|

市場調查報告書

商品編碼

1629755

雲端廣告:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Cloud Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

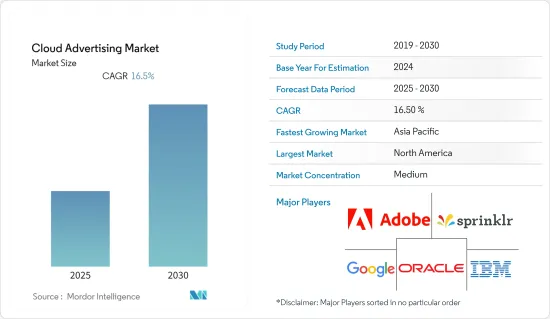

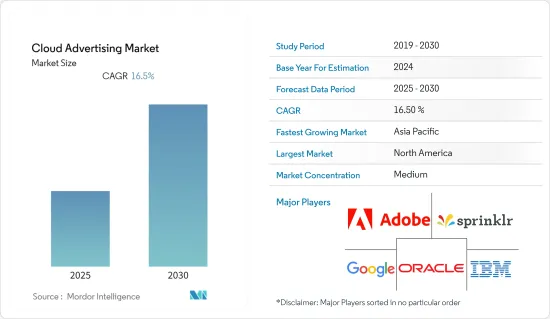

雲端廣告市場預計在預測期內複合年成長率為16.5%

主要亮點

- 我們雲端基礎的廣告平台允許客戶建立、編輯和管理展示廣告宣傳,而無需綁定到特定設備或辦公椅。該細分市場的主要驅動力是智慧型手機使用的不斷增加、網際網路連接的廣泛普及以及數位媒體消費的不斷成長。儘管如此,這些因素預計將在預測期內增加全球網路用戶數量,並為雲端廣告市場開闢新的潛在前景。

- 隨著巨量資料和網路商務的發展,雲端基礎的廣告服務在 SaaS 市場中變得越來越重要。雲端廣告也是網路行銷的關鍵組成部分,使企業能夠比傳統行銷選項產生更高的投資報酬率。

- 技術進步是推動產業發展的最重要因素。由於需求不斷成長,雲端廣告市場的主要參與企業正在專注於開發尖端技術解決方案以主導該領域。這些平台利用資料科學、人工智慧和機器學習等創新技術來改善客戶體驗和廣告參與度。

- 此外,與網際網路相關的經營模式進步,加上其商業性應用的不斷增加和全球網路用戶數量的迅速增加,不僅透過各種形式的數位廣告塑造了雲端廣告的演變,而且塑造了市場。著市場層級和參與企業加強。

- 亞馬遜等一些電子商務巨頭正在將雲端服務納入其經營模式。雲端服務基於雲端行銷,利用網路上的工具與客戶建立聯繫。雲端行銷利用網路上的工具與客戶聯繫,創造一致的購買體驗,在旅程的每一步為客戶提供服務,並為負責人提供內容、資料、流程和報告,幫助您追蹤每個客戶接觸點以實現高級即時。

- 此外,各個最終用戶部門對跨行銷平台的資料分析的需求不斷成長,推動了對統一平台來發布和改進消費者參與計畫的需求。預計這將為研究市場中的供應商創造大量機會,以增加客戶數量並推動市場擴張。

- 由於對數位廣告的需求不斷成長,市場最終將看到需求的增加。對雲端廣告的需求不斷成長,並且將收集更多的客戶資料。資料利用、資料安全問題和嚴格的雲端限制可能是商業擴張的主要障礙。

雲端廣告市場趨勢

SaaS(軟體即服務)領域預計將佔很大佔有率

- SaaS 是一項新興技術,可讓企業在線上存取和儲存資料。 SaaS 技術的關鍵特徵是靈活性、可擴展性、可靠性和敏捷性。軟體即服務 (SaaS) 可透過某些方式協助公司降低IT基礎設施成本。這是企業更頻繁地採用 SaaS 應用程式的關鍵驅動力。

