|

市場調查報告書

商品編碼

1628744

美國家庭護理包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)US Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

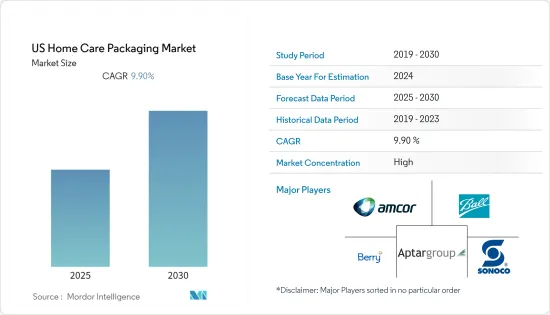

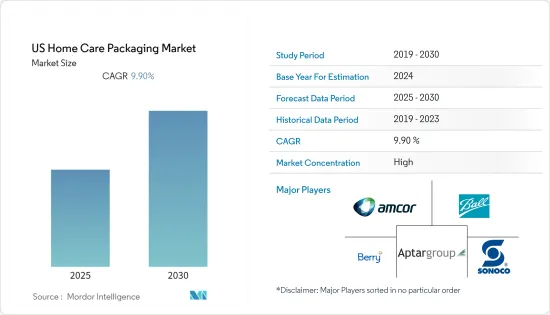

預計美國家庭護理包裝市場在預測期間的複合年成長率為 9.9%。

特別是,隨著消費者健康意識的增強並傾向於避免高昂的醫療費用,對家庭護理產品的需求正在上升。為了滿足這一需求,家庭護理包裝行業正在區分多種包裝解決方案並增強提案,以在不影響安全標準的情況下傳達有用的資訊。預計這部分包裝市場將在預測期內實現高速成長。

根據經濟合作暨發展組織(OECD) 的數據,美國家庭總支出累計14 兆美元。此外,根據經濟分析局的估計,截至 2020 年 1 月,個人收入增加了 19,547 億美元(10.0%)。同樣,個人可支配所得(DPI)增至19,632億美元(11.4%),個人消費支出(PCE)成長2.4%。

儘管景氣衰退,但對家庭保健產品的需求從未減少,對包裝解決方案的需求成正比成長。在耐用性、成本效益和多功能性等優勢的推動下,塑膠已成為企業使用的主要包裝材料之一。由於為了提高耐久性和安全性而進行的研究和開發,PLA、生物分解性的PHA(聚羥基烷酯)和生物PTT(聚對苯二甲酸三甲酯)等聚合物對於產業來說是新事物,並逐漸獲得認可。然而,高昂的成本為長期永續性帶來了挑戰。

在家庭護理產品產業,消費者對包裝材料永續性的認知不斷增強。例如,截至 2021 年 3 月,聯合利華正在增加消費後再生塑膠 (PCR) 的使用。該公司塑膠包裝總量中約 11% 由再生塑膠製成,該公司的目標是到 2025 年使用至少 25% 的再生塑膠。

美國家庭護理包裝市場趨勢

疫情影響居家清洗用品需求增加

在美國,消費者擴大使用電子商務管道來採購家庭護理產品。線上銷售的佔有率仍然較低,但預計在預測期內將擴大。此外,聯合利華正在根據線上通路的產品銷售進行新的收購。

隨著 2020 年清潔時間變得更長,消費者開始擔心傳統清洗產品對健康和環境的副作用。因此,在整個 2021 年,以清洗為目的的家庭護理產品的需求預計將需要支持消費者身心健康的舉措。例如,冠狀病毒大流行導致衛生紙銷售激增,使衛生紙產品成為美國主要的家庭產品類別,價值約104億美元。

美國清潔協會 (ACI) 於 2020 年 9 月發布了《消費者清潔和衛生調查》,旨在探討新冠肺炎 (COVID-19) 大流行前後消費者對清潔和消毒做法的看法和行為。調查顯示,自流感季節開始以來,美國的清潔工作比以往任何時候都多。

