|

市場調查報告書

商品編碼

1640474

中東和非洲醯胺纖維:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030 年)Middle East And Africa Aramid Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

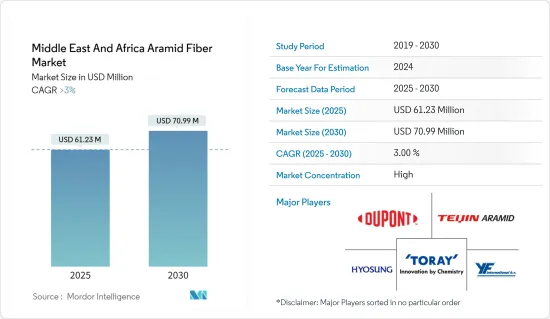

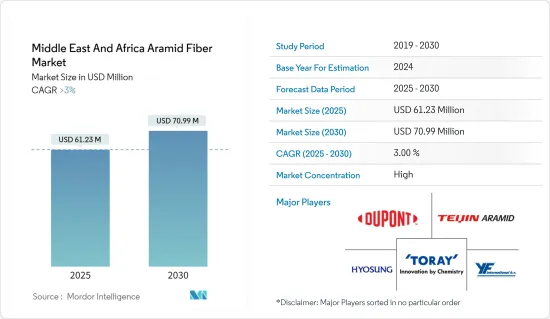

中東和非洲醯胺纖維市場規模預計在 2025 年為 6,123 萬美元,預計到 2030 年將達到 7,099 萬美元,預測期內(2025-2030 年)的複合年成長率將超過 3%。

由於沙烏地阿拉伯和南非政府實施了多項限制措施,COVID-19 疫情對 2020 年的市場產生了負面影響。不過,自從限制措施解除以來,醯胺纖維市場已經恢復良好。近年來,由於汽車和電子終端用戶行業的需求不斷增加,市場實現了顯著的成長率。

主要亮點

- 醯胺纖維作為鋼材的潛在替代品的使用量不斷增加,以及汽車產業對輕量材料的需求不斷增加,預計將推動市場的發展。

- 醯胺纖維的更好替代品的出現阻礙了市場的成長。

- 預計芳香聚醯胺材料製造技術的進步將在預測期內為市場創造機會。

- 由於汽車、航太和國防以及電氣和電子終端用戶產業對醯胺纖維的需求不斷成長,沙烏地阿拉伯預計將佔據市場主導地位。預計在預測期內,其複合年成長率也將達到最高。

中東和非洲醯胺纖維市場趨勢

航太和國防佔據市場主導地位

- 從熱氣球和滑翔機到戰鬥機、客機和太空梭,芳香聚醯胺被用於所有飛機和太空船的零件和結構應用中。醯胺纖維通常用於機翼組件、直升機葉輪、座椅螺旋槳以及儀器和內部組件的外殼。

- 在航太工業中,醯胺纖維在每一代新飛機的建造中都得到了越來越大的應用,以實現全天候運作並改善民航機的視覺系統。此外,溫度穩定性和耐用性等特性可能會在未來幾年進一步推動航太複合材料市場的成長。

- 在中東和北非地區,政府正在不斷探索擴大飛機生產規模的新機會。這促使私營製造商計劃在中東地區擴大生產設施。因此,一些公司宣布了在該地區建立新的飛機製造工廠的計劃。

- 例如,總部位於杜拜的投資公司Markab Capital於2023年2月與義大利Super Jet International公司簽署了一項協議,在阿拉伯聯合大公國組裝、安裝和生產民航機。該工廠計劃投資近 1.8 億美元,生產期間每年可生產 10 至 15 架民航機。

- 同樣,沙烏地阿拉伯的航空旅客數量也在增加。根據世界銀行集團預測,2022年沙烏地阿拉伯航空旅客人數預計將達3,180萬人次,而2021年為2,940萬人次,成長率為8%。因此,預計航空客運量的增加將推動該國的飛機市場,從而推動當前的研究市場。

