|

市場調查報告書

商品編碼

1683511

義大利設施管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Italy Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

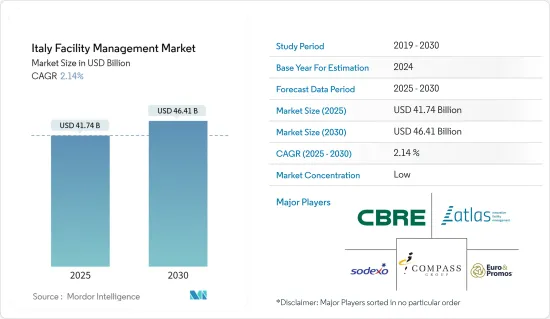

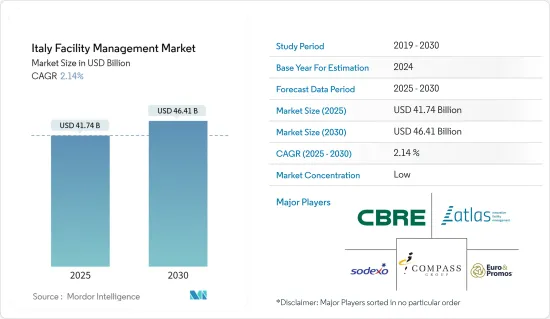

義大利設施管理市場規模預計在 2025 年為 417.4 億美元,預計到 2030 年將達到 464.1 億美元,預測期內(2025-2030 年)的複合年成長率為 2.14%。

國際設施管理協會 (IFMA) 將設施管理定義為將實體職場與組織的勞動力和業務連接,包括設備維護、空間規劃和投資組合預測。這些服務包括領導和策略、房地產和物業管理、計劃管理、品質、人員方面、應急計劃和業務永續營運、環境永續性等。

主要亮點

- 例如,物聯網 (IoT) 是指使用網際網路與 FM 團隊連接的實體設備和感測器。這些會產生性能資料並提醒設施管理人員潛在問題。 FM 可讓您從任何地方監控和控制您的設備。 FM 團隊正在使用物聯網來提供對營運的即時洞察。物聯網可以與 CMMS(基於電腦的維護管理系統)等 FM 軟體結合,以識別問題、自動建立和分配工作訂單(無需人工干預)並追蹤其執行情況。

- 智慧建築中的設施管理利用資料、自動化和新技術,使建築更有效率、更經濟地運作。智慧建築使用感測器和自動化來控制從照明到空間運轉率到能源消耗的一切。利用智慧技術可以幫助收集可靠的資料並為設施管理人員提供做出更好業務決策所需的洞察力。

- 義大利擁有多元化的商業房地產市場,包括零售、辦公室、工業和酒店。近年來,義大利市場穩步成長,尤其是在辦公室和工業領域。義大利的商業房地產價格因位置和房產類型而異,黃金地段通常價格較高。義大利商業房地產行業的主要參與者包括世邦魏理仕 (CBRE)、第一太平戴維斯 (Savills) 和高緯環球 (Cushman & Wakefield)。

- 隨著主要企業進入商業領域,義大利設施管理服務市場需要變得更具凝聚力。例如,市場由 Elmet Srl、Rekeep SpA 和 NAZCA 等地區參與者主導。當地參與者在市場上提供有競爭力的價格,從而降低了供應公司的議價能力,並讓買家能夠以最小的轉換成本快速轉換設施管理供應商。本地企業與國際聯繫較弱,導致其對技術先進的設施管理服務(如用於清潔業務的機器人)的採用率較低,這可能會帶來長期的重大威脅。

- COVID-19 疫情對設施管理公司產生了重大的經濟影響。人員流動的限制已導致計劃工作減少和一些客戶現場活動減少。疫情封鎖影響了該行業的主要企業,包括索迪斯設施管理服務公司和世邦魏理仕集團。

- 自疫情爆發以來,對轉型、創造性解決方案和獨特規劃策略的需求日益增加。隨著對更嚴格的衛生法規、更好的職場安全和清潔度以及數位化職場環境的發展的日益重視,採購對於設施管理市場的疫情後轉型和復甦至關重要。

義大利設施管理市場趨勢

內部設施管理部門預計將佔據較大的市場佔有率

- 內部設施管理是指由客戶組織直接聘用的專用資源所提供的服務。這種設施管理監控通常以傳統的員工-雇主關係為基礎進行績效管理。

- 內部設施管理僱用專門人員來維護和管理設施或區域的各種功能屬性。大多數常見服務通常委託給第三方服務提供者。然而,一些服務,例如保全服務和網路安全援助,仍然在內部運作和監控,以確保我們設施的安全和完整性。

