|

市場調查報告書

商品編碼

1637852

油田化學品 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Oilfield Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

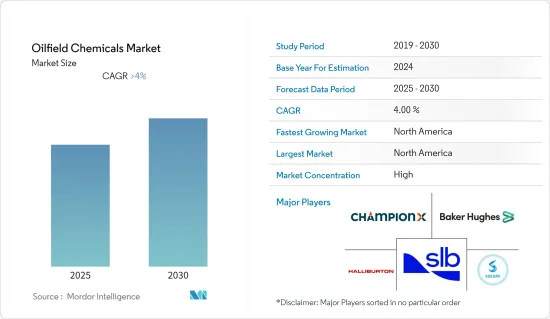

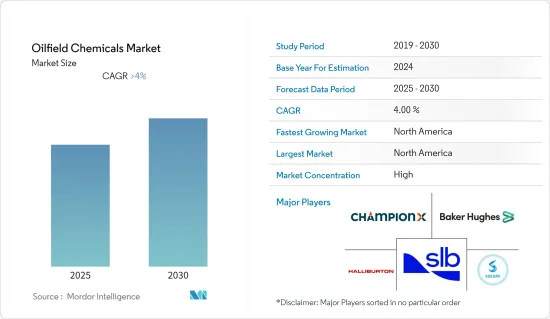

預計油田化學品市場在預測期內複合年成長率將超過4%。

由於新冠肺炎 (COVID-19) 的影響,國家封鎖和社會疏離規定顯著減少了全球交通能源需求。然而,隨著世界各地限制的取消,它們又開始增加。

主要亮點

- 運輸業對石油燃料的需求不斷成長以及頁岩氣探勘的增加預計將在預測期內推動市場需求。

- 清潔能源措施可能會阻礙市場成長。

- 新興國家因深海鑽探作業而創造的新商業視野和生產機會預計將成為油田化學品市場的重大機會。

- 北美地區預計將主導市場。

油田化學品市場趨勢

鑽井和固井應用主導市場

- 在鑽井領域,油田化學品用於穩定溫度並防止受污染的產品進入鑽井液系統。

- 根據國際能源總署(IEA)和BP《2022年世界能源統計年鑑》,中國是最大的原油進口國之一,每天進口超過1,000萬桶。根據國家統計局數據,2021年中國煉廠平均原油吞吐量1,450萬桶,與前一年同期比較成長7.3%。此外,中國石油天然氣集團公司預計,「十四五」(2021-2025年)國內天然氣需求年均增加量將超過200億立方米,到2025年將達到4,300億立方米。

- 2021年9月,印度石油和天然氣部長表示,印度東北部已批准價值120億美元的石油和天然氣計劃,預計2025年完工。透過將東北地區探勘面積從3萬平方公里擴大到6萬平方公里,公司計畫在2025年將油氣產量從900萬噸增加到1,800萬噸。

- 儘管隨著日本整體能源使用總量的下降,日本的石油需求一直在穩定下降,但石油仍是日本最重要的能源來源,約佔其能源供應總量的40%。日本國內產量很少,高度依賴原油進口,其中80%至90%來自中東。

- 澳洲石油天然氣工業在當前澳洲經濟發展中發揮重要作用。澳洲透過生產和出口液化天然氣(LNG)、原油和冷凝油油,為全球石油和天然氣供應做出了小小的貢獻。 2021 年,該國生產了 5,344 兆公升液化石油氣。

- 美國人口普查局發布的報告顯示,2021年採礦和採石業收入較2017年大幅增加。

- 此外,對技術先進的固井產品的巨大需求,例如具有非離子和低黏度特性的聚乙烯醇的銷售,預計將為油田化學品市場創造機會。

北美市場佔據主導地位

- 北美地區由於專注於頁岩氣生產和探勘在全球油田化學品市場佔據主導地位。

- 近年來頁岩氣產量異常增加。由於北美主要新興經濟體的需求增加,預計在預測期內天然氣需求將增加。

- 根據加拿大石油生產商協會(CAPP)統計,2018年至2020年加拿大上游石油和天然氣年收益為2,090億美元。

- 2020年原油產量為446.7萬桶/日,2021年增至467.7萬桶/日。預計到 2035 年,產量將維持在 5,855,000 桶/日。

- 美國是世界上最大的石油和天然氣消費國和出口國之一。根據美國能源資訊署(EIA)預測,2022年美國原油產量預計平均為1,190萬桶/日,較2021年增加70萬桶/日。此外,2023年產量將超過1,280萬桶/日,打破先前2019年創下的1,230萬桶/日的年均紀錄。