- 因此,預計航太和國防工業的成長將推動該地區醯胺纖維市場的發展。

沙烏地阿拉伯主導市場

- 沙烏地阿拉伯是該地區醯胺纖維的重要市場之一。醯胺纖維用於各種終端用戶產業,包括航太和國防、汽車、電氣和電子以及體育用品。

- 沙烏地阿拉伯致力於將自己打造為中東新的汽車中心。沙烏地阿拉伯是汽車和汽車零件的進口大國,目前正尋求吸引OEM(目標商標產品製造商)在該國設立生產工廠,以發展國內汽車工業。

- 沙烏地阿拉伯的目標是透過在地化和增加投資機會來發展汽車產業的本地生產能力,以符合該國的國家戰略目標「2030願景」。沙烏地阿拉伯有意發展汽車產業,預計未來 10 年(至 2030 年)國內輕型汽車銷量將成長 2.2%。

- 工業和礦產資源部長兼沙烏地阿拉伯工業發展基金(SIDF)主席2022年5月宣布,沙烏地阿拉伯的目標是到2030年每年生產30萬輛以上汽車。此外,2022 年汽車銷量達到 483,240 輛,而 2021 年為 465,100 輛。

- 總體而言,預計預測期內汽車和電子等行業的成長將推動該國醯胺纖維市場的發展。

中東和非洲醯胺纖維產業概況

中東和非洲的醯胺纖維市場高度整合。市場的主要企業(不分先後順序)包括杜邦、曉星、帝人芳香聚醯胺、東麗工業公司和 YF International bv。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車產業對輕量材料的需求不斷增加

- 越來越多使用醯胺纖維作為鋼材的替代品

- 其他促進因素

- 限制因素

- 醯胺纖維的更好替代品的可用性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依產品類型

- 對芳香聚醯胺

- 間芳香聚醯胺

- 按最終用戶產業

- 航太和國防

- 車

- 電氣和電子

- 體育用品

- 其他終端用戶產業(石油和天然氣、通訊等)

- 按地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Advanced Materials Technology(Pty)Ltd

- Dupont

- Huvis Corp

- HYOSUNG

- SAERTEX Group

- Tango Engineering

- Teijin Aramid BV

- TORAY INDUSTRIES, INC.

- YF International bv

第7章 市場機會與未來趨勢

- 芳香聚醯胺製造技術的進步

- 其他機會

The Middle East And Africa Aramid Fiber Market size is estimated at USD 61.23 million in 2025, and is expected to reach USD 70.99 million by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The COVID-19 pandemic had negatively affected the market in 2020 owing to several restrictions imposed by the governments of Saudi Arabia and South Africa. However, the aramid fiber market recovered well since the restrictions were lifted. In the recent years, the market registered a significant growth rate due to rising demand from the automotive, electronics end-user industries.

Key Highlights

- The increase in the usage of aramid fibers as a potential substitute for steel materials and the increase in demand for lightweight materials in the automotive industry are expected to drive the market.

- The availability of better alternatives for aramid fibers is hindering market growth.

- The advancements in aramid materials manufacturing technology are expected to create opportunities for the market during the forecast period.

- The Saudi Arabia is expected to dominate the market due to the rising demand for aramid fibers from automotive, aerospace and defense, electrical, and electronics end-user industries. It is also expected to register the highest CAGR during the forecast period.

Middle East and Africa Aramid Fiber Market Trends

Aerospace and Defence Sector Dominated the Market

- Aramids are used for components and structural applications in all aircraft and spacecraft, ranging from hot air balloons and gliders to fighter planes, passenger airliners, and space shuttles. The aramid fibers are generally used in wing assemblies, helicopter rotor blades, seat propellers, and enclosures for instruments and internal parts.

- Every year, the aerospace industry uses a higher proportion of aramid fibers in constructing each new generation of aircraft due to the provision of an all-weather operation of commercial aircraft and enhanced vision systems. Moreover, characteristics such as temperature stability and durability will further fuel the growth of the aerospace composites market over the coming years.

