|

市場調查報告書

商品編碼

1630367

隱私管理軟體 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Privacy Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

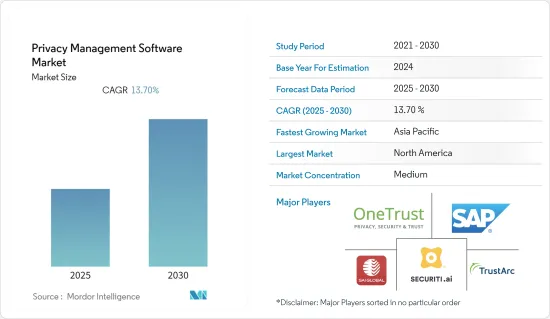

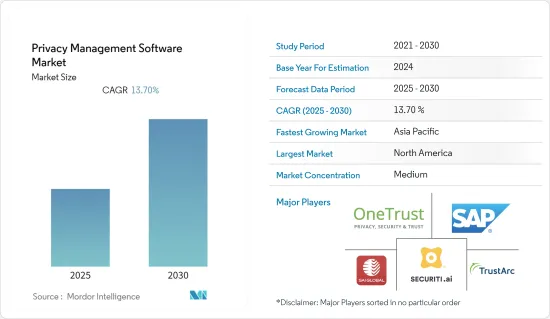

預計隱私管理軟體市場在預測期內的複合年成長率將達到 13.7%。

組織面臨著保護業務產生的資料的艱鉅挑戰。更多的參與和舉措,加上不斷增加的隱私法規和各種資料保護法律,正在推動隱私管理軟體市場的採用。

《加州消費者保護法》(CCPA) 和歐盟 (EU) 一般資料保護規範 (GDPR) 強調了資料保護的重要性以及未能這樣做的組織的後果。此外,資料保護對於管理資訊風險至關重要,從美國金融服務業現代化法(GLBA) 下的金融帳戶資料到健康保險互通性和課責法案 (HIPAA) 下的健康資料,並且必須管理常見風險的合規竊盜。

主要亮點

- 如今,組織面臨著透過多種方式保護敏感資訊和個人資訊的風險。因此,我們需要維護準確的個人資料清單,並在其傳輸和處理方式上表現出勤奮態度。倡導和意識的提高給公司帶來了越來越大的壓力,要求他們為客戶提供對所使用資料的深入了解。因此,隱私管理軟體的採用正在增加。

- BYOD(自帶設備)的使用不斷增加也是推動所研究市場成長的關鍵因素之一。此外,政府法規和資料保護預計將促進市場成長。

- 市場上的主要企業正在與其他公司合作,擴大其隱私管理解決方案組合。例如,去年 10 月,微軟宣布與 Onetrust、Securiti.ai 和 WireWheel 合作,為 Microsoft 365 環境之外儲存的個人資料開發主題權限管理功能,使用戶能夠合理地遵守我們提出的主題特定請求。相應的反應。

- 此外,由於COVID-19的傳播,大多數公司都採用了「在家工作」模式。儘管情況有所改善,但危機為新的混合工作模式打開了大門。

隱私管理軟體市場趨勢

越來越需要遵守隱私要求

- 據美國衛生與公眾服務部 (HHS) 稱,因醫療資料外洩而導致的網路犯罪正在上升。在去年報告的 713 起資料外洩事件中,總合526 起被歸類為「駭客」或「IT 事件」。這些事件佔所有記錄的 94%,去年有 4,310 萬筆記錄被洩露。根據 HIPAA 的數據,去年每天都會通報超過 500 起健康資料外洩事件,平均有 1.95 起健康資料外洩事件。

- 網路犯罪的存在可以追溯到很多年前。多年來,這種威脅已經演變成個人、組織和整個社會的嚴重問題。結果,資料保護條例也演變成更嚴格的法律。據估計,這將加速組織對隱私管理軟體的採用。

- 針對此類案例,新的法規正在實施和製定。每年,英國數位、文化、媒體和體育部 (DCMS) 都會發布一份有關網路安全漏洞的報告,提供有關最常見網路安全漏洞類型的官方統計數據。

- 調查顯示,約 45% 的公司和 65% 的慈善機構實施了“自帶設備”,員工使用筆記型電腦等個人設備進行業務。這些設備提高了工作靈活性的同時,也增加了對資料保護和隱私管理解決方案的需求。

