|

市場調查報告書

商品編碼

1632064

全球雙極小訊號電晶體市場:市場佔有率分析、產業趨勢、成長預測(2025-2030)Global Bipolar Small Signal Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

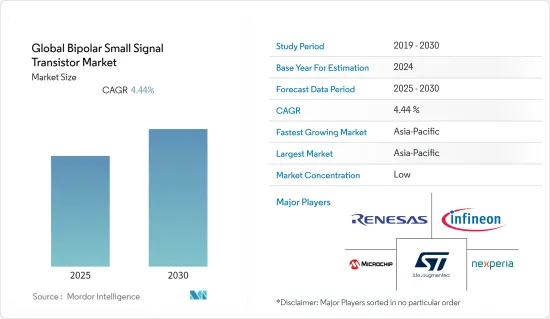

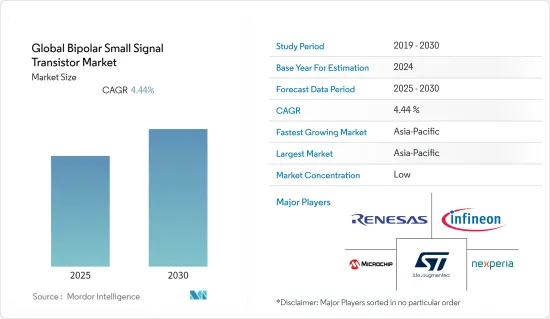

全球雙極小訊號電晶體市場預計在預測期內複合年成長率為4.44%。

許多類型的電晶體用於電動車的生產。近年來汽車產業的成長顯著推動了所研究市場的成長。例如,根據國際能源總署(IEA)的數據,2021年電動車銷量比2020年加倍,達到660萬輛。 2021年,電動車將佔全球汽車市場約9%,市場佔有率較兩年前增加一倍以上。

考慮到其潛力,汽車產業對所研究市場的成長做出了重大貢獻。供應商越來越注重開發適用於汽車領域的產品。例如,ONSemi 的 MMBT6521L 是一款 NPN 雙極小訊號電晶體,專為線性和開關應用而設計。

同樣,電子元件和半導體裝置的領先供應商羅姆提供各種封裝的汽車雙極電晶體,具有小訊號、薄型和高功率特性,以廣泛覆蓋該市場。

市場參與企業面臨的主要挑戰是繼續應對電子設備小型化和電晶體尺寸縮小的成長趨勢,同時保持組件的高性能效率。為了實現全部功能,必須在生產過程中引入電子束技術和X光技術等新技術。必須建立先進的製造工廠,對生產商來說成本相當高。

COVID-19大流行減少了全球電子設備的總消費量,對雙極小訊號電晶體市場產生了不利影響。由於供應鏈中斷,疫情對全球製造業造成了嚴重影響。雙極小訊號電晶體的各種最終用戶已縮減其運作規模並受到影響。

雙極小訊號電晶體市場趨勢

消費性電子產品消費的增加推動市場成長

消費性電子產品的需求以及跨產業電子設備的使用不斷增加,這對雙極小訊號電晶體市場的成長產生了直接或間接的影響。雙極小訊號電晶體用於整個消費性電子應用,例如智慧型手機、平板電腦、攜帶式消費性產品、線性和開關。

智慧型手機是該領域半導體的主要消費者,這些電晶體主要用於放大智慧型手機發送到基地台的訊號。因此,由於行動電話訂閱數量的增加,行動電話使用量的增加預計將推動全球市場。例如,愛立信預計,到2027年終, 5G行動電話用戶數將達到44億。

這些趨勢正在推動供應商開發滿足消費性電子領域要求的產品。例如,東芝擁有豐富的雙極電晶體產品陣容,從小訊號表面黏著技術微電晶體到引線型封裝的高電流、低飽和度和超高速功率電晶體。

自COVID-19爆發以來,許多教育機構已經開始實施虛擬學習並提供線上課程。教育機構數位化的快速成長是推動個人電腦、筆記型電腦和平板電腦等設備成長的關鍵因素之一。因此,教育領域對電腦和周邊設備不斷成長的需求預計將對所研究市場的成長產生積極影響。

