|

市場調查報告書

商品編碼

1631640

世界電晶體 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

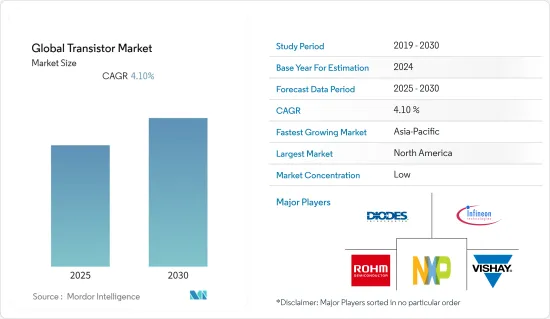

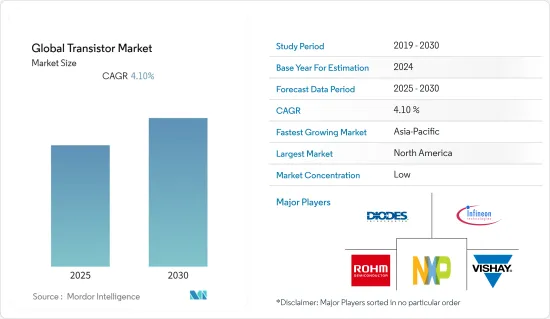

全球電晶體市場預計在預測期內複合年成長率為 4.1%

主要亮點

- 製造商正在專注於開發具有更好功能的更節能的設備,以滿足客戶需求並獲得相對於競爭對手的競爭優勢。這些電晶體的技術進步是基於其2D二硒化鎢 (WSe2) 和二硒化錫 (SnSe2) 層的結構。這兩種半導體材料的尺寸只有幾奈米,人眼是看不見的。

- 在工業自動化和工業4.0時代,工廠使用的電子設備數量不斷增加。以前,最常用的是雙極電晶體。即使在引入 MOSFET 之後,BJT 仍因其製造簡單且速度快而繼續成為數位和類比電路中的首選電晶體。然而,MOSFET 在數位電路中具有一些理想的特性,且數位電路的顯著進步導致 MOSFET 設計通用用於類比和數位功能。

- 電動車需求的不斷成長也推動了電晶體市場的成長。根據國際能源總署(IEA)的數據,2021年電動車銷量將比2020年成長一倍以上,達到660萬輛。到2021年,電動車將佔全球汽車市場的近9%,是兩年前市場佔有率的三倍多。

- 電子產品小型化趨勢不斷發展,在保持元件高性能的同時減少電晶體尺寸是市場相關人員面臨的最大挑戰。需要將電子束和X光技術等新技術引入製造過程中以實現全方位的功能。建立先進製造工廠的需求對製造商來說是巨大的成本負擔。

- COVID-19 大流行減少了全球電子設備的總消費量,對電晶體市場產生了負面影響。由於供應鏈中斷,疫情對全球製造業造成了嚴重影響。電晶體的各種最終用戶都縮減了業務並受到影響。然而,疫情後MOSFET市場成長顯著,並在很大程度上由於計算和消費性電子產品的需求增加而出現反彈,這兩個領域佔矽MOSFET銷售額的近37%。

電晶體市場趨勢

家用電子電器市場的擴大和工業領域電子產品使用的增加

消費性電子產品的需求以及工業領域電子設備的使用不斷增加,這對電晶體市場的成長產生了直接或間接的影響。電晶體用於整個家用電子電器應用,例如防止電池回流、從不同來源(例如交流電源供應器或電池)切換電源以及在不需要時卸載背光。

- MOSFET 是數位電路中最常見的電晶體類型,可整合到記憶體晶片和微處理器中。 MOSFET 電晶體也常用於電壓調節器電路開關,開關速度快,開關時間為奈秒量級。它也應用於低功耗高頻轉換器。除此之外,MOSFET 還可用於擴大機和斬波電路。此外,它還可以用作電子電路的逆變器。

- 先進的醫療設備是實現病患照護品質現代化的關鍵。隨著醫療市場的擴大,超級專科醫院正在使用最新、最可靠的設備進行治療。身體內部的非侵入性影像使專家能夠在對附近組織和器官造成最小傷害的情況下進行手術。 CT 和 MRI 掃描儀中使用 MOSFET 來控制患者傾斜的機架。它也用作X光設備和超音波設備的電源。

