|

市場調查報告書

商品編碼

1632076

亞太地區感應電動機:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Asia-Pacific Induction Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

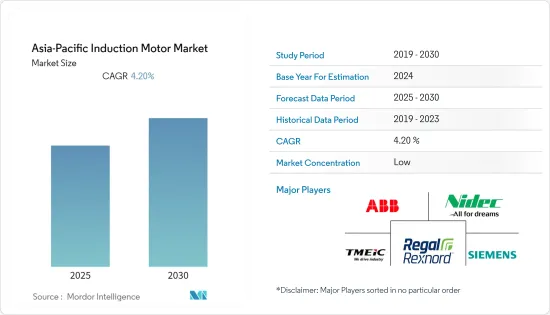

預計亞太地區感應電動機市場在預測期內的複合年成長率為 4.2%。

主要亮點

- 維持世界發展對電能的需求不斷增加,需要持續大規模的電力供應投資,這促進了感應電動機在電力領域的應用。

- 此外,印度和中國等新興國家的都市化不斷加快,感應電動機發揮關鍵作用的應用的需求也不斷增加,例如洗衣機、冰箱、暖通空調和幫浦。例如,日本巨頭大金公司已宣布協議投資100億盧比在斯里城(安得拉邦)建設佔地75英畝的工廠,並逐步建立大型空調製造工廠。

- 亞太地區的工業部門可能會因「中國製造2025」和「印度製造」等多項政府舉措而成長,這將提振感應感應電動機的需求並促進太平洋地區的成長。

- 工業化和商業化的發展將為整個全部區域創造更多的自動化機會。此外,過去 20 年來,家庭數量急劇增加。聯合國預測,2050年亞洲都市化將達64.1%。預計這些因素將進一步增加大規模使用感應電動機的多個行業的需求,例如製造和發電。然而,感應電動機替代品的引入是市場成長的主要限制。

- 幾家主要電器 (FMEG) 公司正在推出在其產品功能中使用感應電動機的新產品。例如,2022年3月,Havells India Limited宣布推出一系列技術先進的風扇,配備ECOACTIV超高效率BLDC馬達和感應電動機。

- 由於製造業停工,COVID-19 大流行對該地區的市場成長產生了負面影響。在需求方面,與 COVID-19 相關的遏制措施和經濟中斷導致該地區的生產和旅行減少,導致感應電動機需求大幅下降。

亞太地區感應電動機市場趨勢

工業應用成長顯著

- 由於具有成本效益、耐用性、免維護以及能夠在所有環境條件下運行等多種優點,三相感應電動機被用於各種應用的 70% 以上的工業機械中。這些馬達用於採礦、汽車、石油和天然氣、醫療保健和製造,是泵浦、升降機、起重機、破碎機、輸送機等的一部分。

- 日本政府通過了日本振興計劃,旨在投資1.3兆美元進一步振興製造業。這將成為日本從傳統製造業轉型為使用先進機械的先進製造程序的重要催化劑,並有望成為日本製造業永續成長的驅動力,從而推動市場研究。

- 印度對工業感應電動機的需求穩定。該國計劃到 2022 年,可再生能源裝置容量達到約 175GW,包括太陽能和風能。該國還計劃到 2030 年,約 40% 的能源來自可再生能源,而目前這一比例約為 15%。因此,感應電動機的需求預計將大幅成長。

- 此外,該地區的其他國家,例如澳大利亞、新加坡和澳大利亞,也重點在該地區採取工業4.0等舉措,並正在將精力投入到製造食品和飲料、紡織和服飾以及汽車行業的引入。對感應電動機的需求。

