|

市場調查報告書

商品編碼

1630382

光敏半導體元件:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Photosensitive Semiconductor Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

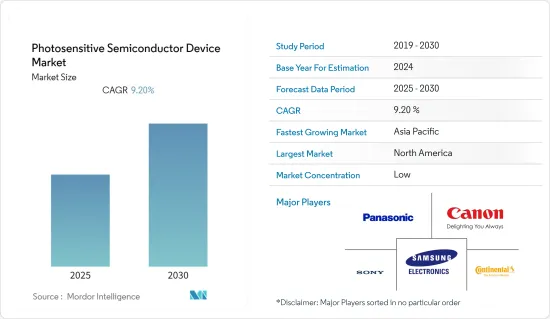

光敏半導體裝置市場預計在預測期內複合年成長率為 9.2%。

主要亮點

- 光電二極體感測器廣泛應用於醫療設備和科學設備,包括醫學成像、光譜學和脈搏血氧飽和度,預計將推動該市場的成長。

- 此外,用於影像感測器的光敏半導體裝置正在顯著擴展其應用領域。例如,CMOS 技術提供了許多優勢,電子製造商可以利用這些優勢來改進設備設計、在市場上區分產品並滿足特定的消費者需求。因此,影像感測器的成長將推動光敏半導體元件市場的成長。

- 中國、印度、韓國、台灣和日本等亞洲國家擁有大量此類設備製造商,並且在新冠肺炎 (COVID-19) 期間經歷了封鎖和生產計劃中斷。由於全球大部分經濟體處於封鎖狀態,交貨僅限於必需品,且企業收益目標也被修改,導致這段期間的銷售額下降。在此期間,由於病毒傳播,世界各國政府下令關閉和暫停消費性電子產品製造流程,光敏半導體裝置市場受到負面影響。然而,各行業、組織、學校和大學對醫療保健設備的使用以及線上工作和學習導致了市場的穩定成長。

光敏半導體裝置市場趨勢

家用電子電器領域預計將佔據最大市場佔有率

- 光敏半導體裝置主要用作許多影像設備和數位相機中的影像感測器,以提高影像消融和儲存的品質。這些影像應用在工業、媒體、醫療和消費應用中享有很高的採用率。

- 由於智慧型手機、保全攝影機、高解析度相機和攝影機的需求不斷增加,光敏半導體裝置市場預計在預測期內將進一步成長。世界各地的製造商都在努力提高解析度、性能和像素尺寸等關鍵參數。

- 此外,CMOS 感光元件中擴大使用光敏半導體元件,透過提供更多片上功能來簡化相機設計,從而在消費市場的低成本端佔據一席之地。例如,SONY新推出的IMX686 Exmor RS 64MP CMOS感測器應用於三星、華為、一加、小米等眾多中階智慧型手機。

- 然而,由於各行各業的公司都經歷了嚴重的景氣衰退,員工的薪資也有所減少。這可以直接影響採用光敏半導體裝置設計的消費性電子產品的購買決策,並影響短期的市場成長。

亞太地區預計成長最快

- 在整個全部區域,中階在智慧型手機、平板電腦和電視等消費性電子產品上的支出不斷增加,推動了消費性電子市場的成長,並帶動了該地區光敏半導體裝置的成長。

- 許多公司正在採用新技術並在該地區進行市場領先的開發。例如,2022年5月,三菱電機公司宣布,該公司已開發出一種在軌積層製造,利用光敏樹脂和太陽紫外線在太空真空中3D列印衛星天線。

- 此外,2022 年 1 月。東麗宣布開發出負型感光聚醯亞胺材料。這種新產品保持了聚醯亞胺特有的耐熱性、機械性能和附著力,同時提高了解析度並能夠在 100微米和其他厚膜上實現高清圖案化。這可能是市場的主要驅動力。

- 該地區軍事基礎設施發展的高投資也推動了市場成長。例如,根據官方文件和軍方資訊來源,印度將在2022-23年在國防和軍事上花費187.6億美元,並將在未來繼續投資,預計將進一步增加。此類投資將增加對監控設備的需求,進而支持該地區光敏半導體元件的成長。

