|

市場調查報告書

商品編碼

1629758

醯胺纖維:市場佔有率分析、產業趨勢、成長預測(2025-2030)Aramid Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

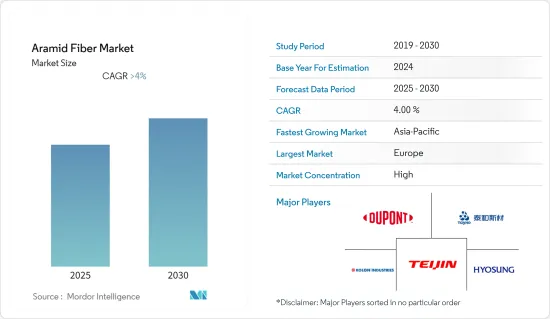

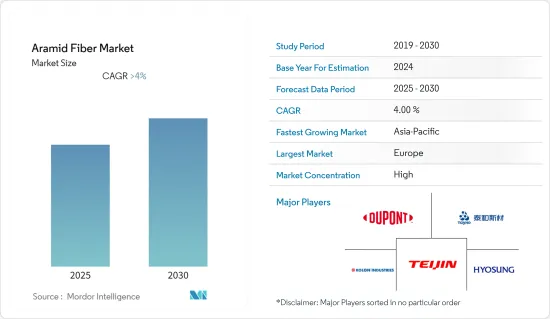

預計醯胺纖維市場在預測期內複合年成長率將超過 4%

主要亮點

- 由於工業部門需求不足,市場受到 COVID-19 的負面影響。疫情期間,汽車、航太、電子等終端用戶產業暫時停產,導致醯胺纖維產品的需求減少。然而,2021年生產活動錄得正成長,導致醯胺纖維需求復甦。預計市場在預測期內也將出現正成長。

- 短期內,許多國家國防支出的增加以及航太領域對醯胺纖維的需求增加預計將推動市場成長。

- 另一方面,研究預測,隨著玻璃纖維等更好的替代品的出現,市場成長將會放緩。

- 由於光纖行業的新應用和無人機市場的成長,預計該市場將在預測期內成長。

- 醯胺纖維市場以歐洲為主,其次是北美和亞太地區,消費量最高的是德國、英國、法國和義大利等國家。

>主要亮點

醯胺纖維市場趨勢

汽車產業需求增加

- 在汽車工業中,醯胺纖維用於製造增強輪胎、渦輪增壓器軟管、動力傳動系統部件、皮帶、煞車皮、墊圈、離合器、座椅織物、電子產品、座椅感測器、混合馬達材料等的材料。

- 此外,醯胺纖維具有高耐熱性,使其成為製造隔熱罩和引擎蓋下應用的理想選擇。

- 近年來,汽車變得越來越輕。為此,汽車製造商正在透過以基於醯胺纖維的複合材料替代金屬來設計更輕、更強且可回收的汽車。對輕型車輛的需求不斷成長正在推動醯胺纖維市場的發展。

- 汽車製造商正在從鋼和鋁轉向複合材料,因此必須透過高度自動化的生產週期來減輕車輛重量並實現成本效益。 BMW、賓士、麥克拉倫、雪佛蘭、蘭博基尼等大公司都在使用碳纖維和鈦合金等材料,讓他們的車更輕、更省油。

- 例如,BMW與德國碳纖維製造商西格里集團合作,投資約10億美元。除了寶馬外,德國汽車製造商奧迪也在其A8豪華轎車的空間框架後壁上使用碳纖維。這種碳纖維的重量比金屬纖維輕 50%。

- 醯胺纖維主要用於賽車領域。醯胺纖維正在成為賽車中玻璃纖維增強塑膠的主要替代品,因為它們在發生碰撞時不會破碎,也不會留下碎片。

- 全球汽車產業在新冠疫情期間出現下滑,但最近又出現成長動能。根據國際汽車工業協會 (OICA) 的數據,2021 年汽車產量約為 8,014 萬輛,高於 2020 年的 7,771 萬輛。

因此,上述因素可能會對未來幾年的市場產生重大影響。

歐洲地區主導市場

- 德國引領歐洲汽車市場,擁有 41 家組裝和引擎生產廠,佔歐洲汽車總產量的三分之一。德國是汽車工業最重要的製造地之一。製造商種類繁多,包括製造設備、材料和零件的製造商、製造引擎的製造商以及組裝整個系統的製造商。

- 根據OICA預測,2020年德國生產的轎車和輕型商用車(LCV)總數將達到約374萬輛,2021年將達331萬輛,降幅為13%。在德國,汽車產量近年來持續下降。造成這種情況的主要原因是高成本、生產轉移到其他國家(例如中國)以及新的WLTP排放法規,這使得許多企業難以滿足要求並註冊新產品。

