|

市場調查報告書

商品編碼

1628847

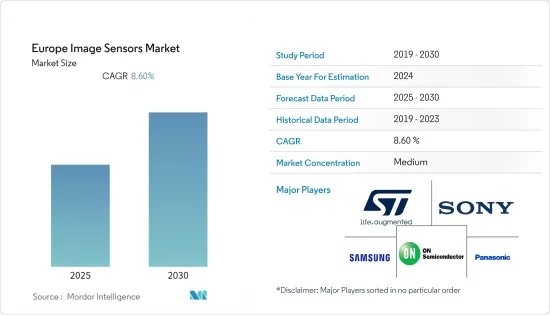

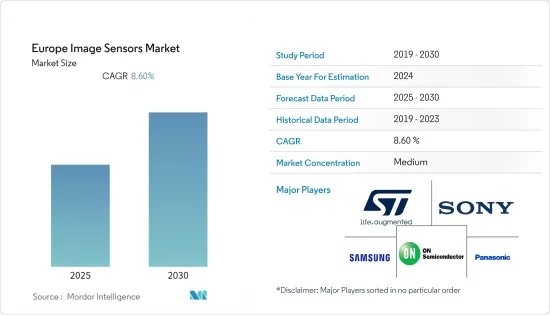

歐洲影像感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

歐洲影像感測器市場預計在預測期內複合年成長率為 8.6%

主要亮點

- 推動影像感測器市場擴張的主要因素是智慧型手機和平板電腦生產數量的增加,以及此類設備中安裝的攝影機數量的增加。隨著這些設備對改進相機功能和高影像品質的需求迅速增加,OEM正在不斷開發影像感測器,以提高多功能性,同時保持設備的輕薄性和易用性,從而推動市場成長。

- 推動影像感測器市場成長的其他原因包括將眾多相機整合到一台設備中,以實現光學變焦、低照度攝影、肖像模式、3D 成像功能和增強的高動態範圍等目的。例如,據愛立信稱,到 2027 年,西歐智慧型手機用戶數量將達到 4.39 億。截至 2021 年,西歐智慧型手機用戶數約為 4.04 億。

- 在 PCB 組裝等工業應用中,CSG 感測器改進的影像品質和影格速率使自動光學偵測 (AOI) 相機能夠快速可靠地偵測缺陷,例如缺失或錯誤插入的電子元件。此外,全球邁向工業 4.0 的努力正在推動使用影像感測器進行 3D影像處理。影像感測器也用於自動化製造過程和監控操作過程。市場上的供應商透過結合影像感測器和 3D 相機來提供更好的產品。例如,SICK 的 3D 相機 Ranger 3 使用 CMOS 影像感測器 M30,並減少片上資料以建立 3D 配置檔案。

- 航太工業的特點是運作環境惡劣、複雜。因此,選擇能夠承受這些極端外部環境並以所需的準確度、可靠性、精密度和可重複性運作的感測器對於最終用戶來說至關重要。現代飛機上安裝的工業感測器的範圍非常廣泛。 2021 年 2 月,Teledyne Technologies 為火星探勘Persevalance 的複雜儀器提供了許多先進的高性能影像感測器。在 2020 年火星任務期間,Teledyne 的感測器將為火星表面和礦物質(包括 Gy 和大氣)的化學成分提供動力、感知和評估。

- 2022 年 2 月,Maxar Technologies 宣布與歐洲太空影像公司和中東太空影像公司簽訂新的五年協議,這兩家公司是為歐洲、北非和中東客戶提供服務的主要合作夥伴。歐洲太空成像和中東太空成像為邊防安全、災難應變和農業等各個領域的政府機構和私人公司提供 Maxar 的高解析度衛星影像。太空技術的發展推動了研究市場。

- 由於感測器是 PN 接面,入射光產生電子電洞對,電流開始流動。這在影像感測器中形成像素並產生影像。感測器通常用於以較低的功率提高工業機械的效率和速度。例如,2021年3月,東芝電子元件及儲存裝置株式會社發布了用於執行高速掃描的A3多功能設備的「TCD2726DG」鏡頭縮小型CCD線性影像感測器。透過減少時序產生器電路和 CCD 驅動器中的引腳數量,該感測器減少了 EMI(電磁干擾)的增加,這是提高時脈速率的一個缺點。減少外圍元件數量並減少客戶的EMI時序調整工作,有利於系統開發。

