|

市場調查報告書

商品編碼

1683830

北美低壓感應馬達:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)North America Low Voltage Induction Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

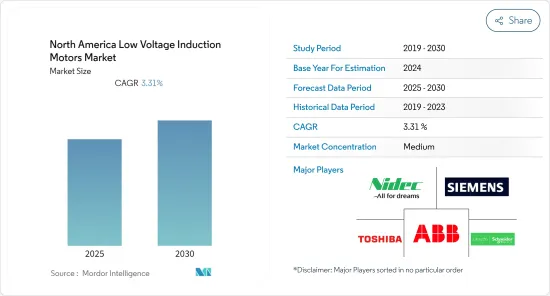

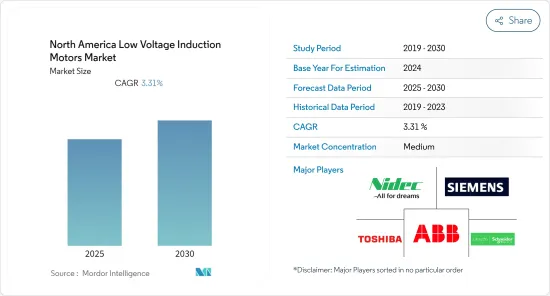

預測期內,北美低壓感應馬達市場預計複合年成長率為 3.31%

主要亮點

- 感應馬達是工業生產系統的主要動力源。對工業 4.0 的日益關注正在推動感應馬達市場的發展。隨著工業自動化推動製造業走向更有效率的生產力,預計北美將在預測期內實現強勁成長。根據 ABB 有限公司的《未來是能源高效的》報告,到 2050 年全球能源使用量預計將增加 50%。馬達消耗了工業能源的約 70%,目前有超過 3 億個工業馬達驅動系統運作。

- 同樣,馬達系統在減少二氧化碳排放和減少廢棄物方面發揮著重要作用。政府為減少二氧化碳排放進行的投資和努力可能會帶來更有效率的馬達。馬達對幾乎所有行業都至關重要,為主要工業流程和輔助系統(如產生壓縮空氣、通風和泵水)提供動力。

- 食品業製造商擴大採用自動化來滿足行業協會制定的準則和法規,以保持其所提供產品的品質。工業馬達也用於發電、石油和天然氣、採礦和製造業等其他主要行業。

- 由於生產成本增加,銅、鋁和銅線價格上漲預計會阻礙市場成長。金屬價格上漲可能會推高銅轉子和定子的成本。此外,美國對俄羅斯實施了貿易限制,而俄羅斯是美國最大的銅線出口國之一,預計這將阻礙市場成長。此外,礦山關閉、勞工騷亂和投機等外部因素預計將刺激感應馬達大量生產中使用的主要金屬價格上漲。

- 墨西哥是最大的天然氣進口國之一,也是最大的汽油買家之一。因此受到了俄烏戰爭的影響。烏克蘭危機對墨西哥的能源政策和實踐產生了重大影響,政府計劃透過擴大水力發電廠的總容量來增加水力發電量。增加水力發電廠的總設備容量有助於墨西哥的氣候政策和承諾,並影響墨西哥的排放努力。預計水力發電廠容量的增加將產生對發電用感應感應馬達的需求。

北美低壓感應馬達市場趨勢

石油和天然氣有望成為最大的終端用戶產業

- 低壓感應電動機預計將在石油和天然氣行業中廣泛應用,因為它們可用於驅動用於從油井開採、加工和運輸石油和天然氣到精製和消費者的泵浦、壓縮機和渦輪機。此外,煉油廠使用低壓感應馬達來驅動幫浦、壓縮機和攪拌器。低壓感應馬達用於將原油精製成汽油、柴油和噴射機燃料等各種產品。

- 此外,低壓感應馬達也用於驅動在蒸餾塔和催化裂解裝置中移動液體的泵浦、驅動增加氣體壓力以便進一步加工或分離的壓縮機,以及操作在反應器和罐中混合液體和固體的攪拌器。

- 此外,這些馬達產生的動力也用於支援原油、石油和天然氣等產品的開採、加工、儲存和運輸。具體來說,低壓感應電動馬達透過為鑽井平台上的絞車和其他機械提供能源來源為鑽井過程提供動力。它們為陸上和海上鑽井作業的許多應用提供動力,並驅動石油和天然氣工業中使用的泵浦、風扇和壓縮機等流體控制設備。