亞太地區預計將出現顯著成長

由於經濟的成長,亞太地區是電晶體市場成長最快的地區。中國、日本、韓國和印度是製造業、消費性電子產品和汽車等最終用戶產業在過去幾十年中顯著成長的主要國家。

例如,中國政府推出了「中國製造2025」。這是一項由國家主導的工業計劃,旨在使中國成為世界領先的高科技產品製造商之一。該計劃旨在透過利用政府補貼、動員國有企業、尋求獲取智慧財產權等方式來趕上並最終超越西方在先進領域的技術優勢。

此外,全部區域工廠的快速自動化,機器人解決方案的使用也正在增加。例如,2021年3月,日本工業機器人製造商FANUC在其上海工廠投資260億日圓。該投資是透過與當地企業上海電氣集團成立的合資企業進行的。由於這些電晶體主要用作機器人內部的電子開關,因此預計在預測期內其需求將會增加。

此外,為了使電動車的成本與汽油車相當,政府呼籲根據印度(混合動力和)電動車的快速採用和製造計劃對電動車提供支持和獎勵。例如,根據 FAME India 計畫的第二階段,重工業部已批准在 25 個邦/聯邦直轄區的 68 個城市設立 2877 個充電站。由於電動車服務站基礎設施開發對電子設備的需求,預計這種趨勢將對雙極小訊號電晶體產生正面影響。

雙極小訊號電晶體產業概況

雙極小訊號電晶體市場競爭激烈,全球主要市場參與者眾多。例如,意法半導體、瑞薩電子公司、英飛凌科技股份公司和 Microchip Technology Inc.WEE Technology Company Limited 等供應商提供雙極小訊號電晶體,並在全球擁有重要影響力。為了在市場上脫穎而出,供應商專注於針對特定應用推出新產品。

2022 年 4 月 - 精密、高效能、小型訊號離散半導體設計商和製造商 Linear Integrated Systems, Inc. 宣布發布 2022 年小型訊號分立資料輯。 2022 年線性系統資料輯中包含雙極單路和雙路 NPN 和 PNP 電晶體產品

2021 年 7 月 - Nexperia 宣布推出九款新型功率雙極電晶體。這些公告擴展了適用於 2A 至 8A、45V 至 100V 應用的熱和電優勢 DPAK 封裝的產品系列。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 消費性電子產品的普及以及電子產品在工業領域的使用不斷增加

- 汽車工業的成長

- 市場限制因素

- 平衡電晶體小型化和保持高性能

第6章 市場細分

- 按類型

- PNP

- NPN

- 按最終用戶產業

- 製造業

- 汽車應用

- 通訊

- 家電

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 世界其他地區

第7章 競爭格局

- 公司簡介

- STMicroelectronics

- Renesas Electronics Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- WEE Technology Company Limited

- Nexperia BV

- Semiconductor Components Industries, LLC

- Diodes Incorporated

- Central Semiconductor Corp

- National Instruments Corp

第8章投資分析

第9章市場的未來

The Global Bipolar Small Signal Transistor Market is expected to register a CAGR of 4.44% during the forecast period.

During the production of electric vehicles, many types of transistors are employed. The recent growth of the automotive industry is significantly driving the growth of the studied market. For instance, according to the International Energy Agency (IEA), Electric car sales doubled in 2021 compared to 2020 and reached 6.6 million. In 2021, electric automobiles accounted for approximately 9% of the worldwide car market, more than doubling their market share from two years earlier.

Considering the potential, the automotive industry is contributing significantly to the studied market's growth. The vendors are increasingly focusing on developing products that can have applications in the automotive sector. For instance, Onsemi's MMBT6521L is an NPN bipolar small signal transistor designed for linear and switching applications.

Similarly, to cover the market extensively, ROHM, a leading provider of electronic components and semiconductor devices, offers automotive bipolar transistors in various packages with the nature of small-signal, thin, and high-power.

The major challenge for market participants is keeping up with the growing trend of downsizing electronic devices and shrinking transistor sizes while maintaining high component performance efficiency. To attain full functioning, new technologies such as electron beam or x-ray technology will be required to be implemented in production processes. Advanced fabrication factories must be set up, which will be quite expensive for the producers.

The Covid-19 pandemic has negatively impacted the bipolar small signal transistor market by reducing the total global consumption of electronic devices. Due to supply chain disruptions, the pandemic has severely affected the global manufacturing sector. It has affected various end-users of bipolar small signal transistors by downsizing their businesses.