- 零售業和旅館業在一定程度上為內部員工提供非專業服務支援。然而,低度開發國家的組織和個人繼續使用承包商從事電梯、暖通空調和 MEP 等專業工作。

- 私人消費、經濟活動和旅遊活動增加等因素推動了大型住宅佈局/計劃、酒店和商業空間的運轉率。因此,對更好的設施管理的需求日益成長。

- 該國的住宅正在興起,這可能會進一步刺激對該公司設施管理服務的需求。疫情爆發之前,建築業投資持續成長。

- 在義大利,物流業正在擴張。外包和供應鏈重組正在興起,其中包括有利於第三方物流參與者並增加其空間需求的策略。不斷增加的房地產擴張計劃可能會增加物流行業新設施的建設,從而增加對設施管理的需求。

商業和零售領域預計將佔據主要市場佔有率

- 商業和零售部門包括商業服務供應商(例如製造商、IT 和通訊業者以及其他服務供應商)使用的辦公大樓。商業設施管理就是讓您的營業地點成為一個健康、安全和溫馨的地方,同時提升您的品牌並為您的客戶提供便利的服務。清潔地板、衛生間和櫥窗展示、組裝引人注目的商店展示,有時甚至徹底整修設施或商店地板,都構成了零售設施管理的過程。這些任務會根據客戶的要求而改變。

- 國內商業建築業投資不斷增加,帶動設施管理業務的發展。各種投資公司聘請物業管理公司來處理他們的房地產投資交易。

- 據仲量聯行稱,羅馬和米蘭的辦公室租賃量均有所增加。企業租戶繼續尋求創新租約的彈性,而員工則希望在工作生活中享有更多自由。在羅馬,收購面積增加到約 15 萬平方米(與前一年同期比較增加 5%)。預計到 2023 年,企業合併、空間縮小和黃金地段遷移將成為整個市場的趨勢,同時人們將更加關注 2030 年永續性目標。

- 疫情過後,歐洲實體店重新開幕緩慢,電子商務發展也緩慢。在義大利等歐洲主要市場,電子商務滲透率幾乎恢復到疫情前的成長趨勢,並持續成長。分店將專注於打造完善的全通路體驗,透過無縫融合線上和店內體驗來提高客戶參與。因此,預計零售商將繼續投資實體店,並專注於更優越的地理位置。

- 預計預測期內,零售業和建設產業的成長、商業領域投資的增加以及全國智慧建築數量的增加將推動設施管理的需求。預計商業和房地產行業的溫和成長將推動市場成長。

義大利設施管理產業概況

義大利設施管理市場比較分散。 FM 供應商正在採用強力的競爭策略來利用他們的專業知識。他們還在廣告上投入了大量資金。市場上的領先供應商,如 CBRE Group Inc.、ATLAS IFM SRL、Sodexo Facilities Management Services(SODEXO GROUP)、Compass Group PLC、Euro &Promos Facility Management、SPA(EURO &PROMOS),都專注於提供整合解決方案來吸引消費者。預計市場上的小型供應商和新進業者將專注於保持與大型供應商相比的成本效益,進一步加劇該國的競爭。此外,隨著國內公共部門日趨成熟,人們的注意力可能會轉向私部門。

- 2023 年 7 月,Mitie Defence Limited 獲得國防基礎設施組織 (DIO) 頒發的價值 1.9057 億美元的契約,為駐義大利的英國陸軍提供關鍵服務。該合約主要涵蓋義大利學校、辦公大樓的維護、維修和服務等硬設施管理,以及廢棄物、洗衣服務等軟設施管理。

- 2023 年 3 月,世邦魏理仕宣布推出一條新的全球服務線,為建造電動車充電基礎設施提供建議,包括電動車充電策略、確定充電地點、規劃和推出電動車充電基礎設施,以及整體專案管理和持續維護。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 2021-2028 年市場規模及預測

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對產業的影響

第5章 市場動態

- 市場促進因素

- 智慧建築日益流行

- 商業地產領域穩定成長

- 市場限制

- 市場分散,有多家本地供應商

第6章 市場細分

- 依產品類型

- 硬體設施管理

- 軟設施管理

- 設施管理類型

- 內部設施管理

- 外包設施管理

- 單一設施管理

- 捆綁設施管理

- 整合性機構管理

- 按最終用戶產業

- 商業和零售

- 設施

- 政府、基礎設施和公共部門

- 製造/工業

- 其他

第7章 競爭格局

- 公司簡介

- CBRE Group Inc.

