|

市場調查報告書

商品編碼

1637843

中東和非洲的居家醫療包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)MEA Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

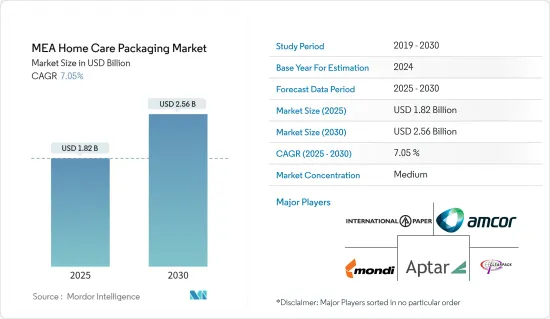

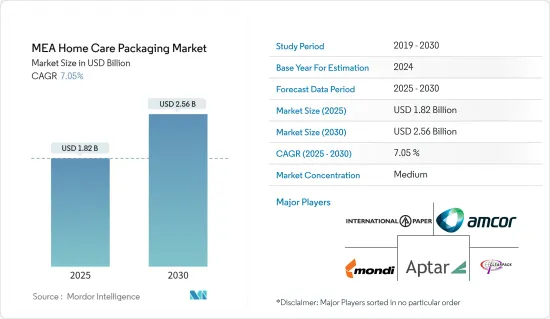

中東和非洲居家醫療包裝市場規模預計到 2025 年為 18.2 億美元,預計到 2030 年將達到 25.6 億美元,預測期內(2025-2030 年)複合年成長率為 7.05%。

主要亮點

- 居家醫療包裝市場包括專為清洗和衛生而設計的產品。低廉的包裝、使用的便利性和儲存的便利性在整個評估期間保持了主要的消費趨勢。對於希望在市場上競爭的品牌所有者來說,較小的包裝尺寸正在成為更具吸引力的選擇,因為它們對整個客戶群來說更實惠。

- 塑膠是包裝居家醫療產品最常用的材料之一。儘管產業成長緩慢,但居家醫療包裝的創新層出不窮,尤其是衣物洗護領域。雖然已開發國家的銷售和收益低迷,但小瓶裝推動了銷售的成長,這使得洗衣精在新興市場更便宜。

- 餐具清潔劑、清潔清潔劑、地板清潔劑家居用品均採用寶特瓶包裝。公司正在採用新的包裝和標籤方法,以保持其產品的可回收性。

- 此外,南非消費者預計需要具有可靠性和可負擔性等基本特徵的優質產品。該地區的消費者通常會根據當地的生活方式、習俗和承受能力來選擇本地或國際品牌。

- 人口成長通常會導致對清洗產品、洗衣精和個人保養用品等居家醫療產品的需求增加。因此,用於容納和分發這些產品的包裝需要相應成長。根據國際貨幣基金組織(IMF)預測,2023年至2028年阿曼總人口預計將持續成長90萬人(增幅17.68%)。

- 中東和非洲居家醫療包裝市場面臨可能影響其成長和永續性的挑戰。關鍵挑戰之一是克服中東和非洲各地不同的監管障礙,這通常會導致包裝標準和環境法規的複雜問題。此外,市場面臨原物料價格不可預測的波動,這可能會影響生產成本和定價策略。

中東和非洲居家醫療包裝市場趨勢

瓶裝市場預計將顯著成長

- 儘管行業成長緩慢,但居家醫療包裝的創新仍然很多,特別是在衣物洗護。儘管已開發國家的銷售和收益低迷,但新興市場正在透過將洗衣劑製成更小、更易於每個人使用的瓶子來促進洗衣精的大規模銷售。

- 隨著衛生意識的增強,尤其是在疫情等事件期間,對消毒劑、消毒劑和清洗產品等居家醫療產品的需求激增。這種增加的需求需要瓶子來容納和分發這些產品。

- 強調衛生和安全的包裝可以增強消費者的信心。在健康和清潔問題驅動的市場中,消費者更有可能信任並購買包裝強調衛生特性的產品。

- 保持衛生標準的永續且環保的瓶子包裝選擇越來越受歡迎。消費者關心他們的個人健康和環境,可生物分解性材料等環保包裝選擇可以符合這些價值。

- 近年來,該地區的住宅數量有所增加。根據 Sidran Institute 和 Sidra Capital 的數據,沙烏地阿拉伯的住宅擁有率預計將從 2017 年的 49.9% 大幅增加到 2030 年的約 70%。因此,對家居產品的需求預計也會相應增加,從而推動市場成長。

紙包裝經歷顯著成長

- 人們對塑膠包裝使用日益成長的環境擔憂正在推動產業尋找永續包裝。零售商實施的減少塑膠和回收措施,以及有關法律行動的政治辯論,引起了媒體的關注,並提高了消費者對塑膠對野生動物和環境造成的巨大問題的認知。

