|

市場調查報告書

商品編碼

1630280

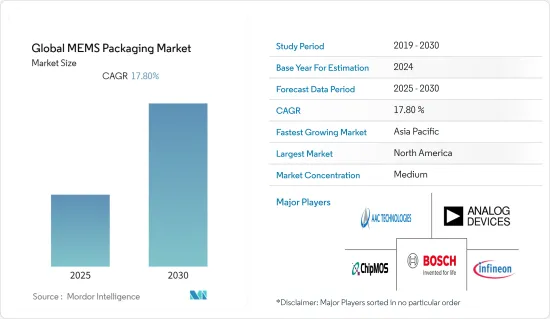

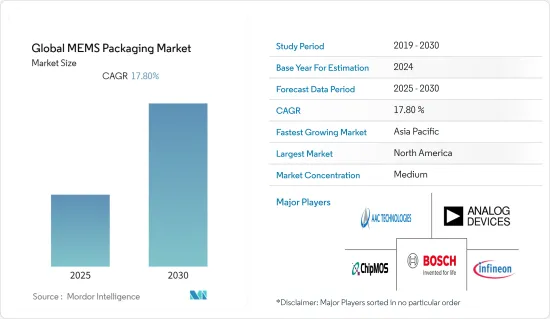

全球 MEMS 封裝 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030 年)Global MEMS Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

全球MEMS封裝市場預計在預測期間內複合年成長率為17.8%

主要亮點

- 隨著MEMS元件的應用範圍顯著擴大,MEMS封裝已從MEMS元件封裝發展到MEMS系統封裝。創新和高效的包裝技術變得越來越重要,新的包裝材料也是如此。

- CMOS 相容的 MEMS 製造流程(例如低溫晶圓鍵合技術和其他單晶片整合)的最新技術發展正在推動 MEMS 封裝市場的創新。另一個新興趨勢是將裸晶圓堆疊應用於低成本無鉛半導體封裝。這使得低成本的小引腳封裝能夠用於大量生產。

- MEMS 的日益普及也促進了嵌入式晶片封裝市場的新需求。儘管該技術並非該市場獨有,但由於高成本、產量比率低,已多元化至利基應用,但未來發展潛力巨大。藍牙和射頻模組的進步以及 WiFi-6 的興起預計將進一步加速對該技術的投資。

- MEMS 設備的日益普及也鼓勵 MEMS 封裝供應商進一步開發創新封裝技術,以提高這些設備的效率和運作效能。例如,主要企業T-SMART於2021年宣布,正致力於針對熱電堆感測器採用異構整合的新型MEMS封裝技術。

- 此外,根據 IEEE 的說法,由於 MEMS 裝置的多樣性以及需要同時暴露和保護許多裝置免受環境影響,MEMS 封裝比IC封裝更具挑戰性。此外,MEMS 封裝還存在一些挑戰,例如晶粒處理、晶粒附著、界面張力和排氣。這些新的 MEMS 封裝挑戰需要緊急的研究和開發工作。

- 隨著世界各地的科技公司在對抗 COVID-19 大流行的過程中加速創新,MEMS 在晶片行業的使用經歷了巨大的成長。對微型設備的需求正在推動電子技術的進步,從更快的熱感成像和就地檢驗到基於微流體的聚合酵素鏈鎖反應(PCR) 工具和 SARS-CoV-2 檢測技術。然而,疫情改變了人們對全球製造業供應鏈的看法,我們現在看到更多的在地化價值鏈和本土化。

MEMS封裝市場趨勢

智慧型手機和連網型設備的普及預計將推動需求

- 全球智慧型手機用戶數量正在顯著增加。消費者正在轉向智慧型手機來存取其提供的各種功能,包括連接、付款、遊戲、攝影、GPS 等。智慧型手機用戶的增加預計將對所研究市場的成長產生積極影響,因為智慧型手機硬體中整合了多個感測器以實現此類功能。

- 根據愛立信行動報告,印度智慧型手機用戶數量預計將從2020年的8.1億增加到2026年的12億。農村地區正在推動連網行動電話的銷售,隨著網路連線的日益普及,對智慧型手機的需求預計也會增加。

- 此外,MEMS 裝置也正在徹底改變消費性電子市場。透過結合所有智慧型手機和平板電腦中的 MEMS 麥克風和 CMOS 影像感測器,家用電子電器製造商正在將傳統設備轉變為可以透過智慧型手機輕鬆遠端控制的連接設備。

