|

市場調查報告書

商品編碼

1498830

2024-2025年全球電子材料氣體(包括Ne和Xe)(重要材料)市場Electronic Gases including Ne & Xe Market Report 2024-2025 (Critical Materials Report) |

||||||

價格

本報告涵蓋了半導體裝置製造中使用的電子材料氣體的市場環境和供應鏈。它還包括主要供應商的資訊、材料供應鏈中的問題和趨勢、供應商市場佔有率的估計和預測以及材料細分市場的市場預測。

目錄

第 1 章執行摘要

第二章研究範圍、目的與方法

第三章半導體產業:市場現況與展望

- 世界經濟與展望

- 半導體產業與全球經濟的聯繫

- 半導體銷售額成長

- 台灣外包廠商每月銷售趨勢

- 晶片銷售趨勢:以電子產品領域劃分

- 電子產品的前景

- 汽車產業的前景

- 智慧型手機前景

- 電腦展望

- 伺服器/IT 市場

- 半導體製造業的成長與擴張

- 在晶片擴張方面投入巨資

- 美國新廠

- 全球工廠擴編推動成長

- 資本投資趨勢

- 先進邏輯技術路線圖

- 工廠投資評估

- 政策和貿易趨勢及影響

- 半導體材料概述

- 引入的晶圓數量:未來預測(截至 2028 年)

- 材料市場預測(~2028 年)

第四章電子材料氣體市場趨勢

- 電子材料氣體市場趨勢:概述

- 電子材料氣體市場趨勢:2023-2024

- 電子材料氣體市場展望

- 電子材料氣體的獲利預測(5年):依細分市場

- 電子材料氣體的獲利預測(5年):依細分市場 - 依主要資料概述

- 電子材料氣體供應能力與需求:概覽

- 電子材料氣體供應能力、需求及投資

- 電子材料氣體產量:依地區劃分

- 擴大電子材料氣體產能

- 投資公告摘要

- 有關投資活動的其他評論

- 稀有氣體(Xe、Kr、Ne):平衡供需:- 概述

- 氦氣供應與需求

- 供需平衡:NF3、三氟化氮

- 供需平衡:WF6、六氟化鎢

- 價格趨勢

- 價格趨勢:霓虹燈

- 價格趨勢:氙氣

- 價格趨勢:氪

- 氦氣價格趨勢與預測

- 技術趨勢/技術驅動因素:概述

- 通用電子材料氣體技術:概述

- 電子材料氣體技術趨勢

- 特種/新興材料及其應用

- WF6 的市場需求:潛在的鉬替代品

- ALE(原子層)蝕刻氣體列表

- 技術趨勢與機會概述

- 區域考慮因素

- EHS(環境、健康與安全)和貿易/物流問題

- 俄羅斯入侵烏克蘭

- 也門胡塞武裝在紅海和亞丁灣發動的攻擊擾亂了全球航運

- 新興的中東衝突可能會擾亂全球技術供應鏈和英特爾的擴張計劃

- 巴拿馬運河歷史性乾旱

- EHS 問題

- EHS 問題

- 貿易/物流問題

- 分析師對電子材料氣體市場趨勢的評估

第五章供給面市場狀況

- 電子材料氣體市場佔有率

- 工業氣體市場佔有率

- 全球前 5 名領先電子材料氣體供應商:本季的活動和報告收入

- 美國供應商排名

- LINDE PLC(2023 年全年及第四季):儘管銷售額下降,利潤仍保持穩定成長,預計業績將持續強勁

- 液化空氣集團(2023 年第四季及全年):2023 年獲利將受到能源價格下跌的壓力,但指標良好

- 由於半導體放緩和市場壓力,勒克電子部門 2023 年第三季的有機銷售額將下降 4%

- TAIYO NIPPON SANSO:第三季銷售額

- 區域趨勢:韓國

- 區域趨勢:日本

- 區域趨勢:中國

- 區域趨勢:俄羅斯

- 區域趨勢:美國

- 區域趨勢:歐洲

- 併購 (M&A) 活動與業務合作(夥伴關係)

- 工廠關閉/出售

- 新進入公司

- 供應商或零件/產品線面臨停產風險

- 電子材料氣體供應商:分析師評估

第六章下游供應鏈:電子材料氣體

- 下游(次級)供應鏈:供應商與市場概覽

- 大宗氣體及其來源

- 螢石供應

- 溴供應

- 下游供應鏈:EHS 與物流問題

- 底層供應鏈:分析師評估

第 7 章供應商簡介

- Air Liquide

- Air Products

- Air Water

- Cryoin Engineering

- DuPont

- 超過 20 個其他項目

第 8 章附錄

- 天然氣用於多個產業

- 特種氣體產業矩陣

- 半導體元件製造所使用的氣體

- 顯示器產業使用的氣體

- 供應商清單:依氣體類型

- 氫化物

- 矽前驅物(矽烷)