此外,86% 的美國人對清洗產品能夠保護他們免受冠狀病毒感染充滿信心。此外,92%的人表示他們有在家中表面使用消毒劑的習慣。超過 50% 的人還計劃繼續更頻繁地擦拭表面並使用消毒劑。

Clorox, Inc.(家庭護理)正在利用 Pine-Sole Original 多表面清潔劑來應對冠狀病毒的威脅。該產品聲稱可以在堅硬、無孔的表面殺死 SARS-CoV-2(導致 COVID-19 的病毒),因此獲得了美國環保署 (EPA) 的核准。

人們對產業永續性的興趣日益濃厚

家庭護理品牌和包裝供應商不斷努力創新,透過品牌在競爭激烈的市場空間中創造差異化。家庭護理包裝領域存在著一個尚未開發的機會,可以透過用更永續性的包裝解決方案(如紙瓶和多層瓦楞紙箱)取代塑膠瓶來幫助減少塑膠污染。這種包裝是幫助消費者減少塑膠消耗的重要機會,甚至可以省去回收的麻煩。這項措施符合政府的要求。例如,2020年,佛羅裡達州記錄了約4,710萬噸城市廢棄物,其中僅塑膠就約佔收集總量的7.33%。

從以產品為基礎的創新來看,寶潔公司的妙抗保 24 已獲得美國環保署 (EPA)核准作為消毒噴霧劑,可有效殺死 SARS-CoV-2。雖然其他多種產品聲稱可以殺死 99.9% 的 SARS-CoV-2,但妙抗保 24 證明了這一點,它可以全天發揮作用,為您家中的表面提供持久的保護。

O3waterworks LLC 推出了一種臭氧驅動的家用清洗和消毒噴霧。這種噴霧瓶產生低濃度的臭氧水,眾所周知,臭氧水可以分解細菌和污染物。它很快就變成水和空氣,並且不留任何殘留物。該公司的噴霧瓶可用於清洗牙刷、清洗水果和蔬菜、沖洗掉落的奶嘴、清洗嬰兒玩具等。

另一位清潔品類領導者 Jelmar 更新了其 CLR 產品線,煥然一新的外觀和新的發音(“CLeaR”)。此外,我們還實施了新的創新宣傳活動並更改了一些產品名稱。這樣做是為了反映產品線範圍的擴大。

聯合利華表示,Love Home & Planet 的「絕大多數」包裝是由可回收材料製成的。 「接下來是蓋子和袋子。該公司的目標是到 2021 年,Love Home & Planet 的包裝採用 100% 回收包裝。在美國,Love Home & Planet 擁有30% 的回收包裝,用於織物護理、洗碗和清潔。本產品含有濃縮清潔劑,採用永續來源的植物來源清洗劑,即使在冷水中也能發揮作用,從而減少水和能源的使用,透過最大限度地減少洗滌次數來延長衣服的使用壽命。

美國家庭護理包裝產業概況

美國家庭護理包裝市場適度分散,由於投資增加、新參與企業以及最終用戶行業應用的擴大,預計將獲得更高的競爭力。下面列出了一些進展。

- 2021 年 8 月 - 聯合利華開發了永續的黑色包裝,該包裝採用以前被視為廢棄物的消費後樹脂材料層壓而成。該公司採用多層消費後樹脂設計來實現永續的黑色塑膠包裝,適用於個人護理、美容、化妝品、家庭護理和食品。這項創新使黑色塑膠廢棄物能夠重新用於這些類別的新包裝。

- 2021 年 7 月 - Westfall Techniques 收購 Carolina Precision Plastics,使其能夠接觸歐萊雅、雅詩蘭黛和 Clorox(泰銖 Bees 的母公司)等著名化妝品和個人護理公司。

