|

市場調查報告書

商品編碼

1630329

轉換後的軟包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Converted Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

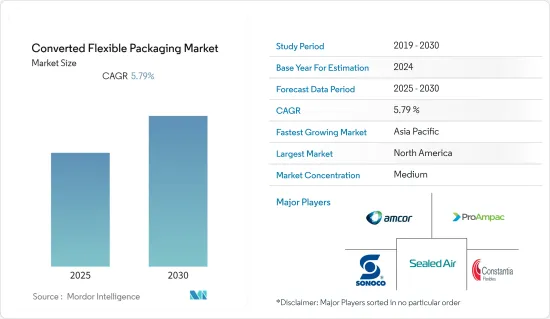

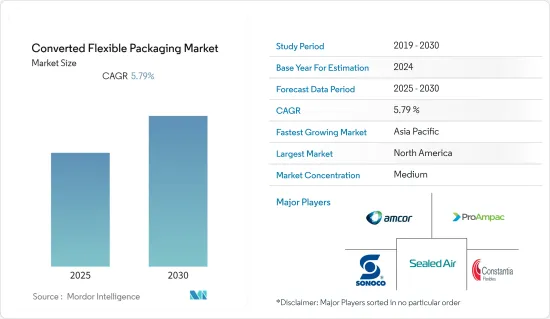

預計轉換軟包裝市場在預測期間內複合年成長率為 5.79%

主要亮點

- 對食品等便利加工產品的需求不斷成長,推動了軟包裝轉型的需求。環保包裝形式的趨勢也不斷成長。創新產品,例如允許冷凍食品和其他食品在包裝內蒸氣的自排氣薄膜,可能代表技術改進和開發的突破。

- 各國電子商務市場的擴張正在創造對紙板和紙板產品的特殊需求,特別是來自運輸和物流公司的需求。另外,包裝材料的環保性提高了包裝材料的受歡迎程度,帶動了市場。

- 此外,鋁箔是用於轉換軟包裝的熱門包裝材料之一。從食品、飲料到化妝品,許多產品都採用鋁包裝,以在整個保存期限內保持產品的完整性。根據歐洲鋁箔協會統計,2021年1月至3月期間向歐洲鋁箔軋延公司的交付達到24.5萬噸,比2020年(23.95萬噸)增加2.3%。

- 不斷變化的軟包裝產業面臨著材料成本上漲和對低脂休閒食品等產品需求增加的挑戰。這些產品需要創新的技術和材料組合來滿足包裝商的新鮮度需求。技術進步包括受控調氣包裝(CAP/MAP),可顯著延長農產品、肉類和其他產品的保存期限。

- 最近爆發的新冠肺炎 (COVID-19) 疫情給轉型的軟包裝製造商帶來了大量擔憂,但預計這種擔憂不會持續太久。疫情封鎖的影響包括供應鏈中斷、製造所用原料的缺乏、勞動力短缺、導致最終產品產量膨脹並超出預算的價格波動以及運輸問題。

改裝軟包裝市場的趨勢

食品和飲料將推動改裝軟包裝市場的成長

- 由於肉類消費量增加等因素,預計轉換後的軟包裝市場將在預測期內呈指數級成長。全球人口成長、收入成長和都市化等因素與肉品消費呈現強烈正相關。世界衛生組織 (WHO) 估計,到 2030 年,肉品消費量可能增加至 3.76 億噸。

- 水產品仍然是推動改裝軟包裝領域成長的主要食品市場之一。預計未來幾年,水產品將繼續主導肉類和家禽市場。消費者對獨立包裝部分和盒裝預調味蛋白質的持續需求將支持這一點。

- 公司專注於食品和飲料行業的永續產品創新。例如,2022 年 3 月,基於纖維的消費包裝解決方案製造商 Graphic Packaging International 擴大了其面向飲料行業的永續多件包裝的範圍。為了履行持續產品創新以支持循環經濟的承諾,該公司推出了 EnviroClip。它是一種軟性紙板,可替代標準塑膠環和飲料罐收縮膜。此類創新正在推動軟包裝市場的轉型。