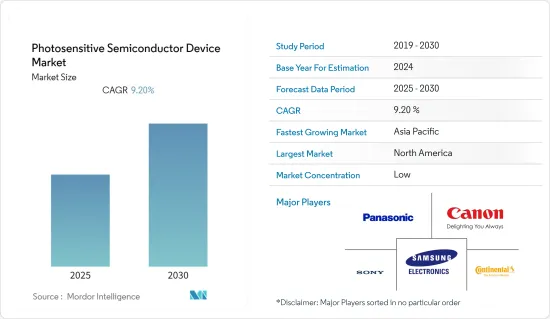

光敏半導體元件產業概況

全球光敏半導體裝置市場高度分散,有多家製造商提供產品。公司不斷投資於產品和技術,以更低的價格為消費者提供更好的產品。此外,公司正在收購專門經營這些產品的公司,以增加其市場佔有率。

- 2022 年 9 月 -FUJIFILM株式會社宣布推出無反光鏡數位相機「FUJIFILM X-H2」。該公司將其稱為緊湊型輕量相機的最新陣容“X系列”。據稱還配備了新開發的背照式40.2MP X-Trans CMOS 5 HR感測器和高速X-Processor 5,可以拍攝高解析度靜態影像和高清8K/30P影片。

- 2021 年 12 月 -Canon Inc.宣布將於 2022 年開始批量生產用於保全攝影機的 3.2MP SPAD 感測器。據該公司介紹,SPAD感測器是一款設計獨特的影像感測器,每個像素都有一個電子元件。對於 CMOS 感測器,所儲存的電子電荷的讀出包含電子噪聲,這會降低影像質量,具體取決於所儲存的光的測量方式。另一方面,使用SPAD感測器,雜訊不會以電訊號形式干擾讀取光,因此可以在沒有訊號雜訊的情況下捕捉清晰的拍攝對象,並且具有拍攝時的高靈敏度和高精度距離測量等優點。能

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 對改進成像和光學感測解決方案的需求

- 長壽命、低功耗

- 市場限制因素

- 物價壓力加大

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 按設備

- 光電管

- 光電二極體

- 光電電晶體

- 光敏電阻

- 光電IC

- 按最終用戶

- 汽車/運輸設備

- 家用電子電器

- 航太/國防

- 衛生保健

- 產業

- 安全與安全

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Sony Corporation

- Samsung Electronics Co. Ltd

- Canon Inc.

- SK Hynix Inc.

- Fujifilm

- Panasonic Corporation

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Teledyne Technologies Inc.

- Hamamatsu Photonics KK

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 70354

The Photosensitive Semiconductor Device Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- The extensive use of photodiode sensors in medical products for medical imaging, spectroscopy, and pulse oximetry, among other medical and scientific instrumentations, is expected to drive the growth of the photodiode in the market.

- Moreover, photosensitive semiconductor devices in image sensors have immensely increased their application area. For instance, CMOS technology offers plenty of benefits that electronics manufacturers leverage to improve device design, differentiate their products in the marketplace, and meet specific consumer needs. Therefore, the growth of image sensors will boost the growth of photosensitive semiconductor devices in the market.

- Asian countries like China, India, South Korea, Taiwan, and Japan have a significant presence of manufacturers of these devices and had experience lockdowns and disrupted production schedules during Covid-19. The sales went down during that period as the lockdown in most global economies had resulted in deliveries limited to essentials and companies revising their revenue targets. Amid the spread of viruses, governments worldwide mandated the lockdown and halt of consumer electronics manufacturing processes, negatively impacting the photosensitive semiconductor device market during that period. However, the use of healthcare devices and online working and study opted by various industries, organizations, schools, and colleges led to a steady growth in the market.

Photosensitive Semiconductor Device Market Trends

Consumer Electronic Segment is Expected to Hold Largest Market Share

- Photosensitive semiconductor devices are primarily used as image sensors in many imaging devices and digital cameras to enhance the quality of cauterization and storage of images. These imaging applications have high adoption in industrial, media, medical, and consumer applications.

- Due to the increasing demand for smartphones, security cameras, high-definition cameras, and camcorders, the photosensitive semiconductor device market is expected to grow more during the forecast period. Manufacturers worldwide strive to enhance main parameters, such as resolution, performance, and pixel size.

