|

市場調查報告書

商品編碼

1644773

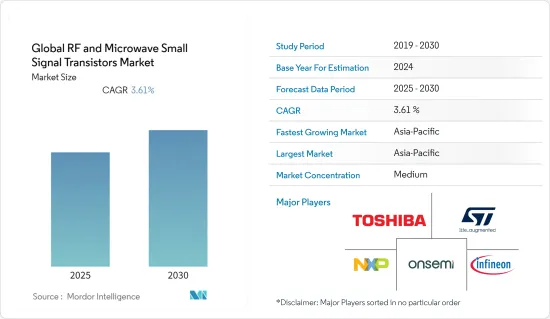

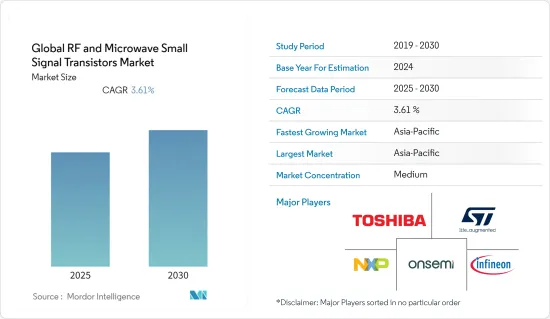

射頻和微波小訊號電晶體市場:全球佔有率分析、產業趨勢和統計、成長預測(2025-2030 年)Global RF & Microwave Small Signal Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,全球射頻和微波小訊號電晶體市場的複合年成長率預計為 3.61%。

射頻和微波小訊號電晶體是主要由矽和鍺製成的半導體。這些裝置中摻雜了雜質,以改變其電氣行為。此外,這些設備還設計用於處理射頻和微波訊號。

射頻模組在汽車產業的應用越來越廣泛。射頻模組在汽車上的主要應用包括車輛監控、遠端檢測、遠端控制和門禁系統。隨著業界迅速接近開發自動駕駛汽車的目標,預計在預測期內將發現射頻模組的新使用案例。

此外,物聯網技術的最新進步進一步推動了所調查市場的成長。例如,根據愛立信的數據,到 2027 年,短距離物聯網連接總數將成長到 243 億。

微波和射頻技術促進設備之間的連接,主要用於支援物聯網的設備的天線模組。由於射頻和微波小訊號電晶體主要用於放大這些訊號,因此對它們的需求預計將大幅成長。

然而,莫耳定律推動半導體產品不斷縮小,這使得製造商在保持高性能的同時縮小電晶體的尺寸變得越來越困難。實現這一目標所需的先進技術將進一步增加這些設備的製造成本,這可能會對市場成長產生不利影響。

COVID-19 對所調查的市場產生了重大影響。這是由於實施各種限制措施,擾亂了供應鏈並在短時間內減少了需求。然而,隨著情況恢復正常,預計市場將保持或超過疫情前的水平成長。

射頻和微波小訊號電晶體市場趨勢

物聯網技術的普及正在推動市場成長

近年來,物聯網因其相關優勢已成為成長最快的技術之一。這項技術促進了設備、雲端和設備本身之間的通訊。因此,公司擴大投資物聯網技術,使其流程更加互聯。例如,根據電力效率研究所的預測,到 2021 年,美國安裝的智慧電錶數量預計將成長到 1.15 億台。

射頻(RF)和微波具有功耗低、操作範圍廣、資料傳輸速度快等優點,是促進物聯網設備之間通訊的關鍵技術之一。由於訊號放大是促進有效通訊的關鍵步驟,因此射頻小訊號電晶體的需求預計會不斷成長。

此外,全球對智慧城市計劃的投資不斷增加也有望推動對物聯網設備的需求。例如,2021年2月,倫敦和五個歐洲夥伴城市透過共享城市計畫對智慧科技投資2.5億歐元。該計劃旨在促進使用智慧技術應對城市挑戰並支持向低碳交通和建築的轉型。

智慧鎖、智慧照明等智慧型設備的興起預計將推動對射頻和微波小訊號電晶體的需求,這些電晶體主要應用於訊號放大。

亞太地區佔很大佔有率

- 由於射頻和微波小訊號電晶體終端用戶產業的快速成長,預計亞太地區將推動研究市場的成長。例如,根據工業和資訊化部的數據,2020年中國汽車銷量將超過2500萬輛。此外,ITA表示,到2025年國內汽車產量預計將達3,500萬輛。