- 然而,疫情的爆發也對許多影像片段產生了負面影響。例如,2020年第一季,汽車和加工產業的生產停止或減少。因此,這些產業對各類感測器的需求大幅下降。由於安全問題和嚴格的政府法規,越來越多的製程營運商開始投資自動化監控系統,壓力感測器的工業和物聯網設備的範圍不斷擴大。例如,在中國,台灣的 OSAT 和日月光科技也報告稱,與 2019 年 11 月和 2020 年 10 月相比,2020 年 11 月的收入增加。此外,京元電子的中國半導體測試子公司金龍科技(蘇州)將投資其新獲得的5.52億元人民幣企業聯合貸款中的至少50%,為新晶片提供額外的產能支援。 。

歐洲影像感測器市場趨勢

汽車領域預計將推動市場成長

- 汽車影像感測器是確保車輛安全的重要功能。除了後視攝影機傳統的感測和可視性應用之外,對車輛內外360度監控和可視性能力的需求已成為明顯的需求。透過ADAS(高級駕駛員輔助系統)和駕駛員監控系統(DMS)的開發和實施,汽車在安全性和可靠性方面取得了進步,使其不僅可以警告駕駛員潛在的事故,還可以進行干預。 。這正在推動研究市場的成長。

- 根據 OICA(國際工業協會)的數據,2021 年德國是歐洲乘用車產量最多的國家。當年生產的乘用車數量約為310萬輛。西班牙位居第二,生產了超過 170 萬輛乘用車。此外,2021年,歐洲汽車產業產量將超過1,630萬輛,其中乘用車約佔總量的85%。如此龐大的汽車產量預計將為當地供應商創造機會,根據客戶需求擴大產品系列併佔領廣泛的市場佔有率。

- 無縫連接、創新的汽車駕駛座以及透過新服務改進的被動安全性:3D 深度感測器在車輛內部監控系統中發揮關鍵作用。對於滿足法規和 NCAP 評估至關重要。這對於實現司機變成乘客的願景也至關重要。

- 因此,2022年6月,英飛凌科技股份公司與3D飛行時間系統專家PMD Technologies AG合作開發第二代REAL3汽車影像感測器,這是一款符合ISO26262標準的高解析度3D影像感測器。該感測器採用 9 x 9 mm2 塑膠 BGA 封裝,具有 640 x 480 像素的 VGA 系統解析度和 4 毫米的小像圈。這允許使用從智慧型手機到汽車應用的各種鏡頭尺寸。 REAL3 感測器的高解析度使其適用於寬視野攝影機應用,例如完整的前排乘客監控系統。由此產生的 3D 身體模型可以準確估計乘員的尺寸和重量,以及高精度的乘員和座椅位置資料,這是智慧安全氣囊展開和約束系統的關鍵資訊。除了安全關鍵應用之外,3D資料還有助於實現舒適功能,例如手勢控制和跟隨乘員動作的直覺內部照明。

- 該地區也見證了新的綜合產品和解決方案的創新激增。 2022年5月,義法半導體開發出全球首款用於駕駛員監控系統(DMS)的百葉窗影像感測器。 DMS 持續監控駕駛員的頭部運動,以識別困倦或分心的徵兆,從而使車輛中的系統能夠發出警告以確保乘員的安全。 VB56G4A是全球領先的百葉窗感測器,利用ST在製造先進3D堆疊背照式(BSI-3D)影像感測器方面的內部投資。這些感測器比第一代 DMS 中常用的傳統正面照明 (FSI) 感測器更靈敏、更小且更可靠。

- 2021 年 7 月,三星發布了新款 ISOCELL Auto 4AC,這是第一款專為汽車應用設計的影像感測器。它旨在用作倒車攝影機或(在更先進的系統中)為環景顯示供電。該技術每個像素整合了兩個光電二極體,一個用於低照度操作的 3.0μm 光電二極體,一個位於角落的 1.0μm 光電二極體用於明亮環境。這種設定使感測器能夠快速適應周圍光線的變化(例如,退出隧道時)。它還具有更少的運動模糊和更寬的動態範圍,有助於減少 LED 照明的閃爍。