- 同樣,2022 年 4 月,亞馬遜宣布推出由再生紙製成的新包裝。當顧客從亞馬遜生鮮或全食超市訂購冷藏或冷凍雜貨時,它們會採用方便的包裝交付,方便顧客在家中回收。過渡到完全可回收的隔熱包裝每年可減少約 735,000 磅塑膠薄膜、315 萬磅天然棉纖維和 1500 萬磅不可回收混合塑膠。

- 此外,烘焙點心消費量的增加繼續推動軟塑膠包裝解決方案的採用,以延長保存期限。大約 80% 的烘焙產品現在以軟包裝形式出售,隨著麵包店現在生產的麵包種類和產品種類越來越多,市場參與企業正在尋求滿足市場需求。

亞太地區佔市場主導地位

- 亞太地區是重要且成長最快的區域市場之一。考慮到中國、印度等新興市場的巨大潛力,轉型後的軟包裝產業近期發生了許多策略聯盟、資產置換、產能擴張、併購等事件。

- 例如,ePac 軟包裝公司於 2022 年 8 月宣布,將在未來 18 個月內加速發展並成為全球性公司。 E-Pac 將在亞太地區、歐洲以及中東和非洲其他地區建立 11 個新的銷售和製造地,從而將 E-Pac 的全球足跡擴大到 36 個地點。

- 水產品是推動軟包裝市場成長的因素之一。據聯合國糧食及農業組織稱,到2030年,將額外需要4,000萬噸水產品來滿足日益成長的需求,增幅接近30%。隨著中國加工、分銷和低溫運輸系統的完善,冷凍和加工水產品的消費預計將穩定成長。此外,高階超級市場的日益普及以及消費者對包括水產品在內的更多樣化和營養豐富的膳食的渴望可能會導致冷凍和加工水產品的銷售增加。

- 近年來,由於包裝食品消費的增加、意識的提高以及對優質產品的需求不斷成長,印度的包裝持續成長。消費者對包裝食品,特別是包裝食品宅配的意識正在增強。 2021 年,印度食品安全與標準局 (FSSAI) 宣布了新的包裝法規,以取代 2011 年的法規。新法規包括60mg/kg或10mg/dm2的遷移限值以及塑膠包裝材料中某些污染物的遷移限值。

- 此外,印刷包裝和日益專業化的肉類薄膜包裝的機會預計將支持該地區的成長。由於其成本效益、多功能性、降級能力和優異的阻隔性能,聚乙烯預計仍將是亞太地區使用最廣泛的薄膜。

軟包裝產業概況

改裝後的軟包裝市場競爭適度且集中,參與企業眾多。就市場佔有率而言,其中一些主要參與企業目前佔據市場主導地位。由於市場內外的建設性力量,市場正在經歷加速成長。由於策略的改進,某些細分市場預計將獲得絕對的市場主導地位。市場吸收成本可以輕鬆處理,為市場擴張創造空間。

- 2022 年 5 月 - ProAmpac 宣布收購專門食品 Packaging,這是一家為快餐和酒店行業生產紙張、薄膜和鋁箔特種包裝產品的家族製造商。隨著 Specialty Packaging 的互補產品系列和製造能力的增加,Proanpack 將擴大其對食品服務客戶的影響力,並擴大其在美國西南部的足跡。

- 2021 年 8 月 - Amcor 宣布建設計畫兩個最先進的研發中心。在比利時和中國建設新設施。我們將從 2022 年中期開始迎接客戶,並在未來兩年內全面擴張。預計總投資約3500萬美元。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 利用市場促進因素和市場限制因素

- 市場促進因素

- 對便捷包裝的需求不斷成長

- 長期儲存需求和生活方式的改變

- 市場限制因素

- 對環境和回收的擔憂

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 按材質

- 塑膠薄膜

- 紙

- 鋁箔

- 其他

- 按用途

- 零售

- 飲食

- 藥品

- 非食品

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭狀況

- 公司簡介

- ProAmpac

- Amcor Plc

- Sealed Air Corporation

- Sonoco Products Company

- Constantia Flexibles Group GmbH

- Graphics Packaging Holding Company

- Bischof+Klein SE & Co. KG

- Honeywell International Incorporated

- Oracle Packaging Inc.(Tekni-Plex Inc.)

