|

市場調查報告書

商品編碼

1630376

東歐可再生能源 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)East Europe Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

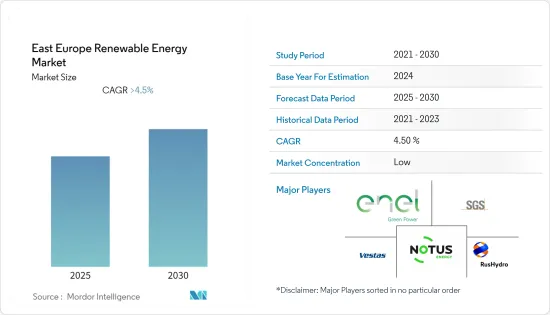

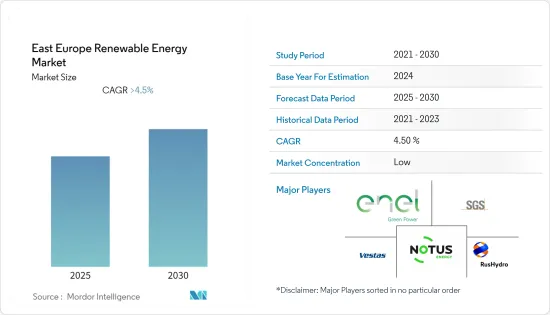

預計東歐可再生能源市場在預測期內將維持4.5%以上的複合年成長率。

COVID-19對2020年的市場產生了輕微影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,環保意識和監管的增強以及每千瓦發電成本的降低等因素預計將推動市場發展。

- 另一方面,太陽能和風力發電儲存的高價格預計將抑制市場。

- 採用薄膜技術製造的新型太陽能電池(在太陽能電池中使用碲化鎘薄塗層)由於其高效率和低成本,可能成為該領域的機會。

- 預計俄羅斯將在預測期內主導該地區的可再生能源市場。這是因為可再生能源計劃的投資正在大幅增加。

東歐可再生能源市場趨勢

水電領域佔市場主導地位

- 由於與美國的歷史關係,東歐各地建造了大型水壩,水力發電領域預計將主導市場。大多數水壩建在俄羅斯。

- 水力發電部分包括可用於供應可再生能源的各種規模的水庫大壩。水力發電是東歐使用最廣泛的可再生能源。

- 2022年1月,波蘭政府宣布全國最大的水力發電廠將恢復建設,距離開工50年、計劃廢棄33年後。該發電廠容量為750兆瓦,建於波蘭西南部的穆爾蒂村。

- 2021年,水力發電(包括混合發電廠)將佔該地區可再生能源發電總量的近72.7%,發電量約為74,101兆瓦。

- 因此,與其他可再生能源相比,供應可再生能源的大型水壩水庫由於規模較大、持續維護且投資成長較低,預計將主導市場。

俄羅斯主導市場

- 2021年,俄羅斯超過18%的電力由俄羅斯水力發電廠生產,該國持有豐富的未開發資源,可大幅增加產量。

- 該國大部分可再生能源是由發電工程生產的。 2021年可再生能源裝置容量為5,620萬千瓦。太陽能領域的新計畫預計將增加整個可再生能源市場。

- 俄羅斯最大的水力發電廠薩亞諾-舒申斯卡亞水力發電廠位於哈卡斯州薩亞諾戈爾斯克的葉尼塞河畔。該電站的拱形重力壩高242米,裝置容量為6.4吉瓦。該發電工程為國家中東部地區提供了充足的電力供應。

- 因此,俄羅斯由於其廣闊的土地面積和不斷增加的可再生能源裝置容量,預計將在預測期內主導市場。

- 然而,俄羅斯與烏克蘭衝突爆發後,由於幾乎所有外國公司都已撤離該國,預計俄羅斯的可再生能源投資組合不會大幅成長。

東歐可再生能源產業概況

東歐可再生能源市場被部分分割。市場的主要企業包括(排名不分先後)PJSC RusHydro、Vestas Wind Systems A/S、Enel Green Power SpA、NOTUS Energy GmbH 和 SGS SA。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2027年可再生能源產能預測(單位:GW)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 水力發電

- 太陽能

- 其他

- 地區

- 俄羅斯

- 波蘭

- 烏克蘭

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Vestas Wind Systems A/S

- Enel Green Power SpA

- NOTUS Energy GmbH

- SGS SA

- Wartsila Oyj Abp

- Hanwha Q Cells Co., Ltd.

