|

市場調查報告書

商品編碼

1640499

亞太地區油田化學品 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Asia-Pacific Oilfield Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

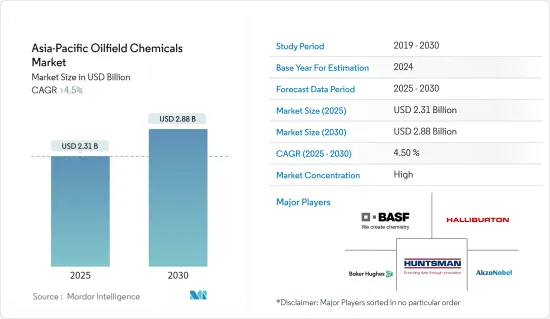

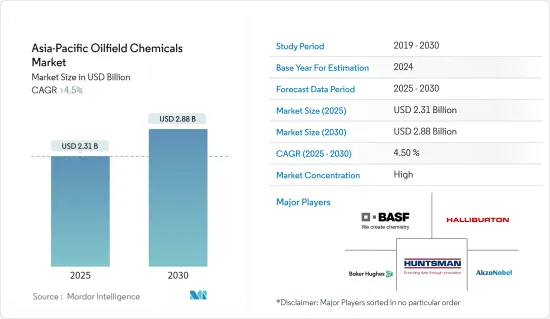

亞太地區油田化學品市場規模預計在 2025 年為 23.1 億美元,預計到 2030 年將達到 28.8 億美元,預測期內(2025-2030 年)的複合年成長率將超過 4.5%。

COVID-19疫情對石油和天然氣行業帶來了不利影響,從而衝擊了亞太地區的油田化學品市場。然而,在新冠疫情過後,由於石油和天然氣行業的需求增加,該地區的油田化學品市場預計將復甦。

關鍵亮點

- 推動市場成長的主要因素之一是亞太地區天然氣探勘和生產的佔有率不斷增加。預計預測期內運輸業對石油基燃料的需求不斷增加將推動市場需求。

- 生質燃料產業的興起可能會阻礙市場成長。隨著對永續性和環境問題的日益關注,油田化學品行業也可能面臨監管壓力和投資者興趣下降。

- 人們對深水和頁岩油氣等非傳統資源的日益關注,為鑽井液、潤滑劑和完井液開闢了新的市場。開發能夠應對這種惡劣環境的高性能環保化學品代表著一個巨大的商機。

- 在整個亞太地區,中國佔據市場主導地位,並且是該地區最大的油田化學品消費國。

亞太地區油田化學品市場趨勢

腐蝕和阻垢劑領域佔市場主導地位

- 腐蝕抑制劑用於減少油井金屬管道的腐蝕。腐蝕抑制是碳鋼管道和容器的首選治療方法。抑制劑的優點是即使該過程正在進行,大多數情況下也可以使用它們。

- 當氧氣與金屬零件反應形成氧化物時,就會發生腐蝕。腐蝕抑制劑透過在暴露的部件上形成一層薄的隔離層來發揮作用。油田中使用多種類型的腐蝕抑制劑。

- 二乙基羥胺、多胺、嗎福林、環己胺、二氧化碳腐蝕抑制劑等。成膜胺混合物用於製備冷凝水管線腐蝕抑制劑。這是因為同時存在高蒸氣蒸氣和蒸氣液體,因此可以保護所有階段。

- 水垢是油田設備表面形成的殘留物,是由於可溶性固體隨著溫度升高而沉澱而變得不溶的。這會導致金屬腐蝕並影響設備的功能和維護。這種沉積會增加腐蝕速度,造成生產損失並限制流動。

- 因此,為了保護油田設備並保持其效率,必須透過添加科學設計的化學物質作為阻垢劑來維持精確的條件。有機磷酸鹽、無機磷酸鹽、聚合物(聚丙烯酸酯)、磷酸酯以及有機螯合劑乙二胺四乙酸(EDTA)等化學物質是一些阻垢劑。腐蝕抑制劑用於減少油井金屬管的腐蝕。對於碳鋼管道和容器,腐蝕抑制是首選的治療方法。