- 紙張比塑膠更容易生物分解性,並且可以輕鬆回收。它還可以在不發生化學反應的情況下重新製漿,並且不易受到污染。為此,一些知名品牌正在用紙質包裝取代塑膠包裝。

- 公司和品牌擴大投資於永續包裝解決方案,例如可堆肥壓縮紙瓶。與相同尺寸的普通塑膠瓶相比,這些紙瓶可節省 60-70% 的塑膠材料,並聲稱可堆肥和可回收。瓶子由外殼和內袋組成,設計易於拆卸和回收。使用後,外殼會從內袋中彈出,使其可回收性提高 7 倍,甚至堆肥。因此,對紙質和塑膠包裝減少的居家醫療的需求不斷增加,預計將促進該地區的市場成長。

- 人口成長可能會增加進入居家醫療市場的參與企業數量,導致品牌之間的競爭加劇。為了在這一競爭格局中脫穎而出,公司可以投資創新的包裝設計和材料,以使其產品脫穎而出並吸引消費者。根據國際貨幣基金組織(IMF)的數據,2022年阿拉伯聯合大公國人口居住987萬,預計2028年將增加至1,100萬。

- 雙收入家庭的成長趨勢預計將推動居家醫療包裝市場的成長。混合紙瓶有效地傳達了您的品牌對消費者的承諾,並產生了巨大的影響。其獨特的纖維外殼在貨架上脫穎而出,使其與鄰近的包裝區分開來,吸引了消費者。

中東和非洲居家醫療包裝產業概況

中東和非洲居家醫療包裝市場已減少一半。主要參與企業包括 Amcor Group GmbH、Mondi Group、International Paper、ClearPack 和 Aptar Group。

- 2023 年 7 月,包裝專家 ALPLA 推出了名為 ALPLARECYCLING 的新品牌。該塑膠包裝公司擁有 13 家工廠,其中 4 家是與當地合作夥伴的合資企業。到 2025 年,該公司計劃加工至少 25% 的 PCR 材料。包裝專家 ALPLA 計劃在南非、羅馬尼亞和泰國投資數百萬美元建造新工廠並擴建波蘭工廠後,將其所有業務合併到 ALPLA Recycling 名下。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 當前政治局勢對市場的影響

第5章市場動態

- 市場促進因素

- 永續包裝的需求增加

- 中東和非洲居家醫療產品增加

- 市場限制因素

- 政府對塑膠使用的規定

第6章 市場細分

- 按材質

- 塑膠

- 紙

- 金屬

- 玻璃

- 依產品類型

- 瓶子

- 金屬罐

- 紙盒

- 瓶子

- 小袋

- 其他

- 依產品

- 洗碗

- 殺蟲劑

- 衣物洗護

- 洗護用品

- 拋光

- 空氣護理

- 其他

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第7章 競爭格局

- 公司簡介

- Amcor Group GmbH

- Mondi Group

- Clearpack Group

- International Paper

- AptarGroup, Inc.

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Ball Corporation

- Sonoco Products Company

- DS Smith PLC

- Tetra Laval Group

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 47774

The MEA Home Care Packaging Market size is estimated at USD 1.82 billion in 2025, and is expected to reach USD 2.56 billion by 2030, at a CAGR of 7.05% during the forecast period (2025-2030).

Key Highlights

- The home care packaging market encompasses products designed for cleaning and hygiene. Low-cost packaging, convenience of use, and convenient storage have maintained key consumer trends throughout the assessment. Small pack sizes, which are more affordable to the whole customer base, have emerged as more appealing options for brand owners looking to acquire a competitive edge in the market.

- Plastic is one of the most used materials for home care product packaging. Home care packaging innovations have been numerous, particularly in laundry care, despite the industry's modest growth. While sales and revenues stagnate in developed countries, developing markets are driving volume sales through small bottle sizes that make laundry detergent affordable.

- Household products, such as dishwashing liquids, toilet cleaners, and floor-cleaning acids, are packaged in PET bottles. Companies are taking new packaging and labeling approaches to maintain the recyclability of their products.

- Furthermore, South African consumers are expected to demand high-quality products with essential features like reliability and affordability. Consumers in this region usually opt for local or international brands depending on local lifestyles, customs, and affordability.

- A growing population typically leads to increased demand for home care products such as cleaning agents, laundry detergents, and personal care items. This necessitates corresponding growth in packaging to contain and distribute these products. According to the International Monetary Fund, The total population in Oman is expected to continuously increase between 2023 and 2028 by 0.9 million people (+17.68%).

- The Middle East and African home care packaging market faces challenges that can impact its growth and sustainability. One significant challenge is navigating through regulatory hurdles, which vary across the Middle East and Africa, often posing complexities related to packaging standards and environmental regulations. Additionally, the market contends with the unpredictability of fluctuating raw material prices, which can affect production costs and pricing strategies.