- In the Middle East and Africa region, governments are always looking for new opportunities to scale the production of airplanes. This has led private manufacturers to plan their expansion for manufacturing facilities in the Middle East region. Thus several companies have announced the establishment of new aircraft manufacturing facilities in the region.

- For instance, in February 2023, Markab Capital, a Dubai-based investment firm, signed an agreement with Super Jet International, an Italian firm, to assemble, install, and produce civil aircraft in the UAE. The plan is to invest nearly USD 180 million, and the facility can manufacture 10 to 15 civil aircraft annually in the production phase.

- Similarly, air passenger traffic is increasing in Saudi Arabia. According to the World Bank Group, the air passenger traffic in the country registered at 31.8 million in 2022, compared to 29.4 million in 2021, at a growth rate of 8%. Thus the growth in air passenger traffic is excepted to drive the market for airplanes in the country, thereby driving the current studied market.

- Thus, the aerospace and defense industry growth is estimated to drive the region's aramid fibers market.

Saudi Arabia to Dominate the Market

- Saudi Arabia is one of the significant markets for Aramid Fibers in the region. Aramid fibers are used in various end-user industries such as aerospace and defense, Automotive, electric and electronics, and sporting goods.

- Saudi Arabia is focusing on establishing itself as the new automotive hub in the Middle East. Although Saudi Arabia is a large importer of vehicles and auto parts, it is now trying to attract original equipment manufacturers (OEMs) to open their production plants in the country to develop its domestic automotive industry.

- Saudi Arabia aims to localize its automotive sector and increase investment opportunities to help the industry develop local manufacturing capacity and align with the Kingdom's Vision 2030 goals to meet its national strategic goals. The kingdom is interested in developing the sector as domestic light vehicle sales are expected to increase by 2.2% over the next decade by 2030.

- The Minister of Industry and Mineral Resources and Chairman of the Saudi Industrial Development Fund (SIDF) announced in May 2022 that Saudi Arabia is targeting to manufacture more than 300,000 cars annually by 2030. Furthurmore, in 2022 the automotive vehicle sales in the country reached 483.24 thousand units compared to 465.10 thousand units in 2021.

- Overall, the growth of industries such as automotive and electronics will likely drive the market for aramid fibers in the country during the forecast period.

Middle East and Africa Aramid Fiber Industry Overview

The Middle East and Africa aramid fiber market is highly consolidated.Some of the key players in the market (not in any particular order) include Dupont, HYOSUNG, Teijin Aramid, TORAY INDUSTRIES, INC, and YF International bv.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 The Increase in Demand for Light Weight Materials in Automotive Industry

- 4.1.2 The Increase in Usage of Aramid Fibers as a Potential Substitute for Steel Materials

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 The Availability of Better Alternatives For Aramid Fibers

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Para-aramid

- 5.1.2 Meta-aramid

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Sporting Goods

- 5.2.5 Other End-user Industries (Oil & Gas, Telecommunication, etc.)

- 5.3 By Geography

- 5.3.1 Middle East and Africa

- 5.3.1.1 Saudi Arabia

- 5.3.1.2 South Africa

- 5.3.1.3 Nigeria

- 5.3.1.4 Qatar

- 5.3.1.5 Egypt

- 5.3.1.6 UAE

- 5.3.1.7 Rest of Middle East and Africa

- 5.3.1 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Advanced Materials Technology (Pty) Ltd

- 6.4.2 Dupont

- 6.4.3 Huvis Corp

- 6.4.4 HYOSUNG

- 6.4.5 SAERTEX Group

- 6.4.6 Tango Engineering

- 6.4.7 Teijin Aramid B.V.

- 6.4.8 TORAY INDUSTRIES, INC.

- 6.4.9 YF International bv

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Aramid Materials Manufacturing Technology

- 7.2 Other Opportunities