- 蝕刻劑/腔室清潔

- 氣相沉積/其他

- 散裝氣體

- 蝕刻氣體路線圖

This report covers the market landscape and supply-chain for Electronic Gases used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 ELECTRONIC GASES BUSINESS - MARKET OVERVIEW

- 1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK

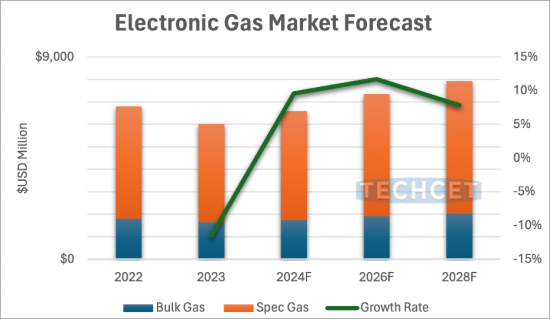

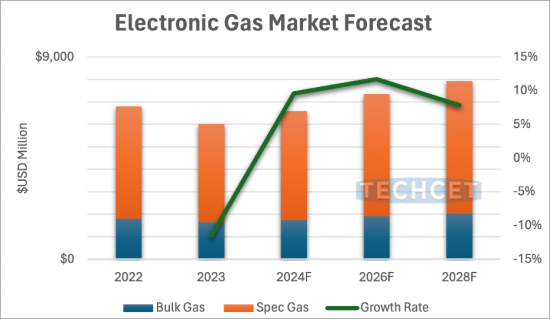

- 1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 1.5 ELECTRONIC GASES SEGMENT TRENDS

- 1.6 TECHNOLOGY TRENDS

- 1.7 COMPETITIVE LANDSCAPE - ELECTRONIC GASES

- 1.7.1 COMPETITIVE LANDSCAPE - INDUSTRIAL GASES

- 1.8 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.10 ANALYST ASSESSMENT OF ELECTRONIC GASES

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 ELECTRONIC GASES MARKET TRENDS

- 4.1 ELECTRONIC GASES MARKET TRENDS - OUTLINE

- 4.1.1 2023 ELECTRONIC GASES MARKET LEADING INTO 2024

- 4.1.2 ELECTRONIC GASES MARKET OUTLOOK

- 4.1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 4.2 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, OVERVIEW

- 4.2.1 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.2 ELECTRONIC GASES PRODUCTION BY REGION

- 4.2.3 ELECTRONIC GASES PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2.4.1 REGIONAL ACTIVITY SPECIALTY GAS INVESTMENTS

- 4.2.5 INVESTMENT ACTIVITY ADDITIONAL COMMENTS

- 4.2.6 RARE GASES - XE, KR, NE - SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.2.6.1 SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND, SELECT GASES

- 4.2.6.2 SUPPLY VS. DEMAND BALANCE - NEON

- 4.2.6.3 SUPPLY VS. DEMAND BALANCE - NEON (CONTINUED)

