|

市場調查報告書

商品編碼

1643205

歐洲資料保護即服務 (DPaaS)市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Data Protection-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

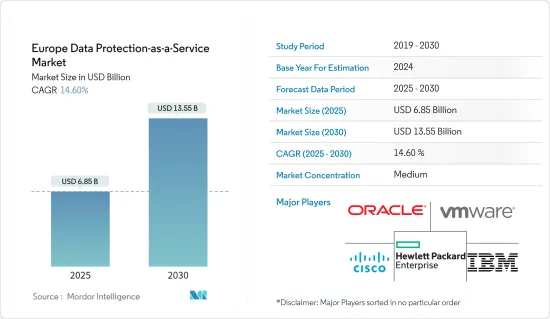

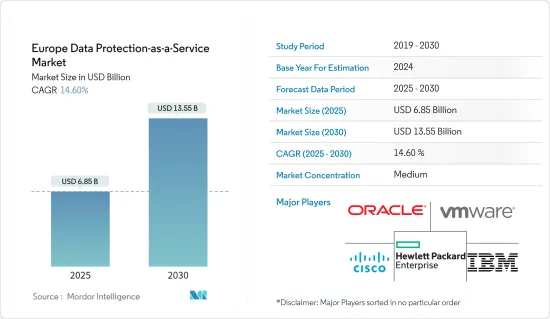

歐洲資料保護即服務 (DPaaS) 市場規模預計在 2025 年為 68.5 億美元,預計到 2030 年將達到 135.5 億美元,預測期內(2025-2030 年)的複合年成長率為 14.6%。

推動歐洲資料保護即服務 (DPaaS) 市場發展的因素是對第三方風險管理的日益關注,以及 GDPR 等嚴格的法規,這刺激了資料保護解決方案的採用。此外,許多歐洲市場供應商正在向不同的行業擴張以獲得競爭優勢並創新其產品,進一步促進市場成長。

關鍵亮點

- 在歐洲,一般資料保護規範(GDPR)是製定個人資料和資訊收集準則的主要法律體制。遵守 GDPR 有關收集、存取和儲存的個人資料的核心原則對企業來說是一個挑戰。因此,資料保護服務能夠實現企業自助分析,同時確保企業管治和合規性。

- 該地區的終端用戶產業也正在強勁轉向雲端運算。產生的行動資料越來越多,而且可能會增加更多的資料來源。這要求該地區需要更先進的資料準備解決方案。

- 儘管歐洲一些國家的資料外洩和網路攻擊不斷增加,但該地區的客戶和組織並不願意與第三方公司共用資料。此外,2023年10月,德國最大的電力供應商之一E.ON的負責人表示,沒有採取足夠的措施保護其關鍵資產免受網路攻擊,並因此呼籲歐洲各地當局採取進一步措施。隨著這些威脅的增加,歐洲國家擴大採用資料保護服務。

- 隨著 COVID-19 疫情的發生率不斷上升,在對抗病毒的過程中,公共當局和醫療專業人員之間對安全、簡單的資料交換方式的需求變得比以前更加透明。然而,受英國脫歐對歐盟的影響,市場面臨不確定性。谷歌計劃將英國客戶帳戶從歐盟隱私監管機構手中奪走,並置於美國管轄之下。此舉正值英國脫離歐盟之際,意味著數百萬客戶的敏感資訊將不再受到保護,並將更加受到英國法律的約束。

歐洲資料保護即服務 (DPaaS) 市場趨勢

預計 BFSI 產業在預測期內將大幅成長

- 隨著銀行和金融服務業參與者日益數位化,保護公司資料免受安全漏洞侵害至關重要。銀行資料中心透過數位化基礎技術支撐的自主營運和混合雲端基礎設施實現現代化,將顯著改善客戶體驗。另一方面,現代化也產生了各種安全漏洞,導致資料外洩和其他資訊遺失。

- 像 Eurobits 這樣的技術服務供應商幫助銀行合作,使客戶能夠快速付款並管理跨多家銀行的銀行帳戶。該公司在兩個資料中心遷移到基於 IBM 雲端技術的 VMware vSphere,以實現其安全銀行應用程式的容器化。