- 由於汽車產業是電晶體的主要消費者之一,因此採用 ADAS、GPS、巡航控制等先進技術的汽車產量增加預計將推動所研究市場的成長。例如,射頻電晶體用於汽車天線模組,以促進汽車自動停車和遠端控制等功能。

- 此外,射頻和微波小訊號電晶體也用於各種家用電子電器,例如機上盒和行動電話,主要用作訊號放大器。預計亞太地區家用電子電器產業的成長將為研究市場的發展創造有利的市場格局。

- 例如,根據 IBEF 的數據,印度家用電器和家用電子電器產業規模預計將在 2021 年達到 98.4 億美元,到 2025 年將成長一倍以上,達到 211.8 億美元(1.48 兆印度盧比)。

射頻和微波小訊號電晶體產業概況

全球射頻和微波小訊號電晶體市場競爭適中,由於各終端用戶群的需求不斷增加,預計預測期內競爭將會加劇。預計供應商將增加對產品創新和設施擴建的投資,以增強其市場地位。在市場上營運的主要公司包括東芝電子設備及儲存設備公司、義法半導體公司、恩智浦半導體公司和英飛凌科技公司。

- 2022 年 5 月—工業、通訊、工業、國防和資料中心產業半導體產品的領先供應商意法半導體 (STMicroelectronics) 和 MACOM Technology Solutions Holdings Inc. 宣布成功生產矽上高頻氮化鎵 (RF GaN-on-Si) 原型。隨著這項發展,ST 和 MACOM 將進一步加強,加快先進 RF GaN-on-Si 產品的上市時間。

- 2022 年 2 月-United Monolithic Semiconductors 宣布推出 CHK8101-SYC,這是一款組裝全密封金屬陶瓷法蘭封裝的 15W GaN 功率電晶體。根據該公司介紹,GaN電晶體可用於高達6GHz的高效能射頻功率應用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 消費性電子產品的普及以及工業領域電子產品應用的日益廣泛

- 物聯網設備的採用日益增多

- 市場限制

- 小型化帶來的技術複雜性

第6章 市場細分

- 按最終用戶產業

- 製造業

- 汽車應用

- 消費性電子產品

- 通訊

- 其他

- 按國家

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Toshiba Electronic Devices & Storage Corporation

- STMicroelectronics

- Semiconductor Components Industries, LLC

- ASI Semiconductor Inc.

- Rectron Semiconductor

- NXP Semiconductors

- Micro Commercial Components Corp.

- Infineon Technologies AG

- Microchip Technology Inc.

- Nexperia

第8章投資分析

第9章:市場的未來

The Global RF & Microwave Small Signal Transistors Market is expected to register a CAGR of 3.61% during the forecast period.

RF & Microwave small-signal transistors are semiconductors made primarily of Si and Ge. These devices are doped with impurities to change their electrical behavior. Furthermore, these devices are designed to handle radio frequency and microwave signals.

RF modules are increasingly being used in the automotive industry. Some major applications of RF modules in automobiles include vehicle monitoring, telemetry, remote control, and access control systems. As the industry is fast approaching its goal to develop autonomous vehicles, new use cases for RF modules are expected to be identified during the forecast period.

Furthermore, the recent advancement in IoT technology further supports the studied market's growth. For instance, according to Ericsson, the total number of short-range IoT connections is expected to increase to 24.3 billion by 2027.

The microwave and RF technologies facilitate connectivity among the devices and are primarily used in the antenna module of IoT-enabled devices; as RF & Microwave, small-signal transistors are predominantly used to amplify these signals, their demand is expected to grow significantly.

However, the miniaturization of semiconductor-based products per Moore's law makes it increasingly difficult for manufacturers to downsize the transistors while maintaining high performance. The requirement of advanced technologies to achieve this is further impacting the cost of production of these devices, which may negatively impact the market's growth.

COVID-19 had a major impact on the studied market, as due to imposition of various restrictions disrupted the supply chain and reduced the demand for a small period. However, with the condition returning to normalcy, the market is expected to witness growth similar to the pre-pandemic level and more.