- Schneider Electric SE

- C&C Energy SRL

- Federal Hydro-Generating Co RusHydro PAO

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 70279

The East Europe Renewable Energy Market is expected to register a CAGR of greater than 4.5% during the forecast period.

COVID-19 marginally impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increased environmental awareness and regulations and decreased cost per kilowatt of electricity generated are expected to boost the market.

- On the other hand, the high price of solar and wind energy storage is expected to restrain the market.

- Nevertheless, new models of solar cells made of a thin film technology that uses thin coatings of cadmium telluride in solar cells, which have higher efficiency and lower cost, may prove to be an opportunity in the sector.

- Russia is expected to dominate the renewable energy market during the forecast period in the region. Due to a significant rise in investment in renewable energy projects.

East Europe Renewable Energy Market Trends

Hydropower Segment to Dominate the Market

- The hydropower segment is expected to dominate the market as a vast reservoir of dams has been built across east Europe due to its history with U.S.S.R. It is expected to remain the largest renewable energy segment in the forecast period. Most of the dams have been constructed in Russia.

- The hydropower Segment includes different-sized reservoir dams that can be used to provide renewable energy. Hydropower is the most used renewable energy in East Europe.

- In January 2022, the Polish government announced that work would be resumed on the country's largest hydroelectric plant 50 years after construction began and 33 years after the project was abandoned. The plant will have a capacity of 750 MW and will be located in the village of Mloty, southwestern Poland.

- Hydropower (including mixed plants) constitute almost 72.7%of the total renewable energy generated in the region, with nearly 74,101 MW of energy being produced, in 2021.

- Therefore, vast reservoirs of dams providing renewable energy are expected to dominate the market due to their large size relative to other renewable energy, a continuation of maintenance, and little increase in investments.

Russia to Dominate the Market

- In 2021, more than 18% of Russia's electricity is produced by Russia's hydroelectric power plants, with the country holding a wealth of untapped resources to increase its output significantly.

- Most of the renewable energy in the country is produced by hydropower projects. In 2021, the country's renewable energy capacity stood at 56.2 GW. New projects in the solar energy sector are expected to be added to the total renewable energy market.

- The biggest hydropower plant in Russia, the Sayano-Shushenskaya hydroelectric power plant, is located on the Yenisei River in Sayanogorsk, Khakassia. The power station's 242m-high arch-gravity dam has an installed capacity of 6.4GW. The hydro project provides plentiful electricity supply in the Central and East regions of the country.

- Hence, Russia is expected to dominate the market due to its large size and increased renewable energy installed capacity in the forecast period.

- However, after the outbreak of the Russia-Ukraine conflict, Russia is not expected to witness any significant growth in its renewable energy portfolio as almost all of the foreign companies have exited the country.

East Europe Renewable Energy Industry Overview

East Europe Renewable Energy Market is partially fragmented. Some of the key players in this market are (not in particular order) PJSC RusHydro, Vestas Wind Systems A/S, Enel Green Power S.p.A., NOTUS Energy GmbH, and SGS SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Installed Capacity Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hydropower

- 5.1.2 Solar

- 5.1.3 Others

- 5.2 Geography

- 5.2.1 Russia

- 5.2.2 Poland

- 5.2.3 Ukraine

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems A/S

- 6.3.2 Enel Green Power S.p.A.

- 6.3.3 NOTUS Energy GmbH

- 6.3.4 SGS SA

- 6.3.5 Wartsila Oyj Abp

- 6.3.6 Hanwha Q Cells Co., Ltd.

- 6.3.7 Schneider Electric SE

- 6.3.8 C&C Energy SRL

- 6.3.9 Federal Hydro-Generating Co RusHydro PAO

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219