|

市場調查報告書

商品編碼

1628822

歐洲油田化學品 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Oilfield Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

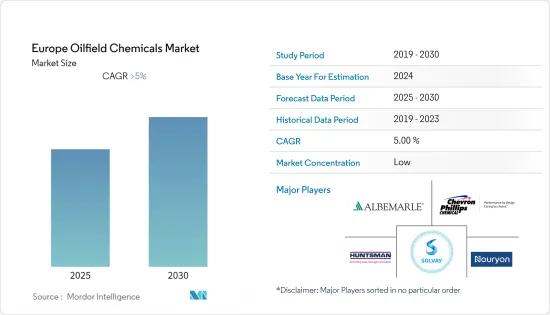

歐洲油田化學品市場預計在預測期內複合年成長率將超過 5%

主要亮點

- COVID-19 對 2020 年市場產生了負面影響。全國範圍內的封鎖和嚴格的社交距離規定擾亂了各個細分市場的供應鏈。然而,由於探勘和鑽探投資以及歐洲能源需求的增加,預計該市場將穩定成長。

- 推動市場的主要因素是頁岩氣探勘和生產的增加以及運輸業對石油燃料的需求增加。頁岩氣開採的環境永續性預計將阻礙市場成長。海上鑽探作業開啟的新視野很可能成為未來的機會。

歐洲油田化學品市場趨勢

油井增產主導市場

- 按應用分類,油田化學品中最大佔有率是油井促效劑。該領域使用的化學物質包括酸性腐蝕抑制劑、界面活性劑和非乳化劑。在油井增產過程中使用酸時,它們可以保護油井設備、泵浦和卡車免受腐蝕。界面活性劑降低各種酸、酸添加劑和壓裂水的表面張力。

- 這些化學品的最佳應用是頁岩氣和緻密油等非傳統資源的生產,其中需要水力壓裂和酸化等技術。

- 英國石油公司公佈的資料顯示,2021年歐盟石油產量將達36.6萬桶/日。這可能會影響油井增產所需的油田化學品的需求。

- 由於對能源獨立的需求不斷增加,預計歐洲將把重點轉向北海的頁岩油開發。因此,井眼增產化學品在不久的將來應該會成為一個非常盈利的市場。

俄羅斯主導市場

- 俄羅斯是世界第二大原油生產國,已探明原油蘊藏量約800億桶。該國嚴重依賴石油和天然氣產業的收入,該產業約佔聯邦收入的 40%。

- 俄羅斯石油和天然氣工業在世界市場上極為重要,供應全球液態烴出口量的約13%。

- 此外,由於天然氣價格競爭機制,俄羅斯向亞太地區特別是中國的天然氣出口不斷增加。

- 儘管從長遠來看,俄羅斯預計仍將是重要的石油和天然氣生產國,但最近達成的石油減產協議可能會暫時減緩石油工業的成長。

- 英國石油公司公佈的資料顯示,2021年歐盟石油產量將達到1,094.4萬桶/日。預計將影響油田化學品的需求。

- 因此,俄羅斯油田化學品預計在預測期內將呈現溫和成長。

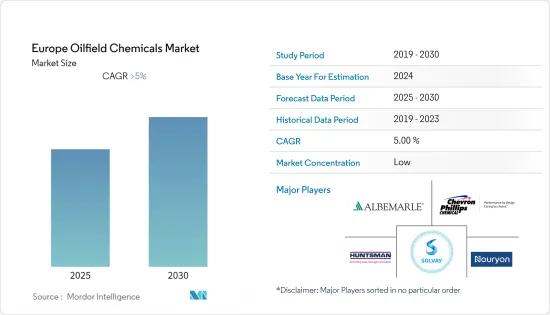

歐洲油田化學品產業概況

歐洲油田化學品市場較分散。市場上的主要企業包括(排名不分先後)Nouryon、Albemarle Corporation、Huntsman International LLC、Solvay 和 Chevron Phillips Chemical Company(鑽井特殊公司)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 增加頁岩氣探勘和生產

- 運輸業對石油基燃料的需求增加

- 抑制因素

- 頁岩氣開採的環境永續性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 化學類型

- 除生物劑

- 緩蝕/阻垢劑

- 去乳化劑

- 聚合物

- 界面活性劑

- 其他

- 目的

- 鑽孔和固井

- 工作的中斷和完成

- 井增產

- 生產

- 提高採收率

- 地區

- 俄羅斯

- 挪威

- 英國

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- Albemarle Corporation

- Ashland

- Baker Hughes, a GE Company LLC

- BASF SE

- Chevron Phillips Chemical Company(Drilling Specialties Company)

- Clariant

- Croda International Plc

- DowDuPont

- Ecolab(Nalco Champion Technologies Inc.)