- 馬達在石油和天然氣上游工業中發揮關鍵作用,廣泛用於驅動泵浦和壓縮機系統等設備。這些都會對能源消耗產生巨大影響。此外,近年來限制二氧化碳排放的需要和新的環境法規的生效,使得石油和天然氣業者更加意識到選擇節能馬達的重要性。由於能源消耗佔馬達整個生命週期成本的 96%,因此為最高效的馬達支付額外的費用將在馬達的整個使用壽命內獲得回報。這就是低壓感應馬達變得越來越重要的原因。

- 美國是世界上最大的石油和天然氣生產國。例如,根據美國能源資訊署 (EIA) 的數據,到 2030 年,原油產量預計將達到 30.01 兆英熱單位。此外,德克薩斯州(美國) 的原油產量佔原油總產量的大部分,因此對生產設施的需求很大。

預計美國將佔較大市場佔有率

- 美國擁有世界上最大的製造業之一,為該國的經濟成長做出了巨大貢獻。例如,根據美國標準與技術研究院(NIST)的數據,2021年製造業為美國GDP貢獻了2.3兆美元,佔GDP總額的12.0%。

- 美國製造業在採用工業4.0方面處於領先地位。該地區對巨量資料和分析、物聯網 (IoT)、機器人和雲端處理等新興技術的投資正在迅速成長。例如,美國印第安納州Conexus於2021年12月發布的新研究發現,美國美國州採用或發展下一代技術的先進製造企業數量比前一年增加了一倍。

- Conexus 與印第安納大學凱利商學院製造業卓越中心合作,對約 140 家公司進行了調查。結果顯示,超過 40% 的受訪企業已經採用了工業 4.0 技術,包括雲端運算、物聯網和人工智慧 (AI)。預計中國對工業 4.0 的日益採用將極大促進馬達的普及。

- 主要市場參與者對該地區的投資不斷增加也顯示該國的成長潛力。例如,2023 年 4 月,ABB 宣布致力於在美國發展,並將透過投資其電氣化和自動化業務來滿足不斷成長的需求。該公司宣布計劃在美國多個計劃上投資 1.7 億美元,包括威斯康辛州新柏林的待開發區驅動服務工廠。

- 美國是世界上最大的石油和天然氣生產國。據美國外交關係委員會稱,美國目前約75%的原油供應和90%的天然氣供應在國內生產。到 2021 年,它將每天生產約 1,100 萬桶原油和約 1,000 億立方英尺的天然氣。交流感應馬達因其簡單、可靠、成本低廉而被廣泛應用於石油和天然氣工業。貝克休斯稱,該國運作的石油和天然氣鑽井平台數量從 2022 年 1 月的 610 個增加到 2023 年 1 月的 771 個。

北美低壓感應馬達產業概況

北美低壓感應馬達市場較為分散,主要參與者包括日本電產株式會社、ABB 有限公司、西門子股份公司、東芝工業株式會社(東芝)和上海電氣集團股份有限公司(上海電氣)。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 5 月-ABB 宣布將向其製造、創新和配電業務投資約 1.7 億美元,加強其在美國的成長策略,以滿足對電氣化和自動化產品日益成長的需求,並支持美國的清潔能源轉型和回流趨勢。

- 2022 年 11 月-西門子宣布打算將其馬達與驅動業務分拆為獨立營業單位。新的馬達與驅動業務將合併西門子現有的五個業務/部門:大型驅動、Sykatec、Weiss Spindeltechnologies 以及西門子數位工業公司的低壓馬達和齒輪馬達部門。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 宏觀趨勢如何影響市場

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要製造商和工廠自動化

- 美國和加拿大主要馬達製造商名單

- 墨西哥主要馬達製造商名單

- 美洲地區馬達進出口主要供應商

- 美洲馬達進出口趨勢

- 工業供應鏈分析

- 美洲供應鏈綜合分析

- 使用的主要原料及對其他地區的依賴程度

- 分銷鏈分析

- 海外生產銷售策略

- 墨西哥產馬達的特點

- 馬達進出口政策

第5章 市場動態

- 市場促進因素

- 住宅和工業能源需求不斷增加

- 北美國家製造業投資增加

- 市場限制

- 原料成本波動

- 與替代 VFD 解決方案相關的高轉換成本

第6章 市場細分

- 按類型

- 單相

- 變形怪

- 按最終用戶產業

- 金屬與礦業

- 石油和天然氣

- 化工和石化

- 用水和污水

- 離散製造業

- 發電

- 食品和飲料

- 其他最終用戶產業

- 按國家

- 美國

- 加拿大

- 墨西哥

第7章 競爭格局

- 公司簡介

- Nidec Corporation

- ABB Ltd

- Siemens AG

- Toshiba Industrial Corporation(Toshiba Corporation)

- Shanghai Electrical Machinery Group Co. Ltd(Shanghai Electric)

- Teco Electric and Machinery Co. Ltd

- Wolong Electric Group Co. Ltd

- Regal Rexnord Corporation

- VEM Group(Sec Electric Machinery Co. Ltd)

第 8 章 供應商排名分析

第9章:市場的未來

簡介目錄

Product Code: 5000406

The North America Low Voltage Induction Motors Market is expected to register a CAGR of 3.31% during the forecast period.

