|

市場調查報告書

商品編碼

1632068

亞太交易所驅動:市場佔有率分析、產業趨勢與成長預測(2025-2030)Asia-Pacific Alternating Current (AC) Drive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

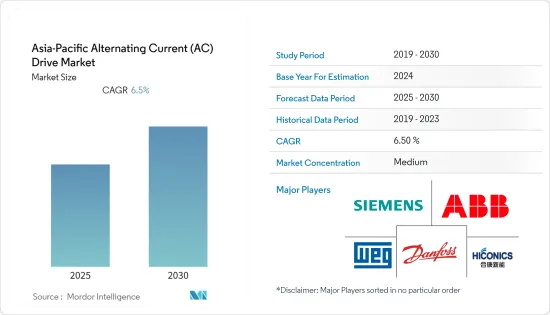

亞太地區交流傳動市場預計在預測期內複合年成長率為 6.5%

主要亮點

- 亞太地區的公共和政府正在鼓勵工業和家庭透過實施節能技術來減少能源使用。透過提高使用交流電源的機器的效率,交流變頻器代表了理想的節能解決方案。交流變頻器可節省馬達 25% 至 70% 的能源。

- 交流變頻器的製造成本較低,加上電費上漲,正在推動其銷售。交流變頻器是世界各地馬達驅動設備製造商的首選,因為它們功耗較低、無需維護且結構簡單。

- 中國已成為世界上最大的製造地之一,使其成為交流變頻器的重要市場。同樣,「印度製造」等舉措預計將進一步推動印度的工業製造和加工行業,使該國成為交流變頻器最有前途的市場之一。

- 此外,COVID-19 大流行對石油和天然氣產業產生了重大影響。例如,由於 COVID-19 大流行導致油價下跌,澳洲蓬勃發展的液化天然氣產業陷入停滯。油價暴跌和地緣政治價格戰已導致超過 800 億美元的投資決策被推遲。

- 由於 COVID-19 大流行,對低電壓交流變頻器的需求大幅下降。由於政府為減緩疫情蔓延而實施的封鎖措施,許多這些產品的製造商已全部或部分關閉工廠。由於 COVID-19 大流行,工業產品需求減少正在拖累亞太地區交流變頻器市場。

亞太交易所推動市場趨勢

電動車需求的增加預計將推動市場成長

- 工業物聯網(IoT)的普及以及使用雲端運算、行動通訊和網路技術來控制和維護這些驅動器預計將推動亞太國家交流變頻器市場的成長。

- 在預測期內,亞太地區對電動車的採用意識不斷增強,預計將推動交流變頻器市場的發展。低壓交流變頻器為通用用途提供高效的速度和扭矩控制,並且維護成本低且尺寸緊湊,因此它們在對節能電氣設備日益成長的需求中發揮著重要作用。

- 此外,2022 年 6 月,總部位於孟買的新興企業PMV Electric 將於下個月在印度推出首款超緊湊型電動車 EaS-E,以加速我計劃在個人出行領域採用永續性。該電動車的展示室售價約為 40 萬印度盧比,一次充電可行駛 200 公里。

- 例如,2021年9月,ABB推出了一款創新一體式電動車(EV)充電器,可提供市場上最快的充電體驗。 Terra 360 是一款模組化充電器,可使用動態配電同時為最多四輛車充電。

- 此外,2022 年 1 月,電動車 (EV) 和清潔能源新興企業Simple Energy 宣布與西門子數位工業軟體公司合作,利用最尖端科技增強其電動車移動解決方案。 Simple Energy 將與西門子一起,與西門子的技術合作夥伴 PROLIM 合作,加強技術共用,幫助印度成為世界電動車之都。

石油和天然氣產業預計將佔據較大佔有率

- 亞太地區成長的主要驅動力是基礎設施、石油和天然氣以及發電行業的資本投資,而對能源效率解決方案的投資也可能推動長期市場成長。

- 由於上游和中游石油和天然氣行業的投資不斷增加,預計交流變頻器在預測期內將快速成長。此外,油氣上游企業逐步投資石油生產活動,提高交流馬達的替代率,推動市場成長。

- 亞太地區的成長主要由石油、天然氣和發電行業的資本投資以及能源效率解決方案的投資所推動。對這些領域的大量投資,加上對節能和再生能源來源的關注以降低成本,預計將推動市場的長期成長。

- 此外,亞太地區石油消費量為3,460萬桶/日,佔全球消費量的35%。過去十年,這一消費量增加了三分之一。該地區最大的消費國是中國。其每日需求量超過1,300萬桶,佔亞太地區總需求的38%(資料來源:國際石油和天然氣生產商協會)。

