|

市場調查報告書

商品編碼

1630419

歐洲液化天然氣燃料庫-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe LNG Bunkering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

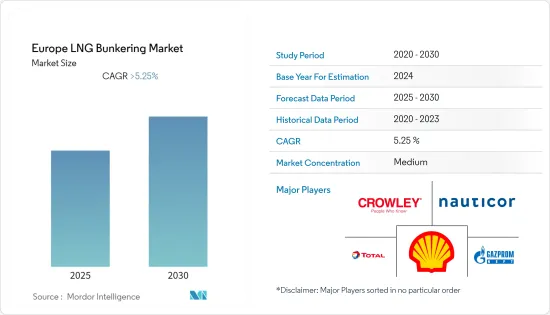

預計歐洲液化天然氣燃料庫市場在預測期內將維持超過5.25%的複合年成長率。

由於地區關閉,COVID-19 大流行對市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 地方政府和國際海事組織為控制排放實施的嚴格環境法規,加上豐富的天然氣供應,預計將刺激所研究市場的成長。

- 然而,一些國家沒有發達的液化天然氣燃料庫基礎設施,這可能會在預測期內阻礙市場。

- 液化天然氣運輸船的訂單和交付量正在增加,而天然氣價格的下降標誌著未來幾年此類船舶機會擴大的開始。

- 預計挪威將在預測期內主導歐洲液化天然氣燃料庫市場。

歐洲液化天然氣燃料庫市場趨勢

渡輪和 OSV 領域佔據市場主導地位

- 渡輪是用於在水上運輸貨物的船隻。客運渡輪用作水上巴士或計程車,從一個地方前往另一個地方。不同的渡輪包括雙頭渡輪、水翼船、氣墊船、雙體船、滾裝/滾裝船、郵輪渡輪 (RoPax) 和高速 RoPax 渡輪。

- 這些船舶主要使用重油、石油和天然氣。然而,政府有關硫、二氧化碳和其他污染物排放的法規鼓勵使用液化天然氣作為船舶燃料。

- 鑑於液化天然氣動力渡輪和 OSV 的大量訂單,未來五年,液化天然氣動力渡輪和 OSV 的數量預計將增加。在預測期內,對液化天然氣燃料庫服務的需求可能會增加。

- 《歐洲綠色交易》由歐盟委員會於 2019 年制定,是旨在 2050 年實現歐洲碳中和的一系列措施舉措。它簡潔地強調了液化天然氣在實現這一目標方面的重要性,並強調了其作為卡車和船舶燃料的用途。

- 然而,有關燃料中硫含量的法規使得使用液化天然氣對這些類型的船舶具有吸引力。原因是營運狀況以及經濟、監管和環境原因。

挪威主導市場

- 挪威一直是全球液化天然氣燃料庫市場的先驅。 2000年,世界上第一艘液化天然氣燃料船Glutra汽車和客運渡輪在挪威投入營運。 17年後的2017年,挪威運作了歐洲最大的專用液化天然氣燃料庫站Hammer Festo,其儲存容量為1250立方米,泵送能力為90噸/小時。

- 氣候問題仍然是挪威高度關注的問題。挪威政府根據《巴黎協定》的溫室氣體排放目標和歐盟排放標準,制定了雄心勃勃且嚴格的排放標準。

- 為了回應全球對海上運輸有害污染物排放日益成長的擔憂,挪威在挪威氮氧化物基金的幫助下成為液化天然氣運輸船的早期投資者。它是由挪威政府主導的。

- 此外,挪威政府正致力於透過管道向其他歐洲國家出口液化天然氣,並削弱俄羅斯對該地區的控制。 2020年初,管道系統營運商Gassco宣布核准其液化天然氣管道,以加強北極巴倫支海的小規模液化天然氣出口。

- 因此,在預測期內,挪威對液化天然氣燃料庫設施的需求大幅增加。

歐洲液化天然氣燃料庫產業概況

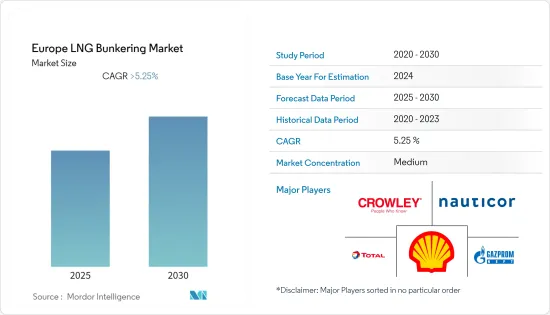

歐洲液化天然氣燃料庫市場適度整合。該市場的主要企業(排名不分先後)包括荷蘭皇家殼牌公司、道達爾公司、克勞利海事公司、Nauticor GmbH &Co.KG 和 Gazpromneft Marine Bunker LLC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 最終用戶

- 油輪船隊

- 貨櫃船隊

- 散裝雜貨車隊

- 渡輪和 OSV

- 其他

- 地區

- 挪威

- 西班牙

- 荷蘭

- 英國

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Shell Plc

- TotalEnergies SE

- Crowley Maritime Corporation

- Nauticor GmbH & Co. KG

- Harvey Gulf International Marine LLC

- ENN Energy Holdings Ltd

- Engie SA

- Gazpromneft Marine Bunker LLC

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 71257

The Europe LNG Bunkering Market is expected to register a CAGR of greater than 5.25% during the forecast period.