- ATLAS IFM SRL

- Sodexo Facilities Management Services(SODEXO GROUP)

- Compass Group PLC

- Euro & Promos Facility Management SPA(EURO & PROMOS)

- Rekeep SpA

- Olly Services SRL

- NAZCA

- Elmet SRL

- Kier Group PLC

第8章投資分析

第9章:市場的未來

The Italy Facility Management Market size is estimated at USD 41.74 billion in 2025, and is expected to reach USD 46.41 billion by 2030, at a CAGR of 2.14% during the forecast period (2025-2030).

The International Facility Management Association (IFMA) defines facility management as combining a physical workplace with an organization's workforce and work, including equipment upkeep, space planning, and portfolio forecasting. These services include leadership and strategy, real estate and property management, project management, quality, human aspects, emergency planning and business continuity, environmental sustainability, and others.

Key Highlights

- Various trends may propel facility management in Italy; for example, the Internet of Things (IoT) refers to physical equipment and sensors that use the Internet to connect with FM teams. They generate performance data that alerts facility managers to potential problems. FMs can monitor and control equipment from any location. FM teams use IoT to deliver real-time insights into their operations. IoT paired with FM software, such as a computerized maintenance management system (CMMS), identifies problems, automatically prepares and assigns work orders without human intervention, and tracks their execution.

- Facility management in smart buildings utilizes data, automation, and new technologies to enable buildings to be run more efficiently and cost-effectively. An intelligent building uses sensors and automation to control all facilities, from lights to space occupancy and energy consumption. With smart technology, robust data can be gathered to give the facilities manager the insights needed to make better business decisions.

- Italy has a diverse commercial real estate market, including retail, office, industrial, and hospitality properties. The Italian market has seen steady growth in recent years, particularly in the office and industrial sectors. Prices for commercial real estate in Italy can vary depending on location and property type, with prime locations typically commanding higher prices. Major Italian commercial real estate industry players include CBRE, Savills, and Cushman & Wakefield.

- The Italian facility management services market needs to be more cohesive as significant local players enter the commercial sector. For instance, the market is dominated by regional players such as Elmet Srl, Rekeep SpA, and NAZCA. Local players offer competitive pricing in the market, which reduces the suppliers' bargaining power and gives the buyers an option to switch their facility management vendors with minimal switching costs quickly. Local players with fewer international relationships are leading to lesser adoption of technically advanced FM services, such as robotics used for cleaning practices, which will be a significant threat with a long-term effect.

- The COVID-19 pandemic had a significant economic impact on facility management companies. People's mobility restrictions resulted in declining project work and decreased activity at several customer sites. The pandemic lockdown impacted major industry businesses, including Sodexo Facilities Management Services and CBRE Group.

- The demand for transformation, creative solutions, and unique planning strategies has increased since the pandemic. Since the emphasis has shifted toward higher hygiene-related rules, better workplace safety and cleanliness, and developing a digitized work environment, sourcing and procurement are essential in the facilities management market's post-pandemic transformation and recovery.

Italy Facility Management Market Trends

The In-house Facility Management Segment is Expected to Hold a Significant Market Share

- In-house facility management refers to services provided by a dedicated resource directly employed by the client organization. In this type of facility management monitoring, performance control is usually conducted under the terms of the conventional employee/employer relationship.

- In-house facility management involves recruiting specialized personnel to maintain and manage various functional attributes of a facility or area. Most generic services are generally outsourced to third-party service providers. However, some services, such as security services or cybersecurity assistance, are still operated and monitored in-house to assure the safety and integrity of the facilities.

- Retail and hotel industries have supported in-house staff for non-specialized services to some extent. However, organizations and individuals in underdeveloped countries continue using contractors for specialized tasks like elevator, HVAC, and MEP work.

- Factors including increased consumer spending, economic activity, and tourism activities have augmented the occupancy of large residential layouts/projects, hotels, and commercial spaces. This has, in turn, increased the need for better facility management.

- The country is witnessing increasing construction in the residential sector, which will further boost the demand for in-house facility management services. Before the pandemic, building investments were continuously increasing.

