|

市場調查報告書

商品編碼

1631570

歐洲煤炭:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Coal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

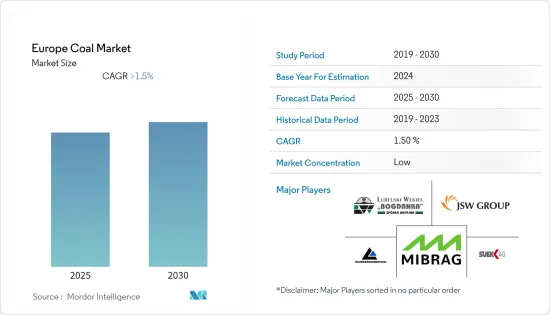

預計歐洲煤炭市場在預測期內的複合年成長率將超過 1.5%。

儘管COVID-19疫情對市場產生了負面影響,但目前市場已達到疫情前的水準。

主要亮點

- 預計市場將受到鋼材需求增加等因素的推動。預計電力產業也將成為預測期內最大的煤炭用戶。頓內茨克盆地等煤炭盆地的存在預計將推動市場,特別是在東歐,許多國家仍在尋求建造需要廉價電力的新燃煤發電廠。

- 然而,放棄煤炭發電以及減少全部區域各種最終用途煤炭使用量的努力可能會減緩所研究市場的成長。

- 「淨煤」等新技術預計將使煤炭更加環保,並降低其發電成本。預計這將提高燃料可靠性並為市場相關人員創造利潤機會。

- 俄羅斯預計將成為該地區最大的煤炭市場,因為它是該地區最大的煤炭用戶和生產國,越來越多的資金正在投資該國的採礦業。

歐洲煤炭市場趨勢

電力產業主導市場

- 儘管歐洲大部分地區的煤炭使用量正在下降,但該地區仍在建造新的燃煤發電廠,其中一些仍在建設中,其他地區則計劃在未來使用。

- 德國是歐盟最大的煤炭消費國。 2020年6月,我們推出了燃煤發電廠。然而,由於公眾和政府組織的強烈抵制,許多專家認為該電廠很可能是該國最後建造的燃煤發電廠之一。

- 歐洲煤炭消費量將減少 4.6%,從 2011 年的 15.98 艾焦耳減少到 2021 年的 10.01 艾焦耳。同時,該地區煤炭產量將從2011年的9.94艾焦耳下降到2021年的5.78艾焦耳,下降5.3%。消費量和產量的減少預計將抑制市場。

- 2019 年在波蘭開設了一座新礦。該礦計劃於 2022 年開始生產煉焦煤。當地資源蘊藏量估計約1.8億噸。 JSW SA 預計到 2030 年將在新設施上投資超過 6.84 億歐元,其中 2019 年至 2022 年期間投資超過 2.05 億歐元。該領域投資的增加和煤炭產量的增加預計將推動市場成長。

- 2021年,波蘭和德國的硬煤用量佔歐盟硬煤用量的60%以上。法國位居第二,荷蘭位居第三。硬煤是電力部門用於特定用途的重要煤炭類型。每個國家對電力需求的增加可能有助於市場成長。

- 隨著越來越多的資金注入電力產業,預計未來幾年它將引領市場。

俄羅斯主導市場

- 煤炭開採長期以來一直是俄羅斯的重要產業,其生產成本位居世界最低之列。然而,由於運輸成本低廉,中國和韓國等靠近西伯利亞地區的國家是俄羅斯煤炭的最大進口國。

- 俄羅斯向中國出口大量煤炭,預計2021年將達1.46艾焦耳左右。同樣,韓國 2021 年將從俄羅斯進口約 0.60 艾焦耳煤炭。

- 俄羅斯煤炭開採量從2020年的8.42艾焦增加至2021年的9.14艾焦,增加了8.8%。

- 2021 年歐洲煤炭消費量仍低迷於 10.1 艾焦耳。同時,該地區煤炭產量增加了5.9%,從2020年的5.67艾焦耳增加到2021年的5.99艾焦耳。消費和生產的成長預計將推動市場。

- 因此,由於煤炭產量和煤炭產業投資的增加,俄羅斯預計將主導歐洲煤炭市場。

歐洲煤炭工業概況

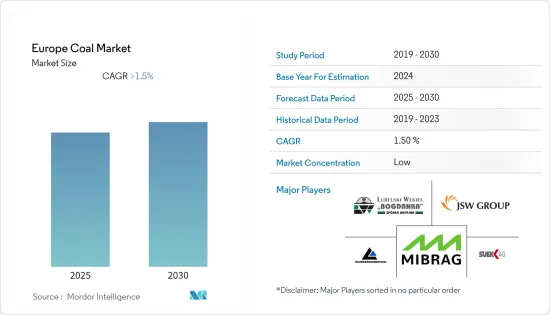

歐洲煤炭市場是部分分割的。市場的主要企業(排名不分先後)包括 Suek AG、UK Kuzbassrazrezugol OAO、Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG)、Lubelski Wegiel Bogdanka SA 和 Jastrzebska Spolka Weglowa SA。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 類型

- 無菸煤

- 煙煤

- 次煙煤

- 褐煤

- 目的

- 電

- 鋼

- 水泥

- 其他

- 地區

- 俄羅斯

- 德國

- 波蘭

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Suek AG

- UK Kuzbassrazrezugol OAO

- Mitteldeutsche Braunkohlengesellschaft mbH(MIBRAG)

- Lubelski Wegiel Bogdanka SA

- Jastrzebska Spolka Weglowa SA

- Siberian Coal Energy Company

- Mechel PAO

- Severstal PAO

- Raspadskaya PAO

第7章 市場機會及未來趨勢

The Europe Coal Market is expected to register a CAGR of greater than 1.5% during the forecast period.