- Transcontinental Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Converted Flexible Packaging Market is expected to register a CAGR of 5.79% during the forecast period.

Key Highlights

- The increasing demand for convenience-oriented processed products such as food is driving the need to transform flexible packaging, as they typically use high-barrier, high-grade packaging materials for longer shelf life. The industry is also noticing an increasing trend towards environmentally friendly formats. Innovative products such as auto-venting films that allow frozen and other foods to be steamed inside the package could represent a breakthrough in technology improvement and development.

- The growing e-commerce market in various countries creates special demand for cardboard and corrugated products, especially from transportation and logistics companies. In addition, the environmental friendliness of packaging materials has made them more popular and is driving the market.

- Further, aluminum foil is one of the popular packaging materials for converted flexible packaging. Many products, from food and beverages to cosmetics, are packaged in aluminum to maintain product integrity throughout their shelf life. According to European Aluminum Foil Association, the first three months of 2021 saw deliveries from European foil rollers reach 245,000 tonnes, up by 2.3% compared to 2020 (239,500 tonnes), led by striving performance in overseas markets, where the growth of over 10% was achieved.

- The transformed flexible packaging industry is being challenged by rising material costs and increased demand for products such as low-fat snack foods. These products require innovative technology and material combinations to meet packers' freshness needs. Technological advances include controlled and modified atmosphere (CAP/MAP) packages, resulting in much longer shelf life for produce, meat, and other products.

- The recent outbreak of COVID-19 has left converted flexible packaging manufacturers in a deluge of concerns expected to be short-lived. The pandemic lockdown impacts include supply chain disruptions, unavailability of raw materials used in manufacturing, labor shortages, price volatility that can bloat end product production and exceed budgets, and shipping issues. etc. is included.

Converted Flexible Packaging Market Trends

Food & Beverage to Drive Growth in the Converted Flexible Packaging Market

- The converted flexible packaging market is anticipated to rise exponentially during the forecast period owing to factors such as increased consumption of meat products. Factors such as global population growth, income growth, and urbanization are strongly and positively associated with meat product consumption. The World Health Organization (WHO) evaluates that meat consumption could rise to 376 million tonnes by 2030.

- Seafood will continue to be one of the leading food markets driving growth in the converted flexible packaging sector. Seafood will continue to lead the market against meat and poultry over the coming years. It will be supported by ongoing consumer demand for individually wrapped portions and case-ready and pre-seasoned proteins.

- Companies are focused on innovating, sustainable products for the food and beverage industry. For instance, in March 2022, Graphic Packaging International, a textile-based consumer packaging solutions manufacturer, expanded its range of sustainable multi-pack packaging for the beverage industry. In line with its commitment to continuous product innovation to support a more circular economy, the company has launched its EnviroClip. It is a soft material paperboard alternative to the standard plastic ring and shrinks film for beverage cans. Such innovations drive the market for converted flexible packaging.

- Similarly, in April 2022, Amazon unveiled new packaging that uses recycled paper. Whether customers order refrigerated or frozen groceries from Amazon Fresh and Whole Foods Market, they are delivered segregated in packages that are easy and convenient for customers to recycle at home. Transitioning to fully recyclable insulation packaging reduces material waste, replacing approximately 735,000 pounds of plastic film, 3.15 million pounds of natural cotton fiber, and 15 million pounds of non-recyclable mixed plastics yearly.

