|

市場調查報告書

商品編碼

1630454

亞太地區屋頂太陽能:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Asia-Pacific Rooftop Solar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

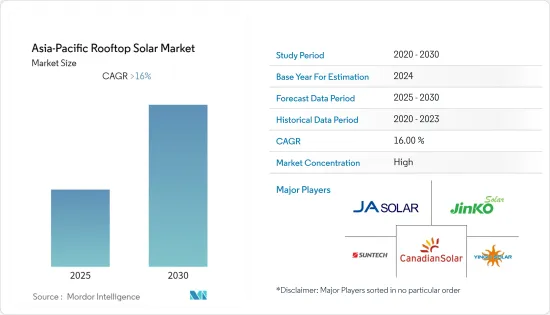

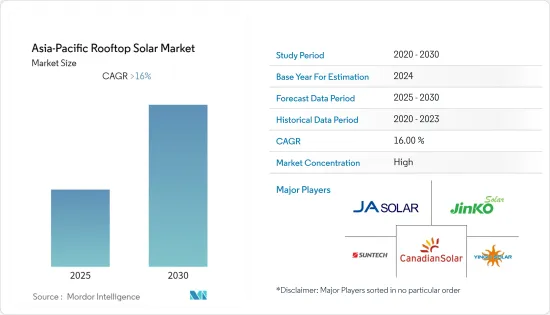

預計亞太地區屋頂太陽能市場在預測期內的複合年成長率將超過 16%。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 短期內,有利的政府措施和對獲得能源安全日益成長的興趣預計將推動市場。

- 另一方面,風力發電等其他再生能源來源的滲透率不斷提高是一個主要限制因素,預計將在預測期內阻礙市場成長。

- 此外,分散式太陽能發電因其經濟效益和提供持續能源供應的能力而受到歡迎,消除了傳統電網電壓波動造成的設備損壞,並正在提高分散式太陽能發電在亞太地區的普及度。市場帶來重大機會。

- 由於中國電力需求的持續成長以及預計增加可再生能源在電力結構中所佔佔有率的目標,中國將在預測期內主導亞太屋頂太陽能發電市場。

亞太地區屋頂太陽能市場趨勢

商業和工業領域預計將主導市場

- 屋頂太陽能市場是亞太地區商業和工業領域成長最快的清潔能源技術之一。受歡迎程度的提高是由於政府在安裝激勵和稅收減免等財政支持方面加強了支持。此外,太陽能電池板成本的下降和效率的提高正在推動這一領域的需求。

- 亞太地區是重要的開發中地區,包括中國、印度等國家。這些國家的工業部門有龐大的能源需求,是太陽能屋頂公司進入的潛在市場。

- 亞太地區太陽能發電裝置容量在過去幾十年中大幅成長,從2012年的20.03GW達到2021年的504.37GW。過去十年,該地區的裝置容量增加了 25 倍。這意味著該地區的太陽能發電組合正在增加。

- 此外,2022年7月,中國住宅部門和國家發展和改革委員會宣布,計劃在2025年,都市區50%的新建公共建築和工廠安裝太陽能板。到2023年終,國家能源局將安裝50%的政黨和政府建築屋頂、40%的學校、醫院和其他公共設施、30%的工業場所、20%的農村住宅我提案用太陽能電池板覆蓋它。已有31個省份、676個地市州報名參加該計劃。

- 因此,隨著屋頂太陽能發電工程在一些地區正在進行和完成,商業和工業領域預計將在預測期內主導市場。

中國主導市場

- 屋頂太陽能發電裝置正在取得顯著發展,這主要是受到政府有利措施和獎勵的推動。該國的電力系統正在向低碳和分散模式轉型。此外,為了加速實現淨零排放目標,各國政府正加強支持力度,加速採用屋頂太陽能等清潔能源技術。

- 該國屋頂太陽能業務的主要驅動力之一是對永續能源的需求不斷成長和太陽能價格下降。屋頂太陽能發電的成本已經與中國工商業需求者的零售電價競爭。

- 中國的太陽能發電裝置正在顯著增加。 2012年為672萬千瓦,但截至2021年,中國已安裝太陽能發電306.4吉瓦。 10年間該國裝置容量增加了45倍以上。預計類似的趨勢在預測期內也將持續。

- 2021年,中國國家能源局宣布了一項新舉措,要求地方政府與太陽能開發商合作建造屋頂陣列。該計劃將允許建築物業主購買太陽能電池板並將其產生的電力出售給開發商,或者開發商可以租用屋頂空間並安裝自己的太陽能電池板。

- 此外,2022 年 8 月,中國政府宣佈在中國江西省的 11 個屋頂上建造 120 兆瓦太陽能發電設施。本計劃由11個子設備組成,佔地工業屋頂總合面積約66.5萬平方公尺。本計劃採用中信博的BIPV-Zhiro解決方案,預計每年發電量約120GWh。

- 因此,由於價格下降以及政府對大多數建築物屋頂太陽能安裝的要求增加,預計中國將在預測期內主導市場。

亞太地區屋頂太陽能發電產業概況

亞太地區屋頂太陽能市場區隔:市場主要企業包括(排名不分先後)晶澳太陽能、晶科能源、尚德電力、英利綠色能源和阿特斯陽光電力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年裝置容量及預測(單位:GW)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 最終用戶

- 住宅市場

- 商業/工業

- 市場分析:按地區(2028 年之前的市場規模和需求預測)

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- JA Solar Holdings Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Suntech Power Holdings Co., Ltd.