The outbreak of COVID-19 had a negative effect on the market.The market has currently reached pre-pandemic levels.

Key Highlights

- Factors such as increasing demand for steel production are likely to drive the market. Also, the electricity sector is expected to be the largest user of coal during the forecast period. As many countries are still trying to build new coal-fired power plants, especially in Eastern Europe, where cheap electricity is required, the presence of coal basins like the Donetsk basin is expected to drive the market.

- But a move away from coal-based power generation and efforts to use less coal in different end-user applications across the region are likely to slow the growth of the studied market.

- New technologies, like "clean coal," are expected to make coal better for the environment and lower the cost of the electricity it makes. This is likely to make the fuel more reliable and give market players a chance to make money.

- Russia is expected to be the biggest market for coal in the region because it uses and makes the most coal and because more money is being put into the mining industry there.

Europe Coal Market Trends

Electricity Sector to Dominate the Market

- Although there has been a reduction in the usage of coal in most of Europe, new coal-fired thermal power plants are still being built in the region, with some that are still under construction and a few that are being planned for future use.

- Germany is the largest user of coal in the European Union. In June 2020, it launched a coal-fired power plant. However, due to massive resistance by the public and governmental organizations, many experts believe that it is likely to be among the last coal-fired power plants being built in the country.

- Coal consumption in Europe decreased by 4.6%, to 10.01 exajoules in 2021 from 15.98 exajoules in 2011. At the same time, the production of coal in the region dropped by 5.3% to 5.78 exajoules in 2021 from 9.94 exajoules in 2011. This decline in consumption and production is expected to restrain the market.

- A new mine opened in Poland in 2019. The mine was expected to start the extraction of coking coal in 2022. Local deposits of the resource are estimated at some 180 million metric tons. JSW SA is expected to invest more than EUR 684 million in the new facility by 2030, including more than EUR 205 million in the 2019-2022 period. Increasing investment in the sector and growing production of coal are expected to aid the market's growth.

- In 2021, Poland and Germany used more than 60% of all the hard coal used in the European Union. France and the Netherlands came in second and third, respectively. Hard coal is a significant type of coal that is used for specific purposes in the electricity sector. Increasing demand for electricity in the countries may aid the growth of the market.

- Since more money is being put into the electricity sector, it is expected to lead the market over the next few years.

Russia to Dominate the Market

- Coal mining has been a critical industry in Russia for a long time, with production costs among the world's lowest. When you add in the high costs of transportation, which are mostly for rail, the final price of Russian coal is almost the same as the prices offered by some of Russia's biggest competitors, like Australia and South Africa.However, countries near the Siberian region, like China and South Korea, due to low transportation costs, are the highest importers of coal from the country.

- Russia sends a lot of coal to China, which was expected to be around 1.46 exajoules in 2021. However, there is still a lot of room for exports to grow in the next few years.Similarly, South Korea imported approximately 0.60 exajoules of coal from Russia in 2021.

- Russia, which makes more coal than any other country in the world, wants to increase its output and exports over the next few years by opening more mines.The mining of coal in Russia increased by 8.8%, to 9.14 exajoules in 2021, from 8.42 exajoules in 2020.

- In the 2021 period, coal consumption in Europe remained stagnant at 10.1 exajoules. At the same time, the production of coal in the region increased by 5.9% to 5.99 exajoules in 2021 from 5.67 exajoules in 2020. The increase in consumption and production will drive the market.

- Hence, Russia is expected to dominate the European coal market due to the increasing production of coal and investments in the sector.

Europe Coal Industry Overview

The European coal market is partially fragmented. Some of the key players in this market (in no particular order) include Suek AG, UK Kuzbassrazrezugol OAO, Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG), Lubelski Wegiel Bogdanka SA, and Jastrzebska Spolka Weglowa SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Anthracite

- 5.1.2 Bituminous

- 5.1.3 Sub-Bituminous

- 5.1.4 Lignite

- 5.2 Application

- 5.2.1 Electricity

- 5.2.2 Steel

- 5.2.3 Cement

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Russia

- 5.3.2 Germany

- 5.3.3 Poland

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Suek AG

- 6.3.2 UK Kuzbassrazrezugol OAO

- 6.3.3 Mitteldeutsche Braunkohlengesellschaft mbH (MIBRAG)

- 6.3.4 Lubelski Wegiel Bogdanka SA

- 6.3.5 Jastrzebska Spolka Weglowa SA

- 6.3.6 Siberian Coal Energy Company

- 6.3.7 Mechel PAO

- 6.3.8 Severstal PAO

- 6.3.9 Raspadskaya PAO