|

市場調查報告書

商品編碼

1628811

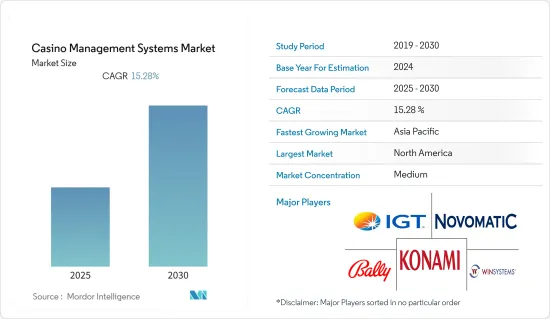

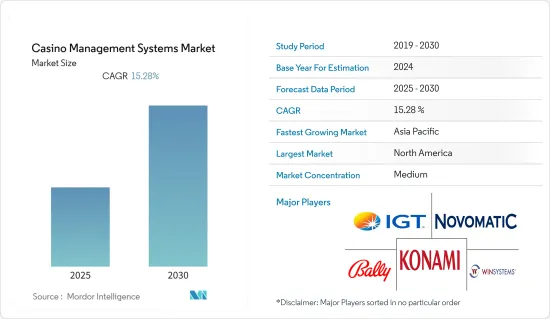

賭場管理系統 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Casino Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

賭場管理系統 (CMS) 市場預計在預測期內複合年成長率為 15.28%

主要亮點

- 用於管理賭場的系統由用於監控玩家、分析玩家活動、處理資金和會計、管理安全和監視或這些的混合的硬體和軟體組成。賭場需要複雜的軟體和硬體基礎設施,不僅可以追蹤營運,還可以在整個工作過程中保持順暢的流程。主要目的是玩家追蹤、活動分析以及持續的安全和監控。這些是賭場執行的一些最重要的業務,也是市場成長機會的主要驅動力。

- 此外,新興經濟體的大部分經濟依賴旅遊業,這鼓勵了賭場的出現。這是因為政府現在允許賭場開設商店,以吸引更多跨境人群,賭場和政府都可以享受到相互接受的好處,這可以是一個樂觀的場景。基於區塊鏈成熟度模型(BMM),政府區塊鏈協會(GBA)獨立審查了AXES.ai 的實體賭場管理平台,並於2023 年4 月將其認可為1 級可信任區塊鏈解決方案。

- 賭場管理系統監控金融活動,確保遵守賭博規則,並向監管機構提供準確的報告。因此,這些系統整合了多種技術,包括臉部辨識、車牌盤式分析儀和其他分析,以幫助營運商阻止遊戲俱樂部樓層的詐騙、竊盜和詐欺行為。提供賭場管理系統的公司一直在尋找融入新技術和改進的方法。預計這將為市場進一步成長提供各種有利可圖的機會。

- 然而,線上賭場的興起和日益嚴格的法規環境可能會成為限制整個預測期內整體市場成長的問題。

- COVID-19 大流行對賭場業產生了負面影響。 COVID-19 大流行對實體賭場業產生了負面影響,許多國家政府實施的旅行限制導致賭場、彩票和其他賭博設施關閉。然而,在後COVID-19市場場景中,由於人工智慧(AI)、機器學習和生物識別等技術的發展,市場預計將出現巨大的成長機會。

賭場管理系統市場趨勢

遊戲產業的成長推動市場成長

- 隨著賭博業對各種先進技術的需求激增,對賭場管理系統的需求也預計會增加。很快,合法性的提高和博彩設施數量的增加預計將成為行業成長的主要推動力。此外,由於世界各地遊戲俱樂部的增加,賭場管理系統市場正在擴大。

- 無線技術和線上賭博的發展也為賭場產業帶來了進一步的前景。簡而言之,賭場度假村需要各種零售商為其提供管理和營運設施所需的軟體。

- 這就是為什麼需要一個中央管理系統來與現代賭場單元中常見的最佳作業系統互動並收集重要資料。網路遊戲、廣告亭、體育和賽馬書籍、RFID 桌子監控、老虎機票務、無現金遊戲和賓果遊戲只是可能與賭場管理軟體整合的一些應用程式。