北美佔最大市場佔有率

北美地區是世界各地主要組織的主要樞紐。零售擴張和物聯網成長正在推動該地區對智慧設備和行動設備的需求。因此,企業必須考慮來自法律、宣傳和資料外洩意識的日益增加的壓力,並遵守資料隱私法規。

- 在公共產業產業,美國政府已強制採用 NERC CIP(北美電力可靠性公司關鍵基礎設施保護)第 5 版作為網路安全標準。醫療保健行業遵守 HIPPA 有關資料保護的要求。這包括採用隱私管理軟體。

- 值得注意的是,美國的網路威脅呈上升趨勢。根據身分盜竊資源中心 (ITRC) 的數據,過去幾年,美國的平均違規數量略有增加。根據ITRC最近的估計,美國面臨的平均資料外洩事件從2013年的614起增加到去年的11,862起。此外,今年上半年,超過 5,300 萬人受到資料外洩的影響,包括外洩、外洩和揭露。

隱私管理軟體產業概況

許多日本和國外的參與企業已經進入隱私管理軟體市場,使其成為一個競爭異常激烈的市場。市場集中度中等,近期將趨於分散。市場主要企業採取的關鍵策略是產品創新、併購、收購和夥伴關係。市場上的一些主要企業包括 OneTrust、TrustArc、Securiti、SAI Global 和 SAP SE。

2022 年 5 月,OneTrust 宣布推出其信任智慧平台,建立了一種新的技術類別,致力於解決圍繞信任和透明度的關鍵業務挑戰。信任智慧提供跨所有信任域的可見性、人工智慧和監管智慧的行動以及自動化,以透過設計反射性地實現信任。

2022 年 1 月,OneTrust 宣布與微軟智慧安全協會 (MISA) 建立合作關係。 MISA 是一個由軟體供應商和資安管理服務提供者組成的社區,它們結合了他們的解決方案來滿足不斷成長的隱私和安全環境的需求。透過此次夥伴關係,OneTrust 將協助 Microsoft 365 客戶在所有 Microsoft 365 系統中自動執行資料主體存取要求 (DSAR)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 隱私管理核心要求與能力

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間敵對關係的強度

- 替代品的威脅

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 不斷增加的隱私法規和多樣化的隱私法

- 越來越需要遵守隱私要求

- 市場問題

第6章 市場細分

- 依部署類型

- 本地

- 按需(雲端/SaaS)

- 按組織規模

- 小型企業

- 主要企業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 供應商排名分析

- 公司簡介

- OneTrust LLC

- TrustArc Inc.

- Securiti Inc.

- SAI Global Pty Ltd.

- SAP SE

- Syrenis Ltd.

- Crownpeak Technology Inc.

- Exterro Inc.

- WireWheel Inc.

- BigID Inc.

- Smart Global Governance

- Privacy Company

- Nymity

- Collibra

第8章投資分析

第9章市場的未來

The Privacy Management Software Market is expected to register a CAGR of 13.7% during the forecast period.

Organizations have been struggling with the daunting task of protecting the data from their operations. The greater involvement and initiatives, coupled with an increase in the number of privacy rules and various laws for data protection, are driving the adoption of the privacy management software market.

The California Consumer Protection Act (CCPA) and the General Data Protection Regulation (GDPR) by the European Union have highlighted the importance of protecting data and the consequences of failing to do so for organizations. Furthermore, data protection is critical in managing information risk, from financial account data for the Gramm-Leach-Bliley Act (GLBA) to healthcare data for the Health Insurance Portability and Accountability Act (HIPAA) and managing compliance for the general risks that information thieves pose to everyone.

Key Highlights

- Organizations these days are subjected to protecting sensitive and private information in many ways. Hence, they are mandated to demonstrate diligence in maintaining accurate inventories of personal data and how it is transmitted and handled. The growing advocacy and awareness have resulted in more pressure on the companies to provide the customer with insight into the data being utilized. This has resulted in increased adoption of privacy management software.

- The rising use of "bring your own device" (BYOD) is one of the significant aspects fueling the growth of the studied market. Moreover, government regulations and data protection would increase market growth.

- Major players in the market are partnering with other firms to expand the portfolio of privacy management solutions. For instance, in October last year, Microsoft announced its partnership with Onetrust, Securiti.ai, and WireWheel to develop subject rights management abilities for personal data stored outside of the Microsoft 365 environment, allowing users to have streamlined responses to subject requests.