- 在印度、泰國、印尼等新興國家,政府推動工業化的措施導致小型和微型製造設備的增加,對節能產品的需求不斷成長。製造業和工業自動化的改進預計將進一步推動亞太地區變頻驅動(VFD)市場。

亞太交易所 (AC) 傳動產業概覽

亞太地區交流變頻器市場競爭激烈,擁有大量全球和區域參與者,例如 ABB LTD、丹佛斯、西門子 AG 和 Weg SA。這些市場參與者佔據了重要的市場佔有率,並致力於擴大基本客群。這些供應商正在優先考慮研發活動、策略聯盟以及其他有機和內部成長策略,以便在預測期內獲得競爭優勢。

- 2022 年 4 月 - WEG 推出 CFW900 變速驅動器 CFW900 VSD 是一款最先進的產品,用於驅動和控制工業機械和製程中的馬達。 CFW900 逆變器可節省能源、提高生產率並提高已安裝流程網路的品質。

- 2022 年 3 月 - 領先的電子製造公司賽米控和丹佛斯 Silicon Power 宣佈建立合作夥伴關係,共同建立專門從事功率半導體模組的電力電子業務。新的賽米控丹佛斯擁有超過 3,500 名電力電子專家,作為電力電子領域的領先合作夥伴,擁有世界一流的技術專業知識。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對節能和效率的需求不斷成長

- 快速工業化和城市發展帶來市場復甦

- 市場問題

- 電動車充電設施不足

第 6 章 細分

- 按電壓

- 低電壓

- 中壓

- 按最終用戶產業

- 石油和天然氣

- 化工/石化

- 發電

- 用水和污水

- 發電

- 金屬/礦業

- 空調

- 飲食

- 離散製造業

- 其他

- 按國家/地區

- 中國

- 印度

- 韓國

- 日本

- 澳洲/紐西蘭

- 其他亞太地區

第7章供應商市場佔有率分析

第8章 競爭格局

- 公司簡介

- ABB LTD

- Danfoss

- Siemens AG

- Weg SA

- Hiconics eco-energy Technology Co., Ltd.

- Toshiba Industrial Products and Systems Corporation

- Teco Electric & Machinery Co., Ltd.

- Nidec Corporation

- Fuji Electric Asia Pacific Pte. Ltd.

- Brilltech Engineers Pvt. Ltd

第9章投資分析

第10章投資分析市場的未來

The Asia-Pacific Alternating Current Drive Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- Utilities and governments of Asia-Pacific encourage industries and households to use less energy by implementing energy-saving techniques. By increasing the efficiency of machines that use AC power, AC drives provide the ideal solution for energy savings. AC drives save between 25% and 70% of the energy used by motors.

- AC drives low production costs, combined with an increase in electricity prices, which has boosted their sales. Manufacturers worldwide prefer these drives for motor-driven equipment because they use less electricity, require less maintenance, and are simple.

- China has emerged as one of the world's largest manufacturing hubs, making it a significant market for AC drives. Similarly, initiatives such as 'Make in India' are expected to further propel India's industrial manufacturing and processing sectors, positioning the country as one of the most promising markets for AC drives.

- Furthermore, the Covid-19 pandemic significantly impacted the oil and gas industry. For example, Australia's thriving LNG industry has stalled due to a drop in oil prices caused by the COVID-19 pandemic. The collapsed oil price and geopolitical price war have delayed more than USD 80 billion in investment decisions.

- The COVID-19 outbreak has greatly reduced the demand for low voltage AC drives. Many manufacturers of these products have completely or partially shut down their plants due to government-imposed lockdowns to slow the spread of the pandemic. As a result of the COVID-19 pandemic, low demand for industrial products weighs on the Asia-Pacific AC Drive Market.

APAC Alternating Current (AC) Drive Market Trends

Increasing Demand for Electric Vehicles is Expected to Cater Market Growth

- The growing popularity of the industrial Internet of Things (IoT), as well as the use of cloud computing, mobile communications, and web technologies for controlling and maintaining these drives, is expected to boost AC drive market growth in countries in the Asia Pacific.

- During the forecast period, the AC drive market is expected to be driven by an increase in awareness about the adoption of electric vehicles in Asia-Pacific. The increased demand for energy-efficient electrical equipment is likely to play a significant role, as low voltage AC drives provide highly efficient speed and torque controls for common purposes, as well as little maintenance and compact size.

