|

市場調查報告書

商品編碼

1631637

小訊號電晶體:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Small Signal Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

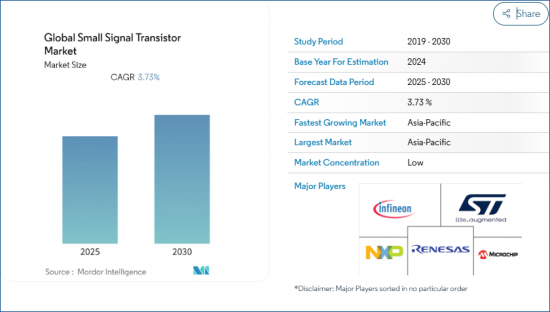

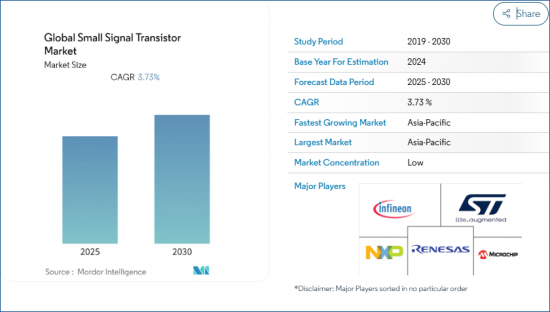

預計全球小訊號電晶體市場在預測期內的複合年成長率為 3.73%。

主要亮點

- 電晶體在許多電子電路中始終發揮核心作用,通常充當開關或放大器。小訊號電晶體是一種既可用於放大又可用於開關低電平訊號的電晶體。

- 小訊號電晶體的典型 hFE 值為 10 至 500,最大 Ic 額定值為 80 至 600mA。最大運作頻率為1~300MHz。小訊號電晶體廣泛應用於各個領域,幾乎在所有裝置中都有應用。

- 通用開關、偏壓電源電路、LED二極體驅動器、紅外線二極體放大器、繼電器驅動器、定時器電路、音頻靜音功能等。隨著物聯網設備的普及,對感測器、微控制器和儲存設備的需求不斷增加。電力電子的需求趨勢是推動市場擴張的主要趨勢。由於最終用戶領域對電力電子裝置的需求不斷成長,小訊號電晶體變得越來越受歡迎。

小訊號電晶體市場趨勢

分析預測消費性電子產品的顯著成長將推動對小訊號電晶體的需求

- 電晶體是電子產業的關鍵創新之一。原因是高電子遷移率、寬溫度限制和低能耗。根據半導體產業協會(SIA)統計,2024年第一季全球半導體銷售額達1,377億美元,較2023年第一季成長15.2%。

- 消費性電子(CE)構成了一個價值數十億美元的產業,隨著技術的進步和新產品線的增加而不斷發展,以改變生活方式。隨著物聯網的出現,各個最終用戶產業擴大採用先進的解決方案來增強業務。

- 小訊號電晶體主要用於增強小訊號,例如幾伏特,僅在使用數百安培的電流時使用。這些電晶體用於現代電子設備。根據分析,家用電子電器和智慧型手機製造需求的激增將在預測期內推動全球對這些電晶體的需求。

- 智慧型手機是該領域半導體的主要消費者。近年來,智慧型手機市場的競爭變得異常激烈。行動電話使用量的增加預計將進一步推動全球市場。例如,據愛立信稱,到 2028 年,北美每部智慧型手機的每月資料流量預計將達到 18.52Exabyte(GB)。到 2023 年,每部智慧型手機的平均資料流量將達到每月 9.78 EB。

亞太地區預計將創下最快成長率

- 中國政府的國家戰略規劃「中國製造2025」也是出版品崛起的一大因素。該計劃的核心目標是半導體產業的成長。此外,中國國家智慧財產局(CNIP)2021年預算預計,到2023年每年申請量將達200萬件。

- 2024 年 5 月,英飛凌科技股份公司宣布推出兩代先進的 CoolGaN 裝置,專為高壓 (HV) 和中壓 (MV) 應用而設計。這些進步將使客戶能夠在 40V 至 700V 的寬電壓範圍內利用氮化鎵 (GaN) 技術。應用範圍的擴大將對加強數位化工作和推動脫碳工作發揮至關重要的作用。值得注意的是,這兩條產品線均採用 8 英寸內部鑄造工藝精心製造,製造地位於居林(馬來西亞)和菲拉赫(奧地利)。