- Rystad表示,海上計劃將推動待開發區投資的復甦,推動石油和天然氣產業對海底基礎設施和鑽井服務的需求。

- 例如,馬來西亞國家石油公司的Kasawari宣布獲得馬來西亞首個捕碳封存(CCS)投資核准,隨後泰國PTT探勘與生產公司(PTTEP)的Lang Lebah項目也計劃於2023年在馬來西亞做出最終投資決定。

- 據能源工業委員會稱,殼牌最近核准對 Gumsut Kakap Gelong Jagdz 酵母(GKGJE) 深水計劃進行投資,該項目是海底回接開發項目,計劃於 2024 年運作。

- 標普全球公司稱,紐西蘭煉油廠 Refining NZ 計劃於 10 月與客戶敲定終端服務契約,在 2022 年上半年將其 Marsden Point 煉油廠改造成進口終端。

- 據標普全球稱,澳洲 Viva Energy 對聯邦政府宣布的燃料安全一攬子計畫表示歡迎,該計畫將維持其在吉朗的精製業務至2027 年6 月,並可選擇再延長三年至2030 年。承諾協議延長六年,至2021年6月。

- 泰國是是拉差香甜辣椒醬煉油廠目前正在實施一項價值 40 億美元的無污染燃料計劃。此次升級預計於 2023 年完成,將使煉油廠的產能從 275,000 桶/天提高到 40 萬桶/天,並提高清潔產品的生產率。

- 此外,亞太地區的新契約表明,預測期內對腐蝕和阻垢抑制劑的投資將增加。

中國主導市場

- 石油和天然氣產業是中國經濟的主要貢獻者之一。石油和天然氣工業在高溫環境下運作。

- 油田化學品用於鑽井、生產、增產和提高採收率活動。開發頁岩層的石油和天然氣蘊藏量需要水力鑽井等活動,從而鼓勵使用油田化學物質。中國在頁岩氣探勘能力和鑽井技術方面取得了許多里程碑式的成就。這使得中國成為世界主要頁岩氣供應國之一。

- 根據英國石油公司2023年統計報告,預計2022年該國石油總產量將達到2.047億噸,較2021年的1.989億噸產量增加2.9%。

- 同樣,過去十年來該國的整體石油消費量也一直在上升。例如,2022 年該國的石油消費量(以千桶/日為單位)為每天 14,295,000 桶,而 2021 年為每天 14,893,000 桶。此外,從 2012 年到 2022 年的 10 年間,消費量每年以 3.6% 的速度成長。

- 此外,同一資訊來源還稱,該國的天然氣產量實現了正成長。例如,2021年天然氣產量為2,092億立方米,2022年增加至2,218億立方米,成長約6.0%。此外,在過去10年裡,產量平均每年成長7.1%。

- 預計該國石油和天然氣生產能力的提高將推動該國油田化學品市場的發展。

亞太地區油田化學品產業概況

亞太地區油田化學品市場本質上是部分整合的。主要企業(不分先後順序)包括阿克蘇諾貝爾公司、哈利伯頓公司、亨斯邁國際公司、貝克休斯公司、BASF公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 運輸業對石油基燃料的需求不斷增加

- 亞太地區頁岩氣探勘和產量不斷增加

- 其他促進因素

- 限制因素

- 生質燃料產業的崛起

- 清潔能源計劃

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 化學類型

- 除生物劑

- 腐蝕和水垢抑制劑

- 乳化劑

- 聚合物

- 界面活性劑

- 其他化學品(有機酸、壓裂液等)

- 應用

- 鑽井和固井

- 提高採收率

- 生產

- 油井增產

- 修井及完井

- 地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 菲律賓

- 澳洲和紐西蘭

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AkzoNobel NV

- Albemarle Corporation

- Ashland

- Baker Hughes Company

- BASF SE

- CLARIANT

- Chevron Phillips Chemical Company LLC

- Dow

- Ecolab

- Elementis PLC

- Haliburton

- Huntsman International LLC

- Innospec

- Kemira

- Newpark Resources Inc.