Key Highlights

- Induction motors constitute the primary power source in the industrial production system. The growing focus on Industry 4.0 primarily drives the market for induction motors. Industrial automation drives the manufacturing sector toward more efficient productivity in North America, which is expected to show strong growth during the forecast period. According to ABB Ltd's report on "The Future is Energy Efficient," global energy usage is expected to grow by 50% by 2050. Electric motors use around 70% of the energy consumed by industry, and more than 300 million industrial motor-driven systems are in operation.

- Similarly, electric motor systems play a crucial role in reducing CO2 emissions and reducing waste. Government investments and efforts to reduce CO2 emissions may create opportunities for more-efficient electric motors. Motors are critical to almost every industry and are responsible for driving core industrial processes and auxiliary systems, such as compressed air generation, ventilation, and water pumping.

- Manufacturers in the food industry are increasingly adopting automation to meet the guidelines and regulations set by industry associations to maintain the quality of products offered. Industrial motors are also used in other major industries, such as power generation, oil and gas, mining, and manufacturing.

- The increase in the prices of copper, aluminum, and copper wires is expected to hinder market growth by increasing production costs. Increased prices of metals are likely to increase the cost of copper rotors and stators. In addition, the US trade restrictions on Russia are expected to hamper the market's growth as it is one of the largest exporters of copper wires to the United States. Furthermore, external factors like mine closings, labor disputes, and speculation are further expected to fuel the price increases for significant metals utilized in the mass production of induction motors.

- Mexico is one of the largest importers of natural gas and one of the largest gasoline buyers. Therefore it was impacted by the Russia-Ukraine war. The Ukraine crisis significantly impacted Mexican energy policies and practices, and the government plans to increase electricity production with water by increasing the total capacity of hydroelectric plants. The increase in hydroelectric plants to the total capacity will contribute to Mexico's climate policies and commitments and affect Mexico's efforts to reduce emissions. The increasing capacity of hydroelectric plants is expected to create the demand for induction motors for power generation.

North America Low Voltage Induction Motors Market Trends

Oil and Gas to be the Largest End-user Industry

- Low voltage induction motors are expected to gain significant popularity in the oil and gas industry as they are significantly used to drive pumps, compressors, and turbines along with their usage to extract, process, and transport oil and gas from wells to refineries to consumers. Additionally, in refineries, low-voltage induction motors are used to drive pumps, compressors, and agitators. They are utilized for refining crude oil into various products, such as gasoline, diesel, jet fuel, and many others.

- Moreover, low voltage induction motor might be utilized for powering a pump that moves liquids through distillation columns or catalytic crackers, to drive a compressor that surges the pressure of gases for further processing or separation, and to run an agitator that mixes liquids or solids in reactors or tanks.

- Furthermore, these motors' power is used to support the extraction, processing, storage, and transportation of products such as crude oil, petroleum, and natural gas. Specifically, low-voltage induction motors power the drilling process by providing an energy source for the rig's draw works and other machinery. They provide power for many applications throughout onshore and offshore drilling operations and drive fluid-control equipment such as pumps, fans, and compressors used by the oil and gas industry.

- Electric motors play a key role in the upstream side of the oil and gas industry and are widely used to drive equipment, such as pump and compressor systems. They may have a dramatic impact on energy consumption. Additionally, with the need to limit CO2 emissions and new environmental regulations coming into force in recent years, oil and gas businesses are becoming more aware of the importance of choosing energy-efficient motors. Because energy consumption accounts for 96% of the total life cycle cost of a motor, paying extra for a premium efficiency motor will result in a return on investment over its lifespan. This has significantly led to the rising importance of low-voltage induction motors.

- The United States is the world's major producer of oil and natural gas. For instance, according to EIA, the production of crude oil is expected to reach 30.01 quadrillion Btu by 2030. Additionally, Texas (United States) produces the country's major share of crude oil and is expected to hold a significant demand for production equipment.

The United States Expected to Hold Significant Market Share

- The United States has one of the largest manufacturing industries in the world, and the sector is also a significant contributor to the country's economic growth. For instance, according to the National Institute of Standards and Technology (NIST), in 2021, manufacturing contributed USD 2.3 trillion to the country's GDP amounting to 12.0% of the total US GDP.