- 許多歐洲銀行正在尋找比美國具有更高安全標準的雲端運算供應商。歐洲銀行正在選擇美國三大雲端運算供應商:微軟、亞馬遜和谷歌。

- 法國和德國相關人員正在與主要科技、通訊和金融公司進行談判,以創建由區域技術和供應商公司營運的競爭性大陸雲端服務。但德國商業銀行等銀行正聯合向美國供應商提出雲端運算要求,以期在資料監管下獲得更大的彈性。

- 在這個市場營運的公司正在不斷投資創新解決方案,以有效解決問題。例如,領先的網路安全解決方案供應商 Fortinet 宣布推出 FortiGate-VM,擴展對 VMware NSX-T 的原生支持,為東西向流量提供進階安全性。

英國市場可望佔主要佔有率

- 英國市場對巨量資料、區塊鏈和其他措施的偏好日益成長,促進了市場的成長。

- 根據SAS研究所稱,英國零售銀行機構在巨量資料採用方面預計將出現驚人的80%的成長,為市場成長做出積極貢獻。

- 時尚零售商 H&M 最近開始使用巨量資料來調整其實體店的商品組合。為了提高收益,這家時尚零售商使用演算法和各種客戶資料來源來從收據、退貨和會員卡資料中獲取見解。

- 在英國,區塊鏈用戶可以參考法國制定的指南來幫助他們遵守資料保護法。英國資料保護機構忽視了與加密貨幣挖礦和相關技術有關的重要立法。法國資料保護機構 CNIL 制定的指南被認為對區塊鏈領域的從業者非常有效。

- 此外,日益增多的網路威脅事件也將推動未來幾年英國市場的成長。例如,根據IBM 2023年2月發布的X-Force威脅情報指數報告,英國佔過去12個月整個歐洲觀察到的威脅的43%。 2022 年,能源和金融業遭受的違規行為最多,佔英國所有網路攻擊的 16%。此外,據 SurfShark 稱,2023 年第二季英國約有 42 萬資料記錄被洩露。這較 2021 年第一季的約 1500 萬例大幅下降。資料外洩數量的大幅下降或許顯示全國範圍內資料保護服務的採用率有所提高。

歐洲資料保護即服務 (DPaaS) 產業概況

歐洲資料保護即服務 (DPaaS) 市場競爭適中,有幾個重要的參與企業。這些參與企業擁有相當大的市場佔有率,並致力於擴大其在歐洲的基本客群。這些供應商專注於研發投資、策略聯盟和其他有機和無機成長策略,以推出新的解決方案,在預測期內佔據相當大的佔有率。

2023年10月,亞馬遜宣布面向歐洲推出獨立雲端服務,旨在最大限度地減少歐盟資料主權擔憂。亞馬遜網路服務 (AWS) 提供的歐洲主權雲端專門針對公共部門客戶和嚴格監管領域的企業。該雲端將安裝在歐洲的伺服器上,以德國為墊片,其營運將由在歐盟營運的 AWS負責人獨家管理。

2023年6月,全球技術和安全公司泰雷茲宣布與Google Cloud建立新的合作關係,以建立新的由AI驅動的生成資料安全功能,幫助企業識別、分類和保護其最敏感的資料。此次合作是泰雷茲生成式人工智慧策略的一部分,旨在為其 CipherTrust資料安全平台的客戶提供新的人工智慧功能和體驗。

2023 年 3 月,雲端保護公司 Axis Security 即將被惠普企業 (HPE) 收購。此外,我們透過提供統一的安全存取服務邊際(SASE) 解決方案將安全功能從邊緣擴展到雲端。這將有助於滿足對作為服務提供的整合網路和安全解決方案日益成長的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 更加重視第三方風險管理

- GDPR 等嚴格法規推動了資料保護解決方案的採用

- 提高歐盟機構的認知

- 市場問題

- 英國脫歐為資料保護帶來不確定性

第6章 COVID-19 對歐洲資料保護即服務市場的影響

第7章 市場區隔

- 服務

- SaaS(Storage-as-a-Service)

- BaaS(Backup-as-a-Service)

- DRaaS(Disaster Recovery-as-a-Service)

- 擴張

- 公共雲端

- 私有雲端

- 混合雲端

- 最終用戶產業

- BFSI

- 醫療

- 政府和國防

- 資訊科技和電訊

- 其他

- 國家

- 英國

- 德國

- 法國

- 歐洲其他地區

第8章 競爭格局

- 公司簡介

- IBM Corporation

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Company

- Dell Technologies

- Cisco Inc.