- SLB

- Solvay

第7章 市場機會與未來趨勢

- 深海鑽探計畫開啟新視野

- 新興經濟體提供生產機會

The Asia-Pacific Oilfield Chemicals Market size is estimated at USD 2.31 billion in 2025, and is expected to reach USD 2.88 billion by 2030, at a CAGR of greater than 4.5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the oil and gas industry, which in turn affected the oilfield chemicals market in the Asia-Pacific region. However, post-COVID-19, the rising demand from the oil and gas industry is expected to revive the market for oilfield chemicals in the region.

Key Highlights

- One of the major factors driving the market's growth is the increased share of gas exploration and production in the Asia-Pacific region. Rising demand for petroleum-based fuel from the transportation industry is expected to drive the market demand during the forecast period.

- The rising biofuel industry is likely to hinder the market growth. With the increasing focus on sustainability and environmental concerns, the oilfield chemicals industry may face regulatory pressures and a decline in investor interest as well.

- The increasing focus on deepwater and unconventional resources like shale oil and gas opens up new markets for drilling fluids, lubricants, and completion fluids. Developing high-performance, environmentally friendly chemicals for these challenging environments is a lucrative opportunity.

- China dominated the market across the Asia-Pacific Region, with the most significant consumption of oilfield chemicals in this region.

Asia-Pacific Oilfield Chemicals Market Trends

Corrosion and Scale Inhibitors segment to dominate the market

- Corrosion inhibitors are used to reduce corrosion in the metallic pipes of the oil well. Inhibition is the preferred treatment for carbon steel pipes and vessels. The advantage of inhibition is that it can be used in most cases even when the process is continuing.

- Corrosion occurs due to the reaction of oxygen with metallic parts to form oxides. Corrosion inhibitors act by forming a thin barrier layer over the exposed parts. Several types of corrosion inhibitors are used in oilfields.

- These include Deha - Diethyl Hydroxyl Amine, Polyamine, Morpholine, Cyclohexylamine, and Carbon Dioxide Corrosion Inhibitors. A mixture of filming amines is used to prepare condensate line corrosion inhibitors. This can protect every stage due to the presence of both high and low vapor/liquids.

- Scale is a residue that forms on the surface of oilfield equipment as a result of the precipitation of soluble solids that become insoluble as temperature increases. This, in turn, causes metallic corrosion that affects the functioning and maintenance of equipment. This deposition increases corrosion rates, causes loss of production, and restricts flow.

- Hence, to safeguard oilfield equipment and to maintain their efficiency, it is necessary to maintain accurate conditions by adding scientifically designed chemicals that act as scale inhibitors. Chemicals, such as organic phosphates, inorganic phosphates, polymers (polyacrylates), phosphonates, and ethylenediaminetetraacetic acid (EDTA), an organic chelating agent, are some of the scaling inhibitors. Corrosion inhibitors are used to reduce corrosion in metallic pipes of oil wells. Inhibition is the preferred treatment for carbon steel pipes and vessels.

- As per Rystad, offshore projects will drive the recovery in greenfield investment, with significant demand for subsea infrastructure and drilling services in the oil and gas industry.

- For example, Petronas's Kasawari announced investment approval for the first carbon capture and storage (CCS) in Malaysia, which was followed by Thai company PTT Exploration and Productions's (PTTEP's) Lang Lebah, targeting FID in 2023 in Malaysia.

- Shell's recent investment approval for the Gumusut-Kakap-Geronggong-Jagus East (GKGJE) deep-water project - a subsea tieback development planned to start up in 2024, according to the Energy Industries Council.

- As per S&P Global Inc., New Zealand's Refining NZ said it was working to finalize terminal services agreements with customers in October to enable the conversion of its Marsden Point refinery into an import terminal in the first half of 2022.