- 該國正在建設的大型石化計劃有10多個,總成本超過2,070億美元。 Thunderhorse 南擴建二期預計將進一步提振市場,因為它是墨西哥灣最大的油田之一。該計劃將在不久的將來增加兩口新的海底生產井,作為整體開發的一部分,並將鑽探約八口井。其他計劃包括 Mad Dog Phase 2、Hershel 和 Manuel。

- 根據Energy Shale Gas Production預測,2040年,天然氣總產量預計將佔加拿大的30%,墨西哥的75%以上。

- 因此,所有這些因素預計將推動北美油氣產業的成長,並進一步提振油田增產化學品市場的需求。

油田化學品產業概況

油田化學品市場高度一體化。油田化學品市場的主要企業包括哈里伯頓、斯倫貝謝有限公司、索爾維、貝克休斯公司和Champion X。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 增加頁岩氣探勘和生產

- 運輸業對石油基燃料的需求增加

- 抑制因素

- 清潔能源舉措

- 產業價值鏈分析

- 波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 化學類型

- 除生物劑

- 緩蝕/阻垢劑

- 去乳化劑

- 聚合物

- 界面活性劑

- 其他化學品

- 目的

- 鑽孔和固井

- 提高採收率

- 生產

- 井增產

- 工人交接和竣工

- 地區

- 亞太地區

- 中國

- 印度

- 印尼

- 馬來西亞

- 泰國

- 澳洲/紐西蘭

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 俄羅斯

- 挪威

- 英國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 阿爾及利亞

- 伊朗

- 伊拉克

- 奈及利亞

- 沙烏地阿拉伯

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Albemarle Corporation

- Ashland

- Baker Hughes Company

- BASF SE

- CES Energy Solutions Corp.

- Clariant

- Croda International PLC

- Chevron Phillips Chemical Company(Drilling Specialties Company)

- Dow

- Elementis PLC

- Flotek Industries Inc.

- Halliburton

- Huntsman International LLC

- Innospec Oilfield Services

- Kemira

- MPRC

- Ecolab(NALCO Champion)

- Nouryon

- Schlumberger Limited

- Solvay

- The Lubrizol Corporation

- Zirax Limited

第7章 市場機會及未來趨勢

- 深海鑽探業務帶來新視野

- 新興國家提供的生產機會

簡介目錄

Product Code: 47879

The Oilfield Chemicals Market is expected to register a CAGR of greater than 4% during the forecast period.

Due to the impact of COVID-19, the energy demands worldwide required for mobility decreased significantly because of nationwide lockdowns and social distancing mandates. However, it is starting to rise again in line with the lifting of restrictions globally.

Key Highlights

- Growing demand for petroleum-based fuel from the transportation industry and increased shale gas exploration are expected to drive the market's demand during the forecast period.

- Clean energy initiatives are likely to hinder market growth.

- Due to deepwater drilling operations, the creation of new business horizons and production opportunities provided by developing countries are expected to act as major opportunities for the oilfield chemicals market.

- North America region is expected to dominate the market.

Oilfield Chemicals Market Trends

Drilling and Cementing Application to Dominate the Market

- In the drilling segment, oilfield chemicals are used to stabilize temperature and prevent contaminated products from entering the drilling fluid system.

- According to the International Energy Agency (IEA) and BP Statistical Review of World Energy 2022, China is one of the largest importers of crude oil, importing more than 10 million barrels a day. According to the National Bureau of Statistics, the average crude oil throughput at Chinese refineries was 14.5 million in 2021, witnessing an increase of 7.3% year-on-year hike. Additionally, according to the China National Petroleum Corporation (CNPC), the average annual increase of natural gas demand in the country is expected to exceed 20 billion cubic meters during the 14th Five-Year Plan (2021-2025) and reach 430 billion cubic meters in 2025.

- In September 2021, the Union Minister of Petroleum and Natural Gas of India stated that oil and gas projects worth USD 12 billion have been sanctioned for Northeast India and are likely to be completed by 2025. By increasing the exploration acreage in the Northeast region from 30,000 to 60,000 square kilometers, the plan is to increase oil and gas production from 9 MMTOE to 18 MMTOE by 2025.

- Oil remains the most important energy source in Japan, accounting for roughly 40% of the total energy supply, despite the fact that Japan's oil demand has been steadily declining in line with the country's overall declining total energy use. With no significant domestic production, Japan is heavily reliant on crude oil imports, with 80% to 90% coming from the Middle East.

- The oil and gas industry in Australia has played an important role in the development of the country's current economy. With the production and export of liquefied natural gas (LNG), crude oil, and condensate, Australia contributes a small but significant amount to the global oil and gas supply. The country produced 5,344 megaliters of LPG in 2021.