- 德國是飛機工業的主要製造地之一,也是各行業製造商的所在地,包括設備製造商、材料和零件供應商、引擎製造商和系統整合商。據聯邦經濟事務和能源部稱,航太是德國的主要產業。它構成了一個強大行業的核心,預計在未來幾年將經歷高速成長。

- 德國航太工業在全國擁有2,300多家公司,其中最集中在德國北部。例如,巴伐利亞州、不萊梅州、巴登-符騰堡州和梅克倫堡-前波莫瑞州擁有許多生產飛機內裝零件和材料的工廠。

- 據國際航空運輸協會稱,由於國內客運量的增加,德國航空業預計將穩定成長。 2021年軍費開支為560億美元,比2020年減少1.4%。俄羅斯於 2022 年 2 月入侵烏克蘭後,政府表示計劃在未來幾年增加軍事開支。這可能會推動德國國防市場在未來幾年內成長。

- 2022年11月,德國斥資1127億美元購買F-35戰鬥機,以對其軍火庫進行現代化改造,增加了一架能夠攜帶核武的新型閃電II飛機。 F-35 是唯一可用於增強國家作戰能力的第五代戰鬥機。

- 所有上述因素預計將對未來幾年的市場成長產生重大影響。

醯胺纖維產業概況

醯胺纖維市場高度整合,前五名企業佔據了全球市場的重要佔有率。該市場的一些主要企業包括 Tai Jin Limited、杜邦公司、煙台泰和高新材料公司、Kolon Industries Inc. 和 Hyosung Corporation。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 各國國防支出增加

- 航太領域的需求不斷增加

- 抑制因素

- 具有更好性能的替代品的可用性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 依產品類型

- 對芳香聚醯胺

- 間芳香聚醯胺

- 按最終用戶產業

- 安全防護設備

- 航太

- 車

- 電子和通訊

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- China National Bluestar(Group)Co. Ltd.

- DuPont

- Hebei Silicon Valley Chemical Co. Ltd.

- Huvis

- HYOSUNG

- KERMEL

- Kolon Industries Inc.

- Shenma Industrial Co. Ltd.

- SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY

- Suzhou Zhaoda Specially Fiber Technical Co. Ltd.

- TEIJIN LIMITED

- TORAY INDUSTRIES INC.

- Wuxi Heshengyuan Carbon Fiber Technology Co. Ltd.

- X-FIPER New Material Co. Ltd.

- Xiamen Chao Yu Environmental Protection Technology Co. Ltd.

- Yantai Tayho Advanced Materials Co. Ltd.

第7章 市場機會及未來趨勢

- 光纖產業的新應用

- 無人機(UAV)市場的擴大

- 其他機會

簡介目錄

Product Code: 55974

The Aramid Fiber Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- >

- The market was negatively impacted by COVID-19, owing to a lack of demand from the industrial sector. During the pandemic scenario, end-user industries such as automotive, aerospace, and electronics halted their production temporarily, leading to a decrease in demand for products made up of aramid fibers. However, in 2021, the production activities registered positive growth, leading to a recovery in the demand for aramid fibers. During the time frame of the forecast, the market is also expected to grow in a positive way.

- Over the short term, the increase in defense spending by many countries and the growing demand for aramid fiber from the aerospace sector are expected to drive the market's growth.

- On the other hand, the study predicts that the growth of the market will be slowed by the availability of better alternatives, such as glass fibers.

- During the forecast period, the market is likely to grow because of new applications in the optical fiber industry and the growth of the market for unmanned aerial vehicles.

- Europe dominated the aramid fiber market, followed by North America and Asia-Pacific, with the largest consumption coming from countries such as Germany, the United Kingdom, France, and Italy.

Key Highlights

Aramid Fiber Market Trends

Increasing Demand from Automotive Industry

- In the automotive industry, aramid fibers are used to make materials that reinforce tires, turbocharger hoses, powertrain parts, belts, brake pads, gaskets, clutches, seat fabrics, electronics, seat sensors, and materials for hybrid motors.

- Furthermore, due to their high thermal resistance, aramid fibers are ideal for the production of heat shields and under-bonnet applications.

- In recent years, there has been a shift toward lightweight automobiles. Due to this, car manufacturers are designing lighter vehicles by replacing metal with composites based on aramid fiber to make them light, tough, and recyclable. The growing demand for lightweight vehicles is favoring the aramid fiber market.

- Automobile manufacturers are shifting from steel or aluminum to composite materials, which are essential to reduce vehicle weight and achieve the cost efficiency of highly automated production cycles. Some of the major companies, such as BMW, Mercedes-Benz, McLaren, Chevrolet, and Lamborghini, have started using materials such as carbon fiber and titanium alloys to make vehicles lightweight and fuel-efficient.