- 4.2.6.4 SUPPLY VS. DEMAND BALANCE - XENON

- 4.2.6.5 SUPPLY VS. DEMAND BALANCE - KRYPTON

- 4.2.7 HELIUM SUPPLY V. DEMAND

- 4.2.7.1 SUPPLY VS. DEMAND BALANCE - HELIUM

- 4.2.7.2 SUPPLY VS. DEMAND BALANCE - REGIONAL HELIUM SUPPLY

- 4.2.7.3 HELIUM SUPPLY RISK BY COUNTRY 2030

- 4.2.7.4 KEY PLAYERS IN THE HELIUM SUPPLY CHAIN

- 4.2.8 SUPPLY VS. DEMAND BALANCE - NF3, NITROGEN TRIFLUORIDE

- 4.2.8.1 ELECTRONIC GASES MARKET OUTLOOK - NF3

- 4.2.9 SUPPLY VS. DEMAND BALANCE - WF6, TUNGSTEN HEXAFLUORIDE

- 4.3 PRICING TRENDS

- 4.3.1 PRICING TRENDS - NEON

- 4.3.2 PRICING TRENDS - XENON

- 4.3.3 PRICING TRENDS - KRYPTON

- 4.3.4 HELIUM PRICE TREND & FORECAST

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1 ELECTRONIC GASES GENERAL TECHNOLOGY OVERVIEW

- 4.4.2 ELECTRONIC GASES TECHNOLOGY TRENDS

- 4.4.3 SPECIALTY/EMERGING MATERIAL AND APPLICATIONS

- 4.4.4 WF6 MARKET DEMAND, POTENTIAL DISPLACEMENT BY MOLYBDENUM

- 4.4.5 ALE ETCH GAS LISTING

- 4.4.6 SUMMARY OF TECHNICAL TRENDS AND OPPORTUNITIES

- 4.5 REGIONAL CONSIDERATIONS

- 4.6 EHS AND TRADE/LOGISTIC ISSUES

- 4.6.1 RUSSIA INVASION OF UKRAINE

- 4.6.2 YEMEN'S HOUTHI ATTACKS IN THE RED SEA AND GULF OF ADEN DISRUPT GLOBAL SHIPPING

- 4.6.3 NEW MIDDLE EAST CONFLICT COULD DISRUPT GLOBAL TECH SUPPLY CHAIN AND INTEL'S EXPANSION PLANS

- 4.6.4 PANAMA CANAL HISTORIC DROUGHT

- 4.6.5 EHS ISSUES

- 4.6.6 EHS ISSUES

- 4.6.7 TRADE/LOGISTICS ISSUES

- 4.7 ANALYST ASSESSMENT OF ELECTRONIC GASES MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 ELECTRONIC GASES MARKET SHARE

- 5.1.1 INDUSTRIAL GASES MARKET SHARE

- 5.2 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 5.2.1 US SUPPLIER RANKING

- 5.3 LINDE PLC FULL YEAR 2023 AND Q4 - ROBUST EARNINGS GROWTH DESPITE SALES DECLINE, FORECASTS CONTINUED STRONG PERFORMANCE

- 5.3.1 AIR LIQUIDE'S Q4 AND 2023 REVENUES WEIGHED BY DECLINING ENERGY PRICES, BUT SHOWING POSITIVE METRICS

- 5.3.2 MERCK'S ELECTRONICS SECTOR FACES 4% ORGANIC SALES DECLINE IN Q3 2023, IMPACTED BY SEMICONDUCTOR SLOWDOWN AND MARKET PRESSURES

- 5.3.3 TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- 5.4 REGIONAL TRENDS- KOREA

- 5.4.1 REGIONAL TRENDS- JAPAN

- 5.4.2 REGIONAL TRENDS- CHINA

- 5.4.3 REGIONAL TRENDS - RUSSIA

- 5.4.4 REGIONAL TRENDS- USA

- 5.4.5 REGIONAL TRENDS- EU

- 5.5 M&A ACTIVITY AND PARTNERSHIPS

- 5.5.1 M&A ACTIVITY AND PARTNERSHIPS

- 5.6 PLANT CLOSURES / DIVESTITURES

- 5.7 NEW ENTRANTS

- 5.8 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.9 TECHCET ANALYST ASSESSMENT OF ELECTRONIC GAS SUPPLIERS

6 SUB-TIER SUPPLY CHAIN, ELECTRONIC GASES

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 BULK GASES AND THEIR SOURCES

- 6.1.2 FLUORSPAR SUPPLY

- 6.1.2.1 FLUORSPAR WORLD RESERVES

- 6.1.2.2 FLUORSPAR SUPPLY, DEMAND AND PRICING IMPACTS

- 6.1.3 BROMINE SUPPLY

- 6.2 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 6.3 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- Air Liquide

- Air Products

- Air Water

- Cryoin Engineering

- DuPont

- ...AND 20+ MORE

8 APPENDIX

- 8.1 GASES USED BY MULTIPLE INDUSTRIES

- 8.1.1 SPECIALTY GAS INDUSTRY MATRIX

- 8.1.2 GASES USED FOR SEMICONDUCTOR DEVICE MANUFACTURING

- 8.1.3 GASES USED IN THE DISPLAY INDUSTRY

- 8.2 SUPPLIER LISTING BY GAS TYPE

- 8.2.1 HYDRIDES

- 8.2.2 SILICON PRECURSORS (SILANES)

- 8.2.3 ETCHANTS/CHAMBER CLEAN

- 8.2.4 DEPOSITION/MISC

- 8.2.5 BULK GASES

- 8.3 ETCH GAS ROADMAPS

- 8.3.1 ETCH ROADMAPS 1 OF 3

- 8.3.2 ETCH ROADMAPS 2 OF 3

- 8.3.3 ETCH ROADMAPS 3 OF 3

LIST OF FIGURES

- FIGURE 1.1: ELECTRONIC GAS MARKET

- FIGURE 1.2: HELIUM DEMAND 2023 - 7.4 BCF

- FIGURE 1.3: TOTAL ELECTRONIC GAS MARKET SHARE 2023, US$6.01B

- FIGURE 1.4: TOTAL INDUSTRIAL GAS MARKET SHARE 2023, US$104B

- FIGURE 1.5: TOP-5 ELECTRONIC GASES MAKERS' QUARTERLY COMBINED SALES (LINDE, AL, AP, RESONAC, TNSC)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.5: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.6: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.7: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.8: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.9: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.10: ESTIMATED GLOBAL FAB SPENDING 2022-2027