- 例如,2022 年 10 月,International Game Technology PLC 宣布其子公司 IGT Global Solutions Corporation 與喬治亞彩票公司簽訂了為期七年的協議,主要目的是部署世界一流的彩票和 iLottery 產品和技術。續約合約。作為合約延期的一部分,IGT 將在 10,000 多個 POS 零售終端上安裝無現金功能,允許玩家使用簽帳金融卡購買彩票。

- 此外,隨著博彩業和賭場度假村的發展,賭場和遊戲開發商有更多機會,從而擴大了其國內和國際分銷管道。

北美市場實現壓倒性成長

- 線上賭博業正在北美迅速擴張。許多玩家被線上賭場所吸引,因為它們的可訪問性和易用性。為了利用這個不斷擴大的行業,許多傳統賭場也推出了線上平台。北美歷來允許多種賭博選擇,對非法賭博也有相當大的容忍度。

- 在美國獲得許可和管理的賭場必須制定適當的系統和程序,以確保玩家和賭徒在出現賭博相關問題(無論是線下還是線上)時得到治療和支持。儘管美國有許多離線或實體賭場,但它們是唯一在特定州獲得許可並經營的賭場,因此能夠向消費者提供合法的線上賭博服務。

- 賭場越來越重視分析,以相互競爭並吸引更多客戶,因為競爭比以往任何時候都更加激烈,機殼也越來越多。對資料庫倉儲技術的投資增加和忠誠卡的大量使用現在記錄了大多數客戶交易。大量美國公民經常去賭場購買彩票、玩拉霸機和賭桌遊戲。

- 2023 年 4 月,International Game Technology PLC 宣布最近在威斯康辛州瓦貝諾的 Potawatomi Casino Hotel Carter 完成了 IGT Advantage 賭場管理系統 (CMS) 的安裝。 CMS 將使 Potawatomi Casino Hotel Carter 的客人能夠享受前瞻性的遊戲體驗,並受益於與姊妹酒店 Potawatomi Casino Hotel 相關的忠誠度獎勵計劃。

賭場管理系統產業概況

在賭場管理系統市場,來自世界各地和區域市場的玩家正在爭奪客戶的注意力。該行業適度分散,隨著本地 CMS 參與者的發展以及彈性價格設定模式的使用加劇了市場競爭。市場主要企業包括 International Game Technology PLC、Novomatic AG、Bally Technologies Inc.、Konami Gaming Inc. 等。

- 2022 年 11 月 - International Game Technology PLC 宣布其子公司 IGT Canada Solutions ULC 已與 Loto-Quebec 簽署了一份為期五年的延期契約,主要提供智慧影片彩票中央系統軟體,包括改進的網路診斷和資料分析。它還支援遊戲標準協會的遊戲到系統(G2S)標準通訊協定,具有增強的玩家用戶介面、令人興奮的多級神秘大獎(Vault Breaker)、改進的負責任遊戲功能、無現金、為玩家中心提供附加功能。

- 2022 年 10 月 - International Game Technology PLC 宣佈在拉斯維加斯 OYO 酒店及賭場開設「財富之輪老虎機區」。該區域的特色遊戲包括動畫「財富之輪 4D 珍藏版」和「財富之輪 Cash Link 2」視訊老虎機。該區域還擁有 IGT 最大的櫥櫃——命運之輪巨型塔。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

- 市場促進因素

- 國際觀光蓬勃發展

- 遊戲產業的成長

- 市場挑戰

- 線上賭場的興起

- 嚴格的法規環境

第5章市場區隔

- 目的

- 會計處理

- 安全和監視

- 飯店管理

- 分析

- 玩家追蹤

- 媒體管理

- 行銷和推廣

- 按最終用戶

- 中小型賭場

- 大型賭場

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 世界其他地區

- 北美洲

第6章 競爭狀況

- 公司簡介

- International Game Technology PLC

- Novomatic AG

- Bally Technologies Inc.