- 2021 年 3 月 - 聯合利華北美公司宣布將向閉合迴路 Partners 領導力基金投資 1500 萬美元,支持到 2025 年每年回收約 6 萬噸美國塑膠包裝廢棄物。聯合利華的投資和每年持續使用約59,000 噸消費後回收(PCR) 塑膠包裝的影響將有助於兌現其到2025 年收集和加工比其銷售量更多的塑膠包裝的承諾。支持。

- 美國公司正尋求大幅擴張歐洲市場,透過改善供應鏈來提高自己的地位。例如,2021 年 3 月,Proanpac 透過收購 IG Industries PLC 和 Brayford Plastics Limited 進軍英國。此外,2021 年 1 月,Proanpac, LLC 宣布已獲得 Pritzker Private Capital (PPC) 的投資,以進一步推進其擴張計劃,包括策略性收購和擴大全球影響力。除了現有和新的共同投資者之外,該公司還獲得了新加坡主權財富基金 GIC 和 PPC 的投資,以推動其成長。

- 2021 年 2 月 - 漢高宣布增加其廁所清潔凝膠包裝中回收聚乙烯 (PEPE) 的含量。例如,「Bif」品牌潔廁劑標準系列達到50%,「ProNature」系列清潔劑達到75%,且公司強調永續性方面以滿足消費者的需求。

- 2021 年 1 月 - 總部位於佛羅裡達州的 Jabil 公司收購了 Ecologic Brands,使其成為其包裝解決方案部門的一部分。此次收購支持公司的永續發展目標。我們簽署了艾倫麥克阿瑟基金會的塑膠經濟全球承諾,承諾我們的客戶從當前解決方案中消除有問題和不必要的塑膠包裝。

- 此外,2020 年 12 月,WD-40(家庭和全球貿易專業人士使用的標誌性多用途產品)和 DS Smith 合作提供紙質可回收二次包裝解決方案,宣布他們已從廢棄物中去除了586,208 件塑膠。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 波特五力分析- 產業吸引力

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 產品創新、差異化與品牌化

- 人均所得上升對購買力有正面影響

- 市場限制因素

- 原物料價格波動

第6章 市場細分

- 按材質

- 塑膠

- 紙

- 金屬

- 玻璃

- 依產品類型

- 瓶子

- 金屬罐

- 紙盒

- 瓶子

- 小袋

- 依居家護理產品分類

- 洗碗

- 殺蟲劑

- 衣物洗護

- 洗護用品

- 拋光

- 空氣護理

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Mondi Group

- Berry Global

- Winpak

- Aptar Group

- Sonoco Products Company

- Silgan Holdings

- Tetra Laval

- DS Smith Plc

- CAN-PACK SA

- Prolamina Packaging

- Ball Corporation

第8章投資分析

第9章 市場機會及未來趨勢

The US Home Care Packaging Market is expected to register a CAGR of 9.9% during the forecast period.

Demand for home care products has been on an upward trend, especially as the consumers, with growing health awareness, tend to avoid expensive medical care costs. To keep up with this demand, the home care packaging industry has ramped up its offerings to differentiate between multiple packaging solutions, conveying useful information without compromising on the safety standards. The packaging market for this segment is set to record high growth during the forecast period.

As per OECD, the United States reported USD 14 trillion towards overall household spending in the country. And, allied personal income was recorded to have increased at USD 1,954.7 billion (10.0%) as of January 2020, according to estimates by the Bureau of Economic Analysis. Similarly, the Disposable personal income (DPI) increased to amount to USD 1,963.2 billion (11.4%), along with personal consumption expenditures (PCE) increased by 2.4%.

Despite the economic setbacks, demand for home healthcare products has never declined, and directly proportional to that is the requirement for packaging solutions. Driven by advantages like durability, cost benefits, and versatility, plastic is one of the packaging materials majorly used by companies. Research and development for increased durability and safety found new entrants into the industry, which include polymers like PLA, biodegradable PHA (polyhydroxyalkanoate), bio PTT (polytrimethyl terephthalate), etc., slowly getting acceptance. However, high cost poses a challenge to their sustainability in the long run.

