|

市場調查報告書

商品編碼

1629804

身臨其境型虛擬實境:市場佔有率分析、產業趨勢、成長預測(2025-2030)Immersive Virtual Reality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

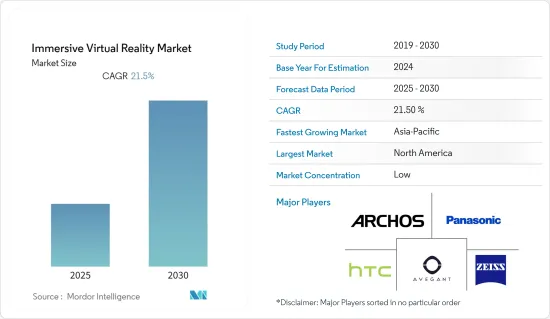

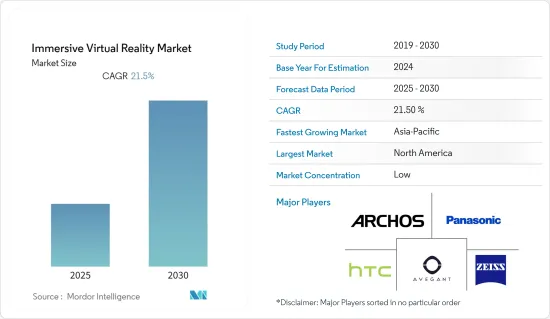

身臨其境型虛擬實境市場預計在預測期內複合年成長率為 21.5%

主要亮點

- 身臨其境型虛擬實境的引入有望成為教育產業的未來。虛擬實境讓您可以毫無風險地練習現實世界中發生的事件。 VR 有助於降低與培訓相關的成本和風險,因此該技術正在各個行業中採用。

- 雲端技術也為身臨其境型虛擬實境供應商帶來了擴充性。隨著 VR 中產生更多資料,雲端服務將在虛擬伺服器上儲存應用程式、資料和內存,並按需傳輸它們。預計這也將促進身臨其境型虛擬實境領域的創新,並提供無縫的服務更新周期。

- 此外,VR 還影響了醫療保健領域,因為它有助於為外科醫生創建虛擬環境。即時訓練涉及昂貴的工具、設備或危險的條件。此類技術的採用預計將拓寬整個醫療保健產業的視野,進而推動市場發展。

- 然而,虛擬實境設備的高成本阻礙了市場在預估期間內的成長。

- COVID-19 危機影響了多家身臨其境型虛擬實境科技公司。由於居家令,虛擬實境遊戲中心在疫情爆發的最初幾個月就關閉了。相反,消費者 VR 市場的採用率顯著增加。在停擺期間,大多數人投資了身臨其境型虛擬實境遊戲,目的是開發遊戲技術的新領域。

身臨其境型虛擬實境市場趨勢

頭戴式顯示器(HMD)預計將佔據很大佔有率

- 頭戴式顯示器是一種輔助顯示器,使用者可以輕鬆地將其固定在頭上,透過主熱視覺提供即時影像。 HMD 專為使用者需要免持情境察覺的情況而設計。專為虛擬實境設計的頭戴式顯示器通常比 AR 或 MR 耳機更大。 HMD 可以安裝在戶外頭盔上,也可以透過頭帶戴在頭上。

- 此外,虛擬實境的需求在改善使用者的遊戲體驗方面發揮著重要作用。因此,HMD 市場受到 PC 遊戲、主機和智慧型手機等應用程式對 VR HMD 的高需求所推動。推動市場發展的另一個因素是主要供應商提供可與更多產品配合使用的軟體。

- HMD不僅應用於虛擬實境遊戲,也應用於軍事、醫療、工程等多種場合。例如,智慧眼鏡和擴增實境技術公司 Vuzix 宣布與 L3 Harris Technologies 合作,為軍用頭戴式系統創建基於波導管的光學引擎。

- 身臨其境型技術已普及,360度影片已成為當前市場場景中的一股新興趨勢。 360度影片為用戶提供影片的全視角。觀看者還可以手動點擊影片並直接與串流的不同方面進行交互,而不僅僅是觀看。透過 360 度內容,觀眾可以透過戴上VR頭戴裝置並觀看 360 度影片的各個方向來獲得親身體驗。預計該市場研究將在預測期內呈指數級成長。

- 此外,娛樂產業目前正在充分利用身臨其境型虛擬實境頭戴裝置。隨著技術創新、研究和開發的不斷進行,它有潛力在未來幾年在娛樂業蓬勃發展。

- 例如,去年 2 月,SONY宣佈為其熱門遊戲機 PlayStation 5 推出一款新的虛擬實境 (VR) 耳機。該耳機包括帶有眼動追蹤的振動回饋和 110 度視野的有機發光二極體螢幕,解析度為 2000x2040 4K HDR,每眼影格速率為 90/120Hz。該耳機還配備了控制器,可為身臨其境型遊戲提供觸覺回饋。

