|

市場調查報告書

商品編碼

1644400

印度煤炭 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Coal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

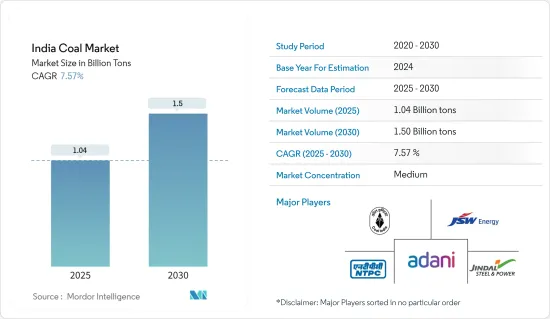

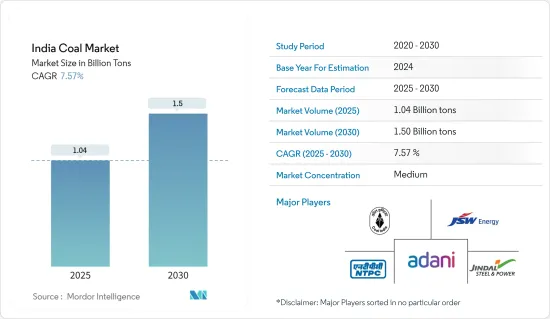

印度煤炭市場規模預計在 2025 年為 10.4 億噸,預計在 2030 年達到 15 億噸,預測期內(2025-2030 年)的複合年成長率為 7.57%。

關鍵亮點

- 從中期來看,預計發電能力擴張計畫、電力需求增加以及工業基礎設施發展活動快速擴張等因素將成為預測期內印度煤炭市場最重要的促進因素。

- 另一方面,預測期內政府增加可再生能源發電的支持措施預計將抑製印度煤炭市場的成長。

- 三個州都有褐煤資源。泰米爾納德邦、拉賈斯坦邦和古吉拉突邦佔褐煤資源的79%。這些資源大部分尚未開發,預計褐煤資源的開採將為市場參與企業提供許多機會。

印度煤炭市場趨勢

火力發電量可望增加,推動市場

- 在印度,煤炭被廣泛用作火力發電廠的燃料,滿足工業、運輸、住宅、商業和公共等各個領域的需求。在預測期內,印度計劃建造更多的燃煤發電廠,預計發電廠部門將佔據市場主導地位。

- 燃煤發電廠透過燃燒煤炭來產生能量。該國是世界第二大煤炭生產國,大部分煤炭用於發電。根據印度煤炭部統計,截至2023年7月,該國進口煤炭8797萬噸,2022-23年煤炭進口總量達2.3767億噸。

- 2023年4月,印度燃煤發電裝置容量為205萬千瓦,佔總裝置容量的49.3%。煤炭消費量的增加顯示該國煤炭使用量不斷增加。煤炭對國家來說儲量豐富且經濟,被發電公司廣泛使用。

- 印度電力部計劃在2022年終前啟動帕特拉圖超級火力發電計劃。該計劃位於賈坎德邦,燃煤發電量為 4,000 兆瓦(MW)。煤炭過去一直是印度重要的發電來源,至今仍佔該國發電產業相當大的佔有率。預計這將對該國火電廠市場產生積極影響。

- 此外,該國計劃於 2023 年前在泰米爾納德邦拉馬納塔普拉姆運作容量為 1,600 兆瓦的 Uppur 火力發電工程。該計劃由泰米爾納德邦發電配電有限公司(TANGEDCO)擁有,投資額為 17 億美元。

- 鑑於上述情況,預計預測期內火力發電發電工程數量的增加將推動印度煤炭市場的發展。

政府對可再生能源的支持預計將抑制市場

- 印度政府推出多項支援措施,到2030年將可再生能源裝置容量提升至450GW。由於煤炭使用會導致有害健康的空氣污染,政府正在積極推廣可再生能源以減少煤炭的使用。

- 根據國際可再生能源機構(IEA)預測,2022年日本可再生能源裝置容量將增加至162.96萬千瓦,與前一年同期比較成長10.8%。

- 作為《巴黎氣候協定》的一部分,印度承諾2030年40%的發電能力來自非石化燃料。為實現這一目標,印度設定了一個雄心勃勃的目標,即在 2022 年之前安裝 1.75 兆瓦的可再生能源裝置容量,其中包括 1 兆瓦的太陽能。此外,還設定了2030年將可再生能源裝置容量增加到45萬千瓦的目標,這將減少全國的煤炭消耗。

- 過去三年,新可再生能源部(MNRE)實施的其他計畫包括太陽能園區計畫、30 萬千瓦防禦計畫和 50 萬千瓦可行性缺口融資(VGF)計畫。 2020年1月,印度製定了2030年安裝450吉瓦可再生能源的雄心勃勃的目標。

- 由於上述因素,可再生能源的成長和政府的支持性舉措預計將在預測期內阻礙印度煤炭市場的成長。

印度煤炭產業概況

印度煤炭市場處於半靜態。市場的主要企業(不分先後順序)包括阿達尼集團、印度煤炭有限公司、JSW 能源有限公司、NTPC 有限公司、金達爾鋼鐵與電力有限公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 市場規模及需求預測(截至2028年)

- 2022 年能源結構

- 煤炭價格(2011-2022)

- 2011-2022 年印度煤炭產量(噸)

- 煤炭進口量(2015-2022)

- 印度各邦煤炭產量(2022 年)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 計劃增加發電能力並增加電力需求

- 工業和基礎設施發展活動快速成長

- 限制因素

- 用清潔能源來源取代煤炭

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 應用

- 發電(動力煤)

- 煉焦煤(焦煤)

- 其他

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- NLC India Ltd

- JSW Energy Limited

- Singareni Collieries Company Limited(SCCL)

- NTPC Ltd

- Jindal Steel & Power Ltd

- Adani Power Ltd

- Coal India Limited

第7章 市場機會與未來趨勢

- 尚未開發的褐煤礦產資源

簡介目錄

Product Code: 71557

The India Coal Market size is estimated at 1.04 billion tons in 2025, and is expected to reach 1.50 billion tons by 2030, at a CAGR of 7.57% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing power generation capacity plans and increasing electricity demand and rapidly growing industrial and infrastructural development activities, are expected to be one of the most significant drivers for the India coal market during the forecast period.