The home care products industry has been witnessing increased awareness among consumers regarding the sustainability of packaging materials. For instance, as of March 2021, Unilever has stepped up the use of post-consumer recycled plastic (PCR). With around 11% of its total plastic packaging volume consisting of recycled plastic, the company aims to use at least 25% recycled plastic by 2025.

US Home Care Packaging Market Trends

Increased Demand for Household Cleaning Products Owing to the Pandemic

The United States is experiencing an increased use of e-commerce channels to procure home care products by consumers. While the share of online sales remains low, it is expected to grow during the forecast period. Furthermore, Unilever has been making new acquisitions based on selling products through online channels.

With extended periods of cleaning throughout 2020, consumers raised concerns over the side effects of traditional cleaning products on health and the environment. Throughout 2021, it is, thus, expected that the demand for home care products designed to provide cleaning efficacy will require efforts to support consumers' physical and emotional wellbeing as well. For instance, The coronavirus pandemic caused a surge in toilet tissue sales, making toilet tissue products the leading home product category in the United States at about USD 10.4 billion.

A consumer cleaning and hygiene research presented by the American Cleaning Institute (ACI) in September 2020 was designed to tap consumer perceptions and actions regarding cleaning and disinfection practices around the COVID-19 pandemic. The survey suggested that Americans were cleaning more than ever before due to the onset of flu season.

Moreover, 86% of Americans were confident in their cleaning products to help protect themselves against coronavirus. 92% of them suggested that they are habituated to using disinfectants on surfaces in their homes. Over 50% of them plan to continue wiping down surfaces more often and using disinfecting products.

The Clorox Company (in-home care) has taken on the coronavirus threat by using its Pine-Sol Original Multi-Surface Cleaner. The product received approval from the US Environmental Protection Agency (EPA) for claims on killing SARS-CoV-2, the virus that causes COVID-19, on hard non-porous surfaces.

Increasing Awareness Over Sustainability Concerns in the Industry

Home care brands and packaging suppliers have been on a constant spree to innovate and create differentiation in a contested market space through branding. Household care packaging has untapped opportunities to help reduce plastic pollution by replacing plastic bottles with more sustainable packaging solutions like paper bottles and multi-layered cardboard cartons. This packaging represents an important opportunity to help consumers to reduce plastic consumption and might even help make recycling less complicated. The effort has also been consistent with the government; for instance, In 2020, Florida recorded nearly 47.1 million tonnes of municipal waste, of which plastic alone constituted about 7.33% of the total collection.

When looking at product-based innovation, P&G's Microban 24 was approved by the US Environmental Protection Agency (EPA) as a sanitizing spray that is effective in killing SARS-CoV-2. With multiple other products claiming to kill 99.9% of the bacteria, Microban 24 certifies this and continues working throughout the day to provide long-lasting protection for surfaces in homes.

O3waterworks LLC introduced a household cleaning and sanitizing spray-fueled ozone. The spray bottle is known to create low-concentration aqueous ozone to break up germs and contaminants. This quickly becomes water and air, leaving no residue. The company's Spray Bottle can be used to clean toothbrushes, wash fruits and veggies, rinse off dropped pacifiers, clean baby toys, to name a few.

Another cleaning category leader, Jelmar, refreshed its CLR line of products with a new look and a new pronunciation ('CLeaR'). Additionally, it had run a new creative campaign, post several products were renamed. This was done to reflect the breadth of the expanded product line.

According to Unilever, the "majority" of Love Home & Planet's packaging was made from recycled and recyclable materials. "Caps and pouches would be the next. The company is working towards 100% recycled packaging across Love Home & Planet by 2021. In the United States, Love Home & Planet includes more than 30 products for fabric care, dishwashing, and cleaning. It incorporates a concentrated laundry detergent made with sustainably sourced plant-based cleansers that are effective in cold water. A dry-wash spray is designed to prolong the life of clothes by minimizing washing while reducing water and energy use.