- Furthermore, most companies adopted the "work from home" model due to the widespread outbreak of COVID-19. Although the situation improved, this crisis opened the door for the new hybrid work model.

Privacy Management Software Market Trends

Rising Need to Achieve Compliance with Privacy Requirements

- According to the HHS, there is an exponential rise in cybercrimes resulting from healthcare data breaches. A total of 526 of the 713 breaches reported in the previous year were categorized as "hacking" or "IT incidents." These incidents accounted for 94 percent of the total records breached, with 43.1 million records last year. Also, HIPAA says that every day last year, 500 or more records and an average of 1.95 violations of health data were reported.

- The existence of cybercrime can be traced back many years. Over the years, the threat has evolved into a severe problem for individuals, organizations, and society as a whole. Therefore, data protection regulations also developed into more stringent laws. According to estimates, this will accelerate organizations' adoption of privacy management software.

- Following such instances, new regulations came into effect and have been formulated. The Department for Digital, Culture, Media, and Sport (DCMS) in the United Kingdom releases a report on a cybersecurity breaches survey each year with the official statistics regarding the most prevalent type of cybersecurity breaches.

- The survey indicated that about 45% of businesses and 65% of charities have implemented "Bring Your Own Device," where staff use their own private devices, such as laptops, for work purposes. While these devices add flexibility at work, they also increase the need for data protection and privacy management solutions.

North America to Hold the Largest Market Share

The North American region is a primary hub for all major organizations worldwide. The expansion of the retail industry and the growth of IoT drive the demand for smart devices and mobiles in the region. Thus, companies must comply with data privacy regulations given the increasing pressure from laws, advocacy, and awareness against data breaches.

- In the utility industry, the US government mandated the adoption of version 5 of the North American Electric Reliability Corporation Critical Infrastructure Protection (NERC CIP) as the cybersecurity standard. The healthcare industry abides by HIPPA requirements for securing data. This also includes the adoption of privacy management software.

- Notably, the United States is experiencing an increasing number of cyber threats. According to the Identity Theft Resource Center (ITRC), the average number of breaches in the country has increased marginally over the past few years. According to the ITRC's recent estimates, the average number of data breaches faced by the United States increased from 614 violations in 2013 to 1,1862 breaches in the last year. Furthermore, in the first half of the current year, more than 53 million individuals were affected by data compromises, including breaches, leakage, and exposure.

Privacy Management Software Industry Overview

There are a lot of domestic and international players in the market for privacy management software, which makes it a very competitive market. The market is moderately concentrated, moving towards fragmentation in the near future. The key strategies adopted by the major players in the market are product innovation, mergers, acquisitions, and partnerships. Some of the major players in the market are OneTrust, TrustArc, Securiti, SAI Global, and SAP SE.

In May 2022, OneTrust announced the launch of a Trust Intelligence Platform, establishing a new category of technology dedicated to solving critical business challenges around trust and transparency. Trust intelligence gives organizations visibility across all trust domains, actions based on AI and regulatory intelligence, and automation to make trust a reflex by design.

In January 2022, OneTrust announced its partnership with the Microsoft Intelligent Security Association (MISA), a community of software vendors and managed security service providers that have combined their solutions to meet the demands of the rising privacy and security landscape. Through this partnership, OneTrust helps Microsoft 365 customers automate data subject access requests (DSARs) across all of their Microsoft 365 systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Core Privacy Requirements and Core Functions of a Privacy Management Offering

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the number of Privacy Rules and Varied Privacy Laws

- 5.1.2 Rising Need to Achieve Compliance with Privacy Requirements

- 5.2 Market Challenges

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-Premise

- 6.1.2 On-Demand (Cloud/SaaS)

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Ranking Analysis

- 7.2 Company Profiles

- 7.2.1 OneTrust LLC

- 7.2.2 TrustArc Inc.

- 7.2.3 Securiti Inc.

- 7.2.4 SAI Global Pty Ltd.

- 7.2.5 SAP SE

- 7.2.6 Syrenis Ltd.

- 7.2.7 Crownpeak Technology Inc.

- 7.2.8 Exterro Inc.

- 7.2.9 WireWheel Inc.

- 7.2.10 BigID Inc.

- 7.2.11 Smart Global Governance

- 7.2.12 Privacy Company

- 7.2.13 Nymity

- 7.2.14 Collibra