例如,ABB近期與瑞士新興企業Seven Senses建立策略夥伴關係,利用人工智慧(AI)和3D視覺映射等技術邏輯為ABB新型自主移動機器人(AMR)提供動力。

- 包括日本和中國在內的多個國家都面臨人口老化的問題,這推動了醫療技術領域的成長。例如,根據日本政府2022年9月公佈的資料,日本75歲以上人口首次超過15%。這些趨勢正在鼓勵企業投資老年人產品,為服務機器人提供者創造巨大的機會。

- 服務機器人通常用於個人和家庭用途,例如吸塵、清潔地板、協助老年人和提供娛樂。但現在有幾家供應商正在探索這些箱子的新應用,為酒店和機場休息室的顧客提供食品和飲料,處理酒店入住和退房服務,甚至運送行李。協助人們等任務,這推動了對服務機器人的需求。

- 然而,認知度較低(尤其是在新興市場)以及服務機器人成本高等挑戰阻礙了市場的成長。此外,操作這些機器人還需要一定的技術知識,這對市場成長來說是一項重大挑戰。

服務機器人市場趨勢

商務用機器人將佔據大量市場佔有率

- 商務用機器人包括現場機器人、國防和安全機器人、醫療援助機器人(MAR)、公共助理機器人、電氣工業機器人和建築機器人。數位技術和自動化解決方案在這些領域的不斷滲透正在推動對商務用機器人的需求。

- 例如,服務機器人被引入建設產業,以克服人事費用高、人手不足和事故等問題。由於人為錯誤的可能性較小,它還有助於建造更可靠的建築。 3D列印機和拆除機器人等技術將進一步推動機器人在建築領域的應用。

- 外骨骼機器人被用作公關機器人。公關機器人大部分用於幫助顧客尋找商品或完成任務。這些機器人被部署在零售業、餐旅服務業、銀行、購物中心、家庭娛樂中心等場所,引導顧客逛商店。

- 商務用機器人的主要應用領域是運輸、客戶服務、醫療保健、專業清潔和農業。交通運輸是上述年份商務用機器人的主要消費者之一。例如,根據IFR的預測,到2023年,美國將擁有最多的商務用機器人製造商,遠遠超過其最接近的競爭對手中國和德國的總合。值得注意的是,機器人新興企業在包括美國在內的主要國家都有強大的影響力,並對現有企業的優勢發起挑戰。

- 服務機器人在醫學和醫療保健領域的應用多種多樣,包括診斷系統、機器人輔助手術和治療以及復健系統。新冠疫情的爆發對推動整個產業對機器人的需求起到了關鍵作用。例如,根據IFR 2021的數據顯示,2021年醫療機器人銷售成長23%,出貨量達1,4823台。

亞太地區成長速度驚人

- 亞太地區是世界上成長最快的地區之一,因為該地區擁有龐大的消費群,尤其是中國、日本、韓國和印度等國家,對服務機器人的需求正在增加。例如,根據 IFR 的數據,2021 年亞洲商務用機器人的銷售量成長了約 30%。

- 地方政府也是發展本地機器人市場的重要因素。例如,印度計劃投資軍事機器人,並準備在未來幾年部署先進的機器人士兵。從全印度機器人協會(AIRA)2022 年 1 月宣布將開始國內生產國防機器人可以看出這一點。

- 該地區的其他國家也出現了類似的趨勢。例如,中國政府對國內機器人產業制定了雄心勃勃的計畫。為推動製造業轉型升級,政府將機器人產業與人工智慧、自動化並列為高階發展的重點領域之一。此次推廣預計將提高中國製造機器人的全球市場佔有率。

- 此外,隨著亞洲金融服務公司精簡成本以提高股東回報並保持盈利,他們擁有了吸引客戶的新工具,例如服務機器人。

- 日本、中國等主要國家的老齡人口也正在大幅增加。根據聯合國統計司(UN DESA)和中國國家統計局(NBSC)的估計,到2050年,60歲及以上人口比重預計將增加到約38.81%。這些趨勢預計將推動該國對服務機器人的需求。

服務機器人產業概況

服務機器人市場適度整合,主要參與者在市場上佔有重要地位。然而,隨著需求的擴大,新參與企業的數量也在增加,導致競爭加劇和市場分化。供應商正在採用產品創新、合作夥伴關係和收購等各種策略來進一步加強其市場地位。主要參與者包括DAIFUKU CO. LTD.、Dematic Corp.、Swisslog Holding AG 和 iRobot Corporation。

2022年9月,加拿大機器人公司Avidbots在C輪資金籌措中籌集了7,000萬美元。該公司主要開發自動清潔機器人,並生產 Neo 2,這是一種專為倉庫、機場和購物中心等商業環境設計的機器人地板清潔器。

2022年9月,領先的B2B技術解決方案供應商Jacky's Business Solutions在Gitex活動上展示了最新的Temi機器人(V3)。該公司採用機器人即服務(RaaS)經營模式在中東推出了這款新型個人助理機器人。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 動態產業和機器人技術創新推動對自動化解決方案的需求

- 醫療保健領域對商務用機器人的需求不斷增加

- 市場限制

- 安裝和維護成本高

第6章 市場細分

- 按應用領域

- 商務用

- 現場機器人

- 商務用清潔

- 檢查和維護

- 建築和拆除

- 物流系統(製造業和非製造業)

- 醫療機器人

- 救援和安全機器人

- 防禦機器人

- 水下系統(民用/通用)

- 人類體外骨骼

- 公關機器人

- 個人/家庭使用

- 家務助理機器人

- 娛樂機器人

- 機器人協助老年人和殘障人士

- 商務用

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Daifuku Co. Ltd

- Dematic Corp.