- Oracle Corporation

- VMware Inc.

- Commvault Systems Inc.

- Veritas Technologies UK Ltd

- Quantum Corporation

- Quest Software UK Ltd

- Hitachi Vantara Corporation

第9章投資分析

第10章:投資分析市場的未來

The Europe Data Protection-as-a-Service Market size is estimated at USD 6.85 billion in 2025, and is expected to reach USD 13.55 billion by 2030, at a CAGR of 14.6% during the forecast period (2025-2030).

The factors driving the European market for data protection-as-a-service are increased focus on third party risk management coupled with stringent regulations, such as GDPR, prompting the adoption of data protection solutions. Many Europe-based market vendors are also innovating their product offerings by penetrating various industries to gain a competitive advantage, further contributing to the market's growth.

Key Highlights

- In Europe, the General Data Protection Regulation (GDPR) is the primary legal framework that structures guidelines for collecting personal data and information. Compliance with the core tenets of GDPR, relating to personal information collected, accessed, and stored, is a hard take for companies. Therefore, data protection services can enable business self-service analytics while ensuring enterprise governance and compliance.

- Cloud migration is also very high among the end-user industries in the region. With more mobile data generated, more data sources are likely to be added. Hence, the region requires more advanced data preparation solutions.

- Even though the number of data breaches and cyberattacks is increasing in several European countries, customers and organizations in this region have been reluctant to share their data with third-party companies. Moreover, in October 2023, the head of Eon, one of the largest power providers in Germany, stated that the country failed to do strong enough to secure critical assets from cyberattacks and, as a result, called on authorities throughout Europe to take more action. With these increasing numbers of threats in European countries are driving the adoption of data protection services.

- With the increasing incidence of the COVID-19 pandemic, the necessity for safe, simple avenues for data exchange between public bodies and healthcare professionals made its way much more transparent than previously in to fight against the virus. However, the market is facing uncertainties owing to the Brexit effect in the European Union. Google plans to move its British customer's accounts out of EU privacy regulators' control and place them under the United States jurisdiction. The shift, prompted by Britain's exit from the European Union, will leave the sensitive information of millions of customers with less protection and within more comfortable reach of British law.

Europe Data Protection-as-a-Service Market Trends

BFSI Industry is Expected to Grow at a Significant Rate Throughout the Forecast Period

- The banking and financial services industry participants are becoming more digitally sophisticated, so safeguarding corporate data from security breaches is essential. Modernized bank data centers with hybrid cloud infrastructure backed by a digital foundation technology and powered by self-driving operations ensure significantly improved customer experiences. On the other hand, modernization created different security loopholes, resulting in data breaches and other information losses.

- Technology service providers, such as Eurobits, help banks work together so that their customers can quickly pay and manage their bank accounts at multiple banking providers. The company migrated to VMware vSphere on IBM's cloud technology in two data centers to containerize its secure banking applications.

- Many European banks are looking for cloud computing providers with higher security standards than they can find in the United States. The European banks are opting for three major United States cloud providers, Microsoft, Amazon, and Google.

- French and German government officials are in talks with major technology, telecommunications, and finance players to create a competitive continental cloud service run by regional technology provider companies. However, banks, like Germany's Commerzbank AG, have teamed up to present joint cloud requirements to the United States providers to increase the flexibility of data-related regulations.

- Players operating in the market continually invest in innovative solutions to tackle problems efficiently. For instance, Fortinet, a significant cybersecurity solutions provider, announced the launch of FortiGate-VM, extending its native support of VMware NSX-T to provide advanced security for East-West traffic.

United Kingdom Country Segment is Expected to Hold a Significant Share

- The increasing preferences for big data, blockchain, and other initiatives across the UK market landscape have contributed to market growth.

- According to the SAS Institute, retail banking organizations in the United Kingdom are expected to lead in Big Data adoption by a staggering 80%, likely contributing to the market's growth positively.