- SaaS(軟體即服務)是傳統存取方式(服務供應商透過網際網路提供軟體或應用程式,最終用戶透過網路或供應商 API 訂閱和存取軟體)的替代方案。 SaaS 是指基於訂閱的模式,其中軟體託管在雲端並透過網路存取。

- 由於組織對單一解決方案來解決其業務問題的需求不斷成長,SaaS 行業正在不斷擴張。該公司正在採用結合了多個程式的 SaaS 平台軟體,包括供應鏈管理、電子商務、商業智慧和客戶關係管理 (CRM)。

- 隨著智慧型手機已成為人們生活中不可或缺的一部分,並且可以隨時隨地輕鬆存取訊息,企業擴大投資於行動 SaaS 和基於應用程式的解決方案。人們可以使用智慧型手機和基於應用程式的 SaaS 來同步、更新和管理文件。面向行動裝置的 SaaS 和基於應用程式的服務預計未來將變得更加流行。

- 基於 SaaS 的應用程式可透過網際網路訪問,並且必須與本地系統和其他雲端正確整合。 SaaS 的主要優勢包括無硬體成本、無初始設定成本、客戶只需為他們使用的內容付費、可擴展的使用、自動更新、跨裝置相容性和無處不在的存取。使用者不管理或控制雲端基礎設施,包括網路、伺服器、作業系統、儲存和單一應用程式功能。

- 隨著雲端基礎的服務日益普及,對 SaaS 解決方案的需求也不斷增加。一些尋求擴大客戶群的 B2B SaaS 供應商面臨潛在潛在客戶開發下降、客戶獲取成本高、客戶維繫率低以及客戶生命週期價值差等挑戰。

- 例如,2023 年 2 月,主要企業的SaaS 採購平台 Vendr 發布了 Explore,這是一個跨軟體產業的動態目錄,旨在幫助企業做出更快、更明智的採購決策。 Explore 為採購和財務團隊提供了關於由世界上最廣泛的 SaaS資料集提供支援的 19,000 多個專案的清晰資訊。 Explore 為採購和財務團隊提供了由世界上最廣泛的 SaaS資料集提供支援的 19,000 多個專案的清晰資訊。

- 在 SaaS 模型中,使用者資料和應用程式的控制較少。直接的 SaaS 應用程式也有獨特的安全問題。 SaaS 應用程式和服務通常與混合環境中的其他雲端或本地模型結合。企業通常需要將 SaaS 應用程式與位於資料中心和其他雲端平台中的多個不同應用程式和平台結合。

北美佔據主要市場佔有率

- 由於該地區最終用戶的雲端採用率較高,北美在全球雲端廣告市場佔據主導地位。市場上大多數的主要供應商也都位於美國。

- 政府機構正在重新定義其行業,以更好地為公民服務。為了加速雲端的採用,美國政府根據美國聯邦雲端運算策略實施了雲端優先計畫。該政策鼓勵服務管理、創新和採用最尖端科技。它還指出,機構的基本能力和使命優先於技術本身。

- 儘管存在後端筒倉系統,但政府也可以透過利用雲端從更大的業務靈活性中受益。早期的雲端採用者包括美國、空軍、海軍、司法部、美國和教育部。這些組織創造了這一趨勢,並為其他組織引領了潮流。

- 此外,由於加拿大和美國等已開發國家零售業迅速採用雲端基礎的解決方案,零售雲端市場在北美佔據主導地位。

- 美國電子商務產業目前由亞馬遜引領,預計該地區雲端解決方案的採用率將在預測期內加速。根據美國人口普查,2022 年電子商務銷售額預計為 10,341 億美元,較 2021 年成長 7.7%(0.4%)。 2021年至2022年,零售總額成長8.1%(0.9%)。 2022 年,總銷售額的 14.6% 透過電子商務完成。

