|

市場調查報告書

商品編碼

1631647

西班牙的設施管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Spain Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

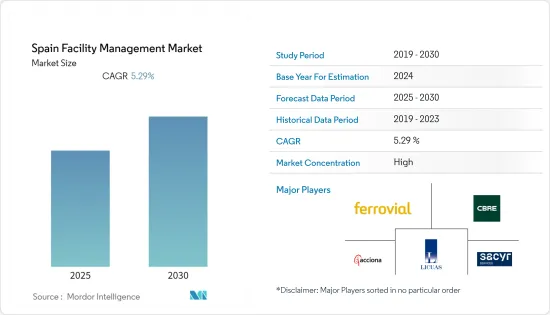

西班牙設施管理 (FM) 市場預計在預測期內複合年成長率為 5.29%

主要亮點

- 據歐盟委員會稱,西班牙教育系統遵循分散的管理和運作模式。教育投資大部分是公共投資,佔高等教育及以下教育總支出的87%以上,高等教育佔66%以上。

- 由於政府主導的大規模投資,設施管理服務擴大委託給私人承包商。例如,2020 年 11 月,國際支援服務、建築和設施服務集團 Interserve Group Limited訂單了一份價值 360 萬英鎊的馬德里自治大學校園清潔服務和害蟲防治合約。

- 西班牙市場領導者在市場上進行了多次策略性收購。例如,2020 年 10 月,Dominion 收購了西班牙新興企業FAMAEX,徹底改變了商業商店和房地產的維護和維修服務。此技術平台允許任何企業或設施經理請求和安排服務。

- 透過新的生產設施增加對醫療領域的投資預計將進一步推動研究市場的成長。例如,2021年5月,BD(Becton Dickinson公司)將在西班牙薩拉戈薩建造一座耗資2億美元的高科技製造工廠,以支持疫苗和其他生技藥品。

- 此外,COVID-19 的爆發對西班牙設施管理公司產生了各種業務影響。對人員流動的限制導致許多客戶現場的計劃工作減少和活動水準降低。世邦魏理仕集團等市場重要參與企業受到疫情封鎖的不利影響。

西班牙設施管理市場趨勢

擴大房地產、醫藥產業投資

- 在經歷了疫情的毀滅性衝擊後,西班牙經濟在 2021 年出現了顯著改善。根據 Sociedad de Tasacion 的數據,2021 年該國住宅銷售數量達到 676,775 套,成長 38.1%。

- 此外,根據西班牙土地註冊處(Registradores)的資料,西班牙整體的外國買家比例從2021年第一季的9.52%和2021年第二季的9.75%增加了0.23%。 。

- 市場上的房地產供應商正在進行收購投資,以擴大房地產行業的規模。例如,Round Hill Capital於2021年9月宣布以3,000萬歐元收購了瓦爾德貝巴斯(馬德里)的一套飯店式公寓。因此,該國的此類發展正在促進該國的設施管理機會。

- 疫情期間醫藥業投資增加。例如,2021年4月,西班牙政府宣布研究人員將開始研究兩種疫苗合併使用的有效性。此外,還將對來自西班牙各地的600名各個年齡層的人進行採樣,以確定是否可以給28天內接種過Astra Zeneca疫苗的患者接種輝瑞疫苗。

- 此外,CDMO平台主要參與企業的各種收購正在對藥品製造地進行併購,以更好地研發COVID-19疫苗。例如,2021年1月,齊格飛宣布從諾華收購巴塞隆納地區的一個藥品製造地。該公司打算將其先前關閉的製造地轉變為一個靈活、有競爭力的 CDMO 平台,為世界各地的各種客戶提供服務。此類舉措正在推動西班牙的設施管理機會。

機構投資人領域預計將大幅成長

- 由於六年的政治和金融緊張局勢以及 COVID-19 的影響,西班牙的機構部門擴張緩慢。然而,2021年9月,西班牙部長會議決定投資4,200萬美元擴建馬德里普拉多博物館。這項投資將使相鄰的皇宮廳在 2024 年之前得以維修。因此,此類投資預計將推動設施產業的設施管理機會。