US Home Care Packaging Industry Overview

The market for Home Care Packaging in the United States is moderately fragmented and is expected to attain a higher degree of competitiveness owing to the increasing investments, new players, and growing applications in end-user industries. Some of the developments are as follows -

- August 2021 - Unilever developed a sustainable black packaging made from layered post-consumer resin materials, which was previously treated as waste. The company had used a multilayer post-consumer resin design to achieve sustainable black plastic packaging suitable for personal care, beauty, cosmetics, home care, and food products. This innovation enables black plastic waste to be re-used in new packaging across these categories.

- July 2021 - Westfall Technik acquired Carolina Precision Plastics, giving Westfall access to prominent cosmetics and personal care companies, including L'Oreal, Estee Lauder, and Clorox (which owns Burt's Bees).

- March 2021 - Unilever North America announced a USD 15 million investment in Closed Loop Partners' Leadership Fund to help recycle an estimated 60,000 metric tons of USlastic packaging waste annually by 2025, an amount equivalent to more than half of UnUnilever'slastics footprint in North America. The impact of UnUnilever'sew investment and its continued use of post-consumer recycled (PCR) plastic packaging, which is approximately 59,000 metric tons per year, will underpin the delivery of its commitment to collect and process more plastic packaging than it sells by 2025.

- American companies have been significantly looking to expand into the European market to improve their position through improved supply chains. For instance, In March 2021, Proampac acquired IG Industries PLC and Brayford Plastics Limited to mark their expansion into the UK. Furthermore, in Jan 2021, ProAmpac LLC announced that it had received investment from Pritzker Private Capital (PPC) to further its expansion plans, including strategic acquisitions and increasing the global footprint. The company received investment from GIC, Singapore's sovereign wealth fund in addition to existing and new co-investors, and PPC to promote its growth.

- February 2021 - Henkel announced the amount of recycled polyethylene (PEPEin the packaging of its toilet cleaner gels increased. By reaching 50% for toilet cleaners in the standard range, for example, from the Biff brand, and, in the case of cleaners from the Pro Nature range, as much as 75%, the company has banked on sustainability aspects to speak to consumers needs.

- January 2021 - Jabil, the company in Florida, acquired Ecologic Brands, which would become part of its Packaging Solutions division. This acquisition would support the cocompany'swn sustainability goals. It is a signatory of the Ellen MacArthur FoFoundation'sew Plastics Economy Global Commitment and pledged to engage its customers "t" eliminate problematic and unnecessary plastic packaging from their current solutions.

- Moreover, In December 2020, WD-40, the iconic multi-use product used in households and by trade professionals worldwide, and DS Smith announced that it worked together to provide a paper-based, recyclable secondary packaging solution that has led to the removal of 586,208 individual pieces of plastic from the waste stream.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis - Industry Attractiveness

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Impact of COVID-19 Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Product Innovation, Differentiation, and Branding

- 5.1.2 Rising Per Capita Income Positively Impacting Purchase Power

- 5.2 Market Restraints

- 5.2.1 Fluctuating Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Metal Cans

- 6.2.3 Cartons

- 6.2.4 Jars

- 6.2.5 Pouches

- 6.3 By Homecare Products

- 6.3.1 Dishwashing

- 6.3.2 Insecticides

- 6.3.3 Laundry Care

- 6.3.4 Toiletries

- 6.3.5 Polishes

- 6.3.6 Air Care

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Mondi Group

- 7.1.3 Berry Global

- 7.1.4 Winpak

- 7.1.5 Aptar Group

- 7.1.6 Sonoco Products Company

- 7.1.7 Silgan Holdings

- 7.1.8 Tetra Laval

- 7.1.9 DS Smith Plc

- 7.1.10 CAN-PACK S.A.

- 7.1.11 Prolamina Packaging

- 7.1.12 Ball Corporation