- In Italy, logistics sectors are expanding. They are outsourcing and restructuring supply chains, including strategies that benefit third-party logistics players and boost their space requirements. Increased real estate expansion plans will increase the construction of new facilities for the logistics sector, thereby increasing the demand for facility management.

The Commercial and Retail Segment is Expected to Hold a Significant Market Share

- The commercial and retail segment includes office buildings used by suppliers of business services, such as manufacturers' corporate offices, IT and communication businesses, and other service providers. Retail facilities management refers to making a company's location hygienic, secure, and welcoming while boosting the brand and simplifying things for the clients. Cleaning floors, restrooms, and window displays, assembling eye-catching retail displays, and occasionally completely renovating the facility or shop floor constitute the retail facilities management process. These tasks vary based on the client's requirements.

- The country's commercial building industry has seen significant investments, propelling the facility management business. Various investment firms have hired real estate management businesses to handle their real estate investments.

- According to JLL, office leasing increased in both Rome and Milan. Corporate tenants continue to seek flexibility with novel leases, while workers want freedom in their working lives. In Rome, take-up climbed to around 150,000 sq. m (+5% Y-o-Y). In 2023, the market-wide trend in company consolidations, space reduction, and prime space relocating and an increased focus on 2030 sustainability targets were anticipated.

- The re-opening of physical retail and e-commerce penetration moderated in Europe after the pandemic. For vital European markets such as Italy, e-commerce penetration broadly returned to its pre-pandemic growth trend and is continuing to grow. Occupiers will likely focus on creating a solid omnichannel experience, seamlessly combining the online and brick-and-mortar experience and increasing customer engagement. Thus, retailers are expected to continue investing in physical stores, focusing more on prime locations.

- The growing retail and construction industry, increasing investment in the commercial sector, and increasing smart buildings in the country are expected to drive the demand for facility management during the forecast period. The gradual growth in the commercial and real estate sectors are expected to drive market growth.

Italy Facility Management Industry Overview

The Italian facility management market is fragmented. FM vendors are incorporating a powerful competitive strategy by leveraging their expertise. In addition, they spend a large chunk of their money on advertising. Major vendors in the market, like CBRE Group Inc., ATLAS IFM SRL, Sodexo Facilities Management Services (SODEXO GROUP), Compass Group PLC, Euro & Promos Facility Management, and SPA (EURO & PROMOS), are focusing on offering integrated solutions to attract consumers. Smaller and new vendors in the market are expected to focus on maintaining cost-benefit over major vendors, further intensifying the competition in the country. The focus will also be directed toward the private sector, owing to the public sector reaching a mature stage in the country.

- July 2023: Mitie Defence Limited was awarded a USD 190.57 million contract by the Defence Infrastructure Organisation (DIO) to provide key services for the UK Armed Forces serving in Italy. The contract primarily involves hard facilities management, such as maintenance, repairs, and servicing and soft facilities management, including waste disposal and laundry services, for school and office buildings in Italy.

- March 2023: CBRE announced the launch of a new global service line that advises clients on establishing their electric vehicle charging infrastructure, including EV-charging strategy, identifying charging site locations, planning and installing EV-charging infrastructure, and providing overall program management and ongoing maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Size and Estimates for the Period of 2021-2028

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Smart Buildings

- 5.1.2 Steady Growth in Commercial Real Estate Sector

- 5.2 Market Restraints

- 5.2.1 Fragmented Market with Several Local Vendors

6 MARKET SEGMENTATION

- 6.1 By Offering Type

- 6.1.1 Hard Facility Management

- 6.1.2 Soft Facility Management

- 6.2 By Facility Management Type

- 6.2.1 In-house Facility Management

- 6.2.2 Outsourced Facility Management

- 6.2.2.1 Single Facility Management

- 6.2.2.2 Bundled Facility Management

- 6.2.2.3 Integrated Facility Management

- 6.3 By End-User Industry

- 6.3.1 Commercial and Retail

- 6.3.2 Institutional

- 6.3.3 Government, Infrastructure & Public Entities

- 6.3.4 Manufacturing and Industrial

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CBRE Group Inc.

- 7.1.2 ATLAS I.F.M. SRL

- 7.1.3 Sodexo Facilities Management Services (SODEXO GROUP)

- 7.1.4 Compass Group PLC

- 7.1.5 Euro & Promos Facility Management SPA (EURO & PROMOS)

- 7.1.6 Rekeep SpA

- 7.1.7 Olly Services SRL

- 7.1.8 NAZCA

- 7.1.9 Elmet SRL

- 7.1.10 Kier Group PLC