- 此外,該行業還外包硬設施管理,主要涉及佈線、電梯、管道以及供暖和製冷。然而,設施也外包軟體設施管理服務,例如安全和地面管理。

- 隨著教育機構建設和維修活動的活性化,對設施管理的需求也增加。例如,EdTech Aprende Institute 籌集了 2,200 萬美元以擴大其西班牙語市場,Valor Capital Group資金籌措了2,700 萬美元以在西班牙語市場建立業務。

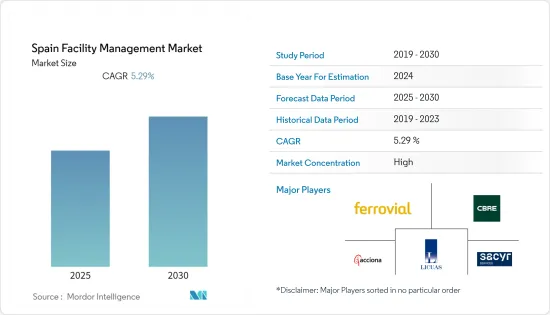

西班牙設施管理業概況

由於具有多年行業經驗的國內外參與企業數量較少,西班牙調頻市場可以被認為是高度集中的。 FM 公司正在將技術融入他們的服務中,並增強他們的服務組合。此外,主要企業正在採取各種成長策略,例如併購、新產品發布、業務擴張、合資企業和夥伴關係,以鞏固其在該市場的地位。

- 2021 年 10 月 - 法羅維亞宣布已達成協議,以約 1.86 億歐元的價格將其西班牙基礎設施服務業務出售給 Portobello Capital。該公司表示,其基礎設施服務業務2020年收益8.22億歐元,預計在被Portobello Capital收購後收益將增加。

- 2021 年 10 月 - 世邦魏理仕集團宣布收購西班牙和葡萄牙的 Bovis,這是一家領先的計劃、管理和諮詢公司,為多個行業的客戶提供服務。此類收購預計將為西班牙設施管理業帶來商機。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 加大房地產、醫藥產業投資

- 教育機構和商業設施的衛生問題增加

- 市場問題

- 利潤率下滑,宏觀環境持續變化

第6章 市場細分

- 按設施管理類型

- 內部設施管理

- 外包設施管理

- 單一設施管理

- 捆綁設施管理

- 綜合設施管理

- 按報價類型

- 硬體維修

- 軟調頻

- 按最終用戶

- 商業設施

- 設施

- 公共/基礎設施

- 工業的

- 其他

第7章 競爭格局

- 公司簡介

- ISS Global

- Ferrovial Servicios

- Acciona Facility Services SA

- Licuas SA

- CBRE Group

- Sacyr Facilites

- The Mail Company

第8章市場展望

The Spain Facility Management Market is expected to register a CAGR of 5.29% during the forecast period.

Key Highlights

- According to European Commission, the Spanish education system has a decentralized management and administration model. Most of the investment in education is public, representing more than 87% of the total spending on education in the case of levels that are lower than higher education and more than 66% in tertiary education.

- Such large-scale investments under government undertaking increase the facility management services to be outsourced to private players. For instance, in November 2020, Interserve Group Limited, the international support services, construction, and equipment services group, received a GBP 3.6 million contract to deliver cleaning services and pest control at the campus of Autonoma University of Madrid.

- The market is witnessing multiple strategic acquisitions between the market leaders in Spain. For instance, in October 2020, DOMINION acquired FAMAEX, the Spanish start-up, to revolutionize the maintenance and repair services of commercial stores and real estate. With this technological platform through which, any company or facility manager could request and schedule a service.

- The increasing investments in the healthcare sector with new production facilities would further help in driving the growth of the studied market. For instance, In May 2021, BD (Becton, Dickinson, and Company) is building a USD 200 million high-tech manufacturing facility in Zaragoza, Spain, to support the production of pre-fillable syringes for vaccines and other biologics.

- Further, the outbreak of COVID-19 has had a mixed business impact on facilities management firms in Spain. The restrictions on the movement of people resulted in a decline in project work and a decreased level of activity across many customer sites. Significant players in the market, such as CBRE Group, and others, were adversely affected due to the pandemic lockdown.