- 近年來,汽車工業擴大採用電子元件和系統來減輕車輛重量並提高燃油效率,ECU(電子控制單元)的使用量不斷增加。從傳統的液壓控制動力方向盤到使用 ECU 的直流馬達的轉變,以及從鹵素燈泡到使用電子鎮流器的安定器的轉變,也是可能的,因為MOSFET 被用作ECU 中的開關元件,我們正在擴大我們的市場。此外,混合動力汽車、電動和燃料電池汽車的發展趨勢也間接推動了電晶體市場的成長。

- 當前尺寸縮小的趨勢導致了裝置密度的增加和晶片功能能力的升級。增加晶片內裝置數量的能力會影響整個系統的性能,同時降低每個電晶體的成本。較小 MOSFET 的通道長度縮短,可實現更低的等效電阻和更高的電流。 MOSFET 製造商正在利用銅夾鷗翼封裝技術來實現小型化,同時保持最大的功能性。這些先進的 MOSFET 通常用於電磁閥控制、馬達控制和 DC/DC 電源轉換,其中 80V 產品組合專門針對引擎管理和 LED 照明應用。

- MOSFET 徹底改變了資訊時代的世界。它們密度的增加使得電腦可以存在於一些小型 IC 晶片上,而無需填滿整個房間,並隨後啟用了智慧型手機等數位通訊技術。硬體製造商對小型 IC 晶片的需求不斷成長,以及智慧型手機和筆記型電腦更新的需求正在推動 MOSFET 市場的成長。

亞太地區正在經歷顯著成長

- 亞太地區是新興經濟體,擁有成長最快的電晶體市場。中國、日本、韓國和印度是這個不斷成長的市場的主要相關人員。該地區對家用電子電器、電動車、智慧型裝置和穿戴式裝置的需求不斷成長,正在推動電晶體市場的成長。

- 中國製造業佔全球的30%,超過5萬家企業在中國擁有一級供應商。隨著全球對電子產品的需求增加,整個供應鏈的需求也增加。因此,中國電晶體市場有望成長。

- 為了擴大電動車充電網路,中央政府已為 FAME(混合動力汽車和電動車的更快採用和製造)計劃撥款 130 億盧比。此外,政府也主動修訂了充電基礎設施發展指南。由於開發電動車服務站基礎設施需要電子設備,因此預計這將對電晶體市場的成長產生積極影響。

- 隨著工廠變得更加自動化,機器人解決方案被用於各種應用。日本工業機器人製造商發那科將投資 260 億日圓(2.4 億美元)強化其上海工廠,使其成為其在中國最重要的投資。該投資將透過與當地上海電氣集團成立的合資企業進行。這種自動化也將間接促進該地區電晶體市場的成長。

- 此外,「印度製造」計畫吸引了許多全球電子公司在印度設立製造工廠。印度政府確認已收到五家公司提出的設立電子晶片和顯示器製造工廠的提案,投資額為1.53兆盧比。這將使印度成為電晶體電子晶片的世界生產國。因此,亞太地區的電晶體市場預計將成長。

電晶體產業概況

電晶體市場高度分散且競爭激烈,參與企業規模各異。每個參與企業都在擴大其產品組合併應對參與企業之間的激烈競爭。因此,OEM享有巨大的購買力,使他們能夠選擇最適合其經營模式的電晶體製造商,更重要的是,能夠在品質和價格之間提供良好的平衡。

- 2022 年 5 月 - 英飛凌科技股份公司推出新型 TRENCHSTOP(TM) 1700 V IGBT7 晶片。屬於標準工業包裝的 EconoDUAL(TM) 3 產品系列。憑藉這種新的晶片技術,EconoDUAL 3可提供900A和750A的主電流,提高了逆變器的功率範圍。與採用傳統 IGBT4 晶片組的模組相比,TRENCHSTOP IGBT7 晶片在相同封裝尺寸的情況下,逆變器輸出電流可提高高達 40%。

- 2022 年 3 月 - 恩智浦半導體推出適用於 32T32R 主動天線系統的全新系列射頻功率分離式元件解決方案,採用最新專有氮化鎵技術 (GaN)。新系列 GaN 分立解決方案專為天線平均功率為 10W、320W 且汲極效率高達 58% 的無線電單元而設計。它包括驅動器和末級電晶體,並利用恩智浦位於亞利桑那州的新 GaN 工廠製造的高線性度 RF GaN 技術。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對節能電子設備的需求不斷成長推動電晶體市場成長

- 消費性電子產品的激增和工業領域電子產品使用的增加推動了需求

- 市場限制因素

- 平衡電晶體的小型化和保持高性能是市場最大的限制因素

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 雙極結型電晶體

- 場效電晶體

- 金屬氧化物半導體場場效電晶體(MOSFET)

- 結型場效電晶體(JFET)

- 按最終用戶

- 消費性電子產品

- 通訊技術

- 車

- 製造業

- 能源/電力

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Semiconductor Components Industries, LLC

- Infineon Technologies AG

- STMicroelectronics

- Diodes Incorporated

- NXP Semiconductors

- Renesas Electronics Corporation

- Linear Systems

- Texas Instruments Incorporated

- Vishay Intertechnology Inc.