- Swisslog Holding AG(KUKA)

- Seegrid Corporation

- Omron Corporation

- JBT Corporation

- SSI Schaefer AG

- Grenzebach GmbH & Co. KG

- Smith & Nephew PLC

- Stryker Corp.

- Intuitive Surgical Inc.

- Knightscope Inc.

- Kollmorgen Corporation

- Brokk AB

- Husqvarna AB

- Construction Robotics LLC

- iRobot Corporation

- Ecovacs Robotics

- Neato Robotics

- Transbotics Corporation

- Medtronic PLC

- Northrop Grumman

- BAE Systems

- UBTECH Robotics Inc.

- SMP Robotics Systems Corp.

- Vision Robotics Corporation

- Naio Technologies SAS

第8章投資分析

第9章:未來市場展望

The Service Robotics Market size is estimated at USD 71.91 billion in 2025, and is expected to reach USD 175.46 billion by 2030, at a CAGR of 19.53% during the forecast period (2025-2030).

Service robots offer several features, such as delivering precise and high-quality service and helping users reduce human mistakes and operational expenses, due to which their demand has increased. Additionally, the rapid proliferation of service robot capabilities owing to technological innovations is also among the key factors driving the market's growth.

Key Highlights

- Service robots, both personal (for household, entertainment applications, etc.) and professional (for defense, security, medical assistance, etc.), are gaining significant popularity as technological improvement and the development of affordable robots have significantly enhanced their penetration among general consumers. According to data from the International Federation of Robotics (IFR), sales of professional service robots increased by about 37% in 2021.

- Technological innovations concerning cognition, interaction, and manipulation have made service robotics more appealing. Technology and other component providers have moved the robotics ecosystem forward. For instance, recently, ABB entered into a strategic partnership with Switzerland-based start-up Sevensense to enhance ABB's new Autonomus Mobile Robotics (AMR) offering with techn ologies such as artificial intelligence (AI) and 3D vision mapping.

- The aging population of several countries, including Japan and China, is also driving the growth in the medical technology sector, thus, creating a massive market for service robotics in the region. For instance, according to the Japanese government's data released in September 2022, for the first time, Japan's over 75s accounted for over 15% of the population. Such trends encourage companies to invest in products for the elderly, which is a massive opportunity for the service robot providers.

- Service robots are usually deployed for personal/household purposes, like vacuum and floor cleaning, elderly assistance, and entertainment. However, several vendors have now started exploring new cases and are focusing on designing robots to perform tasks, such as delivering food and drinks to customers at hotels and airport lounges, handling check-in and check-out services at hotels, and even carrying luggage, which is boosting the demand for service robots.

- However, the factors such as low awareness, especially in developing regions, and the higher cost of service robots are challenging the growth of the studied market. Furthermore, a certain degree of technical know-how is also required to operate these robots, which is a significant challenge for the market's growth.

Service Robotics Market Trends

Professional Use of Robots to Account for a Significant Share in the Market

- Professional robots consist of field robots, defense, and security robots, medical assisting robots (MAR), public assistant robots, electrical industry robots, and robots for construction purposes. The increasing penetration of digital technologies and automation solutions across these sectors drives the demand for professional robots.

- For instance, service robots are deployed in the construction industry to overcome heavy labor costs, shortages, and accidents. It also helps construct more reliable buildings since there is less chance of human error. Technologies like 3D printing and demolition robots further act as catalysts in adopting robots in the construction sector.

- Exoskeleton robots are used as public relations robots. Most public relations robots are used to assist customers in finding an item or completing a task. These robots are deployed in retail to guide customers around a store and in the hospitality industry, banks, shopping malls, family entertainment centers, and more.

- Major application areas for professional robots are transportation, hospitality, medical, professional cleaning, and agriculture. Transportation was among the leading consumer of professional robots in the aforementioned year. For instance, according to IFR, in 2023, the United States boasts the largest number of professional service robot manufacturers, significantly surpassing the combined count of China and Germany, its closest competitors. Notably, leading nations, including the United States, see a robust presence of robotics startups, challenging the dominance of established firms.