- Konami Gaming Inc.

- Winsystems Inc.

- TCS John Huxley

- Aristocrat Leisure Limited

- Apex Gaming Technology

- MICROS Systems Inc.(變更為 Oracle Hospitality)

- Agilysys

- Amatic Industries GmbH

- Bluberi Gaming Technologies Inc.

- Decart Ltd.

第7章 投資分析

第8章 市場機會及未來趨勢

The Casino Management Systems Market is expected to register a CAGR of 15.28% during the forecast period.

Key Highlights

- Systems for managing casinos may comprise hardware and software to monitor players, analyze player activity, handle money and accounting, manage security and surveillance, or a mix of these. Casinos need sophisticated software and hardware infrastructure to keep track of operations as well as to maintain a smooth flow throughout the entire working method. The main goals are tracking players, analyzing activity, and ongoing security and surveillance. These are some of the duties that casinos perform that are of the utmost importance, driving the market's growth opportunities significantly.

- Moreover, in developing countries, the reliance on tourism for a significant chunk of the economy has boosted the emergence of casinos. This is because governments now permit casinos to set up shops to attract a large crowd from across borders, which can result in an optimistic scenario for both the casinos and the government as they reap the benefits of mutual acceptance. In accordance with the Blockchain Maturity Model (BMM), the Government Blockchain Association (GBA) independently examined and classified AXES.ai's land-based casino management platform as a Level One Trusted Blockchain Solution in April 2023, making it the first blockchain solution.

- Casino management systems monitor financial activities, assure adherence to gambling rules, and offer precise reporting to regulatory organizations. Hence, to help operators stop fraud, theft, and cheating on the gaming club floor, these systems integrate numerous technologies, including facial recognition, license plate readers, and other analytics. Companies that provide casino management systems always look for ways to improve and incorporate new technology. This is expected to bring various lucrative opportunities for the market to grow further.

- However, the rise of online casinos as well as the rise in the stringent regulatory environment could be a matter of concern that could limit the market's overall growth throughout the forecast period.

- The COVID-19 pandemic has negatively impacted the casino industry. It had harmed the land-based casino industry; the stay-at-home restrictions imposed by governments across many countries led to closing of casinos, lottery, and other gambling venues. However, in the post-COVID-19 market scenario, the market is expected to witness significant growth opportunities due to the rising developments in technologies like artificial intelligence (AI), machine learning, and biometrics.

Casino Management Systems Market Trends

Growth of Gaming Industry drives the market growth

- The demand for casino management systems is anticipated to increase as the gambling industry's need for various advanced technologies soars. Shortly, it is expected that growing legality and an increase in gaming establishments will be significant drivers of industry growth. Additionally, the market for casino management systems is expanding because of the rise in gaming clubs worldwide.

- The development of wireless technology and online gambling has also given the casino sector additional prospects. In essence, a casino resort needs a variety of retailers to supply the required software for the management and operation of the facilities.

- Therefore, a single central management system is necessary to interface with and gather vital data from the best operational systems often found in contemporary casino units. Internet gaming, advertising kiosks, sports and racebooks, RFID table monitoring, slot ticketing, cashless gaming, and bingo are just a few applications that are likely to be integrated with casino administration software.

- For Instance, in October 2022, International Game Technology PLC announced its subsidiary, IGT Global Solutions Corporation, signed a seven-year contract extension agreement with the Georgia Lottery Corporation mainly to deploy its world-class lottery and iLottery products and technology. As part of the contract extension, IGT would install cashless functionality on more than 10,000 point-of-sale retail terminals, allowing players to purchase lottery with a debit card.

- Moreover, with the growth of the gaming industry and casino resorts, casino, and game developers are achieving more opportunities and thus expanding the prevailing channels domestically and internationally.