Bipolar Small Signal Transistor Market Trends

Increasing Consumption of Consumer Electronic Goods to Drive the Market Growth

The demand for consumer electronic products and the usage of electronics across industries has been increasing, directly or indirectly impacting the bipolar small signal transistor market to growth. Bipolar small-signal transistors are used throughout consumer electronics applications such as smartphones, tablets, portable consumer products, linear and switching, etc.

The smartphone is the major consumer of semiconductors in this segment as these transistors are used primarily for the amplification of signals the smartphone sends to the base station. Hence, with the number of mobile subscriptions growing, the increasing usage of mobile phones is anticipated to drive the global market. For instance, according to Ericsson, By the end of 2027, 5G mobile subscriptions are expected to reach 4.4 billion.

Such trends are encouraging the vendors to develop products that can fulfill the requirements of the consumer electronic sector. For instance, Toshiba offers an extensive lineup of bipolar transistors ranging from small-signal, surface-mounted, ultra-small transistors to power transistors with lead-type packages, including high current, low-saturation, and ultra-high-speed types.

Since the outbreak of COVID-19, many institutions have started implementing virtual learning methods and offering online courses. The surge in digitization in educational institutions is one of the key factors driving the increase in devices such as computers, laptops, and tablets. As a result, the increased demand for computers and peripherals in the education sector is expected to positively influence the growth of the studied market.

Asia-Pacific Region is Expected To Witness Significant Growth

Asia-Pacific is the fastest-growing transistor market because of the region's growing economy. China, Japan, South Korea, and India are among the major countries wherein the end-user sectors such as manufacturing, consumer electronics, and automotive have grown significantly over the past few decades.

For instance, the Chinese government has launched "Made in China 2025," a state-led industrial program to make China the world's leading manufacturer of high-tech goods. The program aims to leverage government subsidies, mobilize state-owned firms, and seek intellectual property acquisition to catch up to and eventually surpass Western technological superiority in sophisticated sectors.

Additionally, robotic solutions are increasingly being used, as factories across the region are fast becoming automated. For instance, in March 2021, Fanuc, a Japanese industrial robot manufacturer, invested JPY 26 billion in its Shanghai facility. The investment was made through a joint venture with Shanghai Electric Group, a local company. As these transistors are used inside robots primarily as electronic switches, the demand is expected to increase during the forecast period.

Furthermore, to bring the cost of electric vehicles at par with petrol vehicles, the government, under the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles in India scheme, supports electric vehicles and demand incentives. For instance, under Phase II of the FAME India Scheme, the Ministry of Heavy Industries has sanctioned 2877 charging stations in 68 cities across 25 states/UTs. Such trends are expected to positively impact the bipolar small signal transistor, owing to the need for electronic devices in the infrastructural development for EV service stations.

Bipolar Small Signal Transistor Industry Overview

The bipolar small signal transistor market is competitive, with various global key market players. For instance, the majority of vendors such as STMicroelectronics, Renesas Electronics Corporation, Infineon Technologies AG, Microchip Technology Inc. WEE Technology Company Limited provide Bipolar small-signal transistors and are having significant global presence. To achieve market differentiation, the vendors focus on new product launches that deal with a specific application.

April 2022 - Linear Integrated Systems, Inc., a designer and manufacturer of precision, high-performance, small-signal discrete semiconductors, announced the release of its 2022 Small Signal Discrete Data Book. Bipolar Single and Dual NPN and PNP Transistors Products included in the 2022 Linear Systems Data Book.

July 2021 - Nexperia announced nine new power bipolar transistors. These recent announcements will extend the company's portfolio of products in the thermally and electrically advantageous DPAK package to cover applications from 2 A to 8 A and from 45 V up to 100 V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector

- 5.1.2 Growth of the Automotive Sector

- 5.2 Market Restraints

- 5.2.1 Scaling Down the Size of Transistors and Simultaneously maintaining High Performance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PNP

- 6.1.2 NPN

- 6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Automotive Applications

- 6.2.3 Communication

- 6.2.4 Consumer Electronics

- 6.2.5 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 Microchip Technology Inc.

- 7.1.5 WEE Technology Company Limited

- 7.1.6 Nexperia B.V

- 7.1.7 Semiconductor Components Industries, LLC

- 7.1.8 Diodes Incorporated

- 7.1.9 Central Semiconductor Corp

- 7.1.10 National Instruments Corp