- Furthermore, In June 2022, PMV Electric, a Mumbai-based startup, plans to introduce its first micro-electric car, the EaS-E, in India next month to accelerate the adoption of sustainability in the personal mobility space. This EV is expected to cost around Rs 4 lakh ex-showroom and has a driving range of up to 200 kilometers per charge.

- For Instance, in September 2021- ABB introduced an innovative all-in-one Electric Vehicle (EV) charger that provides the market's fastest charging experience. The Terra 360 is a modular charger that can charge up to four vehicles simultaneously using dynamic power distribution.

- Moreover, in January 2022- Simple Energy, an electric vehicle (EV) and clean energy start-up, announced a collaboration with Siemens Digital Industries Software to enhance EV mobility solutions with cutting-edge technologies. Along with Siemens, Simple Energy has enlisted PROLIM, Siemens' Technology Partner, to share technologies to strengthen India's bid to become the world's EV capital.

Oil and Gas industry is Expected to Cater Major Share

- Growth in the Asia-Pacific region can be attributed primarily to capital investments in the infrastructure, oil, gas, and power generation sectors, as well as the investments in energy efficiency solutions further likely to drive long-term market growth.

- With increased investment in the oil and gas upstream and midstream sectors, the AC drive is expected to grow rapidly during the forecast period. Furthermore, oil and gas upstream companies are gradually investing in oil production activity, which will increase the replacement rate of AC electric motors, supporting market growth.

- Growth in the Asia-Pacific region can be attributed primarily to capital investments in the oil, gas, and power generation sectors and investments in energy efficiency solutions. The massive investments in these sectors, combined with a focus on energy conservation and renewable energy sources to reduce costs, are expected to drive the market's long-term growth.

- In addition, Asia Pacific consumes 34.6 million barrels of oil per day, accounting for 35% of global consumption. This consumption has increased by one-third in the last decade. The region's largest consumer is China. Its requirement of more than 13 million barrels per day accounts for 38% of total demand in the Asia Pacific (source: International Association of Oil & Gas Producers).

- The increase in micro and small-scale manufacturing units in developing countries such as India, Thailand, and Indonesia due to government policies to promote industrialization has resulted in a growing need for energy-efficient products, resulting in a demand for AC drive in the APAC region. Improvements in the manufacturing sector and industrial automation would further drive the Asia Pacific variable frequency drive (VFD) market.

APAC Alternating Current (AC) Drive Industry Overview

The Asia-Pacific AC Drives market is moderately competitive, with numerous global and regional players such as ABB LTD, Danfoss, Siemens AG, Weg SA, and many more. These market participants have a sizable market share and are focused on expanding their customer base. These vendors prioritize R&D activities, strategic partnerships, and other organic and inorganic growth strategies to gain a competitive advantage during the forecast period.

- April 2022- WEG introduces the CFW900 Variable Speed Drive. The CFW900 VSD is the most cutting-edge product for driving and controlling motors in industrial machines and processes. The CFW900 inverter saves energy, increases productivity, and improves quality in the process network in which it is installed.

- March 2022- SEMIKRON and Danfoss Silicon Power, one of the leading players in electronics manufacturing, announced a partnership to form a joint Power Electronics business focused on power semiconductor modules. With over 3,500 dedicated power electronic specialists already on board, the new SEMIKRON-Danfoss will provide world-class technology expertise as the leading partner in Power Electronics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy Savings and Efficiency

- 5.1.2 Rapid Industrialization and Urban Development to Fuel the market

- 5.2 Market Challenges

- 5.2.1 Inadequate Charging facilities for Electric Vehicles

6 SEGMENTATION

- 6.1 By Voltage

- 6.1.1 Low

- 6.1.2 Medium

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Power Generation

- 6.2.6 Metal & Mining

- 6.2.7 HVAC

- 6.2.8 Food & Beverage

- 6.2.9 Discrete Industries

- 6.2.10 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 South Korea

- 6.3.4 Japan

- 6.3.5 Australia and New Zealand

- 6.3.6 Rest of Asia-Pacific

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB LTD

- 8.1.2 Danfoss

- 8.1.3 Siemens AG

- 8.1.4 Weg SA

- 8.1.5 Hiconics eco-energy Technology Co., Ltd.

- 8.1.6 Toshiba Industrial Products and Systems Corporation

- 8.1.7 Teco Electric & Machinery Co., Ltd.

- 8.1.8 Nidec Corporation

- 8.1.9 Fuji Electric Asia Pacific Pte. Ltd.

- 8.1.10 Brilltech Engineers Pvt. Ltd