|

市場調查報告書

商品編碼

1690139

印度屋頂太陽能:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Rooftop Solar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

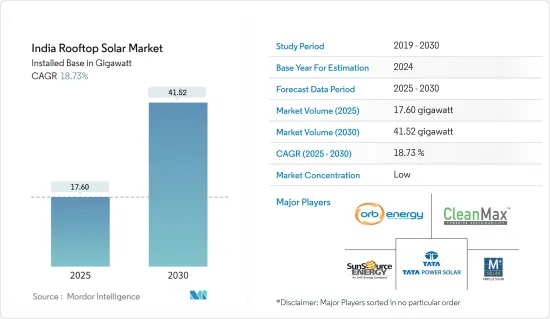

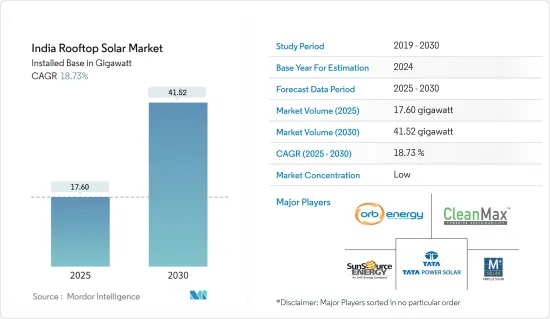

就裝置容量而言,印度屋頂太陽能市場規模預計將從 2025 年的 17.60 吉瓦成長到 2030 年的 41.52 吉瓦,預測期間(2025-2030 年)的複合年成長率為 18.73%。

主要亮點

- 從長遠來看,商業和工業部門的需求不斷成長以及政府對可再生能源整合的關注等因素預計將成為市場成長的主要驅動力。

- 另一方面,屋頂計劃安裝速度緩慢可能會抑制未來幾年印度屋頂太陽能市場的成長。

- 然而,尚未開發的太陽能潛力和日益分散化使得住宅和工業客戶減少對中央電網的依賴,預計這將在預測期內帶來成長機會。

印度屋頂太陽能市場趨勢

預計併網部分將佔據市場主導地位

- 在併網屋頂系統中,太陽能發電面板或陣列透過電源逆變器單元連接到公用電網,並與公用電網並行運作。消費者產生的電力透過淨計量系統輸送到中央電網。商業、工業和住宅消費者通常使用此類連接來減少電費。

- 在印度,由於政府的各項政策和舉措,併網太陽能發電系統近年來得到了顯著發展。預計這將有助於實現2030年的國家可再生能源目標。

- 印度推出了併網太陽能屋頂計劃,以鼓勵各邦和中央政府安裝屋頂太陽能設備。印度的目標是到2026年3月底,實現併網屋頂太陽能計劃的累積設備容量達到約4萬兆瓦。

- 例如,新和可再生能源部於 2019 年 3 月啟動了屋頂太陽能計畫第二階段方案,以實現既定目標。根據該計劃,該部將向消費者提供中央財政援助(CFA),用於在個人家庭或居民福利協會/集體住宅協會安裝屋頂太陽能(RTS)。

- 2023 年 9 月將推出一個國家入口網站,以方便消費者在線上建立 RTS。全國各地的住宅消費者均可申請安裝屋頂太陽能板,並將補貼直接存入銀行帳戶。

- 根據尼泊爾新可再生能源部 (MNRE) 的數據,2023-2024 年期間,併網屋頂太陽能的累積設備容量將達到 11.8 吉瓦,比 2022-2023 年的 8.9 吉瓦成長 33.86%。裝置容量的激增主要得益於 2023 年多個大型太陽能發電工程的運作使用和併網。

- 古吉拉突邦、馬哈拉斯特拉邦和卡納塔克邦是電網屋頂太陽能容量最高的邦。截至2024年3月,預計發電容量:古吉拉突邦345萬千瓦、卡納塔克邦790萬千瓦、拉賈斯坦邦115萬千瓦。

- 總體而言,由於屋頂太陽能發電的採用率不斷提高,政府以支持政策和計劃的形式提供的支持以及雄心勃勃的可再生能源目標等因素,印度屋頂併網市場的併網部分預計將在預測期內大幅成長。

政府對可再生能源整合的重視可望推動市場

- 根據印度新可再生能源部(MNRE)的數據,印度的太陽能部署在全球排名第五。截至 2023 年 6 月 30 日,印度總合70.1 吉瓦的太陽能發電工程運作。其中包括5722萬千瓦地面太陽能計劃、1037萬千瓦屋頂太陽能計劃和251萬千瓦離網太陽能計劃。

- 截至 2023 年 3 月,屋頂太陽能容量已增加至 8,877 兆瓦(截至 2022 年 9 月 30 日為 7,520 兆瓦)。成長的主要驅動力是住宅消費者意識的提高和政府針對住宅領域的補貼。

