|

市場調查報告書

商品編碼

1636434

密封馬達的全球市場:市場佔有率分析、行業趨勢/統計、成長預測(2025-2030)Global Hermetic Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

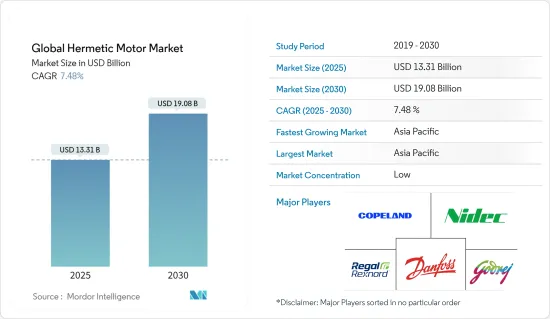

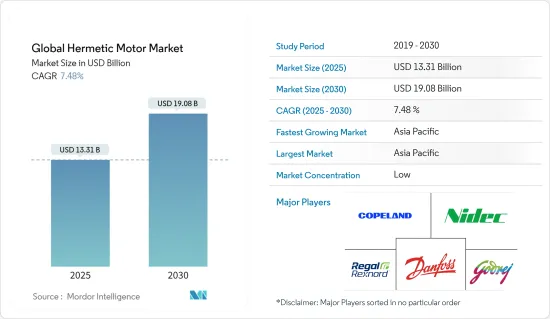

2025年,Hermetic 馬達的全球市場規模預計為133.1億美元,預計到2030年將達到190.8億美元,預測期間(2025-2030年)複合年成長率為7.48%。

主要亮點

- 從中期來看,全球低溫運輸產業的擴張和暖通空調產業需求的增加將推動全球封閉市場的發展。

- 然而,它們面臨著初始成本高、可修復性有限和應用依賴等挑戰。

- 由於技術的不斷進步,全球封閉式馬達市場正在迎來重大機會。儘管存在挑戰,高效設計、智慧技術、先進材料和環保系統等創新預計將推動需求並開闢新的成長途徑。

- 亞太地區最近佔據了重要的市場佔有率,預計在預測期內將成為最大和最快的市場。

全球密封馬達市場趨勢

額定輸出功率為 1 HP 或以下的密封馬達預計將成為一個重要的細分市場。

- 額定輸出功率為 1 馬力或更低的密閉式壓縮機經常用於冰箱和水冷卻器等家用電子電器以及商務用冷凍業務。這些壓縮機對於食品保存至關重要,因為它們可以保持低溫,從而減緩細菌生長並減少腐敗。

- 封閉式壓縮機根據額定馬力和背壓水平進行分類。例如,額定功率為 1/5 至 1/4 馬力、低背壓的壓縮機通常用於冷凍庫和冰箱中。另一方面,額定功率為 1/10 至 1/5 HP、可產生適度背壓的壓縮機非常適合飲料展示。最後,為高背壓設計的額定值為 1/16 至 1/2 HP 的壓縮機用於冷卻器和除濕器。

- 2017年至2021年,美國冷庫容量從36億立方英尺增加到37.3億立方英尺。然而,在2021年達到高峰後,2023年略有下降至36.9億立方英尺。

- 即使 2023 年冷藏能力下降,對額定功率低於 1 匹馬力的封閉式壓縮機的需求仍將保持強勁。推動這一需求的是藥品製冷、生物製藥製造以及食品和飲料行業所發揮的重要作用,所有這些都與醫療保健成本的不斷上升以及在大量投資的支持下的高效製冷系統有關。