醫療領域預計將佔據主要市場佔有率

- 影像感測器在各種醫療領域都有應用,例如牙科影像、數位乳房X光乳房X光攝影、眼科、X光影像重建、內視鏡檢查、數位病理學、整形外科和外科手術。高解析度、快速影格速率、高近紅外線靈敏度、高影像品質和醫學成像器感測器是推動這項技術發展的關鍵改進。一些地區公司正在開發包括可靠、準確和高性能的視覺和相機感測器在內的創新產品,以提高成像效率和準確性,並滿足醫療和生命科學領域日益苛刻的要求。

- 例如,2021 年6 月,先進數位成像解決方案提供商OmniVision Technologies, Inc. 推出了下一代OH08A,這是首款用於一次性和可重複使用內視鏡的800 萬像素(MP) 解析度感測器,我們也推出了OH08B CMOS 影像。此外,新型 OH08B 是首款採用 OmniVision Nyxel 近紅外線 (NIR) 技術的醫療級影像感測器,為醫療產業帶來了可見頻譜以外的突破性影像處理功能。此外,OH08B 是首款採用 OmniVision Nyxel 近紅外線 (NIR) 技術的醫療級影像感測器,為醫療產業帶來了可見頻譜以外的先進成像功能。

- 此外,2021 年 11 月,OmniVision Technologies, Inc. 和醫療應用高品質高高光譜遙測和頻譜相機系統開發商 Diaspective Vision GmbH 宣布推出一款採用專有頻譜成像技術的新型內視鏡相機。開發。根據醫學影像第五維Dispective Vision,MALYNA提供顯示組織的各種灌注參數和風險結構的高光譜遙測影像和頻譜影像、用於癌症檢測的ICG影像以及即時影像,它將成為像超音波、 MRI 和電腦斷層掃描。透過以這種方式組合各種成像方法,您可以最大限度地提高內視鏡檢查的效率。此影像感測器適用於胃鏡檢查、十二指腸鏡檢查、羊膜鏡檢查、腹腔鏡檢查和大腸鏡檢查。

- 此外,CMOS 影像感測器擴大用於醫學 X 光成像,而不是非晶質平板。使用 CMOS 的 X 光成像不需要鏡頭,因此影像感測器的尺寸必須與要成像的區域的尺寸相符。

- 2021年3月,佳能公司宣布開發數位廣播(DR)2新技術「內建AEC1輔助」。在該技術中,設備的X光影像感測器利用類似的組件,既可以產生影像,又可以即時檢測與發射的X光相對應的像素值3,當像素值達到指定值時,系統會發出警報線發生器。為了強化這項標準運作,佳能利用多年來培育的影像感測器和X光感測器技術,開發了新的「內建AEC支援」技術。隨著最新技術的引入,以前需要單獨設備的影像處理設備現在可以內建其功能。

歐洲影像感測器產業概況

歐洲影像感測器市場適度整合,許多大大小小的公司相互競爭。透過產品和技術發布、策略聯盟、收購、擴張和合作,這些參與企業尋求在市場上競爭。該市場的主要企業包括ST微電子、BAE系統、安森美半導體等。

- 2021 年 12 月 - 索尼半導體解決方案公司宣布開發出一種使用兩層電晶體像素的新型堆疊 CMOS 影像感測器技術。在傳統的CMOS影像感測器中,光電二極體和像素電晶體放置在同一基板上,但採用此技術,光電二極體和像素電晶體分離在不同的基板層上。這將飽和訊號等級提高到先前型號的大約兩倍,擴大了動態範圍,降低了噪聲,並顯著改善了成像特性。

- 2021 年 10 月 - 以智慧電源和感測技術而聞名的 Onsemi 宣布推出一款新型 1/1.7 吋 8.3MP CMOS 數位影像感測器,具有捲簾百葉窗和嵌入式高動態範圍 (eHDR) 技術。 AR0821CS 即使在惡劣的照明條件下也能提供出色的影像質量,滿足各種商務用、消費和工業需求。這些應用包括掃描器/讀取器、機器視覺相機、高階無人機、儀表板相機、智慧建築監控/安全系統等。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 增加在行動裝置中安裝具有影像感測器的高解析度攝影機