- Additionally, the increase in the use of photosensitive semiconductor devices in CMOS sensors is providing a foothold at the low-cost end of the consumer market by offering more functions on-chip that simplify camera design. For instance, Sony's newly launched IMX686 Exmor RS 64MP CMOS sensors are being used in many mid-range phones of Samsung, Huawei, OnePlus, Xiaomi, etc.

- However, due to the vast economic downturn experienced by companies across industries, employees are also witnessing salary cuts. This may directly impact the purchase decision for consumer electronics designed with photosensitive semiconductor devices and affect the growth of the market on a short-term basis.

Asia Pacific is Expected to be the Fastest growing Region

- Across the region, there is an increase in spending by the middle class on consumer electronics products such as smartphones, tablets, televisions, etc., which is driving the consumer electronics market growth and guiding the growth of photosensitive semiconductor devices in the region.

- Many companies are using new technologies and development in the region that can drive the market. For instance, in May 2022, Mitsubishi Electric Corporation announced that the company had developed an on-orbit additive-manufacturing technology that uses photosensitive resin and solar ultraviolet light for the 3D printing of satellite antennas in the vacuum of outer space.

- Additionally, in January 2022. Toray Industries, Inc. announced that the company had developed a negative photosensitive polyimide material. This new offering maintains polyimides' characteristic thermal resistance, mechanical properties, and adhesiveness while increasing resolutions and enabling high-definition pattern formation on 100-micrometer and other thick films. And that will drive the market significantly.

- The high investments in developing the infrastructure of armed forces in the region have boosted the market's growth. For instance, according to an official document and military sources, India has spent USD 18.76 billion in the year 2022-23 on its defense and armed forces, which is expected to increase more in the future to update the armed forces and reinforce their combat capacities over regional rivals. These investments will increase the demand for surveillance equipment, which will, in turn, boost the growth of photosensitive semiconductor devices in the area.

Photosensitive Semiconductor Device Industry Overview

The Global Photosensitive Semiconductor Device Market is highly fragmented, having multiple manufacturers providing the product. Companies continuously invest in products and technology to encourage better products at lower prices for their consumers. The companies are also acquiring companies that specifically deal with these products to boost their market share.

- September 2022 - FUJIFILM Corporation announced the launch of the mirrorless digital camera 'FUJIFILM X-H2'. The company stated it as the latest addition to the X Series of compact, lightweight cameras lineup. Moreover, they also said that the camera features the new back-illuminated 40.2MP X-Trans CMOS 5 HR sensor and the high-speed X-Processor 5 capable of capturing high-resolution stills and high-definition 8K/30P video.

- December 2021 - Canon Inc. announced to start of mass production of the 3.2MP SPAD sensor for security cameras in 2022. As per the company, the SPAD sensor is a uniquely designed image sensor with each pixel possessing an electronic element. With CMOS sensors, the readout of the accumulated electronic charge contains electronic noise, which diminishes image quality due to how accumulated light is measured. Meanwhile, with SPAD sensors, noise does not interfere with the readout of light as electrical signals, which enables clear image capture of subjects free from signal noise and provides advantages such as greater sensitivity during image capture and high-precision distance measurement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Demand for Improved Imaging and Optical Sensing Solutions

- 4.4.2 Long Life and Low Power Consumption

- 4.5 Market Restraints

- 4.5.1 Increasing Price Pressure

- 4.6 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Device

- 5.1.1 Photocell

- 5.1.2 Photodiode

- 5.1.3 Phototransistor

- 5.1.4 Photoresistor

- 5.1.5 Photo IC

- 5.2 End User

- 5.2.1 Automotive and Transportation

- 5.2.2 Consumer Electronics

- 5.2.3 Aerospace and Defence

- 5.2.4 Healthcare

- 5.2.5 Industrial

- 5.2.6 Security and Survelliance

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Sony Corporation

- 6.1.2 Samsung Electronics Co. Ltd

- 6.1.3 Canon Inc.

- 6.1.4 SK Hynix Inc.

- 6.1.5 Fujifilm

- 6.1.6 Panasonic Corporation

- 6.1.7 Continental AG

- 6.1.8 Robert Bosch GmbH

- 6.1.9 Denso Corporation

- 6.1.10 Teledyne Technologies Inc.

- 6.1.11 Hamamatsu Photonics K.K.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219