北美佔主要佔有率

- 由於身臨其境型虛擬實境玩家和新興新興企業的存在,北美佔據了主要佔有率,為市場成長創造了巨大的機會。北美也是採用創新的先驅,這使其比其他地區更具優勢。

- 此外,身臨其境型虛擬實境技術也擴大應用於國防、軍事和執法環境。透過模擬真實的車輛、士兵和戰鬥環境,我們可以提供多種場景的訓練模擬。這些技術還可以提供即時資訊和情境察覺,提升軍人做出快速、明智決策的能力。

- 美國的軍費開支是全世界最高的。在去年3月發布的今年預算提案中,拜登政府要求國防支出為8,133億美元。對軍事裝備增強的投資正在推動該地區對身臨其境型虛擬實境的需求。

- 使用者可以使用虛擬實境來彌合教育工作者和學生之間的差距。使用虛擬實境的遠距學習系統將教育工作者和學生聚集在同一個房間,使他們能夠以數位方式表達自己。去年4月,為學校和教育機構提供擴增實境和虛擬實境(AR/VR)內容的VictoryXR宣佈在美國推出10個「Metaversities」。為了提供學生元宇宙中的學習選擇,多家教育機構正計劃部署數位雙胞胎校園。此外,每位學生還將收到一個 Quest 2 VR頭戴裝置,以便在課堂上使用。

身臨其境型虛擬實境產業概況

身臨其境型虛擬實境市場本質上具有適度的競爭性。此外,旨在提高身臨其境型虛擬環境的品質、效能和有效性的研發工作預計將在未來幾年推動市場需求並加劇主要供應商之間的競爭。主要供應商包括 EON Reality、Carl Zeiss AG、Archos 和SONY。最近的趨勢包括:

2022 年 10 月,微軟宣布與 Meta 合作,將該公司最受歡迎的生產力和協作應用程式引入新款 Quest Pro VR頭戴裝置。在佩戴 Quest 2 和 Quest Pro 耳機時,用戶可以在 Meta 的 VR「工作室」中存取 Windows 365 應用程式。您也可以在 VR 中加入 Microsoft Teams 會議。

2022 年 5 月,PrecisionOS 宣布與西門子 Healthineers 合作,提供身臨其境型虛擬實境 (VR) 培訓。此模組可協助外科醫生和技術人員練習使用西門子 Health Inears 的行動 3D C 臂 Cios Spin 進行術中品管和手術工作流程指導。多用戶P2P培訓課程允許外科醫生和技術人員共用他們對虛擬患者的手術技術知識。這使得協作變得更加容易。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 使用虛擬實境進行航太和國防領域的訓練和模擬

- HMD在遊戲娛樂領域的普及

- 市場限制因素

- 產品成本高

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按設備

- 手勢追蹤裝置

- 頭戴式顯示器

- 按最終用戶產業

- 娛樂與遊戲

- 航太/國防

- 衛生保健

- 教育

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭狀況

- 公司簡介

- Carl Zeiss AG

- Avegant Corporation

- HTC Corporation

- Archos

- Panasonic Corporation

- Magic Leap

- Sony Corporation

- Samsung Electronics Co., Ltd.

- Google LLC

- Microsoft Corporation

- Oculus(Facebook, Inc.)

- Eon Reality

- CyberGlove Systems

- Leap Motion(Ultrahaptics)

- Sixense Enterprises Inc.

第7章 市場機會及未來趨勢

第8章投資分析

The Immersive Virtual Reality Market is expected to register a CAGR of 21.5% during the forecast period.

Key Highlights

- The implementation of immersive virtual reality is expected to be the future of the education industry. Virtual reality enables the risk-free practice of events that occur in the real world. VR has been instrumental in reducing the cost and risks associated with training, and thus, it has led to the adoption of technology across different industries.

- Cloud technologies are also promising scalability to immersive VR vendors. As VR-generated data increases, cloud services will store apps, data, and memory on virtual servers and stream them on demand. This is also expected to drive innovation in immersive VR and service updates in an uninterrupted cycle.

- Moreover, VR has also influenced the healthcare sector because it helped create a virtual environment for the surgeon. Real-time training involves expensive tools and equipment or hazardous conditions. The adoption of such technology is expected to expand horizons for the healthcare industry as a whole, which in turn will boost the market.

- But virtual reality devices are more expensive, which is stopping the market from growing during the time frame that was predicted.

- The COVID-19 crisis impacted several immersive VR tech companies. VR gaming centers were closed due to stay-at-home orders during the initial months of the pandemic. On the contrary, the consumer VR market witnessed a significant increase in adoption. During the lockdown, most people invested in immersive VR gaming as they aimed to explore new frontiers in gaming technology.

Immersive Virtual Reality Market Trends

Head Mounted Displays is Expected to Have Significant Share

- A head-mounted display is a secondary display that can be easily worn on the head by the user to get live video from the primary thermal sight. HMDs are designed specifically for situations where the user requires hands-free situational awareness. Head-mounted displays designed for virtual reality are typically larger than their AR or MR headsets. HMD can be installed on an outdoor helmet or worn on the head with a head strap.