- FIGURE 3.11: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.12: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.13: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.14: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.15: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.18: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.19: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: ELECTRONIC GAS MARKET

- FIGURE 4.2: HELIUM DEMAND 2023 - 7.4 BCF

- FIGURE 4.3: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- FIGURE 4.4: NEON SUPPLY/DEMAND FORECAST

- FIGURE 4.5: GLOBAL NEON REVENUES

- FIGURE 4.6: XENON SUPPLY/DEMAND FORECAST

- FIGURE 4.7: GLOBAL XENON REVENUES

- FIGURE 4.8: KRYPTON SUPPLY/DEMAND FORECAST

- FIGURE 4.9: GLOBAL KRYPTON REVENUES

- FIGURE 4.10: HELIUM SUPPLY & DEMAND (BCF)

- FIGURE 4.11: HELIUM DEMAND BY APPLICATION 2023 - 5.9 BCF

- FIGURE 4.12: WW HELIUM CAPACITY BY REGION 2023 VS. 2028 (BCF)

- FIGURE 4.13: HELIUM SUPPLY RISK BY COUNTRY 2030

- FIGURE 4.14: NF3 SUPPLY/DEMAND FORECAST

- FIGURE 4.15: WF6 SUPPLY/DEMAND FORECAST

- FIGURE 4.16: WORLDWIDE NOBLE GASES ASP TREND

- FIGURE 4.17: MO PRECURSORS

- FIGURE 4.18: PLASMA AND THERMAL ALE PROCESSES

- FIGURE 4.19: 2023 SEMICONDUCTOR ELECTRONIC GASES REVENUE SHARE BY REGION

- FIGURE 4.20: GREENHOUSE GAS PROTOCOL, DETAILED CATEGORIES

- FIGURE 4.21: SCOPE 3 EMISSIONS FOR SEMICONDUCTOR COMPANIES

- FIGURE 4.22: CO2-EQUIVALENT EMISSIONS FOR TYPICAL FAB

- FIGURE 5.1: TOTAL ELECTRONIC GAS MARKET SHARE 2023, US$6.01B

- FIGURE 5.2: TOTAL INDUSTRIAL GAS MARKET SHARE 2023, US$104 B

- FIGURE 5.3: TOP-5 ELECTRONIC GASES MAKERS' QUARTERLY COMBINED SALES (LINDE, AL, AP, RESONAC, TNSC)

- FIGURE 5.4: AIR LIQUIDE'S Q4 AND 2023 REVENUES

- FIGURE 5.5: MERCK'S 2023 REVENUES

- FIGURE 5.6: TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- FIGURE 5.7: KOREA SEMICONDUCTOR DEVELOPMENT PLAN

- FIGURE 6.1: LEADING COUNTRIES BASED ON MINE PRODUCTION OF FLUORSPAR WORLDWIDE IN 2023

- FIGURE 6.2: WW RESERVES OF FLUORSPAR IN 2023, BY COUNTRY (US$/KILOTONNE)

- FIGURE 6.3: FLUORSPAR PRICE IN US 2014-2023 (US$/KILOTONNE)

- FIGURE 6.4: WW BROMINE SUPPLY 2023 (KILOTONNES)

- FIGURE 8.1: ELECTRONIC SPECIALTY GASES

- FIGURE 8.2: BULK GASES

LIST OF TABLES

- TABLE 1.1: ELECTRONIC GASES(S) GROWTH OVERVIEW

- TABLE 1.2: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 1.3: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: ELECTRONIC GASES SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.2: OVERVIEW OF ANNOUNCED 2023/2024 ELECTRONIC GASES SUPPLIER INVESTMENTS

- TABLE 4.3: REGIONAL SUMMARY OF GAS MARKET

- TABLE 4.4: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- TABLE 4.5: SUPPLIERS WITH LOCATIONS IN AREAS OF HIGH RISK

- TABLE 4.6: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE

- TABLE 5.1: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 5.2: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 5.3: ESTIMATED SUPPLY CHAIN SUPPLIER RANKING

- TABLE 6.1: BULK AND INERT GAS APPLICATION AND SOURCE DESCRIPTION

- TABLE 8.1: SPECIALTY GAS INDUSTRY MATRIX

- TABLE 8.2: GASES USED IN FPD MANUFACTURING

- TABLE 8.3: HYDRIDE GAS SUPPLIERS

- TABLE 8.4: SILICON PRECURSOR SUPPLIERS

- TABLE 8.5: ETCHANT GAS SUPPLIERS

- TABLE 8.6: DEPOSITION/MISC. GAS SUPPLIERS

- TABLE 8.7: BULK GAS SUPPLIERS

- TABLE 8.8: ETCH ROADMAPS

- TABLE 8.9: ETCH ROADMAPS

- TABLE 8.10: ETCH ROADMAPS

02-2729-4219

+886-2-2729-4219