- 台灣半導體市場也在政府的支持下不斷成長。 2023 年 10 月,東芝電子歐洲公司(東芝)發布了 TLP3475W,這是一款繼電器,旨在最大限度地減少高頻訊號的插入損耗和功率衰減。本產品適用於半導體測試應用,例如高速記憶體測試儀、邏輯測試儀和探針卡。 TLP3475W 採用最佳化的封裝設計,可降低寄生電容和電感,進而降低 20GHz 頻率範圍(典型值)內的訊號插入損耗。與之前的型號 TLP3475S 相比,這項改進將性能提高了 1.5 倍。

- 此外,台積電等公司在中國進行了多次投資,華為等本土公司也進入了晶片生產領域。美國的禁運使得華為採購晶片變得極為困難,華為別無選擇,只能發展自己的製造能力。

小訊號電晶體產業概況

小訊號電晶體市場競爭非常激烈。半導體產業正進入專業化時期。從歷史上看,該行業一直專注於製造執行各種任務的電腦晶片。這些晶片在某種程度上是有連結的。然而,當今的半導體應用更加複雜和多樣化,導致出現了許多在多個垂直領域擁有專業知識的利基企業。此外,除了像英特爾這樣設計、製造和製造半導體產品的少數大公司外,這個市場上的許多參與者都將業務外包。因此,該產業緊密融入全球供應鏈,競爭激烈且協作深入。由於上述因素,下一代電晶體市場是一個分散的市場,參與者眾多。

2022年4月,精密、高效能小訊號離散半導體設計商與製造商Linear 整合式 Systems宣布發表2022年小型訊號分立資料輯。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 消費性電子產品的普及和工業中電子產品使用的增加推動了需求

- 物聯網需求不斷擴大

- 市場限制因素

- 分析功率電晶體的採用對市場帶來的挑戰

第6章 市場細分

- 按類型

- PNP

- NPN

- 按用途

- 製造業

- 汽車應用

- 通訊

- 家電

- 其他

- 地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- NXP Seminconductors NV

- ST Microelectronics

- Renesas Electronics Corporation

- Infenion Technologies AG

- Semiconductor Components Industries, LLC(Onsemi)

- WEE Technology Company Limited

- Nexperia

- Microchip Technology Inc.

- Diodes Inc.

- Central Semiconductors Corporation

第8章投資分析

第9章 未來趨勢

The Global Small Signal Transistor Market is expected to register a CAGR of 3.73% during the forecast period.

Key Highlights

- Transistors have always played a central role in many electronic circuits, where they usually function either as a switch or an amplifier. Small Signal Transistors are transistors that can be used to both amplify and switch low-level signals.

- For small-signal transistors, typical hFE values range from 10 to 500, with maximum Ic ratings ranging from 80 to 600mA. The maximum operational frequencies are between 1 and 300 MHz. Small signal transistors are widely used in all segments and for applications in almost all equipment.

- On/off switches for general use, bias supply circuits, LED diode driver, infrared diode amplifier, relay driver, timer circuits, audio mute function, and so on. Sensors, microcontrollers, and memory devices are in more demand as IoT devices become more prevalent. Growing demand for power electronics is a major trend driving market expansion. Small signal transistors are becoming more popular as the demand for power electronics grows in end-user sectors.

Small Signal Transistor Market Trends

The significant growth in the consumer electronics sector is analyzed to boost the demand for small signal transistors

- Transistors represent one of the significant innovations in the electronics industry. This can be accredited to their high electron mobility, wide temperature limits, and low energy consumption. According to the Semiconductor Industry Association (SIA), Global semiconductor sales reached USD 137.7 billion during the first quarter of 2024, an increase of 15.2% compared to the first quarter of 2023.

- Consumer electronics (CE) forms a multibillion-dollar industry, steadily progressing and developing with the technology and adding new product lines toward changing lifestyles. With the advent of IoT, various end-user industries are increasingly adopting the advanced solution to enhance their operations.