- Yingli Green Energy Holding Co., Ltd.

- Canadian Solar Inc.

- Huawei Technologies Co., Ltd.

- Sungrow Power Supply Co. Ltd

- Trina Solar Limited

- Hanwha SolarOne Co. Ltd.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 71565

The Asia-Pacific Rooftop Solar Market is expected to register a CAGR of greater than 16% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the short term, favorable government policies and an increasing focus on gaining energy security are expected to drive the market.

- On the other hand, increasing penetration of other renewable energy sources like wind energy is major restraint expected to hinder the market's growth during the forecasted period.

- Moreover, the increasing popularity of distributed solar power generation in terms of economic benefits and ability to provide constant energy, which eliminates equipment damage due to voltage fluctuations in the conventional power grid, is expected to create significant opportunities for the Asia-pacific rooftop solar market.

- China is expected to dominate in the Asia-Pacific rooftop solar market over the forecast period due to the constantly increasing power demand in the country and the target for increasing renewable energy share in the power mix.

Asia-Pacific Rooftop Solar Market Trends

Commercial and Industrial Segment is Expected to Dominate the Market

- The rooftop solar PV market is one of the fastest-growing clean energy technologies in Asia-Pacific commercial and industrial segments. The increasing popularity is due to the increasing government supports in incentives and financial assistance like tax benefit for installation. Moreover, the declining cost of solar panels and their increasing efficiency have propelled their demand in the segment.

- The Asia-pacific region is a significant developing region with countries like China and India, amongst others. These countries have massive energy demand from their industrial segment, serving as a high-potential market for solar rooftop companies to penetrate.

- The solar PV installation capacity in the Asia-Pacific region has increased significantly in past decades, from 20.03 GW in 2012 to 504.37 GW in 2021. The installed capacity in the region has grown by 25 folds in the last decade. This signifies the increasing solar PV portfolio in the region.

- Furthermore, In July 2022, China's housing department and the National Development and Reform Commission announced the plans for new-build public buildings and factories in towns and cities to be covered at 50% by solar panels by 2025. By the end of 2023, the National Energy Bureau proposed to cover with solar panels 50% of rooftop space on party and government buildings, 40% of schools, hospitals, and other public buildings, 30% of industrial and commercial spaces, and 20% of rural households. A total of 676 counties from 31 provinces have registered for the scheme.

- Therefore, with the regions undergoing and completing rooftop solar projects, the commercial and industrial segment is expected to dominate the market over the forecast period.

China to Dominate the Market

- The rooftop solar PV installations are witnessing significant developments driven mainly by favorable government policies and incentives. The country's electricity system is transitioning to low carbon and a more distributed model. Further, to foster the change to the net zero-emission target, the government is offering increased support to increase the penetration of clean energy technologies such as rooftop solar PV.

- One of the critical drivers for the country's rooftop solar business is the rising demand for sustainable energy and falling solar PV prices. Rooftop solar costs are already competitive with retail electricity prices for industrial and commercial customers in China.

- Solar PV installations have increased significantly in the country. As of 2021, China had installed 306.4 GW of solar PV compared to 6.72 GW in 2012. The installation capacity in the country has increased by more than 45 folds in 10 years. A similar trend is expected to be followed during the forecasted period.

- In 2021, China's National Energy Bureau announced a new initiative for local governments to partner with solar developers to build rooftop arrays. Under the scheme, building owners can purchase solar panels and sell the power they generate to developers, or developers can lease rooftop space to install solar panels they own.

- Furthermore, in August 2022, the Chinese government announced a new 120 MW solar installation spread across 11 rooftops in China's Jiangxi province, which is expected to be the world's largest single-capacity, building-integrated PV project. The project consists of 11 sub-installations covering a total rooftop space of roughly 665,000 square meters in an industrial park. The project uses the CITIC Bo BIPV-Zhiro solution and is expected to generate around 120 GWh of solar energy annually.

- Hence China is expected to dominate the market during the forecasted period due to declining prices and increasing government mandate on most buildings' solar rooftop installations.

Asia-Pacific Rooftop Solar Industry Overview

The Asia-Pacific rooftop solar market is fragmented. Some of the primary critical players in the market include (in no particular order) JA Solar Holdings Co., Ltd., JinkoSolar Holding Co., Ltd., Suntech Power Holdings Co., Ltd., Yingli Green Energy Holding Co., Ltd., and Canadian Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-Users

- 5.1.1 Residential

- 5.1.2 Commercial and Industrial

- 5.2 Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 India

- 5.2.2 China

- 5.2.3 Japan

- 5.2.4 Australia

- 5.2.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 JA Solar Holdings Co., Ltd.

- 6.3.2 JinkoSolar Holding Co., Ltd.

- 6.3.3 Suntech Power Holdings Co., Ltd.

- 6.3.4 Yingli Green Energy Holding Co., Ltd.

- 6.3.5 Canadian Solar Inc.

- 6.3.6 Huawei Technologies Co., Ltd.

- 6.3.7 Sungrow Power Supply Co. Ltd

- 6.3.8 Trina Solar Limited

- 6.3.9 Hanwha SolarOne Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219