- 該地區的所有電子商務公司都可以從雲端運算中受益匪淺。由於電子商務,整個「線上交易」業務正在改變。雲端運算在電子商務領域的優勢和使用正在迅速擴大。這種擴張是由公司快速、輕鬆地擴展業務的需求以及從任何地方儲存和存取資料的需求所推動的。

- 因此,該地區的企業正在轉向雲端進行資料儲存和分析,而且這種趨勢可能會持續下去。透過採用無伺服器架構和容器等新技術,企業可以進一步降低 IT 成本,同時獲得利用雲端資源的好處。

雲端廣告產業概況

市場上的領先參與企業對雲端前提具有較高的市場滲透率,並透過創新獲得更高的永續競爭優勢。所有剩餘的雲端廣告公司都在爭奪重要的市場佔有率,加劇了競爭對手之間的敵意。此外,在該市場營運的公司正在收購從事雲端廣告技術的公司,以增強其產品能力。

- 2022 年 9 月 - 業界領先的複雜通訊軟體供應商 Vochato 最近宣布與 Salesforce Marketing Cloud 進行新的整合。這種整合允許負責人使用 Salesforce 的行銷自動化工具 Journey Builder 向客戶發送簡訊。 Avocato Salesforce Marketing Cloud 整合實現了客戶生命週期的閉迴路,使您成為少數能夠在所有主要 Salesforce 雲端簡化 SMS 通訊的組織之一。此外,我們也提供適用於 Slack、Okta、Zapier 和 Microsoft Azure 的連接器。

- 2022 年 9 月 - 領先的行銷績效管理雲端解決方案 Plannuh 已被財務績效管理雲端軟體和行銷績效管理 SaaS 供應商的發明者 Planful Inc. 收購。 Planful 收購 Plannuh 可以實現行銷、財務和其他業務用戶之間的順利協作。這些功能為領先的財務長和行銷長提供了推動整個企業業務成長所需的資源。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 雲端服務採用趨勢不斷增強

- 更重視有針對性的行銷和競爭情報

- 市場問題

- 資料安全漏洞

第6章 市場細分

- 按類型

- 公共雲端

- 私有雲端

- 混合雲端

- 按服務

- IaaS(Infrastructure-as-a-Service)

- SaaS(Software-as-a-Service)

- PaaS(Platform-as-a-Service)

- 按最終用戶

- 零售

- 媒體娛樂

- 資訊科技和電訊

- BFSI

- 政府機構

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Adobe Inc.

- Google LLC(Alphabet Inc.)

- Sprinklr Inc.

- Oracle Corp.

- IBM Corp.

- Microsoft Corp.

- Salesforce.com Inc.

- Amazon Web Services Inc.

- InMobi Pte. Ltd

- SAP SE

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 55905

The Cloud Advertising Market is expected to register a CAGR of 16.5% during the forecast period.

Key Highlights

- Cloud-based advertising platforms enable customers to build, edit, and administer display advertising campaigns without being bound by a particular device or office chair. The primary drivers of the sector are the constantly increasing usage of smartphones, extensive internet connectivity, and expanding consumption of digital media. Nonetheless, these factors are anticipated to raise the number of internet users globally over the course of the forecast period and open up fresh potential prospects for the cloud advertising market.

- Cloud-based advertising services are becoming increasingly important in the SaaS market as big data and internet commerce evolve, allowing businesses to employ commercial cloud solutions to control prices in various ways. Also, because cloud advertising is a crucial component of online marketing, it helps companies generate higher ROI than traditional marketing options.

- Technological advancements are the most important elements driving the industry. Due to the increasing demand, the key players in the cloud advertising market focus on developing cutting-edge technology solutions to rule the sector. These platforms will improve customer experiences and engagement with advertisements by utilizing innovative technology like data science, AI, and machine learning.