- Small-signal transistors are mostly used to enhance small signals, such as a few volts, and only when mill amperes of current are used. Modern electronic devices make use of these transistors. During the forecast period, a surge in demand for the manufacturing of consumer electronics and smartphones is analyzed to boost demand for these transistors globally.

- The smartphone is the major consumer of semiconductors in this segment. The smartphone market has been very competitive in recent years. The increasing usage of mobile phones is further anticipated to drive the global market. For instance, according to Ericsson, the monthly smartphone data traffic per smartphone in North America is forecasted to amount to 18.52 exabytes (GB) per active device by 2028. In 2023, the average data traffic per smartphone amounted to 9.78 EB per month.

Asia Pacific is Expected to Register the Fastest Growth Rate

- The Chinese government's Made in China 2025 national strategic plan has also been a significant factor in the publications' rise. The central aim of the plan is the growth of the semiconductor industry. Also, China's National Intellectual Property Administration (CNIP) 2021 budget anticipates 2 million filings per year till 2023.

- In May 2024, Infineon Technologies AG has unveiled two advanced generations of CoolGaN devices designed for high-voltage (HV) and medium-voltage (MV) applications. These advancements empower customers to harness Gallium Nitride (GaN) technology across a wider voltage spectrum, spanning from 40 V to 700 V. This expanded range of applications bolsters digitalization efforts and plays a pivotal role in advancing decarbonization initiatives. Notably, both product lines are meticulously crafted using 8-inch in-house foundry processes, with manufacturing hubs in Kulim (Malaysia) and Villach (Austria).

- The semiconductor market in Taiwan is also growing due to support from the government. In October 2023, Toshiba Electronics Europe GmbH ("Toshiba") has introduced the TLP3475W, a photorelay designed to minimize insertion loss and power attenuation in high-frequency signals. This device is aimed at semiconductor testing applications, including high-speed memory testers, logic testers, and probe cards. The TLP3475W features an optimized package design that reduces parasitic capacitance and inductance, thereby decreasing signal insertion loss in the 20GHz frequency range (typical). This improvement represents a 1.5x enhancement in performance over the previous TLP3475S model.

- Moreover, China is witnessing multiple investments from companies such as TSMC, as well as local companies such as Huawei are entering into producing their chips as the US embargo has made it significantly difficult for Huawei to buy chips, so it has no other alternative but to develop the capability to manufacture for itself.

Small Signal Transistor Industry Overview

The market for small signal transistors is highly competitive. The semiconductor industry is undergoing a specialization period. Historically, the industry has focused on manufacturing computer chips that can perform various jobs. These chips were somewhat connected. However, today's semiconductor applications are more complex and varied, resulting in the emergence of several niche businesses with specialized knowledge across many verticals. Furthermore, apart from a few significant firms like Intel, which design, fabricate, and manufacture semiconductor goods, many players in this market outsource their operations. This has made the sector highly competitive and deeply collaborative, as it is tightly integrated into global supply chains. The factors mentioned above make the next-generation transistors market a fragmented market with the presence of many players.

In April 2022, Linear Integrated Systems, Inc., a designer and manufacturer of precision, high-performance, small-signal discrete semiconductors, announced the release of its 2022 Small Signal Discrete Data Book.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Forces of Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector will Drive the Demand

- 5.1.2 Growing demand for IoT

- 5.2 Market Restraints

- 5.2.1 Adoption of power transistors is analyzed pose a challenge for the market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PNP

- 6.1.2 NPN

- 6.2 By Application

- 6.2.1 Manufacturing

- 6.2.2 Automotive applications

- 6.2.3 Communication

- 6.2.4 Consumer electronics

- 6.2.5 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Seminconductors N.V

- 7.1.2 ST Microelectronics

- 7.1.3 Renesas Electronics Corporation

- 7.1.4 Infenion Technologies AG

- 7.1.5 Semiconductor Components Industries, LLC(Onsemi)

- 7.1.6 WEE Technology Company Limited

- 7.1.7 Nexperia

- 7.1.8 Microchip Technology Inc.

- 7.1.9 Diodes Inc.

- 7.1.10 Central Semiconductors Corporation