- ROHM CO

第7章 投資分析

第8章市場的未來

The Global Transistor Market is expected to register a CAGR of 4.1% during the forecast period.

Key Highlights

- The manufacturers are focusing on developing more power-efficient devices with better functioning to meet the customers' demand and have a competitive edge over others. The advancement in technology for these transistors is evolving by building them with 2-D layers of tungsten diselenide (WSe2) and tin diselenide (SnSe2). These two semiconducting materials are few nanometres and are invisible to the human eyes.

- In this era of Industrial automation and Industry 4.0, electronic equipment used in the plants is increased. Previously the bipolar junction transistor was the most used. Even after MOSFETs became available, the BJT remained the transistor of choice for digital and analog circuits because of their ease of manufacture and speed. However, the MOSFET has several desirable properties for digital circuits, and significant advancements in digital circuits have pushed MOSFET design to be used commonly for both analog and digital functions.

- The increase in demand for electric vehicles is also boosting the market growth of transistors. Various types of transistors are used in the manufacturing process of EVs.According to the International Energy Agency (IEA), in 2021, electric car sales will more than double compared to 2020 and reach 6.6 million. Electric cars represented nearly 9% of the global car market in 2021, with more than tripling the market share from two years earlier.

- The rising trend of miniaturization of electronic products and scaling down the size of the transistors while maintaining the high-performance efficiency of the components is the biggest challenge for the market players. There will be a requirement for new technology implementation in the manufacturing processes to achieve all functionality, such as electron beam or x-ray technology. Advance fabrication plants need to be set up, which will cost huge for the manufacturers with huge cost association.

- The covid 19 pandemic has negatively impacted the transistor market by reducing the total global consumption of electronic devices. Due to supply chain disruptions, the pandemic has severely affected the global manufacturing sector. It has affected various end-users of transistors by downsizing their businesses. But MOSFET's market growth is noticeable after the pandemic with a huge recovery due to an increase in demand for computing and consumer electronics which contributes nearly 37% of silicon MOSFET revenues.

Transistor Market Trends

Proliferation of Consumer Electronics market and Increase in Use of Electronics in the Industrial Sector

The demand for consumer electronic products and the usage of electronics across industries has been increasing, directly or indirectly impacting the transistor market to growth. Transistors are used throughout consumer electronics applications such as reverse battery protection, switching power from different sources like an AC adapter and batteries, and turning offloads like backlighting when they are not needed.

- MOSFET is the most common type of transistor in digital circuits, with the potential to be integrated into a memory chip or microprocessor. MOSFET transistors are also commonly used in voltage-controlled circuit switches and have a high switching speed and a switching time in order of nanoseconds. It also has applications in low-power high-frequency converters. In addition to this, MOSFET can be used in amplifying circuits and in chopper circuits. In addition, it can be used as an inverter in electronic circuits.

- Advance medical devices are the key to modernizing the quality of care for patients. With the increase of the health care market, super-specialty hospitals are using ultra-modern reliable equipment in their treatment process. Non-intrusive imaging of the body empowers the specialist to perform operations while minimizing harm to neighboring tissue and organs. MOSFETs have been utilized in CT and MRI scanners to control the gantry on which the patient is leaning. They are also used in the power supply for X-ray and ultrasound machines.

- As the automobile industry has increasingly used electronic components and systems in recent years to make car bodies that are lighter in weight and achieve fuel efficiency, the use of electronic control units (ECUs) has advanced. The transition from power steering systems that use conventional oil pressure control to DC motors that use ECU and similarly in transitioning halogen bulbs to discharge bulbs that now use electronically ballast devices are also making the MOSFETs market grow because MOSFETs are used as the switching device in ECUs. Additionally, the trend of hybrid vehicles, Electric vehicles, and fuel-cell vehicles is indirectly making the transistor market grow.