- 政府制定了全面的政策和政策來支持屋頂太陽能的採用。各國政府已經實施了多項淨計量舉措,允許屋頂太陽能用戶將其產生的多餘電力賣回給電網,從而提供經濟效益並有助於穩定電網。

- 例如,2024 年 3 月,拉賈斯坦邦電力監管委員會 (RERC) 將屋頂太陽能裝置的淨計量限額從 500kW 提高到 1MW。該委員會的決定是透過特別命令做出的,旨在透過擴大淨計量容量來鼓勵更多採用屋頂太陽能裝置。

- 此外,2023 年 11 月,泰米爾納德邦電力監管委員會 (TNERC) 發布了一項新命令,支持該州政府的指令,免除中小微型企業屋頂太陽能消費者 50% 的網路費用。

- 截至 2023 年 3 月,MNRE 宣布已安裝了約 40.4 兆瓦的屋頂太陽能容量,而 2023 年 1 月的目標是 357.9 兆瓦。

- 2023年8月,馬哈拉斯特拉邦電力監管委員會提案監管修正案,將太陽能屋頂計劃的淨計量上限提高至1兆瓦。在印度大多數邦,MNRE 規定的屋頂太陽能發電廠的淨計量容量約為 500kW。如果該修正案核准,可能會導致大型消費者對屋頂太陽能計劃的採用增加。這可能有利於發展印度的屋頂太陽能市場。

- 此類政府獎勵通常包括補貼、稅收稅額扣抵、津貼、貸款和額外的綠色信貸。印度政府正在針對住宅、商業和工業(C&I)太陽能發電系統推出新的具有經濟吸引力的激勵措施。預計這將在預測期內推動市場發展。

印度屋頂太陽能產業概況

印度屋頂太陽能市場比較分散。該市場的主要企業包括 Clean Max Enviro Energy Solutions Pvt。有限公司、塔塔電力太陽能系統有限公司、Orb Energy Pvt. Ltd、Amplus Solar Power Private Limited 和 Sunsource Energy Pvt.有限公司

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 政府注重可再生能源整合

- 商業和工業領域的需求不斷增加

- 限制因素

- 屋頂計劃安裝進度緩慢

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 最終用戶

- 產業

- 商業(包括公共部門)

- 住宅

- 網格類型(僅限定性分析)

- 併網

- 離網

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Cleantech Energy Corporation Pte Ltd

- Fourth Partner Energy Pvt. Ltd

- Amplus Solar Power Pvt. Ltd

- Clean Max Enviro Energy Solutions Pvt. Ltd

- Sunsource Energy Pvt. Ltd

- Orb Energy Pvt. Ltd.

- Tata Power Solar Systems Limited

- Mahindra Susten Pvt. Ltd

- Growatt New Energy Technology Co. Ltd

- Roofsol Energy Pvt. Ltd

- 市場排名分析

第7章 市場機會與未來趨勢

- 尚未開發的太陽能潛力和對擴大分散化的關注

簡介目錄

Product Code: 70202

The India Rooftop Solar Market size in terms of installed base is expected to grow from 17.60 gigawatt in 2025 to 41.52 gigawatt by 2030, at a CAGR of 18.73% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as increasing demand in the commercial and industrial sectors and government emphasis on renewable energy integration are expected to be significant drivers for the market's growth.

- On the other hand, slow-paced installation of rooftop projects may likely restrain the growth of the Indian rooftop solar market over the coming years.

- Nevertheless, the untapped solar potential and focus on increasing decentralization would enable residential and industrial customers to rely less on central grids, which is expected to be a growth opportunity during the forecast period.

India Rooftop Solar Market Trends

The On-grid Segment is Expected to Dominate the Market

- In the on-grid rooftop system, photovoltaic panels or arrays are connected to the utility grid through a power inverter unit, allowing them to operate in parallel with the electric utility grid. The electricity generated by consumers is fed into the central power grid through a net-metering scheme. Such kind of connection is commonly used by commercial, industrial, and residential consumers to reduce electricity bills.

- In India, on-grid or grid-connected solar PV systems have witnessed significant growth in recent years owing to the various government policies and initiatives. This is likely to support the country in achieving its 2030 national renewable energy target.

- The country introduced the Grid Connected Solar Rooftop Scheme to promote solar rooftop installation by the state and central government. India aims to achieve a cumulative installed capacity of about 40,000 MW from Grid Connected Rooftop solar projects by the end of March 2026.

- For instance, the Ministry of New and Renewable Energy launched the Rooftop Solar Programme Phase-II scheme in March 2019 to reach the set targets. Under the scheme, the ministry is expected to provide consumers with Central Financial Assistance (CFA) for installing Rooftop Solar (RTS) in individual households or Resident Welfare Associations/Group Housing Societies.