MEA Home Care Packaging Market Trends

The Bottles Segment is Anticipated to Witness Significant Growth

- Home care packaging innovations have been numerous, particularly in laundry care, despite the industry's modest growth. While sales and revenues are stagnating in developed countries, developing markets are driving volume sales through small bottle sizes that make laundry detergent affordable to all.

- Heightened hygiene awareness, especially during events such as a pandemic, results in a surge in demand for home care products like disinfectants, sanitizers, and cleaning agents. This increased demand requires bottles to contain and distribute these products.

- Packaging that emphasizes hygiene and safety features can enhance consumer confidence. In a market driven by health and cleanliness concerns, consumers are more likely to trust and purchase products with packaging that highlights their hygienic properties.

- Sustainable and eco-friendly bottle packaging options that maintain hygiene standards are becoming increasingly popular. Consumers are concerned about personal health and the environment, and eco-friendly packaging options, like biodegradable materials, can align with these values.

- In the past few years, the number of homeowners in the region has been rising. According to the Sidran Institute and Sidra Capital, the share of home ownership in Saudi Arabia is expected to increase significantly from 49.9% in 2017 to around 70% in 2030. Consequently, the demand for home products is also expected to increase proportionally, bolstering market growth.

Paper Packaging is Observing Notable Growth

- Increasing environmental concerns over the use of plastic packaging are driving industries to look for sustainable packaging. Retailers' implementation of plastic-reducing and recycling measures and political discussions of legal measures have created media attention, raising consumer awareness of the enormous problem plastics can pose to wildlife and the environment.

- Paper is far more biodegradable than plastic and can be easily recycled. It can also be re-pulped without chemical reactions and is less sensitive to contamination. This has led to some established brands replacing plastic packaging with paper.

- Companies and brands are increasing their investment in sustainable packaging solutions, like compostable compressed paper bottles. These paper bottles claim to save 60-70% of plastic material compared to regular plastic bottles of the same size and are both compostable and recyclable. Comprised of an outer shell and an inner pouch, this bottle is made to disassemble for recycling easily. The outer shell pops away from the internal bag after use and can be recycled up to seven times more or composted. Therefore, increasing demand for paper-based packaging and less plastic packaging in-home care is expected to augment market growth in this region.

- The growing population can attract more players into the home care market, leading to increased competition among brands. To stand out in this competitive landscape, companies may invest in innovative packaging designs and materials to differentiate their products and attract consumers. According to the International Monetary Fund, in 2022, approximately 9.87 million inhabitants lived in the United Arab Emirates, and this figure is estimated to grow to 11 million by 2028.

- The rising trend of dual-income households is expected to drive growth in the home care packaging market. Hybrid paper bottles effectively communicate a brand's commitment to consumers, making a significant impact. Their unique fiber shell stands out on shelves, setting them apart from neighboring packaging and captivating consumers.

MEA Home Care Packaging Industry Overview

The Middle East and African home care packaging market is semi-fragmented. Some of the major players in the market are Amcor Group GmbH, Mondi Group, International Paper, ClearPack, and Aptar Group.

- July 2023: ALPLA, a packaging expert, introduced a new brand called ALPLARECYCLING. There were 13 facilities owned by the plastic packaging company, including four joint ventures with local partners. By 2025, the company plans to process at least 25% PCR material. Packaging expert ALPLA is expected to unify all its operations under the name ALPLArecycling after investing millions into new facilities in South Africa, Romania, Thailand, and a site extension in Poland.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of the Current Geo-Political Scenario on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Sustainable Packaging

- 5.1.2 Augmenting Home Care Products In MEA Region

- 5.2 Market Restraints

- 5.2.1 Government Regulation for Plastic Usage

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Products Type

- 6.2.1 Bottles

- 6.2.2 Metal Cans

- 6.2.3 Cartons

- 6.2.4 Jars

- 6.2.5 Pouches

- 6.2.6 Others

- 6.3 By Products

- 6.3.1 Dishwashing

- 6.3.2 Insecticides

- 6.3.3 Laundry Care

- 6.3.4 Toiletries

- 6.3.5 Polishes

- 6.3.6 Air Care

- 6.3.7 Others

- 6.4 By Country

- 6.4.1 United Arab Emirates

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Mondi Group

- 7.1.3 Clearpack Group

- 7.1.4 International Paper

- 7.1.5 AptarGroup, Inc.

- 7.1.6 ALPLA Werke Alwin Lehner GmbH & Co KG

- 7.1.7 Ball Corporation

- 7.1.8 Sonoco Products Company

- 7.1.9 DS Smith PLC

- 7.1.10 Tetra Laval Group

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219