- The current trend of miniaturization in size has led to an increase in the device density and upgraded the functional capacity of the chip. The ability to increase the number of devices in the chip influences the performance of the complete system while reducing the cost of each transistor. The decreased channel length of a smaller MOSFET can achieve lower equivalent resistance and higher current flow. MOSFET manufacturers utilize the copper clip gull-wing package technology to achieve a smaller size while maintaining maximum functionalities. These advanced MOSFETs are generally used in solenoid control, motor control, and DC/DC power conversion, with the 80V portfolio aimed explicitly at engine management and LED lighting applications.

- The MOSFET revolutionized the world during the information age. Its high density enables a computer to exist on a few small IC chips rather than filling a room and later making possible digital communications technology such as smartphones. The increase in demand for smaller IC chips for hardware manufacturers and the need for updated smartphones and laptops drive the MOSFET market to grow.

Asia-Pacific to Witness a Significant Growth

- Asia-Pacific is the fastest growing market for transistors because of the region's developing economy. China, Japan, South Korea, and India are the major stakeholders in this growing market. An increase in demand for consumer electronics, electric vehicles, smart devices, and wearables in the region is driving the growth of the transistors market.

- China accounts for 30% of global manufacturing because more than 50 000 companies' have tier-1 suppliers in China. With the global demand for electronic products, the demand will increase for the entire supply chain. Because of this, the transistor market in China will grow.

- In order to increase the EV charging network, the central government has allocated Rs 1,300 crore in the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme. Further, the government has proactively amended guidelines for charging infrastructure development. This will create a positive impact on the transistor market to grow because of the need for electronic devices in the infrastructural development for EV service stations.

- As factories become increasingly automated, robotic solutions are finding usage across the full spectrum of applications. Japanese industrial robot maker Fanuc will make its most significant investment in China, pouring 26 billion yen ($240 million) into fortifying its Shanghai plant. The outlay will be made through a joint venture operated with local player Shanghai Electric Group. This automation will also indirectly help the transistors market to grow in the region.

- In addition, the Make in India program has attracted many global electronics companies to set up manufacturing plants in India. The Indian government confirmed it had received proposals from five companies to establish electronic chip and display manufacturing plants with an investment of INR 1.53 trillion. This will make India a global producer of transistors-embedded electronic chips. By this, the transistor market will grow in the APAC region.

Transistor Industry Overview

The transistor market is fragmented and competitive in nature, owing to many small and large players. The players are expanding their portfolio, which caters to the intense rivalry among the players. As a result, OEMs are enjoying significant buying power with the leverage to choose a transistor manufacturer that best fits their business model and, more importantly, one that can adequately balance quality and price.

- May 2022-Infineon Technologies AG has launched the new TRENCHSTOP(TM) 1700 V IGBT7 chip. In the standard industrial package, EconoDUAL(TM) 3 product family. With this new chip technology, the EconoDUAL 3 provides a leading current of 900 A and 750 A, improving the power range for inverters. Compared to modules with the previous IGBT4 chipset, the TRENCHSTOP IGBT7 chip enables up to 40 percent higher inverter output current in the same package size.

- MAR 2022- NXP Semiconductors has announced a new series of RF power discrete solutions for 32T32R active antenna systems, using its latest proprietary gallium nitride technology (GaN). The new series of GaN discrete solutions are designed for 10 W average power at the antenna, targeting 320 W radio units, with up to 58% drain efficiency. It includes driver and final-stage transistors and leverages NXP's highly linearizable RF GaN technology manufactured in NXP's new GaN fab in Arizona.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase In Demand of Power Efficient Electronic Devices is Driving The Transistor Market to Grow

- 4.2.2 Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector will Drive the Demand

- 4.3 Market Restraints

- 4.3.1 Scaling Down the Size of Transistors and Simultaneously maintaining High Performance is a Biggest Restraint for the Market

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Types

- 5.1.1 Bipolar Junction Transistor

- 5.1.2 Field Effect Transistor

- 5.1.2.1 Metal oxide semiconductor Field-Effect Transistor (MOSFET)

- 5.1.2.2 Junction Field-effect Transistor (JFET)

- 5.2 By End-Users

- 5.2.1 Consumer Electronics

- 5.2.2 Communication and Technology

- 5.2.3 Automotive

- 5.2.4 Manufacturing

- 5.2.5 Energy and Power

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Semiconductor Components Industries, LLC

- 6.1.2 Infineon Technologies AG

- 6.1.3 STMicroelectronics

- 6.1.4 Diodes Incorporated

- 6.1.5 NXP Semiconductors

- 6.1.6 Renesas Electronics Corporation

- 6.1.7 Linear Systems

- 6.1.8 Texas Instruments Incorporated

- 6.1.9 Vishay Intertechnology Inc.

- 6.1.10 ROHM CO