- In September 2023, the National Portal was launched to ease the online process for consumers to install RTS. Residential consumers from any part of the country are eligible to apply for the installation of rooftop solar panels and receive a subsidy directly in their bank accounts.

- According to the Ministry of New and Renewable Energy (MNRE), during the 2023-2024 period, the cumulative solar rooftop installed capacity connected to the grid reached 11.8 GW, representing an increase of 33.86% from 8.9 GW in the 2022-2023 period. Several large-scale solar energy projects were operational and connected to the grid during 2023, which was majorly responsible for the sharp increase in the installed capacity.

- Gujarat, Maharashtra, and Karnataka are the states with the highest on-grid rooftop solar PV installed capacity. Until March 2024, Gujarat generated 3.45 GW, while Karnataka and Rajasthan generated around 7.9 GW and 1.15 GW, respectively.

- Overall, factors including the increasing adoption of rooftop solar energy for power generation, government support in the form of supportive policies, schemes, and ambitious renewable targets are expected to witness significant growth of the on-grid segment in the Indian solar rooftop market during the forecast period.

Government Emphasis on Renewable Energy Integration is Expected to Drive the Market

- According to the Ministry of New and Renewable Energy (MNRE), India secured the fifth position globally in the deployment of solar power. As of June 30, 2023, the country commissioned solar projects with a total capacity of 70.10 GW. This capacity comprised 57.22 GW from ground-mounted solar projects, 10.37 GW from rooftop solar projects, and 2.51 GW from off-grid solar projects.

- As of March 2023, the rooftop solar capacity increased to 8,877 MW, compared to 7,520 MW as of September 30, 2022. The primary factors attributed to this growth included heightened awareness among residential consumers and government subsidies targeted toward the residential segment.

- The government has formulated comprehensive policies and regulations to support rooftop solar deployment. The government took several net metering initiatives, which allow rooftop solar users to sell excess electricity generated back to the grid, providing financial benefits and promoting grid stability.

- For instance, in March 2024, the Rajasthan Electricity Regulatory Commission (RERC) raised the limit for net metering from 500 kW to 1 MW for rooftop solar installations. The Commission's decision, made through a suo motu order, aims to promote the adoption of rooftop solar installations by expanding the net metering capacity.

- Further, in November 2023, the Tamil Nadu Electricity Regulatory Commission (TNERC) issued a new order endorsing the state government's directive to exempt 50% of network charges for rooftop solar consumers in the MSME sector.

- As of March 2023, the MNRE quoted that about 404 MW of rooftop solar capacity was installed against the target of 357.9 MW up to January 2023, a decline from 678 MW since the previous financial year.

- In August 2023, the Maharashtra Electricity Regulatory Commission proposed amendments in regulations to increase the capping of net metering to 1 MW for solar rooftop projects. The net-metering applicability stood around 500 kW for rooftop solar plants in most Indian states as mandated by MNRE. The approval of proposed amendments might lead to an increase in the adoption of rooftop solar projects by large consumers. This might benefit the development of the solar rooftop market in India.

- These government incentives usually include subsidies, tax credits, grants and loan programs, and additional green credits. The Indian government is rolling out new fiscally attractive incentive schemes for residential, commercial, and industrial (C&I) solar PV systems. This will likely drive the market during the forecast period.

India Rooftop Solar Industry Overview

The Indian rooftop solar market is fragmented. Some key players in this market include Clean Max Enviro Energy Solutions Pvt. Ltd, Tata Power Solar Systems Limited, Orb Energy Pvt. Ltd, Amplus Solar Power Private Limited, and Sunsource Energy Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Emphasis Towards Renewable Energy Integration

- 4.5.1.2 Increasing Demand in the Commercial and Industrial Sector

- 4.5.2 Restraints

- 4.5.2.1 Slow-Paced Installation of Rooftop Projects

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 End-user

- 5.1.1 Industrial

- 5.1.2 Commercial (Including Public Sector)

- 5.1.3 Residential

- 5.2 Grid Type (Qualitative Analysis Only)

- 5.2.1 On-grid

- 5.2.2 Off-grid

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cleantech Energy Corporation Pte Ltd

- 6.3.2 Fourth Partner Energy Pvt. Ltd

- 6.3.3 Amplus Solar Power Pvt. Ltd

- 6.3.4 Clean Max Enviro Energy Solutions Pvt. Ltd

- 6.3.5 Sunsource Energy Pvt. Ltd

- 6.3.6 Orb Energy Pvt. Ltd.

- 6.3.7 Tata Power Solar Systems Limited

- 6.3.8 Mahindra Susten Pvt. Ltd

- 6.3.9 Growatt New Energy Technology Co. Ltd

- 6.3.10 Roofsol Energy Pvt. Ltd

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped Solar Potential and Focus to Increase Decentralization

02-2729-4219

+886-2-2729-4219