|

市場調查報告書

商品編碼

1640626

下一代電晶體:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Next-Generation Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

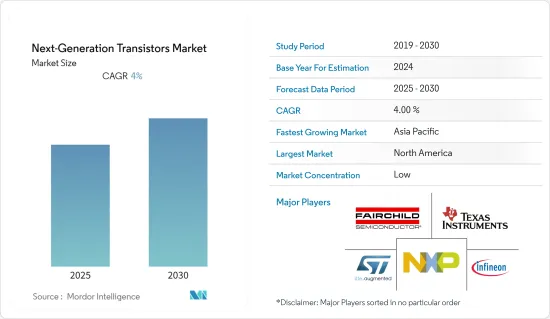

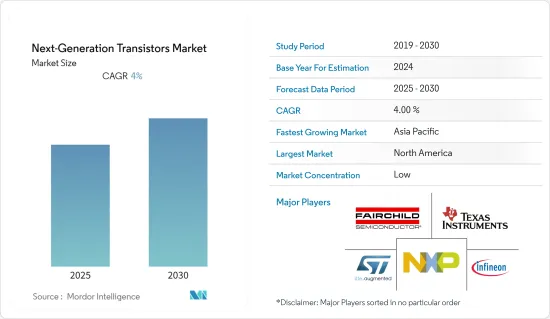

預測期內,下一代電晶體市場預計複合年成長率為 4%

關鍵亮點

- 半導體材料是電子產業的關鍵技術創新之一。這是因為它具有高電子遷移率、寬溫度限制和低能耗。根據SEMI預測,2022年全球半導體製造設備對目標商標產品製造商的銷售額預計將達到創紀錄的1175億美元,較2021年的1025億美元成長14.7%,2023年將達到1208億美元。

- 消費性設備中日益增多的先進功能也推動了快速即時處理的需求。此外,隨著物聯網的出現,人工智慧、資料分析、即時資料傳輸和處理等功能正在成為任何先進設備的基本必需品,為研究市場的供應商創造了巨大的機會。此外,台積電在 2022 年北美技術研討會上展示了即將推出的製造流程技術,其中的亮點是其下一代 2nm 節點的細節,內部稱為「N2」。該公司將於 2022年終開始生產 3nm 節點。

- 2022年4月,科學家開發出第一個磁電電晶體,這可能有助於提高電子產品的功率效率。該團隊的設計不僅降低了內建微電子裝置的能耗,而且還將儲存特定資料所需的電晶體數量減少了 75%,從而使裝置體積更小。它還可以為微電子裝置提供“竊取記憶”,這意味著即使在關機或突然斷電後,它們也能準確地記住用戶上次停止的位置。

- 此外,許多市場參與企業正轉向在其製造流程中採用奈米片。例如,2022 年 6 月,台灣晶片製造商台積電披露了其期待已久的 2nm 製造製程節點的細節,該節點將於 2025 年到來,採用奈米片電晶體架構並增強其 3nm 技術。據該公司介紹,新一代矽半導體晶片的速度預計會更快。隨著製程節點的縮小以及科技業繼續努力遵循莫耳定律,預計其能源效率將更高。

- 此外,後疫情時代也對半導體和其他電子元件產業的生產和製造能力產生了影響。例如,根據中國報紙報道,2022 年 6 月,深圳奧密克龍的停工導致全球最大的電子市場之一華強北再次部分關閉。華強北位於深圳市福田區,是半導體、行動電話等電子設備的供應中心。根據財經媒體財聯社報道,隨著深圳加強措施遏止高傳染性新冠肺炎疫情的蔓延,華強北的一些商販已暫時停止營業。這些商戶包括華強電子世界1號店和2號店。

下一代電晶體市場趨勢

高電子移動性電晶體(HEMT) 的採用日益增多

- 高電子移動性電晶體產生高增益,使其非常適合用作放大器。它還允許高速切換。此外,這些電晶體的電流波動相對較小,因此雜訊係數較低。

- 許多公司正在開發比傳統電晶體工作頻率更高的 HEMT 設備。例如,Nanoscience Technologies 於 2022 年 11 月宣布推出新型低 RDS(on) 650V E-mode GaN HEMT 裝置。 INN650D080BS 功率電晶體採用標準 8x8 DFN 封裝,導通電阻為 80mΩ(典型值 60mΩ),可用於圖騰柱 LLC 架構和快速電池充電器等高功率應用。

- 例如,Ampleon 於 2022 年 9 月發布了其新型 CLL3H0914L-700 GaN-SiC高電子移動性電晶體。這種強大的 GaN 電晶體針對需要長脈衝寬度和高佔空比的雷達應用進行了最佳化。此電晶體的設計目標是在 50V 電壓下工作時,單一電晶體的峰值輸出功率超過 700W,效率超過 70%,脈衝寬度(約 2 毫秒),達到行業領先水平。脈衝寬度(波長)(300 s)和20% 佔空比。