The COVID-19 outbreak negatively impacted the market due to regional lockdowns. Currently, the market reached pre-pandemic levels.

Key Highlights

- Stringent environmental regulations imposed by local government bodies and IMO to curb emissions, coupled with the abundant natural gas availability, are expected to stimulate the industry growth of the market studied.

- However, some countries lack of LNG bunkering infrastructure will likely hinder the market during the forecast period.

- The orders and deliveries of LNG-powered vessels are increasing, and the reduced natural gas prices marked the beginning of expanding opportunities for such vessels in the coming years.

- During the forecast period, Norway is expected to dominate the LNG bunkering market in Europe.

Europe LNG Bunkering Market Trends

Ferries & OSV Segment to Dominate the Market

- Ferries are vessels used to carry cargo across the water. A passenger ferry is used as a water bus or taxi to travel from one place to another. Various ferries include double-ended, hydrofoil, hovercraft, catamaran, roll-on/ roll-off, cruise ferry (RoPax), fast RoPax ferry, and others.

- These vessels majorly operate on heavy fuel oil and marine gas oil. However, government regulations regarding the emission of sulfur, carbon dioxide, and other pollutants encourage using LNG as fuel in vessels.

- In the next five years, the LNG-based ferries and OSVs are projected to increase, considering the large number of LNG-fueled ferries and OSVs on order. It is likely to increase the demand for LNG bunkering services in the forecast period.

- European Green Deal, formed in 2019 by the European Commission, is a set of policy initiatives to make Europe carbon neutral by 2050. It briefly underlines the importance of LNG for achieving this aim and emphasizes the usage of LNG as fuel for trucks and marine vessels.

- However, with the regulations related to sulfur content in the fuel, the option of using LNG is attractive to these types of vessels. It is because of the operating profile and economic, regulatory, and environmental reasons.

Norway to Dominate the Market

- Norway is always a pioneer country in the global LNG bunkering market. In 2000, the world's first LNG-fueled vessels, the Glutra car and passenger ferry, were made operational in Norway. Seventeen years later, in 2017, Hammerfest, Europe's largest dedicated LNG bunkering station with 1250 m3 storage and a pump capacity of 90 tons/hour, was operational in Norway.

- The focus on climate issues remains high in Norway. The Norwegian government is setting ambitious and stern emission norms to align itself with the greenhouse gas emissions targets of the Paris Agreement and within the EU emission standards.

- To counter the increasing global concerns regarding the harmful emission of pollutants from marine transportation, Norway invested early in LNG ships and was helped by the Norwegian NOx fund. The Norwegian government initiated it.

- Moreover, the country's government is focusing on exporting LNG through a pipeline to other European countries to reduce the domination of Russia in the region. In early 2020, the pipeline system operator, Gassco, announced that the company approved its LNG pipeline to boost its small-scale LNG exports from the Arctic Barents Sea.

- Hence, this significantly increased the demand for LNG bunkering facilities in Norway during the forecast period.

Europe LNG Bunkering Industry Overview

The Europe LNG bunkering market is moderately consolidated. Some of the major players in this market (in no particular order) include Royal Dutch Shell Plc, Total SA, Crowley Maritime Corporation, Nauticor GmbH & Co. KG, and Gazpromneft Marine Bunker LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Tanker Fleet

- 5.1.2 Container Fleet

- 5.1.3 Bulk and General Cargo Fleet

- 5.1.4 Ferries and OSV

- 5.1.5 Others

- 5.2 Geography

- 5.2.1 Norway

- 5.2.2 Spain

- 5.2.3 Netherlands

- 5.2.4 United Kingdom

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell Plc

- 6.3.2 TotalEnergies SE

- 6.3.3 Crowley Maritime Corporation

- 6.3.4 Nauticor GmbH & Co. KG

- 6.3.5 Harvey Gulf International Marine LLC

- 6.3.6 ENN Energy Holdings Ltd

- 6.3.7 Engie SA

- 6.3.8 Gazpromneft Marine Bunker LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219