- As per S&P Global Inc, Australia's Viva Energy welcomed the federal government's announcement of a fuel security package and, as part of this, would make a six-year commitment to maintain refining operations at Geelong through to June 2027 with a further three-year option to extend until June 2030.

- A USD 4 billion clean fuel project is being undertaken at Thailand's Sriracha refinery. The upgrade is slated to be completed in 2023 and will increase the refinery's capacity from 275,000 b/d to 400,000 b/d, boosting the yield of cleaner products. as per S&P Global Inc.

- Furthermore, new contracts for maintenance in Asia-Pacific exhibit increased investment in corrosion and scale inhibitors during the forecast period.

China to Dominate the Market

- The oil and gas industry is one of the key contributors to the Chinese economy. The oil and gas industry operates in high-temperature environments.

- Oilfield chemicals are used in drilling, production, stimulation, and enhanced oil recovery activities. Developing oil and gas reserves from shale formations requires activities such as hydraulic drilling, which encourages the use of oilfield chemicals. China has achieved many milestones in capacity and drilling techniques in shale gas exploration. This makes it one of the top shale gas suppliers around the globe.

- According to BP Statistical Review 2023, the overall oil production in the country reached 204.7 million metric tons in 2022 at a growth rate of 2.9% compared to 198.9 million metric tons produced in 2021.

- Similarly, the country's overall oil consumption has been on the rise over the past decade. For instance, in 2022, the country's oil consumption in thousands of barrels per day was 14,295 thousand barrels per day, whereas in 2021, the consumption stood at 14,893 thousand barrels per day. In addition, the consumption growth rate has been 3.6% yearly over the decade between 2012 and 22.

- Moreover, the same source cited that the country witnessed positive growth in natural gas production. For instance, in 2021, the natural gas produced was 209.2 billion cubic meters, whereas in 2022, the production increased to 221.8 billion cubic meters, which is around 6.0% growth. In addition, over the decade, production has been growing by an average of 7.1% yearly.

- The increase in the production capacities of oil and gas in the country is likely to drive the market for oilfield chemicals in the country.

Asia-Pacific Oilfield Chemicals Industry Overview

The Asia-Pacific oilfield chemicals market is partially consolidated in nature. The major players (not in a particular order) include AkzoNobel N.V., Haliburton, Huntsman International LLC, Baker Hughes Company, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Petroleum-based Fuel from the Transportation Industry

- 4.1.2 Increased Shale Gas Exploration and Production in Asia-Pacific

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rising Biofuel Industry

- 4.2.2 Clean Energy Initiatives

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemical Type

- 5.1.1 Biocide

- 5.1.2 Corrosion and Scale Inhibitor

- 5.1.3 Demulsifier

- 5.1.4 Polymer

- 5.1.5 Surfactant

- 5.1.6 Other Chemical Types (Organic Acids, Fracturing Fluids, etc.)

- 5.2 Application

- 5.2.1 Drilling and Cementing

- 5.2.2 Enhanced Oil Recovery

- 5.2.3 Production

- 5.2.4 Well Stimulation

- 5.2.5 Workover and Completion

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Malaysia

- 5.3.6 Thailand

- 5.3.7 Indonesia

- 5.3.8 Vietnam

- 5.3.9 Philippines

- 5.3.10 Australia & New Zealand

- 5.3.11 Rest of Asia-pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel N.V.

- 6.4.2 Albemarle Corporation

- 6.4.3 Ashland

- 6.4.4 Baker Hughes Company

- 6.4.5 BASF SE

- 6.4.6 CLARIANT

- 6.4.7 Chevron Phillips Chemical Company LLC

- 6.4.8 Dow

- 6.4.9 Ecolab

- 6.4.10 Elementis PLC

- 6.4.11 Haliburton

- 6.4.12 Huntsman International LLC

- 6.4.13 Innospec

- 6.4.14 Kemira

- 6.4.15 Newpark Resources Inc.

- 6.4.16 SLB

- 6.4.17 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Horizons Opened Up due to Deep-water Drilling Operations

- 7.2 Production Opportunities Provided by Developing Countries