- The fashion retailer H&M recently started using Big Data to tailor its merchandising mix in its brick-and-mortar stores. To enhance its bottom line, the fashion retailer uses algorithms and different customer data sources to gain insights from receipts, returns, and data from loyalty cards.

- In the United Kingdom, blockchain users can refer to the guidance developed in France to help them comply with data protection laws. The United Kingdom's data protection authority has ignored the significant legislation related to cryptocurrency mining and related technologies. The guidance developed by CNIL, the French data protection authority, has been considered efficient for people working in the blockchain field.

- Furthermore, the increasing number of cyber-threat incidents is also driving the growth of the United Kingdom country segment in the coming years. For instance, according to IBM's X-Force Threat Intelligence Index report, published in February 2023, 43% of threats observed throughout Europe during the previous 12 months were in the UK. In 2022, the energy and financial sectors experienced the highest number of breaches, accounting for 16% of all cyberattacks in the UK. Moreover, according to SurfShark, approximately 420 thousand data records in the United Kingdom (UK) were compromised in the second quarter of 2023. The number dropped significantly compared to about 15 million in the first quarter of 2021. Such a significant drop in data compromises might indicate the considerable adoption of data protection services nationwide.

Europe Data Protection-as-a-Service Industry Overview

The European data protection-as-a-service market is moderately competitive and has several significant players. These players account for a substantial market share and are focusing on expanding their customer base across the European region. These vendors focus on research and development investment to introduce new solutions, strategic alliances, and other organic and inorganic growth strategies to capture a significant share during the forecast period.

In October 2023, Amazon announced the availability of standalone cloud services for Europe, aiming to minimize concerns regarding EU data sovereignty. The European Sovereign Cloud from Amazon Web Services (AWS), particularly for public sector clients and business enterprises in highly regulated sectors, will be made available by the company. The cloud will be installed on European servers, with Germany serving as the launchpad, and its operation will be governed solely by AWS personnel operating in the EU.

In June 2023, Thales, a global player in technology and security, announced a new partnership with Google Cloud to create new generative AI-powered data security capabilities to help businesses identify, categorize, and safeguard their most critical data. The association is a component of Thales' generative AI strategy, which aims to provide customers of the company's CipherTrust data security platform with new AI-powered capabilities and experiences.

In March 2023, Axis Security, a company that offers cloud protection, will soon be acquired by Hewlett-Packard Enterprise HPE. Additionally, it expanded its edge-to-cloud security capabilities by providing a unified Secure Access Services Edge (SASE) solution. It will now be able to satisfy the increasing demand for integrated networking and security solutions that are provided as a service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Third-party Risk Management

- 5.1.2 Stringent Regulations, such as GDPR Prompting the Adoption of Data Protection Solutions

- 5.1.3 Increasing Awareness among EU Institutions

- 5.2 Market Challenges

- 5.2.1 Uncertainty Regarding Data Protection Landscape due to Brexit

6 IMPACT OF COVID-19 ON THE EUROPE DATA PROTECTION-AS-A-SERVICE MARKET

7 MARKET SEGMENTATION

- 7.1 Service

- 7.1.1 Storage-as-a-Service

- 7.1.2 Backup-as-a-Service

- 7.1.3 Disaster Recovery-as-a-Service

- 7.2 Deployment

- 7.2.1 Public Cloud

- 7.2.2 Private Cloud

- 7.2.3 Hybrid Cloud

- 7.3 End-user Industry

- 7.3.1 BFSI

- 7.3.2 Healthcare

- 7.3.3 Government and Defense

- 7.3.4 IT and Telecom

- 7.3.5 Other End-user Industries

- 7.4 Country

- 7.4.1 United Kingdom

- 7.4.2 Germany

- 7.4.3 France

- 7.4.4 Rest of Europe

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 IBM Corporation

- 8.1.2 Amazon Web Services Inc.

- 8.1.3 Hewlett Packard Enterprise Company

- 8.1.4 Dell Technologies

- 8.1.5 Cisco Inc.

- 8.1.6 Oracle Corporation

- 8.1.7 VMware Inc.

- 8.1.8 Commvault Systems Inc.

- 8.1.9 Veritas Technologies UK Ltd

- 8.1.10 Quantum Corporation

- 8.1.11 Quest Software UK Ltd

- 8.1.12 Hitachi Vantara Corporation