- 此外,家用電子電器的需求不斷成長以及高電子移動性電晶體的適用性正在推動市場成長。據IBEF稱,印度家用電子電器和家用電子電器產業最近的價值為98.4億美元,預計到2025年將成長一倍以上,達到14.8億印度盧比(211.8億美元)。此類家用電子電器產品的發展預計將進一步推動研究市場的成長。

- 此外,義法半導體最近宣布推出一系列名為 STi2GaN(ST 智慧整合 GaN)的 GaN 裝置。此零件採用 ST 的無鍵合線封裝技術,具有堅固性和可靠性。新產品系列旨在利用 GaN 的高功率密度和效率來提供 100 V 和 650 V高電子移動性電晶體(HEMT) 裝置。

亞太地區市場顯著成長

- 亞太地區是電子產業的中心,每年有數十億台電子設備在該地區生產並銷售。然而,亞太地區在全球電子元件出口中發揮著至關重要的作用。該地區家用電子電器市場的快速成長是亞太地區在全球下一代電晶體市場的主要成長要素。

- 此外,中國和日本等新興經濟體擁有大型電子製造地,有潛力成為電晶體市場的重要參與企業。而且下一代行動電話可能會更加重視提升行動電話的效能,並擁有更好的規格。預計更多電晶體的整合將使行動電話體積更小、處理速度更快,從而完全滿足消費者的需求。根據IBEF統計,2022年第一季「印度製造」智慧型手機出貨量年增7%,超過4,800萬部,印度製造的智慧型手機出貨量超過1.9億部。

- 據IBEF稱,2019年國家電子政策的目標是到2025年生產10億支行動電話(價值1900億美元),其中6億部(價值1000億美元)將出口。

- 此外,為了改變這種狀況,中國已將半導體產業的發展作為「中國製造2025」計畫的重要組成部分。中國的目標是擴大市場佔有率,而國內晶片生產可以滿足國內 14 億公民日常使用的智慧型手機、個人電腦和其他設備的 80% 需求。預計所有這些因素都將支持市場擴張。

- 此外,該地區也是三星、英特爾和台積電等半導體市場參與企業的所在地。兩家公司承認,從 2023 年起,採用 3nm 或 2nm 技術的邏輯裝置生產將逐步從主導的 FinFET 電晶體架構轉變為類似奈米片的架構。

- 此外,2022年4月,韓國第三大企業集團SK集團宣布,將收購三星電子有限公司的全資子公司三星電子有限公司,以加強其電池相關業務。全資子公司三星電子有限公司,以加強其電池相關業務。 SK 表示將購買管理股權並額外斥資 1,200 億韓元(9,500 萬美元)收購 Yes Powertechnix 95.8% 的股份。此外,SK最近投資268億韓元收購了Yes Powertechnix 33.6%的股份。這些發展可能會刺激該地區的需求。

下一代電晶體產業概況

下一代電晶體市場競爭激烈。半導體產業本身正在經歷專業化階段。從歷史上看,半導體產業專注於生產能夠執行一些通用功能的電腦晶片。這些晶片彼此之間有一定的關聯。然而,如今半導體應用變得更加細緻入微和差異化,從而催生出大量在各行各業擁有專業知識的利基參與企業。此外,在這個行業中,除了英特爾等少數主要參與企業設計、製造和生產半導體產品外,許多參與企業都將其職能外包。因此,該產業與全球供應鏈深度交織,既存在激烈的競爭,也存在著深度的合作。

- 2022 年 6 月 - 跨國 GaN(氮化鎵)功率半導體領導者 GaN Systems 宣布推出業界最廣泛的 GaN 功率電晶體產品組合中的一款新型電晶體。 GS-065-018-2-L 擴展了GaN Systems 的高性能、低成本電晶體產品組合,具有更低的導通電阻、更高的穩健性和熱性能以及850V VDS(瞬態)額定值。是。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 擁抱市場動態

- 市場促進因素

- 技術進步導致對更高密度設備的需求

- 消費性電子產品的普及

- 市場限制

- 維持莫耳定律的成本越來越高,但報酬卻越來越低

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 高電子移動性電晶體(HEMT)

- 雙極接面電晶體 (BJT)

- 場效電晶體(FET)

- 多射極電晶體(MET)

- 雙柵極金屬氧化物半導體場場效電晶體

- 按最終用戶產業

- 航太和國防

- 工業的

- 通訊

- 家用電子電器

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- NXP Semiconductors NV

- Infineon Technologies AG

- STMicroelectronics NV

- Fairchild Semiconductor International, Inc.(ON Semiconductor Corp.)