North America to Witness the Dominant Market Growth

- In North America, the industry of online gambling has been expanding rapidly. A significant amount of gamers have been attracted to online casinos by their accessibility and ease. To take advantage of this expanding industry, many conventional casinos have also launched online platforms. Numerous gambling options were historically permitted in North America, and there was a fair amount of tolerance for illegal gaming.

- All U.S.-licensed and controlled casinos, both offline and online, must have systems and procedures that can and will aid players and gamblers in receiving treatment and support if they have gambling-related difficulties. There are a lot of offline or land-based casinos in the United States, but only those will be allowed to provide their consumers with legal online gambling services since they are licensed and run in specific states.

- Casinos are putting a significant emphasis on analytics to compete with one another and make sure they attract more customers in light of the increased competition and more housing than previously. Most customer transactions are recorded owing to growing investments in database warehousing technologies and the mass usage of loyalty cards. Numerous U.S. citizens frequently purchase lottery tickets and go to casinos to play slot machines and table games.

- In April 2023, International Game Technology PLC declared that it recently had completed an installment of the IGT ADVANTAGE casino management system (CMS) at Potawatomi Casino Hotel Carter in Wabeno, Wisc. The CMS would allow Potawatomi Casino Hotel Carter guests to enjoy future-forward gaming experiences and reap the benefits of a loyalty rewards program linked with the sister property Potawatomi Casino Hotel.

Casino Management Systems Industry Overview

Players from around the world and regional markets compete for customer's attention in the casino management systems market. The industry is moderately fragmented, and the development of local CMS players and the use of flexible pricing models have increased market rivalry. The major players in the market are International Game Technology PLC, Novomatic AG, Bally Technologies Inc., and Konami Gaming Inc., among others.

- November 2022 - International Game Technology PLC has declared subsidiary, IGT Canada Solutions ULC, has signed a five-year contract extension with Loto-Quebec mainly to deliver an enhanced version of its INTELLIGENT video lottery central system software and related components, which includes improved network diagnostics and data analytics. It also supports the Gaming Standards Association's Game to System (G2S) standard protocol, which allows an enhanced player user interface, exciting multi-level mystery jackpots (Vault Breaker), improved responsible gaming features, cashless and additional player-centric functionality.

- October 2022 - International Game Technology PLC has declared the Wheel of Fortune Slots Zone launch at the OYO Hotel & Casino Las Vegas, where Standout game titles include the animated Wheel of Fortune 4D Collector's Edition and Wheel of Fortune Cash Link 2 video slots. The zone also features the IGT's largest cabinet, the Wheel of Fortune Megatower.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Booming International Tourism

- 4.5.2 Growth of the Gaming Industry

- 4.6 Market Challenges

- 4.6.1 Rise of Online Casinos

- 4.6.2 Stringent Regulatory Environment

5 MARKET SEGMENTATION

- 5.1 Purpose

- 5.1.1 Accounting and Handling

- 5.1.2 Security and Surveillance

- 5.1.3 Hotel Management

- 5.1.4 Analytics

- 5.1.5 Player Tracking

- 5.1.6 Media Management

- 5.1.7 Marketing and Promotions

- 5.2 By End-user

- 5.2.1 Small and Medium Casinos

- 5.2.2 Large Casinos

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 International Game Technology PLC

- 6.1.2 Novomatic AG

- 6.1.3 Bally Technologies Inc.

- 6.1.4 Konami Gaming Inc.

- 6.1.5 Winsystems Inc.

- 6.1.6 TCS John Huxley

- 6.1.7 Aristocrat Leisure Limited

- 6.1.8 Apex Gaming Technology

- 6.1.9 MICROS Systems Inc. (Renamed Oracle Hospitality)

- 6.1.10 Agilysys

- 6.1.11 Amatic Industries GmbH

- 6.1.12 Bluberi Gaming Technologies Inc.

- 6.1.13 Decart Ltd.