- 改進醫學影像解決方案

- 增加公共場所安全和監控支出

- 市場限制因素

- 製造成本高

- 市場機會

- 汽車應用的增加

第6章 市場細分

- 按類型

- CMOS

- CCD

- 按最終用戶產業

- 家用電子電器

- 醫療保健

- 工業的

- 安全監控

- 汽車/交通

- 航太/國防

- 其他

- 按國家/地區

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

第7章 競爭格局

- 公司簡介

- STMicroelectronics

- BAE Systems

- On Semiconductor

- Toshiba

- Sony Corporation

- Samsung Electronics Co., Ltd

- Nikon

- Panasonic Corporation

- SK Hynix

- Omnivision

第8章投資分析

第9章 未來展望

簡介目錄

Product Code: 55694

The Europe Image Sensors Market is expected to register a CAGR of 8.6% during the forecast period.

Key Highlights

- The primary element propelling the expansion of the image sensor market is the rise in the production of smartphones and tablets and the rising number of cameras incorporated into such devices. As the need for improved camera functions and good image quality in such devices grows quickly, OEMs are constantly developing image sensors that will increase their versatility while maintaining the device's thinness and usability, boosting the market.

- Other reasons propelling the growth of the image sensor market include the desire to integrate numerous cameras into a single device for purposes such as optical zoom, low light photography, portrait mode, 3D imaging features, and enhanced high dynamic range. For instance, According to Ericsson, By 2027, there will be 439 million smartphone subscriptions in Western Europe. There were about 404 million smartphone subscribers in Western Europe as of 2021.

- In an industrial application such as a PCB assembly, the CSG sensors improved image quality and frame rate allow an automated optical inspection (AOI) camera to rapidly and reliably spot defects such as a missing or an incorrectly inserted electronic component. Furthermore, the Industry 4.0 initiatives globally are also pushing the use of 3D imaging with image sensors. Also, image sensors are being used to automate manufacturing processes and monitor operational processes. The vendors in the market are also combining image sensors and 3D cameras for a better offering. For example, SICKs Ranger 3, a 3D camera, uses CMOS image sensor M30 to create a 3D profile with reduced on-chip data.

- A harsh and complex operating environment characterizes the aerospace industry. Therefore, choosing a suitable sensor to withstand such external environment extremities and performing at the desired accuracy, reliability, precision, and repeatability are of prime importance for the end-users. The spectrum of industrial sensors on a modern aircraft is quite broad. In February 2021, Teledyne Technologies supplied many of its advanced, high-performance image sensors to the Mars Rover Perseverance's complicated instruments. During the Mars 2020 mission, Teledyne sensors will power, sense, and evaluate the chemical composition of the surface and minerals, including Gy and the atmosphere.

- In February 2022, Maxar Technologies announced a new five-year deal with European Space Imaging and Space Imaging Middle East, critical partners serving customers in Europe, Northern Africa, and the Middle East. European Space Imaging and Space Imaging Middle East provide Maxar high-resolution satellite imagery to a broad spectrum of government and commercial organizations for border security, disaster response, and agriculture. Developments in space technology will drive the studied market.

- Since the sensor is a PN junction, incoming light causes it to start producing electron-hole pairs and start conducting current. This creates the pixels inside the image sensors, which in turn create the pictures. The sensors are commonly used to increase the efficiency and speed of industrial machinery while using less power. For instance, in March 2021, The "TCD2726DG," a lens reduction type CCD linear image sensor for A3 multifunction printers that perform high-speed scanning, was made available by Toshiba Electronic Devices & Storage Corporation. The timing generator circuit and fewer CCD driver pins in the new sensor reduce increased electromagnetic interference (EMI), a drawback of a faster clock rate. System development is facilitated by a decrease in the number of peripheral parts, customers' EMI and timing adjustment work, and both.

- However, the pandemic outbreak also negatively affected many image sectors. For instance, during the first quarter of 2020, output was on hold or decreased in the automobile and process industries. As a result, these businesses experienced a considerable decrease in the demand for all types of sensors. Due to safety concerns and strict government restrictions, the range of industrial and IoT devices for pressure sensors increased as more process businesses began to invest in automation monitoring systems. For instance, in China, Taiwan-based OSAT and ASE Technology also reported increased revenue in November 2020, compared to November 2019 and October 2020. KYEC's semiconductor testing subsidiary in China, King Long Technology (Suzhou), also reported investing at least 50% of its newly obtained syndicated loan of CNY 552 million in purchasing more testing equipment to provide additional capacity support for new chips.