Spain Facility Management Market Trends

Growing Investments in real estate and pharmaceutical industries

- The Spanish economy has witnessed substantial improvement in 2021 post the pandemic's catastrophic shock. According to Sociedad de Tasacion, the sale of dwelling homes in the country reached to 676,775 units and showed an increase of 38.1% in 2021.

- Moreover, according to data from the Spanish Land Registry (Registradores), the proportion of foreign buyers across Spain as a whole increased by 0.23 % from 9.52% in the first quarter of 2021 and 9.75% in the second quarter of 2021, suggesting that international buyers are beginning to return.

- The real estate vendors in the market have been investing in acquisitions for scaling in the real estate sectors. For instance, in September 2021, Round Hill Capital announced the acquisition serviced apartment asset in Valdebebas (Madrid) for an investment of EUR 30 million. Therefore such developments in the country is driving opportunities for facility management in the country.

- The investments in the Pharmaceutical industry increased during the pandemic. For instance, in April 2021, the government of Spain announced that the researchers would start studying the effects of mixings two vaccines. In addition, the trial is expected to draw a sample of 600 people of all ages from across Spain to determine if the Pfizer vaccine can be given to patients who have received the AstraZeneca Vaccine dose within 28 days.

- Furthermore, various acquisitions from the key players of CDMO platforms are exercising mergers and acquisitions of pharmaceutical manufacturing sites to better research and develop COVID-19 vaccines. For instance, in January 2021, the company Siegfried announced the acquisition of pharmaceutical manufacturing sites from Novartis in the Barcelona region. The company intends to transform the formerly captive manufacturing sites into flexible and competitive customer-facing CDMO platforms offering their services to various customers worldwide. Such initiatives driving opportunities for facility management in Spain.

Institutional Sector is Expected to Grow Significantly

- The country has been witnessing the delayed expansion of institutional sectors due to a six-year-long political and financial tensions followed by the impact of COVID-19. However, in September 2021, Spain's council of ministers awarded Madrid's Museo Nacional del Prado with USD 42 million to compete for the anticipated expansions. The investment will allow institutions to renovate the neighboring Hall of Realms by 2024. Therefore such investments are expected to drive opportunities for facility management in the institutional sector.

- Further, the sector outsources the facility management mainly for hard facility management, which deals with wiring, elevators, plumbing, heating, and cooling. However, institutions also outsource soft facility management services such as security and ground keeping.

- With increased construction and renovation activities in the institutional sector, the demand for facility management is witnessing growth. For example, EdTech Aprende Institute raised USD 22 million to expand in Spanish-speaking markets, and Valor Capital Group raised USD 27 million in financing to establish a presence in Spanish-speaking markets.

Spain Facility Management Industry Overview

Spain's FM market is considered nearly concentrated as few local and international players are present with significant years of industry experience. The FM companies are incorporating technologies into their services, which are adding strength to their service portfolio. Moreover, major players have adopted various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in this market.

- October 2021 - Ferrovial announced that it reached an agreement to sell the infrastructure Service business in Spain to Portobello Capital for approximately EUR 186 million. According to the company, its infrastructure service business in 2020 accounted for a revenue of EUR 822 million and is expected to witness revenue growth post the acquisition by Portobello Capital.

- October 2021 - CBRE group announced the acquisition of Bovis Spain and Portugal, which is one of the leading project management and consultancy firm serving clients across multiple sectors. Such acquisitions are expected to bring opportunities for the company's facility management sector in Spain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments in real estate and pharmaceutical industries

- 5.1.2 Increaseing hygine concers across educational institutes and commercial properties

- 5.2 Market Challenges

- 5.2.1 Diminishing Profit Margins and Ongoing Changes in Macro-environment

6 MARKET SEGMENTATION

- 6.1 By Facility Management Type

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single Facility Management

- 6.1.2.2 Bundled Facility Management

- 6.1.2.3 Integrated Facility Management

- 6.2 By Offering Type

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-Users

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ISS Global

- 7.1.2 Ferrovial Servicios

- 7.1.3 Acciona Facility Services SA

- 7.1.4 Licuas SA

- 7.1.5 CBRE Group

- 7.1.6 Sacyr Facilites

- 7.1.7 The Mail Company