- Moreover, Technological advancements concerning the internet, combined with its increasing commercial application and the rapid growth in the number of internet users worldwide, have not only shaped the evolution of cloud advertising through different forms of digital advertising but have also enhanced the advertising business models, along with the market levels and players.

- Some of the e-commerce giants, such as Amazon, have integrated cloud service into their business models, which are based on cloud marketing, utilizing the internet's tools to connect with customers. It helps create a consistent buyer experience, serves customers at each step of their journey, and tracks every customer touch point required for highly sophisticated real-time communication and coordination of marketers, content, data, processes, and reporting.

- Furthermore, the growing demand for data analytics across the marketing platform by various end-user sectors is increasing the need for a unified platform to publish and improve consumer engagement programs. This is anticipated to generate many opportunities for the vendors in the market under study to increase their clientele, propelling market expansion.

- The market will eventually experience increased demand due to the rising need for digital advertising. The need for cloud advertising is growing, leading to more customer data being collected. Effective data utilization, data security issues, and strict cloud restrictions may be significant barriers to commercial expansion.

Cloud Advertising Market Trends

Software-as-a -Service (SaaS) segment is Expected to Occupy Significant Share

- SaaS is an emerging new technology that allows businesses to access and store data online. Among the key attributes of SaaS technology are flexibility, scalability, reliability, and agility. Software as a service (SaaS) helps businesses with their IT infrastructure costs in specific ways. This is the main factor driving firms to embrace SaaS apps more frequently.

- Software-as-a-Service (SaaS) refers to an alternative way of accessing software, instead of traditional access methods (where the service provider delivers software and applications through the internet and the end-users subscribe to the software and access it via the web or vendor APIs). SaaS refers to a subscription-based model in which the software is hosted in the cloud and accessed through the internet.

- The SaaS industry is expanding due to rising demand from organizations for a single solution to resolve business issues. Businesses employ SaaS Platform software, which combines several programs, including supply chain management, e-commerce, business intelligence, and customer relationship management (CRM).

- Businesses are investing increasingly in mobile SaaS, and app-based solutions as smartphones become essential to people's lives, allowing for simple access to information whenever and wherever. People may synchronize, update, and manage documents using smartphones and app-based SaaS. SaaS for mobile devices and app-based services is predicted to become more prevalent.

- SaaS-based applications can be accessed through the internet and require proper integration with on-premise systems or other clouds. The significant benefits of SaaS include no hardware costs, no initial setup costs, a pay-for-what-the-customer use factor, scalable usage, automatic updates, cross-device compatibility, and accessibility from any location. The users neither manage nor control the cloud infrastructure, which includes networks, servers, operating systems, storage, and individual application capabilities.

- The rising popularity of cloud-based services drives the demand for SaaS solutions. Several B2B SaaS suppliers who want to expand their clientele faces challenges like poor lead generation, high customer acquisition expenses, low customer retention rates, and subpar customer lifetime value.

- For instance, in February 2023, The top SaaS purchase platform, Vendr, unveiled Explore, a dynamic catalog of the entire software industry designed to assist businesses in making quicker and more informed purchasing decisions. Explore gives procurement and finance teams a clear glimpse into over 19,000 items powered by the world's most extensive SaaS data set. This enables them to evaluate alternatives and sort and filter depending on essential aspects.

- In the SaaS model, users are not given much control over the data or the application. There are also specific security concerns with straight SaaS applications. SaaS applications and services are often combined with other cloud and on-premises models in hybrid environments. Organizations often need their SaaS applications to couple with multiple different applications and platforms in their data centers and other cloud platforms.

North America to Hold Significant Market Share

- North America is dominating the global cloud advertising market due to the high cloud adoption rate among regional end users. Most of the significant market vendors are also US-based.

- Government agencies are redefining their industries in order to provide better citizen services. In order to hasten the adoption of the cloud, the U.S. government implemented the CloudFirst policy, according to the U.S. Federal Cloud Computing Strategy. This policy encourages the administration of services, innovation, and the implementation of cutting-edge technologies. This also states that the agency's fundamental competencies and mission will take priority over the technology itself.