預計中國將佔主要佔有率

- 中國的工業生產在過去幾年中持續成長,預計將帶來新計劃和工業擴張,這可能會推動感應電動機的需求。

- 此外,中國制定了透過加快排放來應對氣候變化,到2060年實現碳中和,並排放實施多項提高能源效率的措施,預計將在提高工業和基礎設施效率方面發揮重要作用。 。

- 該國已從政治上認知到高效馬達的重要性,新的國家標準要求馬達的最低效率等級為 IE3,並於 2021 年 6 月 1 日生效。

- 汽車製造商正在擴大在中國的製造工廠,預計這將在預測期內推動感應電動機的需求。例如,特斯拉宣布計劃於 2022 年 2 月在上海開始建造一家新工廠,作為將其在華產能增加一倍以上的計劃的一部分,以滿足中國出口市場日益成長的汽車需求。

- 此外,中國人口向城市的遷移導致污水處理廠的增加,以滿足此需求。 2000年代初,中國約有500座都市廢水處理廠,但現在已超過4,000座。

亞太地區感應電動機產業概況

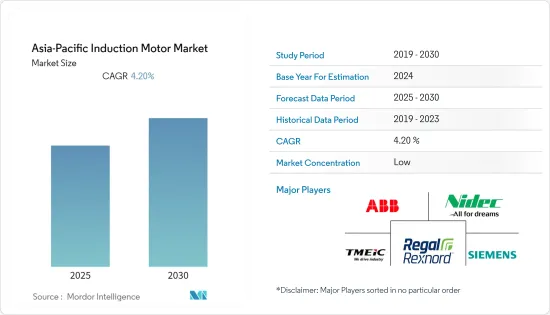

亞太地區感應電動機市場呈現碎片化狀態,國內和國際廠商均提供技術先進的感應電動機。市場上的主要供應商正在採取合併、收購和產品發布等舉措來增加其在市場上的影響力。

- 2022 年 1 月 - 作為採礦業的高效解決方案,WEG 提供 M Mining 系列滑環電機,機架 560,1,300kW,3,300V,4 極,50Hz,用於驅動阿根廷一家礦業公司的球磨機。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 提高能源效率的需求日益增加

- 住宅和工業領域對節能的需求日益成長

- 市場挑戰

- 替代方案的可用性

第 6 章 細分

- 按類型

- 單相感應電動機

- 三相感應電動機

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 發電

- 用水和污水

- 金屬/礦業

- 飲食

- 離散製造業

- 其他最終用戶產業

- 按國家/地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Nidec Corporation

- Siemens AG

- Regal Rexnord Corporation

- TMEIC

- WEG SA

- Fuji Electric Co., Ltd.

- Kirloskar Electric Company

- SEALOCEAN

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91183

The Asia-Pacific Induction Motor Market is expected to register a CAGR of 4.2% during the forecast period.

Key Highlights

- The increasing demand for electrical energy to sustain global development requires consistent heavy investments in power supply generation that have driven the application of induction motors in the electricity sector.

- Moreover, the growing urbanization in emerging economies such as India and China has increased the demand for washing machine, refrigerator, HVAC, pumps, and other applications in which induction motor has a key role in their functioning. For instance, Japanese major player Daikin has announced that it has finished the purchase agreement for a 75-acre plant at Sri City (Andhra Pradesh) with an investment of 1,000 Crore to set up a large air-conditioner manufacturing plant, which will come up in phases.

- The industrial sector in Asia-Pacific is likely to grow as a result of several initiatives by the government, such as 'Make in China 2025' and 'Make in India,' which will boost the demand for induction motors, thereby driving the growth in the region.

- The growth in industrialization and commercialization creates more automation opportunities across the region. Also, households have grown exponentially over the last two decades. The United Nations expects that urbanization in Asia will reach 64.1% by 2050. Such factors are further expected to drive demand in several sectors like manufacturing, and power generation, where induction motor finds its application on a large scale. However, introducing alternatives for induction motors is the major restraining factor for the market's growth.

- Several leading fast-moving electrical goods (FMEG) companies are introducing new products that use induction motors for the product's function. For instance, in March 2022, Havells India Limited announced the launch of a new range of technologically advanced fans equipped with ECOACTIV super-efficient BLDC and induction motors.