- For instance, BMW partnered with German carbon fiber producer SGL Group with an investment of approximately USD 1 billion. Apart from BMW, another German automobile manufacturer, Audi, uses carbon fiber to produce the rear wall of the space frame for its A8 luxury sedan. The carbon fiber is 50% lighter in weight than its metallic predecessor.

- Aramid fibers find major applications in automobile racing events. They are becoming a major alternative for fiberglass-reinforced plastic in racing automobiles, as they do not shatter and leave debris in the event of a crash.

- The global automotive industry witnessed a downfall in the COVID era but has gained momentum in more recent times. According to the International Organization of Motor Vehicle Manufacturers (OICA), around 80.14 million vehicles will be produced globally in 2021, compared to 77.71 million in 2020.

Because of this, the above factors are likely to have a big effect on the market in the next few years.

Europe Region to Dominate the Market

- Germany leads the European automotive market, with 41 assembly and engine production plants that contribute to one-third of the total automobile production in Europe. Germany is one of the most important places for the automotive industry to make things. It is home to a wide range of manufacturers, including those who make equipment, materials, and parts; engines; and those who put the whole system together.

- According to the OICA, the total number of cars and light commercial vehicles (LCV) produced in Germany amounted to about 3.74 million units in 2020 and reached 3.31 million units in 2021, with a decline rate of 13%. The country has been witnessing this decline in automotive production over the past few years. This is mostly because of the high costs, the move of production to other countries (like China), and the new WLTP emission control rules, which made it hard for many companies to register their new products because they couldn't meet the requirements.

- Germany, being one of the leading manufacturing bases for the aircraft industry, is home to manufacturers from different segments, such as equipment manufacturers, material and component suppliers, engine producers, and whole system integrators. Aerospace is a key industry in Germany, according to the Federal Ministry of Economic Affairs and Energy. It has a strong industrial core and is expected to grow at a high rate in the coming years.

- The German aerospace industry includes more than 2,300 firms located across the country, with northern Germany recording the highest concentration of firms. In Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern, for example, there are a lot of factories that make parts and materials for airplane interiors.

- According to the IATA, the aviation industry in Germany is expected to grow steadily due to the growth of passenger traffic in the country. The country spent USD 56.0 billion on its military in 2021, 1.4% less than in 2020. Due to the Russian invasion of Ukraine in February 2022, the government has said that it plans to spend more on the military in the coming years. This will help the German defense market grow in the coming years.

- In November 2022, Germany purchased F-35 fighter jets with an investment of USD 112.7 billion in order to modernize the military with the addition of new Lightning II aircraft capable of carrying nuclear weapons. The F-35 is the only fifth-generation fighter available to strengthen the country's operational capabilities.

- In the coming years, all of the above factors are expected to have a big effect on the growth of the market.

Aramid Fiber Industry Overview

The aramid fiber market is highly consolidated; the top five players dominate the global market with a significant share. Some of the key companies in the market include Tai Jin Limited, DuPont, Yantai Tayho Advanced Materials Co. Ltd., Kolon Industries Inc., and Hyosung Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Defense Spending by Many Countries

- 4.1.2 Growing Demand from the Aerospace Sector

- 4.2 Restraints

- 4.2.1 Available Alternatives with Better Properties

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product Type

- 5.1.1 Para-aramid

- 5.1.2 Meta-aramid

- 5.2 By End-user Industry

- 5.2.1 Safety and Protection Equipment

- 5.2.2 Aerospace

- 5.2.3 Automotive

- 5.2.4 Electronics and Telecommunication

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 China National Bluestar (Group) Co. Ltd.

- 6.4.2 DuPont

- 6.4.3 Hebei Silicon Valley Chemical Co. Ltd.

- 6.4.4 Huvis

- 6.4.5 HYOSUNG

- 6.4.6 KERMEL

- 6.4.7 Kolon Industries Inc.

- 6.4.8 Shenma Industrial Co. Ltd.

- 6.4.9 SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY

- 6.4.10 Suzhou Zhaoda Specially Fiber Technical Co. Ltd.

- 6.4.11 TEIJIN LIMITED

- 6.4.12 TORAY INDUSTRIES INC.

- 6.4.13 Wuxi Heshengyuan Carbon Fiber Technology Co. Ltd.

- 6.4.14 X-FIPER New Material Co. Ltd.

- 6.4.15 Xiamen Chao Yu Environmental Protection Technology Co. Ltd.

- 6.4.16 Yantai Tayho Advanced Materials Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications in the Optical Fiber Industry

- 7.2 Market Expansion of Unmanned Aerial Vehicles (UAV)

- 7.3 Other Opportunities

02-2729-4219

+886-2-2729-4219