- According to a report published by US Census Bureau, the mining and quarrying revenue increased significantly in 2021 as compared to 2017.

- Additionally, the massive demand for technologically advanced cementing products, such as sell polyvinyl alcohol with non-ionic and low-viscous properties, is expected to create opportunities for the oilfield chemicals market.

North America to Dominate the Market

- The North American region dominates the global oilfield chemicals market due to an increased emphasis on shale gas production and exploration.

- Shale gas production has been increasing exceptionally over recent years. Due to increasing demand from the major developing economies of North America, the demand for natural gas is expected to grow over the forecast period.

- As per the Canadian Association of Petroleum Producers (CAPP), the annual revenue generated from upstream oil and natural gas in Canada fro nm 2018-2020 was USD 209 billion.

- The crude oil production in 2020 was 4,467 thousand barrels per day, while it increased to 4,677 thousand barrels per day in 2021. Production is estimated to remain at 5,855 thousand barrels per day in the forecast period till 2035.

- The United States is one of the world's largest consumers and exporters of oil and gas. According to U.S. Energy Information Administration (EIA), Crude oil production in the United States is expected to average 11.9 million barrels per day (b/d) in 2022, up 0.7 million b/d from 2021. Also, the output will exceed 12.8 million b/d in 2023, breaking the previous annual average record of 12.3 million b/d set in 2019.

- There are more than 10 large petrochemical projects under construction in the country, which have a combined value of over USD 207 billion. Thunder Horse South Expansion Phase 2 will further boost the market as it is one of the largest oil fields in the Gulf of Mexico. This project will add two new subsea production wells in the near term, and about eight wells will be drilled as part of the overall development. The other projects include Mad Dog Phase 2, Herschel, and Manuel.

- According to Energy Shale Gas Production, total natural gas production is projected to contribute 30% and more than 75% in Canada and Mexico by 2040.

- Hence, all such factors are expected to drive the growth of the oil and gas industry in North America, which is further expected to boost demand for the oilfield stimulation chemicals market.

Oilfield Chemicals Industry Overview

The oilfield chemicals market is highly consolidated. Key players in the oilfield chemicals market include Halliburton, Schlumberger Limited, Solvay, Baker Hughes Company, and Champion X.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Shale Gas Exploration and Production

- 4.1.2 Rising Demand for Petroleum-based Fuel from the Transportation Industry

- 4.2 Restraints

- 4.2.1 Clean Energy Initiatives

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemical Type

- 5.1.1 Biocides

- 5.1.2 Corrosion and Scale Inhibitors

- 5.1.3 Demulsifiers

- 5.1.4 Polymers

- 5.1.5 Surfactants

- 5.1.6 Other Chemical Types

- 5.2 Application

- 5.2.1 Drilling and Cementing

- 5.2.2 Enhanced Oil Recovery

- 5.2.3 Production

- 5.2.4 Well Stimulation

- 5.2.5 Workover and Completion

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Indonesia

- 5.3.1.4 Malaysia

- 5.3.1.5 Thailand

- 5.3.1.6 Australia & New Zealand

- 5.3.1.7 Vietnam

- 5.3.1.8 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Russia

- 5.3.3.2 Norway

- 5.3.3.3 UK

- 5.3.3.4 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Columbia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Algeria

- 5.3.5.2 Iran

- 5.3.5.3 Iraq

- 5.3.5.4 Nigeria

- 5.3.5.5 Saudi Arabia

- 5.3.5.6 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Ashland

- 6.4.3 Baker Hughes Company

- 6.4.4 BASF SE

- 6.4.5 CES Energy Solutions Corp.

- 6.4.6 Clariant

- 6.4.7 Croda International PLC

- 6.4.8 Chevron Phillips Chemical Company (Drilling Specialties Company)

- 6.4.9 Dow

- 6.4.10 Elementis PLC

- 6.4.11 Flotek Industries Inc.

- 6.4.12 Halliburton

- 6.4.13 Huntsman International LLC

- 6.4.14 Innospec Oilfield Services

- 6.4.15 Kemira

- 6.4.16 MPRC

- 6.4.17 Ecolab (NALCO Champion)

- 6.4.18 Nouryon

- 6.4.19 Schlumberger Limited

- 6.4.20 Solvay

- 6.4.21 The Lubrizol Corporation

- 6.4.22 Zirax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Horizons Created Due to Deepwater Drilling Operations

- 7.2 Production Opportunities Offered by Developing Countries

02-2729-4219

+886-2-2729-4219