- Further, the demand for virtual reality plays a vital role in enhancing the user's gaming experience. Thus, the HMD market is driven by the high demand for VR HMDs in applications such as PC games, consoles, and smartphones. The market is also driven by the key vendors putting out more products and software that work together.

- HMDs are not only used in virtual reality gaming; they've also been utilized in military, medical, and engineering contexts, among various others. For example, Vuzix, a smart glasses and augmented reality technology company, announced a partnership with L3 Harris Technologies to make a waveguide-based optics engine for military head-mounted systems.

- Immersive technologies are becoming widely popular, and 360-degree videos are a raging emerging trend in the current market scenario. Three hundred sixty-degree videos give users a full panoramic view of the video. Viewers can further click manually through the video and directly interact with different aspects of the stream instead of just watching it. 360-degree content allows viewers to wear a VR headset and look around a 360-degree video in all directions to get a real-life experience. This market study is anticipated to expand exponentially over the forecast period.

- Moreover, the entertainment field is currently making the best possible use of immersive virtual reality's HMD. With increasing innovation, research, and development, it has the potential to thrive in the entertainment industry for many more years to come.

- For instance, in February last year, Sony unveiled its new virtual reality (VR) headset for the smash-hit game console PlayStation 5. The headset includes vibrating feedback with eye-tracking and a 110-degree field of view with a 4K HDR resolution of 2000x2040 per eye using an OLED screen with a frame rate of 90/120 Hz. The headset also includes controllers, which provide haptic feedback for immersive gaming.

North America Occupies Major Share

- North America occupies the major share due to the presence of immersive virtual reality players and budding start-ups, which creates a huge opportunity for the market to grow. It has also been a pioneer in adopting innovations, which gives North America an edge over other regions.

- Moreover, there is an increasing potential for immersive VR technology to be used in defense, military, and law enforcement contexts. It helps provide training simulations that can be used to prepare personnel for various scenarios by simulating actual vehicles, soldiers, and combat environments. These technologies can also provide information and situational awareness in real-time, enhancing the ability of personnel to make quick and informed decisions.

- The United States has the highest military expenditure in the world. In the budget proposal for the current fiscal year, as released in March last year, the Biden administration sought USD 813.3 billion for national defense. Such investments in enhancing military types of equipment are boosting the demand for immersive VR in the region.

- Users can use virtual reality to bridge the gap between educators and students. Distance learning systems that use virtual reality can bring educators and students together in the same room with digital representations of themselves. In April last year, VictoryXR, a provider of augmented and virtual reality (AR/VR) content for schools and educational institutions, announced ten "Metaversities" would be launching in the United States, with several educational institutions planning to roll out digital twin campuses in order to provide learning options for students in the metaverse. In addition, each student will receive a Quest 2 VR headset for use during their course.

Immersive Virtual Reality Industry Overview

The immersive virtual reality market is moderately competitive in nature. Furthermore, research and development initiatives aimed at improving immersive virtual environments' quality, performance, and effectiveness are projected to propel market demand in the years to come, increasing the competition among the key vendors. Some of the key vendors are EON Reality, Carl Zeiss AG, Archos, Sony Corporation, etc. Some recent developments are:

In October 2022, Microsoft announced its partnership with Meta to bring its most popular productivity and collaboration apps to the new Quest Pro VR headset. While wearing the Quest 2 and Quest Pro headsets, users will be able to access their Windows 365 apps within Meta's VR "workrooms." They'll also be able to participate in Microsoft Teams meetings in VR.

In May 2022, PrecisionOS announced its partnership with Siemens Healthineers to offer immersive virtual reality (VR) training. The module helps surgeons and technicians practice using Siemens Healthineers' mobile 3D C-arm Cios Spin for intraoperative quality control and surgical workflow guidance. Multi-user, peer-to-peer training sessions would let surgeons and technicians share their knowledge of surgical procedures on a virtual patient. This would make it easier for them to work together.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Use of Virtual Reality in Aerospace & Defense for Training and Simulation

- 4.3.2 Penetration of HMDs in Gaming and Entertainment Sector

- 4.4 Market Restraints

- 4.4.1 High Product Cost

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Device

- 5.1.1 Gesture Tracking Devices

- 5.1.2 Head Mounted Displays

- 5.2 By End-user Industry

- 5.2.1 Entertainment & Gaming

- 5.2.2 Aerospace & Defense

- 5.2.3 Healthcare

- 5.2.4 Education

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Carl Zeiss AG

- 6.1.2 Avegant Corporation

- 6.1.3 HTC Corporation

- 6.1.4 Archos

- 6.1.5 Panasonic Corporation

- 6.1.6 Magic Leap

- 6.1.7 Sony Corporation

- 6.1.8 Samsung Electronics Co., Ltd.

- 6.1.9 Google LLC

- 6.1.10 Microsoft Corporation

- 6.1.11 Oculus ( Facebook, Inc.)

- 6.1.12 Eon Reality

- 6.1.13 CyberGlove Systems

- 6.1.14 Leap Motion (Ultrahaptics)

- 6.1.15 Sixense Enterprises Inc.