- 截至 2024 年 1 月,北美食品和飲料產業預計將顯著成長,並計劃新計畫。其中包括約 24 家新工廠和 16 項擴建計劃,凸顯了該行業的積極投資和發展。

- 基於這些趨勢,1 HP(馬力)或以下的密封馬達很可能將主導市場。

亞太地區預計將主導市場

- 在人口成長的推動下,亞太地區工業快速成長,推動了對高效冷凍系統的需求。這些系統在食品和飲料、製藥和製造等各個領域都很重要,並且正在推動封閉式馬達市場的發展。

- 中國和印度等國家的經濟發展正在導致可支配收入的增加。隨著消費功率的增加,家用和商務用冷凍設備的需求大幅增加,而這些設備主要依賴封閉式馬達。

- 此外,政府舉措、冷凍技術的進步以及食品飲料和半導體領域的一波新計畫正在放大這一需求。綜合而言,這些因素顯示亞太地區密封馬達市場前景光明。

- 例如,在Semicon India 2024活動上,莫迪政府展示了對印度半導體產業的承諾,提供50%的財政支持並培養國際夥伴關係。此類舉措凸顯了對精確環境控制和高效冷卻解決方案日益成長的需求,並標誌著半導體製造中對密封馬達的需求激增。

- 例如,2024年5月,中國推出了第三支國營投資基金,資本規模高達475億美元。

- 2024年5月,信越化學宣佈在中國浙江省成立新公司信越有機矽(平湖)。我們將建立一個新的矽膠產品生產工廠,使我們的矽膠業務實現一個大的飛躍。由於產量擴張,對密封馬達的需求不斷增加。

- 鑑於這些動態,亞太地區有望引領密封馬達市場。

全球密封馬達產業概況

全球密封馬達市場已減少一半。該市場的主要企業(排名不分先後)包括 Copeland Corporation LLC、Nidec Corp.、Danfoss A/S、Godrej Industries Limited 和 Regal Rexnord Corp.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 研究假設和市場定義

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 全球低溫運輸產業的擴張

- 暖通空調產業需求不斷成長

- 抑制因素

- 初始成本高、可修復性有限、應用依賴

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 投資分析

第5章市場區隔

- 類型

- 交流密閉馬達

- 直流全封閉馬達

- 額定輸出

- 1 HP 或以下

- 1~5HP

- 5HP以上

- 目的

- 冷凍壓縮機

- 空調機組

- 工業冷凍

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 合併、收購、合資、合夥和協議

- 主要企業策略

- 公司簡介

- Copeland LP

- Nidec Corporation

- Man Energy Solutions SE

- Danfoss A/S

- Tecumseh Products Company LLC

- Huayi Compressor Co. Ltd

- Godrej Lawkim Motors

- Regal Rexnord Corporation

- Frascold SPA

- ABB LTD

- 其他知名公司名單

- Market Player Ranking

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 50003664

The Global Hermetic Motor Market size is estimated at USD 13.31 billion in 2025, and is expected to reach USD 19.08 billion by 2030, at a CAGR of 7.48% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the expansion of the global cold chain industry and the increasing demand in the HVAC industry are going to drive the global hermetic market.

- On the other hand, the market faces challenges due to high initial costs, limited repairability, and application-specific dependency.

- Nevertheless, due to ongoing technological advancements, the global hermetic motor market is poised for significant opportunities. Innovations, such as high-efficiency designs, smart technologies, advanced materials, and eco-friendly systems, are expected to drive demand and open new avenues for growth, despite existing challenges.

- Asia-Pacific recently held a significant market share, and it is expected to be the largest and fastest market during the forecast period.

Global Hermetic Motor Market Trends

Less than 1HP Power Rated Hermetic Motor is Expectected to be a Significant Segment

- Household appliances such as refrigerators and water coolers, along with commercial refrigeration operations, frequently utilize hermetic compressors rated at less than 1 horsepower. These compressors are crucial for food storage, as they maintain low temperatures that slow down bacterial reproduction and reduce spoilage.

- Hermetic compressors are classified based on horsepower ratings and back pressure levels. For instance, compressors rated at 1/5-1/4 HP, which produce low back pressure, are commonly found in freezers and refrigerators. In contrast, those rated at 1/10-1/5 HP, which provide medium back pressure, are ideal for beverage displays. Lastly, compressors rated at 1/16-1/2 HP, designed for high back pressure, are used in coolers and dehumidifiers.

- From 2017 to 2021, the refrigerated storage capacity in the United States grew from 3.6 billion cubic feet to 3.73 billion cubic feet. However, after peaking in 2021, it saw a slight dip to 3.69 billion cubic feet in 2023.