- The Covid-19 pandemic has negatively impacted the region's market growth due to the stoppage of manufacturing industry operations. On the demand side, containment measures and economic disruptions related to covid-19 have led down production and mobility in the region, producing a significant drop in demand for induction motors.

Asia Pacific Induction Motor Market Trends

Industrial Applications to Register Significant Growth Rate

- Three-phase induction motors are used in over 70% of industrial machinery for different applications owing to their several benefits, such as being cost-effective, durable, maintenance-free, and can work in any environmental condition. These motors are used in mining, automotive, oil and gas, healthcare, and manufacturing industries and are part of pumps, lifts, cranes, crushers, conveyors, etc.

- The Japanese government has adopted a plan, 'Rebirth of Japan,' which aims to further boost the manufacturing sector by investing USD 1.3 trillion. This is also expected to be a significant catalyst in the country's transition from traditional manufacturing to advanced manufacturing processes using advanced machinery and a driving force for sustainable growth in the Japanese manufacturing sectors, consequently driving the market studied.

- India has been experiencing steady demand for induction motors in industrial applications. The country has been planning to reach around 175 GW of installed renewable capacity, which includes solar and wind power, by 2022. The country has also planned to derive about 40% of the energy from renewable sources by 2030, which is currently at around 15%. Hence, the demand for an induction motor is expected to grow significantly.

- Moreover, other countries in the region, such as Australia, Singapore, and Australia, are focusing on taking initiatives like industry 4.0 in the region, driving the demand for induction motors by implementing energy-efficient systems in the manufacturing of food and beverage industry, textile and clothing, automotive industry.

China is Expected to Hold Major Share

- The industrial production of China has been showing continuous growth over the past few years, and it is expected to result in new projects and industrial expansions, which, in turn, may drive the demand for induction motors.

- Moreover, with China setting a target to combat climate change by speeding up the reductions in emissions to reach carbon neutrality before 2060, several measures to improve energy efficiency are expected to play a vital role in helping the industry and infrastructure to reduce their emissions.

- The country has recognized the importance of efficient electric motors as a matter of policy, with the launch of a new national standard that requires the motors to have a minimum efficiency level of IE3 coming into effect on June 1, 2021.

- Automakers have been expanding their manufacturing plants in China which is expected to drive the demand for induction motors in the forecast period. For instance, in February 2022, Tesla announced that it is planning to start work on a new plant in Shanghai as a part of a plan to more than double production capacity in China to meet the growing demand for its cars in the country's export markets.

- In addition, China's internal population migration to cities is causing growth in the number of waste water treatment plants to meet the demand. At the beginning of the millennium, China had around 500 municipal wastewater treatment plants, reaching above 4,000.

Asia Pacific Induction Motor Industry Overview

The Asia-Pacific induction motor market is fragmented owing to the presence of local and international players that offer induction motors with technological advancements. The key vendors in the market are taking initiatives such as mergers, acquisitions, and product launches to enhance their presence in the market.

- January 2022 - With efficient solutions in the mining sector, WEG supplied a slip ring motor from the M Mining line, frame 560, 1,300 kW, 3,300 V, four poles, and 50 Hz to drive the ball mill of a mining company in Argentina.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Higher Energy Efficiency

- 5.1.2 Rising Need of Power Savings in Residential and Industrial Sectors

- 5.2 Market Challenges

- 5.2.1 Availability of Alternative Options

6 SEGMENTATION

- 6.1 By Type

- 6.1.1 Single Phase Induction Motor

- 6.1.2 Three Phase Induction Motor

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Metal & Mining

- 6.2.6 Food & Beverage

- 6.2.7 Discrete Industries

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Australia & New Zealand

- 6.3.6 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Nidec Corporation

- 7.1.3 Siemens AG

- 7.1.4 Regal Rexnord Corporation

- 7.1.5 TMEIC

- 7.1.6 WEG SA

- 7.1.7 Fuji Electric Co., Ltd.

- 7.1.8 Kirloskar Electric Company

- 7.1.9 SEALOCEAN

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219