- Texas Instruments Incorporated

- Intel Corporation

- GLOBALFOUNDRIES Inc.

- Taiwan Semiconductor Manufacturing Company

- Samsung Electronics Co., Ltd

- Microchip Technology Inc.

第7章投資分析

第 8 章:市場的未來

The Next-Generation Transistors Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- Semiconductor materials represent one of the significant innovations in the electronics industry. This can be accredited to their high electron mobility, wide temperature limits, and low energy consumption. According to SEMI, worldwide sales of total semiconductor manufacturing equipment by original equipment manufacturers reached a record USD 117.5 billion in 2022, rising 14.7% from the previous industry high of USD 102.5 billion in 2021 and forecasted to increase by USD 120.8 billion in 2023.

- The growing scope of advanced features in consumer devices is also fueling the need for fast and real-time processing. Furthermore, with the advent of IoT, features like AI, data analytics, real-time data transfer, and processing are becoming a basic necessity for any advanced devices, creating a massive opportunity for the studied market vendors. Furthermore, TSMC showcased its upcoming manufacturing process technology at the company's 2022 North America Technology Symposium, with the highlight being details of its next-generation 2nm node, known internally as N2. The company will go into production with the 3nm node at the end of 2022.

- Moreover, in April 2022, Scientists created what they believe is the first magneto-electric transistor that could help to make electronics more power-efficient. Along with curbing the energy consumption of any microelectronics that incorporate it, the team's design could reduce the number of transistors needed to store specific data by as much as 75 percent leading to smaller devices. It could also lend those microelectronics "steel-trap memory" that remembers exactly where its users leave off, even after being shut down or abruptly losing power.

- Further, many players in the market are shifting towards employing nanosheets in their manufacturing process. For instance, in June 2022, Taiwanese chipmaker TSMC revealed details of its much-anticipated 2nm production process node - set to arrive in 2025 - which will use a nanosheet transistor architecture and enhancements to its 3nm technology. According to the company. The newer generations of silicon semiconductor chips are expected to increase speed. They will be more energy efficient as process nodes shrink and the tech industry continues to fight to hang onto Moore's Law.

- Moreover, Post Covid 19 is affecting the production and manufacturing capacity of the semiconductor and other electronics components industry. For instance, in June 2022, according to sources in the Chinese Press, Shenzhen's Omicron lockout forced Huaqiangbei, one of the world's biggest electronics markets, to partially close once again. Huaqiangbei, a center for the supply of semiconductors, cellphones, and other electronics, is situated in the Futian District of Shenzhen. According to financial media Cailianshe, certain vendors in Huaqiangbeihave temporarily ceased operations as Shenzhen intensified measures to control the spread of the highly contagious Omicron Covid-19. These vendors include the first and second stores of HuaqiangElectronics World.

Next-Generation Transistors Market Trends

Increasing adoption of High Electron Mobility Transistor (HEMT)

- High electron mobility transistors produce high gain, making these transistors very useful as amplifiers. They can quickly switch speeds. And shallow noise values are produced as the current variations in these transistors are relatively low.

- Many companies are developing HEMT devices that operate at higher frequencies than conventional transistors. For instance, in November 2022, Nanoscience Technology announced a new low RDS(on) 650V E-mode GaN HEMT device. In a standard 8x8 DFN package, INN650D080BS power transistors have an on-resistance of 80m (60m typical), enabling higher power applications such as totem pole LLC architectures or fast battery chargers.

- For instance, in September 2022, Ampleon Launched a new CLL3H0914L-700 GaN-SiC High-electron-mobility transistor. This rugged GaN transistor is optimized for radar executions where long pulse width and high-duty cycles are needed. The transistor was engineered to accomplish over 700W of peak output power from a single transistor while operating at a voltage of 50V with industry-leading efficiency of over 70%, as well as developed thermally for long pulse applications, such as pulse widths (~2 milliseconds) and 20% duty cycles.

- Moreover, the growing demand for consumer electronics and the applicability of high electron mobility transistors drive market growth. According to IBEF, the Indian appliances and consumer electronics industry stood at USD 9.84 billion recently and is expected to more than double to reach INR 1.48 lakh crore (USD 21.18 billion) by 2025. Such developments in consumer electronics will further drive the studied market growth.

- Furthermore, STMicroelectronics recently announced a new family of GaN parts designated STi2GaN, which stands for ST Intelligent and Integrated GaN. The pieces use ST's bond-wire-free packaging technology to provide robustness and reliability. The new product family aims to leverage the high-power density and efficiency of GaN to offer a range of 100- and 650-V high-electron-mobility transistor (HEMT) devices.