- On the other hand, supportive government policies to increase renewable energy generation is expected to restrain the growth of the Indian coal market during the forecast period.

- Nevertheless, availability of lignite resources in three states: Tamil Nadu, which accounts for 79% of lignite resources, Rajasthan, and Gujarat. Most of the resources are untapped, and the mining of lignite sources is expected to create several opportunities for the market players.

India Coal Market Trends

Increasing Thermal Power Generation is Expected to Drive the Market

- Coal is extensively used in India to fire thermal power stations and, in turn, meet the demand for various sectors, such as industry, transport, residential, commercial, and public services. The power stations segment is expected to dominate the market, supported by India's plan to add additional coal-fired plants during the forecast period.

- Coal-fired power plants generate energy from the combustion of coal. The country is the second-largest coal producer globally and uses most coal to produce electricity. According to the India Ministry of Coal statistics, as of July 2023, the country imported 87.97 million tonnes of coal, moreover, the total coal imports registered 237.67 million tonnes in 2022-23.

- In April 2023, India's total coal installed generation capacity was 205 GW, which accounted for 49.3 % of the full installed power generation capacity. The increased consumption of coal exhibits the growing usage of coal in the country. Coal is abundant and economical for the country and is widely used by power-generating companies.

- The Ministry of Power in India is plplansommission Patratu Super Thermal Project by the end of 2022. The project is located in Jharkhand and can produce 4000 megawatts (MW) of coal-fired power. For India, coal has been a significant source of power generation in the past and still holds a considerable share in the country's power generation industry. This is expected to positively impact the thermal power plant market in the country.

- Moreover, the country plans to commission the Uppur Thermal Power Project located in Ramanathapuram, Tamilnadu, with a capacity of 1600 MW by 2023. The project is owned by Tamil Nadu Generation and Distribution Corporation Ltd (TANGEDCO) and has an investment cost of USD 1.7 billion.

- Hence, owing to the above points, increasing thermal-based power generation projects are expected to drive the Indian Coal Market during the forecast period.

Supportive Government Policies for Renewables is Expected to Restrain the Market

- The Indian government has introduced numerous supportive policies to increase the renewable energy installed capacity to 450 GW by 2030. Since the utilization of coal leads to air pollution linked with health disorders, the government is actively promoting renewables to reduce coal usage.

- According to International Renewable Energy Agency, the total renewable energy installed capacity raised to 162.96 GW in 2022, with an annual growth rate of 10.8% compared to the previous year.

- As part of the Paris Climate Agreement, India has committed to install 40% of its electricity generation capacity from non-fossil fuels by 2030. To achieve this goal, India has set an ambitious target of setting up 1,75,000 MW of renewable energy capacity, including 1,00,000 MW of solar power, by 2022. Further, a target of 4,50,000 MW installed RE capacity by 2030 has also been fixed, and this, in turn, culminates in the reduction in the usage of coal across the country

- Some other schemes implemented by the Ministry of New and Renewable Energy (MNRE) in the last three years are the Solar Park Scheme, the 300 MW defense Scheme, and the 500 MW of VGF (Viability Gap Funding) Scheme. In January 2020, India made an ambitious target of having 450 GW of renewable energy by 2030.

- Owing to the above factors increasing renewables with supportive government policies is expected to hamper the growth of the Indian Coal Market in the forecast period.

India Coal Industry Overview

The India coal market is semi-consolidated. Some of the major players in the market (in no particular order) include Adani Group, Coal India Limited, JSW Energy Ltd, NTPC Ltd, and Jindal Steel & Power Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, until 2028

- 4.3 Energy Mix, 2022

- 4.4 Coal Prices, 2011-2022

- 4.5 Coal Porduction in India, in Tonnes, 2011-2022

- 4.6 Coal Imports, 2015-2022

- 4.7 Statewise Coal Production, India, 2022

- 4.8 Recent Trends and Developments

- 4.9 Government Policies and Regulations

- 4.10 Market Dynamics

- 4.10.1 Drivers

- 4.10.1.1 Increasing Power Generation Capacity Plans and Increasing Electricity Demand

- 4.10.1.2 Rapidly Growing Industrial and Infrastructural Development Activities

- 4.10.2 Restraints

- 4.10.2.1 Coal Substituted with Clean Energy Sources

- 4.10.1 Drivers

- 4.11 Supply Chain Analysis

- 4.12 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Power Generation (Thermal Coal)

- 5.1.2 Coking Feedstock (Coking Coal)

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NLC India Ltd

- 6.3.2 JSW Energy Limited

- 6.3.3 Singareni Collieries Company Limited (SCCL)

- 6.3.4 NTPC Ltd

- 6.3.5 Jindal Steel & Power Ltd

- 6.3.6 Adani Power Ltd

- 6.3.7 Coal India Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped Mining Lignite Sources

02-2729-4219

+886-2-2729-4219