- 健康意識的提高,尤其是在 COVID-19 爆發之後,正在推動使用感測器追蹤用戶生物識別資料的連網型穿戴式裝置設備市場的發展。由於 MEMS 裝置在這些裝置中發揮重要作用,因此不斷成長的需求預計將對研究市場產生積極影響。例如,根據思科系統公司的預測,到 2022 年,全球穿戴式裝置的總數預計將達到 11 億台。

北美佔據主要市場佔有率

- 北美地區傳統上是全球電子產業的主要股東,因其研發能力強,擁有英特爾、戴爾等主要半導體和高科技公司,以及電子設備、物聯網和先進技術的存在。高滲透率。例如,該地區被認為是採用 ADAS 車輛和自動交通解決方案的先驅之一。德意志銀行預計,到2021年,美國ADAS汽車產量預計將成長至1,845萬輛。

- 汽車製造商擴大採用 MEMS 裝置來為其車輛添加獨特的功能。例如,基於MEMS的雷射雷達已經取代了自動駕駛/無人駕駛汽車、工業機器人、無人機等。 2021 年 9 月,通用汽車選擇 Cepton 供應基於 MEME 的雷射雷達,用於 2023 年的生產。通用汽車將使用 Cepton LiDAR 為自動緊急煞車和行人偵測等 ADAS 功能提供支持,以支援其即將推出的 Ultra Cruise 系統。

- 這些公司也專注於最新的感測器創新,並因其創新產品而受到認可。例如,2022 年 4 月,北美和全球半導體組裝和測試服務供應商Unisem 憑藉其 MEMS 腔體封裝在 MEMS 和感測器技術大會 (MSTC) 上贏得了封裝製程對決。

- 最近,在全球晶片短缺的情況下,當地半導體產業的提振正迫使北美地區政府增加對半導體及相關產業的投資。例如,加拿大政府承諾在2022年初投資2.4億美元,與當地研究人員和公司合作,進一步加強加拿大在半導體產業的地位。預計此類案例將為所研究市場的成長創造有利的市場情景。

- 此外,智慧型手機和家用電子電器產品也是推動MEMS裝置需求的關鍵產業之一,這反過來又對該地區的封裝服務需求產生正面影響。例如,根據消費者技術協會(CTA)的數據,預計2021年美國5G智慧型手機出貨量將達到1.06億支。

MEMS封裝產業概況

MEMS封裝市場競爭溫和。由於該行業是資本密集型行業,市場上領先的供應商因其多樣化的產品系列和產品開發而具有優勢。供應商的創新能力很大程度取決於其研發投入。此外,該行業的資本密集性質對新進入者構成了進入障礙。該市場的主要企業包括 ChipMos Technologies Inc.、AAC Technologies、Bosch Sensortec GmbH、Infineon Technologies AG 和 Analog Devices, Inc.。

- 2022 年 8 月 - 領先的 MEMS 技術解決方案供應商美新 (MEMSIC) 發布首款 MEMS 6 軸慣性感測器 (IMU) MIC6100HG。該產品整合了三軸加速器和3軸陀螺儀,可支援具有高靈敏度感測的體感互動系統,例如智慧遙控器和遊戲控制器。此外,MIC6100HG 6軸IMU感測器配備大容量FIFO,支援I2C/I3C/SPI通訊模式。 LGA封裝尺寸為2.5x3x0.83mm,資料輸出頻率為2,200Hz。

- 2022 年 2 月-義法半導體宣布推出第三代 MEMS 感測器。該公司表示,這款新型感測器旨在實現智慧工業、消費行動、醫療和零售領域性能和功能的下一次飛躍。新推出的 LPS22DF 和防水 LPS28DFW 氣壓感知器的工作電流為 1.7μA,絕對壓力精度為 0.5hPa,並且採用最小的封裝之一 (2.0 x 2.0 x 0.74mm)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 不斷成長的智慧汽車市場

- 智慧型手機普及率和連網型設備的增加

- 感測器在工業上的應用

- 市場限制因素

- 複雜的製造程序

第6章 市場細分

- 依感測器類型

- 慣性感測器

- 光學感測器

- 環境感測器

- 超音波感測器

- RF MEMS

- 其他

- 按最終用戶

- 車

- 行動電話

- 家用電子電器

- 醫療系統

- 工業的

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- ChipMos Technologies Inc.