Europe Image Sensors Market Trends

The Automotive Segment is Expected to Drive the Market's Growth

- Image sensors for automotive applications are an essential feature for car safety. Beyond the sensing and viewing applications of traditional rear-view cameras, the demand for all-around interior and exterior monitoring and viewing capabilities has become an unequivocal necessity. Through the development and implementation of Advanced Driver Assistance Systems (ADAS) and Driver Monitoring Systems (DMS), cars have become and will continue to progress in safety and reliability, not only to alert drivers to potential incidents but to intervene as well. This is driving the growth of the studied market.

- According to OICA (International Organization of Motor Vehicle Manufacturers), Germany made the most passenger automobiles in Europe in 2021. In that year, it produced about 3.1 million passenger cars. With over 1.7 million passenger automobiles produced, Spain came in second. Furthermore, more than 16.3 million vehicles were produced in the European automotive sector in 2021, with passenger cars making up about 85% of the total. Such huge production of cars will create an opportunity for the local vendors to expand their product portfolio according to the requirements of the clients and capture a wide market share.

- Seamless connectivity with new services, innovative car cockpits, and improved passive safety: 3D depth sensors play a vital role in monitoring systems in the vehicle cabin. They are essential to meet regulations and NCAP ratings. They are also vital to realize the vision of the driver becoming a passenger.

- To that end, in June 2022, Infineon Technologies AG, in partnership with 3D time-of-flight system specialist pmd technologies ag, developed the second generation of the REAL3 automotive image sensor - an ISO26262-compliant high-resolution 3D image sensor. The sensor is encased in a 9 x 9 mm2 plastic BGA package and offers a VGA system resolution of 640 x 480 pixels with a tiny image circle of 4 mm. It allows lens sizes like those known from smartphones to automotive applications. The high resolution of the REAL3 sensor makes it appropriate for camera applications with a wide field of view, like complete front-row occupant monitoring systems. The resulting 3D body models enable accurate estimates of occupant size and weight and highly precise passenger and seat position data, which is key information for intelligent airbag deployment and restraint systems. Besides safety-critical applications, the 3D data facilitates comfort features like gesture control or intuitive interior lighting that follows passengers' movements.

- The region is also witnessing an upsurge in the innovation of new and comprehensive products and solutions. In May 2022, STMicroelectronics developed a global-shutter image sensor for driver monitoring systems (DMSs). They constantly watch the driver's head movements to recognize signs of drowsiness and distraction, enabling systems in the vehicle to generate warnings that can preserve the safety of occupants. The global-shutter sensor, the VB56G4A, leverages ST's in-house investment in manufacturing advanced 3D-stacked back-side illuminated (BSI-3D) image sensors. These are more sensitive, smaller, and reliable than conventional front-side illuminated (FSI) sensors typically used in first-generation DMSs.

- In July 2021, Samsung launched its new ISOCELL Auto 4AC, its first image sensor, tailor-made for cars. It is intended to be utilized as a reverse camera or (on more advanced systems) to power surround view monitors. The technology integrates two photodiodes per pixel - one 3.0 µm for low-light operation and one 1.0 µm placed in the corner that will be used for bright environments. This setup enables the sensor to quickly adjust to changes in the surrounding light, ex: when exiting a tunnel. It also offers a high dynamic range with little motion blur and reduces the flicker of LED lights.

The Healthcare Sector is Expected to Hold a Significant Market Share

- Imaging sensors have applications in various medical sectors like dental imaging, Digital Mammography, Ophthalmology, X-Ray image reconstruction, Endoscopy, and digital pathology, Orthopedic and surgical procedures. High resolution, fast frame rate, high NIR sensitivity, excellent image quality, and medically qualified imager sensors are the key improvements that help to advance the technique. Several regional companies are developing innovative products, including reliable, accurate, and high-performance vision and camera sensors, to improve image efficiency and accuracy and meet the medical and life sciences sector's ever-demanding requirements.