- The US manufacturers are among the leading adopters of Industry 4.0. Investments in advanced technologies, like big data and analytics, the Internet of Things (IoT), robotics, cloud computing, etc., are rising at a rapid pace in the region. For instance, as per the findings of a new study from Conexus, Indiana, published in December 2021, the number of advanced manufacturers in Indiana, United States, that adopted or grown next-generation technologies had doubled since the previous year.

- Conexus partnered with the Indiana University Kelley School of Business Center for Excellence in Manufacturing to survey around 140 companies. As per the organization, over 40% of the respondents implemented Industry 4.0 technology, including cloud computing, IoT, and artificial intelligence (AI). The growing implementation of Industry 4.0 in the country is expected to boost the adoption of electric motors significantly.

- Growing investments in the region by major players in the market are also indicative of the growth potential in the country. For instance, in April 2023, ABB announced that it was committed to growing in the United States, and this would be reached by investing in its electrification and automation businesses that meet increased demand. The company announced plans to invest USD 170 million in several US projects, including a greenfield drives and services facility in New Berlin, Wisconsin.

- The United States is the world's major producer of oil and natural gas. According to the Council on Foreign Relations, the United States now produces around 75% of its crude oil and 90% of its natural gas supply domestically. By 2021, the country was producing nearly eleven million barrels of crude oil per day and about one hundred billion cubic feet of gas per day. AC induction motors are widely used in the oil and gas industry because of their simplicity, reliability, and low cost. According to Baker Hughes, the number of oil and gas rigs operating in the country increased from 610 in January 2022 to 771 by January 2023.

North America Low Voltage Induction Motors Industry Overview

The North American low voltage induction motors market is moderately fragmented, with the presence of major players like Nidec Corporation, ABB Ltd, Siemens AG, Toshiba Industrial Corporation (Toshiba Corporation), and Shanghai Electrical Machinery Group Co. Ltd (Shanghai Electric). Players in the market are adopting strategies, such as partnerships and acquisitions, to enhance their product offerings and gain sustainable competitive advantage.

- May 2023 - ABB announced that it is stepping up its growth strategy in the United States by investing around USD 170 million in manufacturing, innovation, and distribution operations to meet the rising demand for electrification and automation products and to support the current clean energy transition and reshoring trends.

- November 2022 - Siemens announced its intention to separate its motor and drive business into an independent entity. The new motor and drives business would amalgamate five current Siemens businesses/divisions: Large drives, Sykatec, Weiss Spindeltechnologies, and the low voltage motors and geared motor divisions from Siemens Digital Industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of Macro Trends on the Market

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Major Manufacturers and Factory Automation

- 4.3.1 List of Key Motor Manufacturers in United States and Canada

- 4.3.2 List of Key Motor Manufacturers in Mexico

- 4.3.3 Key Vendors Exporting and Importing Electric Motors to Americas

- 4.3.4 Export and Import Trends of Electric Motors in the Americas

- 4.4 Industry Supply Chain Analysis

- 4.4.1 Consolidated Analysis of the Local Supply Chain in the Americas

- 4.4.2 Major Raw Materials Used and their Dependency on Other Regions

- 4.5 Distribution Chain Analysis

- 4.6 Overseas Production and Sales Strategies

- 4.7 Characteristics of Motors Produced in Mexico

- 4.8 Import/Export Policies for Electric Motors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Energy Demand in Residential and Industrial

- 5.1.2 Rising Investment in Manufacturing Sector Across the NA Countries

- 5.2 Market Restraints

- 5.2.1 Fluctuating Cost of Raw Materials

- 5.2.2 High Switching Cost Along with Alternate VFD Solutions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single Phase

- 6.1.2 Poly Phase

- 6.2 By End-user Industry

- 6.2.1 Metal and Mining

- 6.2.2 Oil and Gas

- 6.2.3 Chemicals and Petrochemicals

- 6.2.4 Water and Wastewater

- 6.2.5 Discrete Industries

- 6.2.6 Power Generation

- 6.2.7 Food and Beverage

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nidec Corporation

- 7.1.2 ABB Ltd

- 7.1.3 Siemens AG

- 7.1.4 Toshiba Industrial Corporation (Toshiba Corporation)

- 7.1.5 Shanghai Electrical Machinery Group Co. Ltd (Shanghai Electric)

- 7.1.6 Teco Electric and Machinery Co. Ltd

- 7.1.7 Wolong Electric Group Co. Ltd

- 7.1.8 Regal Rexnord Corporation

- 7.1.9 VEM Group (Sec Electric Machinery Co. Ltd)

8 VENDOR RANKING ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219