Asia Pacific to Experience Significant Market Growth

- The Asia Pacific region is an electronics hub with billions of electronic devices manufactured annually for consumption, specifically in this region. However, the Asia-Pacific region plays a significant role in exporting electronic components across the globe. The rapid growth in the consumer electronics market in this region is the key growth factor for the Asia-Pacific region in the Global Next Generation Transistor Market.

- Furthermore, the developing economies of the region, such as China and Japan, have massive electronics manufacturing bases and hold the potential to become significant players in the transistors market. Further, the next-generation phones would be entirely focused on improving the performance of phones with better specifications. Integrating more transistors is expected to direct to smaller phones with faster processing, which caters perfectly to consumer needs. According to IBEF, Shipments of "Made-in-India" smartphones rose 7% YoY in Q1 2022 to reach over 48 million units, while over 190 million smartphones made in India were shipped.

- According to IBEF, The National Policy on Electronics 2019 targets the production of one billion mobile handsets valued at USD 190 billion by 2025, out of which 600 million handsets valued at USD 100 billion are likely to be exported.

- Furthermore, China has made the growth of its semiconductor industry a key component of its Made in China 2025 agenda to alter this situation. China intends to increase its market share in electronics while having local chip production meet 80% of domestic demand for the numerous smartphones, PCs, and other devices that its 1.4 billion citizens use daily. All of these elements are anticipated to support market expansion.

- Moreover, the region has several players in the semiconductor market, like Samsung, Intel, and TSMC. These firms have acknowledged that starting in 2023, the production of logic devices using the 3nm or 2nm technology generations will gradually switch from the workhorse FinFETtransistor architectures to nanosheet-like architectures.

- Furthermore, in April 2022, The third-largest conglomerate in South Korea, SK Group, will acquire Yes Powertechnix, the only domestic manufacturer of power semiconductors based on a component of silicon and carbide (SiC), which are emerging as a key component of electric vehicles, as part of a group-wide effort to strengthen its battery-related business. SK Inc. said it would purchase management rights and a further KRW 120 billion (USD 95 million) to acquire 95.8% of Yes Powertechnix. Further, the business recently invested KRW 26.8 billion to acquire a 33.6% ownership in Yes Powertechnix. Such development may fuel the region's demand.

Next-Generation Transistors Industry Overview

The next-generation transistors market is highly competitive. The semiconductor industry itself is going through a phase of specialization. Historically, the industry has concentrated on producing computer chips that could perform several generalized functions. These chips were related to each other to some extent. But today, the applications of semiconductors are more nuanced and differentiated, leading to the proliferation of niche players with specialized expertise across various verticals. Moreover, in this industry, many players outsource their functionalities except a few major players like Intel, who design, fabricate, and manufacture semiconductor products. This makes the sector deeply connected to global supply chains and has made this industry fiercely competitive and deeply collaborative.

- June 2022 - GaN Systems, the multinational player in GaN (gallium nitride) power semiconductors, introduced a new transistor in the industry's broadest portfolio of GaN power transistors. The GS-065-018-2-L expands the firm's high-performance, low-cost transistor portfolio and features lower on-resistance, raised robustness and thermal performance, and an 850V VDS (transient) rating.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Dynamics

- 4.3 Market Drivers

- 4.3.1 Technological Advancements Leading To Demand for Increasing Device Densities

- 4.3.2 Proliferation of Consumer Electronics

- 4.4 Market Restraints

- 4.4.1 Cost of Maintaining Moore's Law is Getting Higher with Low Returns

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 High Electron Mobility Transistor (HEMT)

- 5.1.2 Bipolar Junction Transistor (BJT)

- 5.1.3 Field Effect Transistors (FET)

- 5.1.4 Multiple Emitter Transistor (MET)

- 5.1.5 Dual Gate Metal Oxide Semiconductor Field Effective Transistor

- 5.2 By End User Industry

- 5.2.1 Aerospace & Defense

- 5.2.2 Industrial

- 5.2.3 Telecommunications

- 5.2.4 Consumer Electronics

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NXP Semiconductors N.V.

- 6.1.2 Infineon Technologies AG

- 6.1.3 STMicroelectronics N.V.

- 6.1.4 Fairchild Semiconductor International, Inc. (ON Semiconductor Corp.)

- 6.1.5 Texas Instruments Incorporated

- 6.1.6 Intel Corporation

- 6.1.7 GLOBALFOUNDRIES Inc.

- 6.1.8 Taiwan Semiconductor Manufacturing Company

- 6.1.9 Samsung Electronics Co., Ltd

- 6.1.10 Microchip Technology Inc.