- Service robots are used in medical and healthcare for various applications, including diagnostic systems, robot-assisted surgery or therapy, rehabilitation systems, etc. The outbreak of the COVID-19 pandemic played an important role in driving the demand for robots across the sector. For instance, according to IFR 2021, a 23% growth in the sales of medical robots was recorded in 2021, with the number of shipments touching 14,823 units.

Asia Pacific to Exhibit a Significant Growth Rate

- The Asia Pacific is one of the fastest-growing regions in the world, owing to the presence of a large consumer base, among which the demand for service robots is increasing, especially in countries such as China, Japan, South Korea, and India, among others. For instance, according to IFR, in 2021, the sales of professional robots grew by about 30% in Asia.

- Regional governments are also a significant factor in developing a regional robotics market. For instance, India plans to invest in military robotics, and the country is preparing to deploy advanced robotic soldiers in the next few years. This is evident from the fact that in January 2022, the All India Robotics Association (AIRA) announced the beginning of indigenous manufacturing of defense robots.

- A similar trend has been observed across other countries of the region as well. For instance, the Chinese government has ambitious plans for the country's robotics industry. The government has listed the robotics industry, along with artificial intelligence (AI) and automation, as one of the priority sectors for high-end development to push forward the transformation and upgradation of the manufacturing industry. This push is expected to raise the global market share of Chinese-made robots.

- Further, financial services companies in Asia are looking to streamline costs to boost dividends to shareholders, maintain profitability, and have a new tool at their disposal that appeals to customers, for example, service robots.

- Some major countries, such as Japan, China, etc., are also witnessing significant growth in the aged population. According to the estimation of UN DESA and the National Bureau of Statistics of China (NBSC), the percentage of the population aged 60 and above is expected to grow to about 38.81% by 2050. Such trends are expected to drive the demand for service robots in the country.

Service Robotics Industry Overview

The Service Robotics market is moderately consolidated, as major players have a significant market presence. However, with the demand growing, new players are also entering the market, driving competition and the market toward a fragmented stage. Vendors are adopting various strategies to consolidate further their market presence, including product innovation, partnerships, acquisitions, etc. Some major players include Daifuku Co. Ltd, Dematic Corp., Swisslog Holding AG, and iRobot Corporation.

In September 2022, Avidbots, a robotics company based in Canada, raised USD 70 million in the Series C funding round. The company primarily develops autonomous cleaning robots and has built Neo 2, a robotic floor cleaner designed for commercial environments such as warehouses, airports, and shopping malls.

In September 2022, Jacky's Business Solutions, a leading B2B technology solutions provider, announced a showcase of its latest iteration of Temi Robot (V3) at the Gitex event. The company launched this new personal assistance robot in the Middle East with Robot-as-a-service (RaaS) business model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automated Solutions from Dynamic Industries and Robot Innovations

- 5.1.2 Increased Demand for Professional Robots in Healthcare

- 5.2 Market Restraints

- 5.2.1 High Cost of Installation and Maintenance

6 MARKET SEGMENTATION

- 6.1 By Field of Application

- 6.1.1 Professional

- 6.1.1.1 Field Robots

- 6.1.1.2 Professional Cleaning

- 6.1.1.3 Inspection and Maintenance

- 6.1.1.4 Construction and Demolition

- 6.1.1.5 Logistics Systems (Manufacturing and Non-manufacturing)

- 6.1.1.6 Medical Robots

- 6.1.1.7 Rescue and Security Robots

- 6.1.1.8 Defense Robots

- 6.1.1.9 Underwater Systems (Civil/General)

- 6.1.1.10 Powered Human Exoskeletons

- 6.1.1.11 Public Relation Robots

- 6.1.2 Personal/Domestic

- 6.1.2.1 Robots for Domestic Tasks

- 6.1.2.2 Entertainment Robots

- 6.1.2.3 Elderly and Handicap Assistance

- 6.1.1 Professional

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku Co. Ltd

- 7.1.2 Dematic Corp.

- 7.1.3 Swisslog Holding AG (KUKA)

- 7.1.4 Seegrid Corporation

- 7.1.5 Omron Corporation

- 7.1.6 JBT Corporation

- 7.1.7 SSI Schaefer AG

- 7.1.8 Grenzebach GmbH & Co. KG

- 7.1.9 Smith & Nephew PLC

- 7.1.10 Stryker Corp.

- 7.1.11 Intuitive Surgical Inc.

- 7.1.12 Knightscope Inc.

- 7.1.13 Kollmorgen Corporation

- 7.1.14 Brokk AB

- 7.1.15 Husqvarna AB

- 7.1.16 Construction Robotics LLC

- 7.1.17 iRobot Corporation

- 7.1.18 Ecovacs Robotics

- 7.1.19 Neato Robotics

- 7.1.20 Transbotics Corporation

- 7.1.21 Medtronic PLC

- 7.1.22 Northrop Grumman

- 7.1.23 BAE Systems

- 7.1.24 UBTECH Robotics Inc.

- 7.1.25 SMP Robotics Systems Corp.

- 7.1.26 Vision Robotics Corporation

- 7.1.27 Naio Technologies SAS