RF & Microwave Small Signal Transistors Market Trends

Proliferation of IoT Technology to Drive the Growth of the Market

IoT, in recent years, has emerged to become one of the fastest-growing technologies owing to the benefits associated with it. The technology facilitates communication between devices, the cloud, and the devices themselves. Hence, enterprises are increasing their investment in IoT technology to make their process highly interconnected. For instance, according to the Institute for Electric Efficiency forecasts, the number of smart meters installed in the United States is expected to increase to 115 million units in 2021.

Radio Frequency (RF) & Microwaves are among the key technologies to facilitate communication between IoT-enabled devices owing to the benefits such as low power consumption, good operating range, and data penetration transmission rate. As the amplification of signals is a key step in facilitating effective communication, the RF small-signal transistors are expected to witness a growth in demand.

Furthermore, the increasing investment in smart city projects across various parts of the world is also expected to drive the demand for IoT-enabled devices. For instance, in February 2021, London and five European partner cities triggered an investment of EUR 250 million in smart technologies through the Sharing Cities program. The program is intended to promote the use of smart technologies to address urban challenges and support the shift to low-carbon transport and buildings.

As smart devices such as smart lock, smart lighting, etc. increases, RF & Microwave small signal transistors with major application in signal amplification are expected to witness increased demand.

Asia Pacific to Hold Significant Share

- The Asia Pacific region is expected to drive the growth of the studied market owing to the rapid growth of several end-user industries of RF & microwave small-signal transistors. For instance, according to the Ministry of Industry and Information Technology, over 25 million vehicles will be sold in China in 2020. Furthermore, according to ITA, the domestic production of automobiles is expected to reach 35 million cars by 2025.

- As the automotive industry is among the major consumer of transistors, the increasing production of vehicles that incorporate advanced technologies such as ADAS, GPS, cruise control, etc., is expected to support the growth of the studied market. For instance, the RF transistors are used in the antenna module of the vehicles to facilitate features such as self-parking and remote control of cars.

- Small Signal RF & Microwave transistors are also used in various consumer electronic devices such as set-top boxes and mobile phones primarily as signal amplifiers. The growth of the consumer electronics industry in the APAC region is expected to create a favorable market scenario for the development of the studied market.

- For instance, according to IBEF, India's appliances and consumer electronics industry stood at USD 9.84 billion in 2021 and is expected to more than double to reach USD 21.18 billion (INR 1.48 Lakh Crore) by 2025.

RF & Microwave Small Signal Transistors Industry Overview

The Global RF & Microwave Transistors Market is moderately competitive and is expected to grow in competition during the forecast period owing to the increasing demand for these devices across various end-user verticals. The vendors are expected to increase their investment in product innovation and facility expansion to strengthen their market presence. Some major players operating in the market include Toshiba Electronic Devices & Storage Corporation, STMicroelectronics, NXP Semiconductors, Infineon Technologies, etc.

- May 2022 - STMicroelectronics and MACOM Technology Solutions Holdings Inc., a leading supplier of semiconductor products for the Industrial, Telecommunications, Industrial, Defense, and Datacenter industries, announced the successful production of radio-frequency Gallium-Nitride-on Silicon (RF GaN-on-Si) prototypes. With this progress, ST and MACOM are expected to further expand their efforts to accelerate the delivery of advanced RF GaN-on-Si products to the market.

- February 2022 - United Monolithic Semiconductors announced the release of the CHK8101-SYC, a 15W GaN Power transistor assembled in a fully hermetic metal-ceramic flange power package. According to the company, these GaN transistors can be used for RF power applications up to 6GHz with high performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector

- 5.1.2 Increasing Adoption of IoT enabled Devices

- 5.2 Market Restraints

- 5.2.1 Technological Complexities Arising due to Miniaturization

6 MARKET SEGMENTATION

- 6.1 By End User Vertical

- 6.1.1 Manufacturing

- 6.1.2 Automotive Applications

- 6.1.3 Consumer Electronics

- 6.1.4 Communication

- 6.1.5 Others

- 6.2 By Country

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toshiba Electronic Devices & Storage Corporation

- 7.1.2 STMicroelectronics

- 7.1.3 Semiconductor Components Industries, LLC

- 7.1.4 ASI Semiconductor Inc.

- 7.1.5 Rectron Semiconductor

- 7.1.6 NXP Semiconductors

- 7.1.7 Micro Commercial Components Corp.

- 7.1.8 Infineon Technologies AG

- 7.1.9 Microchip Technology Inc.

- 7.1.10 Nexperia