- Even with the 2023 dip in refrigerated storage capacity, the demand for hermetic compressors rated under 1 horsepower remains robust. This demand is fueled by their essential role in pharmaceutical refrigeration, biopharmaceutical manufacturing, and the food and beverage sector, all bolstered by rising healthcare expenditures and significant investments in efficient refrigeration systems.

- As of January 2024, the North American food and beverage industry is gearing up for substantial growth, with plans for around 66 new projects. This includes nearly 24 new plants and 16 expansion initiatives, underscoring the sector's vigorous investment and development.

- Given these trends, hermetic motors rated at less than 1HP (Horse Power) are poised to dominate the market.

Asia-Pacific Region is Expected to Dominate the Market

- Rapid industrial growth in the Asia-Pacific region, fueled by its expanding population, is driving a heightened demand for efficient refrigeration systems. These systems are crucial across various sectors, including food and beverage, pharmaceuticals, and manufacturing, subsequently propelling the market for hermetic motors.

- Economic advancements in nations such as China and India are translating to increased disposable incomes. With this boost in spending power, there's a notable uptick in demand for both household and commercial refrigeration appliances, which predominantly depend on hermetic motors.

- Furthermore, government initiatives, technological strides in refrigeration, and a wave of new projects in the food, beverage, and semiconductor sectors are amplifying this demand. Collectively, these elements paint a bright future for the hermetic motor market in the Asia-Pacific.

- Take, for example, the Semicon India 2024 event. Here, the Modi government showcased its commitment to India's semiconductor industry, offering 50% financial backing and fostering international partnerships. Such initiatives underscore the rising need for precise environmental controls and efficient cooling solutions, hinting at a surge in hermetic motor demand within semiconductor manufacturing.

- In another instance, May 2024 saw China launching its third state-backed investment fund, with a hefty USD 47.5 billion capital, all aimed at fortifying its semiconductor landscape, as reported by a government-run companies registry.

- In May 2024, Shin-Etsu Chemical Co. Ltd unveiled its new venture, Shin-Etsu Silicone (Pinghu) Co. Ltd, in Zhejiang Province, China. This initiative, featuring a fresh plant for silicone products, underscores a major leap in its silicone business. With this manufacturing expansion, the appetite for hermetic motors continues to rise.

- Given these dynamics, the Asia-Pacific is poised to lead the hermetic motor market.

Global Hermetic Motor Industry Overview

The Global hermetic motor market is semi-fragmented. Some of the key players in this market (in no particular order) include Copeland Corporation LLC, Nidec Corp, Danfoss A/S, Godrej Industries Limited, and Regal Rexnord Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions and Market Definition

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Billion, Till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Expansion of the Global Cold Chain Industry

- 4.5.1.2 Increasing Demand in HVAC Industry

- 4.5.2 Restraints

- 4.5.2.1 High Initial Costs, Limited Repairability and Application Specific Dependency

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 AC Hermetic Motors

- 5.1.2 DC Hermetic Motors

- 5.2 Power Rating

- 5.2.1 Less than 1 HP

- 5.2.2 1 - 5 HP

- 5.2.3 Above 5 HP

- 5.3 Application

- 5.3.1 Refrigeration Compressors

- 5.3.2 Air Conditioning Units

- 5.3.3 Industrial Refrigeration

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 Nordic Countries

- 5.4.2.6 Turkey

- 5.4.2.7 Russia

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Australia

- 5.4.3.4 Malaysia

- 5.4.3.5 Thailand

- 5.4.3.6 Indonesia

- 5.4.3.7 Vietnam

- 5.4.3.8 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Qatar

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle-east and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Copeland LP

- 6.3.2 Nidec Corporation

- 6.3.3 Man Energy Solutions SE

- 6.3.4 Danfoss A/S

- 6.3.5 Tecumseh Products Company LLC

- 6.3.6 Huayi Compressor Co. Ltd

- 6.3.7 Godrej Lawkim Motors

- 6.3.8 Regal Rexnord Corporation

- 6.3.9 Frascold SPA

- 6.3.10 ABB LTD

- 6.4 List of Other Prominent Companies

- 6.5 Market Player Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219