- ELEMENTIS PLC

- Exxon Mobil Corporation

- Flotek Industries, Inc.

- Halliburton

- Huntsman International LLC.

- Innospec

- Kemira

- Newpark Resources Inc.

- Nouryon

- Schlumberger Limited

- Solvay

- Zirax Limited

第7章 市場機會及未來趨勢

- 海上鑽井業務開啟新視野

- 其他機會

簡介目錄

Product Code: 55023

The Europe Oilfield Chemicals Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. The nationwide lockdowns and stringent social distancing mandates led to supply chain disruptions across different market segments. However, the market is expected to grow steadily owing to increasing investments in exploration and drilling and demands for energy in the European region.

- The major factors driving the market studied are the increased shale gas exploration and production and the rising demand for petroleum-based fuel from the transportation industry. Environmental sustainability in shale gas extraction is expected to hinder the market's growth. New horizons opened up due to offshore drilling operations are likely to act as an opportunity in the future.

Europe Oilfield Chemicals Market Trends

Well Stimulation to Dominate the Market

- The well-stimulation segment holds the largest share of oilfield chemicals by application. The chemicals used in this segment include acid corrosion inhibitors, surfactants, and non-emulsifiers. These provide excellent protection to oil well equipment, pumps, and trucks from corrosion while working with acid for the well-stimulation process. Surfactants reduce the surface tension of various acids, acid additives, and water fracturing.

- The best application of these chemicals is seen in the production of unconventional resources like shale gas and tight oil, where there is a requirement for technologies such as hydraulic fracturing and acidizing.

- As per data published by British Petroleum, oil production in the European Union reached 366 thousand barrels per day in 2021. This will impact the demand for oilfield chemicals required for well stimulation.

- Europe is expected to shift its focus to shale exploration in the North Sea due to an increasing requirement for energy self-sufficiency. Hence, the well stimulation chemicals are supposed to have a very profitable market in the near future.

Russia to Dominate the Market

- Russia is the second largest producer of crude oil globally, with verified oil reserves of about 80,000 million barrels of oil. The country greatly depends on the revenues obtained from the oil & gas industry, which accounts for around 40% of the federal revenues.

- Russia's oil and gas industry is crucial in the global market, supplying about 13% of the global liquid hydrocarbon exports.

- Also, there are increasing exports of natural gas from Russia to the Asia-Pacific region, especially China, due to the competitive pricing mechanism for natural gas.

- Russia is expected to continue as one of the significant producers of oil & gas in the long run, but the recent agreement to cut the crude oil output might temporarily slow down the growth of the petroleum industry.

- As per data published by British Petroleum, oil production in the European Union reached 10,944 thousand barrels per day in 2021. This will impact the demand for oilfield chemicals.

- Hence oilfield chemicals are expected to witness moderate growth in Russia during the forecast period.

Europe Oilfield Chemicals Industry Overview

The Europe oilfield chemicals market is fragmented in nature. The major companies in the market (not in a particular order) include Nouryon, Albemarle Corporation, Huntsman International LLC, Solvay, and Chevron Phillips Chemical Company (Drilling Specialties Company), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Shale Gas Exploration and Production

- 4.1.2 Rising Demand for Petroleum-based Fuel from Transportation Industry

- 4.2 Restraints

- 4.2.1 Environmental Sustainability in Shale Gas Extraction

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemical Type

- 5.1.1 Biocide

- 5.1.2 Corrosion & Scale Inhibitors

- 5.1.3 Demulsifiers

- 5.1.4 Polymers

- 5.1.5 Surfactants

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Drilling & Cementing

- 5.2.2 Work-over & Completion

- 5.2.3 Well Stimulation

- 5.2.4 Production

- 5.2.5 Enhanced Oil Recovery

- 5.3 Geography

- 5.3.1 Russia

- 5.3.2 Norway

- 5.3.3 United Kingdom

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Ashland

- 6.4.3 Baker Hughes, a GE Company LLC

- 6.4.4 BASF SE

- 6.4.5 Chevron Phillips Chemical Company (Drilling Specialties Company)

- 6.4.6 Clariant

- 6.4.7 Croda International Plc

- 6.4.8 DowDuPont

- 6.4.9 Ecolab (Nalco Champion Technologies Inc.)

- 6.4.10 ELEMENTIS PLC

- 6.4.11 Exxon Mobil Corporation

- 6.4.12 Flotek Industries, Inc.

- 6.4.13 Halliburton

- 6.4.14 Huntsman International LLC.

- 6.4.15 Innospec

- 6.4.16 Kemira

- 6.4.17 Newpark Resources Inc.

- 6.4.18 Nouryon

- 6.4.19 Schlumberger Limited

- 6.4.20 Solvay

- 6.4.21 Zirax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Horizons Opened Up Due to Offshore Drilling Operations

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219