- AAC Technologies Holdings Inc.

- Bosch Sensortec GmbH

- Infineon Technologies AG

- Analog Devices, Inc.

- Texas Instruments Incorporated.

- Taiwan Semiconductor Manufacturing Company Limited

- MEMSCAP SA

- Orbotech Ltd.

- TDK Corporation

- MEMSIC Semiconductor Co., Ltd

- STMicroelectronics

第8章投資分析

第9章 市場未來展望

The Global MEMS Packaging Market is expected to register a CAGR of 17.8% during the forecast period.

Key Highlights

- MEMS packaging has evolved from packaging MEMS devices to packaging MEMS systems as the application of MEMS devices has expanded significantly. Innovative and efficient packaging technology is becoming increasingly important, as are new packaging materials.

- The recent technological development of CMOS-compatible MEMS manufacturing processes for low-temperature wafer bonding and other single-chip integration are among the driving innovations in the MEMS packaging market. Another emerging trend is the application of bare wafer stacks for low-cost lead-free semiconductor packages. This enables a low-cost, small-pin package for high-volume production.

- The increasing adoption of MEMS is also contributing to new demand in the embedded die packaging market. The technology is not unique to the market, but its high cost and low yields have diversified it into niche applications, but the potential for future development is immense. Advancements in Bluetooth and RF modules and the rise of WiFi-6 will likely accelerate investment in this technology further.

- The growing adoption of MEMS devices is also encouraging the MEMS packaging vendors to develop innovative packaging techniques further to enhance these devices' efficiency and operational performances. For instance, in 2021, T-SMART, a leading semiconductor manufacturing company, announced that it is working towards a new MEMS packaging technology based on Heterogeneous Integration for the thermopile sensor.

- Furthermore, according to IEEE, MEMS packaging is more challenging than IC packaging due to the diversity of MEMS devices and the need for many devices to be in contact with and protected from the environment simultaneously. In addition, there are also challenges within MEMS packaging, such as die handling, die attachment, interfacial tension, and outgassing. These new MEMS packaging challenges require urgent R&D efforts.

- The usage of MEMS in the chip industry has witnessed immense growth as technology companies around the world accelerated innovation in the fight against the COVID-19 pandemic. The need for tiny devices drives advances in electronics, ranging from thermal imaging and faster point-of-care testing to microfluidics-based polymerase chain reaction (PCR) tools and techniques to detect SARS-CoV-2. However, the pandemic has changed the perception of the global supply chain in manufacturing, where more localized value chains and regionalization have come into the picture.

MEMS Packaging Market Trends

Growing Adoption of Smartphones and Connected Devices is Expected to Drive the Demand

- The number of smartphone users is rising enormously worldwide. Consumers are switching to smartphones to access various functionality they offer, including connectivity, payment, gaming, photography, and GPS. As multiple sensors are integrated into the smartphone's hardware to enable such functionality, the growing number of smartphone users is expected to positively impact the studied market growth.

- According to Ericsson Mobility Report, smartphone subscription in India is expected to grow from 810 million in 2020 to 1.2 billion in 2026. With rural areas driving the sale of internet-enabled phones, demand for smartphones is expected to increase as Internet connectivity spreads further.

- Moreover, MEMS devices are also revolutionizing the consumer electronics market. Combining the MEMS microphones and CMOS image sensors found in all smartphones and tablets, the consumer electronic device manufacturing companies are turning the traditional devices into connected ones that can easily be remotely controlled through smartphones.

- The increasing health consciousness, especially after the outbreak of COVID-19, drives the market for connected wearable devices that use sensors to track users' biological data. As MEMS devices play an integral role in these devices, the increasing demand is expected to impact the studied market positively. For instance, according to CISCO Systems, the total number of wearable devices is expected to reach 1.1 billion globally by 2022.

North America to Hold Significant Market Share

- The North American region traditionally has been a major shareholder of the global electronics industry owing to factors such as higher R&D capabilities, the presence of some of the biggest semiconductor and tech companies such as Intel, Dell, etc., along with higher penetration of electronic devices, IoT, and advanced automotive technologies. For instance, the region is considered one of the pioneers in adopting ADAS-enabled vehicles and autonomous transportation solutions. According to Deutsche Bank, ADAS vehicle production in the US is expected to grow to 18.45 million by 2021.