- Moreover, the rising consumption of baked goods continues to drive the adoption of flexible plastic packaging solutions to extend shelf life. With around 80% of bakery products sold in converted flexible packaging and bakeries now producing a wider variety of bread and more items, market participants are developing advanced solutions to meet market demand.

Asia-Pacific Holds a Dominant Position in the Market

- The Asia Pacific is one of the important and fastest growing regional markets. Given the great potential in developing markets such as China and India, the transformed converted flexible packaging industry has recently seen several strategic partnerships, asset exchanges, capacity expansions, mergers, and acquisitions.

- For instance, in August 2022, ePac Flexible Packaging announced that it would accelerate its growth over the next 18 months and transition into a global company. Eleven new sales and manufacturing locations will be established in Asia Pacific, Europe, and other regions, expanding ePac's global footprint to 36 locations.

- Seafood is one of the main drivers of growth in the converted flexible packaging market. According to the Food and Agriculture Organization (FAO), an additional 40 million tonnes of seafood will be needed by 2030 to meet rising demand or a nearly 30% increase. As China's processing, distribution, and cold chain systems improve, frozen and processed seafood consumption is expected to grow steadily. Additionally, the growing popularity of high-end supermarkets and consumer desire for a more varied and nutritious diet, including seafood, is seen as an increase in frozen and processed fish sales.

- In recent years, India has seen sustained growth in packaging owing to rising consumption of packaged food, awareness, and demand for quality products. Consumer awareness of packaged food, especially packaged food delivery, is increasing. In 2021, the Food Safety and Standards Authority of India (FSSAI) announced new packaging regulations to replace the 2011 regulations. The new rules include migration limits of 60 mg/kg or 10 mg/dm2 and migration limits for certain contaminants in plastic packaging materials.

- In addition, growth in the region is expected to be supported by opportunities for printed packaging and increasingly specialized film packaging for meat products. Polyethylene is expected to continue to be the most widely used film in Asia-Pacific due to its cost-effectiveness, versatility, downgrade capability, and excellent barrier properties.

Converted Flexible Packaging Industry Overview

The Converted Flexible Packaging Market is moderately competitive and concentrated and consists of some influential players. Regarding market share, some of these major players currently dominate the market. The market is showing an increase in growth rate due to constructive forces from internal and external market forces. Certain areas of the market are expected to gain absolute dominance in the market due to improved strategies. Market-absorbed costs are easily handled, creating room for market expansion.

- May 2022 - ProAmpac announced the acquisition of Specialty Packaging, Inc., a family-owned manufacturer of specialty packaging products in paper, film, and foil for the fast food and hospitality industries. The addition of Specialty Packaging's complementary product portfolio and manufacturing capabilities will extend ProAmpac's reach to food service customers and expand its footprint in the Southwest United States.

- August 2021 - Amcor has announced plans to construct two new state-of-the-art innovation centers. The new facilities in Belgium, and China. The company will welcome customers from mid-2022 and fully extend over the next two years. The total investment is expected to be approximately USD 35 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Augmented Demand for Convenient Packaging

- 4.3.2 Need for Longer Shelf Life and Changing Lifestyles

- 4.4 Market Restraints

- 4.4.1 Concerns about the Environment and Recycling

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Covid-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic Film

- 5.1.2 Paper

- 5.1.3 Aluminum Foil

- 5.1.4 Other Materials

- 5.2 By Application

- 5.2.1 Retail

- 5.2.2 Food & Beverage

- 5.2.3 Pharmaceutical

- 5.2.4 Non-Food

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ProAmpac

- 6.1.2 Amcor Plc

- 6.1.3 Sealed Air Corporation

- 6.1.4 Sonoco Products Company

- 6.1.5 Constantia Flexibles Group GmbH

- 6.1.6 Graphics Packaging Holding Company

- 6.1.7 Bischof + Klein SE & Co. KG

- 6.1.8 Honeywell International Incorporated

- 6.1.9 Oracle Packaging Inc. (Tekni-Plex Inc.)

- 6.1.10 Transcontinental Inc.