- For instance, in June 2021, OmniVision Technologies, Inc., a provider of advanced digital imaging solutions, announced its next-generation OH08A and OH08B CMOS image sensors, the first 8 megapixels (MP) resolution sensors for single-use and reusable endoscopes. Additionally, the new OH08B is the first medical-grade image sensor to use OmniVision's Nyxelnear-infrared (NIR) technology, bringing revolutionary imaging capabilities beyond the visible spectrum to the medical industry. Additionally, the OH08B is the first medical-grade image sensor to use OmniVision's Nyxelnear-infrared (NIR) technology, bringing advanced imaging capabilities beyond the visible spectrum to the medical industry.

- Further, in November 2021, OMNIVISION Technologies, Inc., and Diaspective Vision GmbH, developer of high-quality hyperspectral and multispectral camera systems for medical applications, announced their partnership in developing a new type of endoscopic camera, the MALYNA system, based on proprietary multispectral imaging technology. According to Diaspective Vision, the fifth dimension of medical imaging, the MALYNA is set to become a standard diagnostics tool like ultrasound, MRI, and CT scans as it provides live imaging in addition to hyperspectral and multispectral imaging, which shows the different perfusion parameters and risk structures of the tissue, and ICG imaging for cancer detection. This combination of different imaging procedures maximizes productivity during endoscopy. The image sensor is suitable to be utilized in gastroscopes, duodenoscopes, amnioscopes, laparoscopes and colonoscopes.

- Further, in place of amorphous silicon flat panels, CMOS image sensors are now often employed for medical X-Ray imaging. Since there is no lens required for CMOS-based X-ray applications, the image sensor's size must coincide with the size of the target region.

- In March 2021, the development of the new "Built-in AEC1 assistance" technology for digital radiography (DR)2 was announced by Canon Inc. With this technique, the X-ray image sensor of the device makes use of similar parts that can do both picture production and real-time detection of the pixel value3 corresponding to emitted X-rays, alerting the X-ray generator when the pixel value reaches a predetermined value. Canon has developed its new "Built-in AEC Assistance" technology by utilizing the image and X-ray sensor technologies the business has developed over its long history in order to enhance such standard operations. With the enable of modern technologies, imaging equipment now has built-in capabilities that formerly required separate devices.

Europe Image Sensors Industry Overview

The Europe Image Sensors Market is moderately consolidated due to many large and small players churning the competition in the market. Through product and technology launches, strategic partnerships, acquisition, expansion, and collaboration, these players try to gain a competitive edge in the market. Key players in the market are ST Microelectronics, BAE System, On Semiconductor, etc.

- December 2021 - Sony Semiconductor Solutions Corporation announced that it had developed the new stacked CMOS image sensor technology with 2-Layer Transistor Pixel. Whereas conventional CMOS image sensors' photodiodes and pixel transistors occupy the same substrate, Sony's latest technology separates photodiodes and pixel transistors on different substrate layers. This new architecture approximately doubles saturation signal level relative to conventional image sensors, widens dynamic range, and reduces noise, thereby substantially improving imaging properties.

- October 2021 - Onsemi, a prominent person in intelligent power and sensing technologies, announced the availability of a new 1/1.7-inch 8.3 MP CMOS digital image sensor with a rolling shutter and embedded High Dynamic Range (eHDR) technology. The AR0821CS meets various needs of commercial, consumer, and industrial applications by providing superior image quality in challenging lighting conditions. These applications comprise scanners/readers, machine vision cameras, high-end drones, dashboard cameras, and smart building surveillance/security systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Incorporation of high-resolution cameras with image sensors in mobile devices

- 5.1.2 Improving medical imaging solutions

- 5.1.3 Increasing expenditure on security and surveillance in public places

- 5.2 Market Restraints

- 5.2.1 High Manufacturing costs

- 5.3 Market Opportunities

- 5.3.1 Increasing automotive applications

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 CMOS

- 6.1.2 CCD

- 6.2 By End-User Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Healthcare

- 6.2.3 Industrial

- 6.2.4 Security and Surveillance

- 6.2.5 Automotive and Transportation

- 6.2.6 Aerospace and Defense

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 BAE Systems

- 7.1.3 On Semiconductor

- 7.1.4 Toshiba

- 7.1.5 Sony Corporation

- 7.1.6 Samsung Electronics Co., Ltd

- 7.1.7 Nikon

- 7.1.8 Panasonic Corporation

- 7.1.9 SK Hynix

- 7.1.10 Omnivision

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219