- Automotive companies are increasingly adopting MEMS devices to add unique functionality to their vehicles. For instance, MEMS-based LiDARs were an alternative to autonomous/driverless cars, industrial robots, UAVs, etc.; in September 2021, General Motors selected Cepton for the supply of MEME-based LiDAR for 2023 production. General Motor is expected to use the Cepton LiDAR to enhance ADAS capabilities for automatic emergency braking and pedestrian detection and to enable its upcoming Ultra Cruise system.

- Companies are also focused on innovating the latest sensors and are receiving recognition for their innovative products. For instance, in April 2022, Unisem, a North American and global semiconductor assembly and test services provider, won the Packaging Process Showdown at MEMS and SENSORS Technical Congress (MSTC) for its presentation, MEMS Cavity Packages.

- The recent push to the local semiconductor industry amid the global chip shortage has forced the governments in the North American region to increase their investment in the semiconductor and related industries. For instance, through a USD 240 million investment in early 2022, the government Canadian government has committed to work with local researchers and companies to strengthen Canada's position in the industryfurther. Such instances are expected to create a favorable market scenario for the growth of the studied market.

- Furthermore, the smartphone and consumer electronics also are among the leading industries driving the demand for MEMS devices which n turn is positively impacting the demand for packaging services in the region. For instance, according to the Consumer Technology Association (CTA), the 5G smartphone shipments in the United States was expected to reach 106 million in 2021.

MEMS Packaging Industry Overview

The MEMS packaging market is moderately competitive. As the industry is capital intensive, major vendors in the market are banking on diverse product portfolios and product development to gain an edge. The innovation capabilities of the vendors are highly dependent on their R&D investments. Additionally, the industry's capital-intensive nature poses an entry barrier to new entrants. Some key players operating in the market are ChipMos Technologies Inc., AAC Technologies, Bosch Sensortec GmbH, Infineon Technologies AG, and Analog Devices, Inc., among others.

- August 2022 - MEMSIC, a leading MEMS technology solution provider, releases the first MEMS 6-axis inertial sensor (IMU) MIC6100HG. The product integrates a 3-axis accelerometer and a 3-axis gyroscope, which can support motion-sensing interactive systems such as smart remote controls and game controllers with sensitive sensing. Additionally, the MIC6100HG 6-axis IMU sensor has a large FIFO and supports I2C/I3C/SPI communication mode. The LGA package size is 2.5x3x0.83mm, and the data output frequency is 2200Hz.

- February 2022 - STMicroelectronics introduced its third generation of MEMS sensors. According to the company, the new sensors are designed to enable the next leap in performance and features for smart industries, consumer mobiles, healthcare, and retail sectors. The newly launched LPS22DF and waterproof LPS28DFW barometric pressure sensors, which operate from 1.7µA and have absolute pressure accuracy of 0.5hPa and are packed in one of the smallest footprints (2.0 x 2.0 x 0.74mm).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Smart Automotive Market

- 5.1.2 Increasing Smart Phone Adoption Rate & Connected Devices

- 5.1.3 Sensor Usage in Industries

- 5.2 Market Restraints

- 5.2.1 Complex Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Sensor Type

- 6.1.1 Inertial Sensors

- 6.1.2 Optical Sensors

- 6.1.3 Environmental Sensors

- 6.1.4 Ultrasonic Sensors

- 6.1.5 RF MEMS

- 6.1.6 Others

- 6.2 By End User

- 6.2.1 Automotive

- 6.2.2 Mobile Phones

- 6.2.3 Consumer Electronics

- 6.2.4 Medical Systems

- 6.2.5 Industrial

- 6.2.6 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ChipMos Technologies Inc.

- 7.1.2 AAC Technologies Holdings Inc.

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Infineon Technologies AG

- 7.1.5 Analog Devices, Inc.

- 7.1.6 Texas Instruments Incorporated.

- 7.1.7 Taiwan Semiconductor Manufacturing Company Limited

- 7.1.8 MEMSCAP S.A.

- 7.1.9 Orbotech Ltd.

- 7.1.10 TDK Corporation

- 7.1.11 MEMSIC Semiconductor Co., Ltd

- 7.1.12 STMicroelectronics