- Governments are also benefiting from more business flexibility because of cloud usage, despite their back-end silo systems. Early cloud adopters include the U.S. Army, Air Force, Navy, DOJ, USDA, Department of Education, and more. These organizations created the trend and led the way for others to follow.

- Furthermore, the Retail Cloud Market indicates that North America is dominant as a result of the quick adoption of cloud-based solutions in the retail industry in industrialized nations like Canada and the U.S. The increase in mobile and new technology investments is also anticipated to help the regional industry maintain its dominance in the ensuing years.

- The e-commerce sector in the United States is now driven by Amazon, which will accelerate the adoption rate of cloud solutions in the region over the projected period. According to the U.S. Census, e-commerce sales were anticipated at USD 1,034.1 billion in 2022, up 7.7% (0.4%) from 2021. From 2021 to 2022, total retail sales climbed by 8.1% (0.9%). 14.6 percent of all sales in 2022 were made through e-commerce.

- All e-commerce enterprises in the region can benefit significantly from cloud computing. The entire "online transaction" business is changing because of e-commerce. The benefits and use of cloud computing in the eCommerce sector are expanding rapidly. The need for organizations to scale their operations quickly and easily, as well as the requirement for them to be able to store and access data from any location, are fueling this expansion.

- As a result, Companies in the region increasingly use the cloud to store and analyze their data, and the trend seems to continue. Businesses can cut their I.T. expenses further while reaping the benefits of utilizing cloud resources by introducing new technologies like serverless architecture and containers.

Cloud Advertising Industry Overview

The prominent players across the market have high level of market penetration into the cloud premises, bearing higher sustainable competitive advantage through innovation. All the remaining cloud advertising companies are competing to capture considerable market share, leading to high competitive rivalry. The companies operating in the market are also acquiring companies working on Cloud Advertising technologies to strengthen their product capabilities.

- September 2022 - Vochato, the industry's top supplier of sophisticated messaging software, recently unveiled a new integration with Salesforce Marketing Cloud that will enable marketers to text customers using Salesforce's Journey Builder marketing automation tool. The Avochato Salesforce Marketing Cloud integration closes the client lifecycle loop, making it one of the few organizations that can streamline SMS communications across all major Salesforce Clouds. Additionally, the business offers Slack, Okta, Zapier, and Microsoft Azure connectors.

- September 2022 - Plannuh, a top-tier marketing performance management cloud solution, has been acquired by Planful Inc., the inventor of financial performance management cloud software and Marketing Performance Management SaaS Vendor. Planful now offers smooth cooperation between the marketing and finance departments as well as other business users due to the acquisition of Plannuh. These capabilities provide cutting-edge CFOs and CMOs with the resources they need to encourage more business growth across the enterprise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend for the Adoption of Cloud Services

- 5.1.2 Growing Emphasis on Targeted Marketing and Competitive Intelligence

- 5.2 Market Challenges

- 5.2.1 Vulnerability Toward Data Security

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By Service

- 6.2.1 Infrastructure as a Service (IaaS)

- 6.2.2 Software as a Service (SaaS)

- 6.2.3 Platform as a Service (PaaS)

- 6.3 By End User

- 6.3.1 Retail

- 6.3.2 Media and Entertainment

- 6.3.3 IT and Telecom

- 6.3.4 BFSI

- 6.3.5 Government

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adobe Inc.

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 Sprinklr Inc.

- 7.1.4 Oracle Corp.

- 7.1.5 IBM Corp.

- 7.1.6 Microsoft Corp.

- 7.1.7 Salesforce.com Inc.

- 7.1.8 Amazon Web Services Inc.

- 7.1.9 InMobi Pte. Ltd

- 7.1.10 SAP SE

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219