|

市場調查報告書

商品編碼

1632081

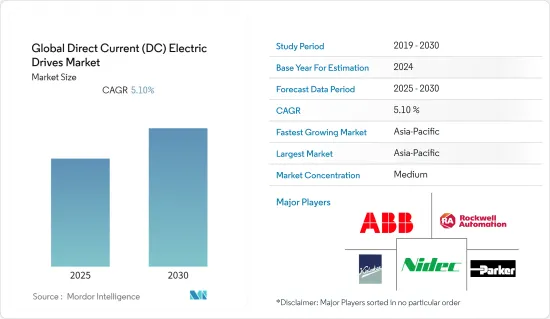

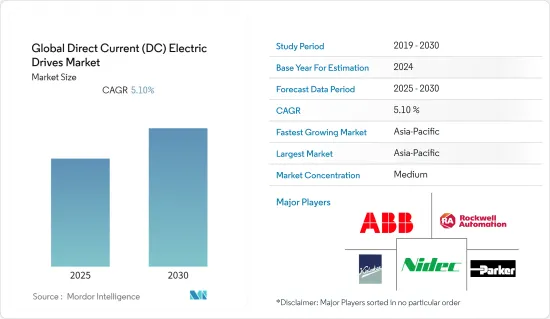

全球直流 (DC) 電力驅動市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Direct Current (DC) Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計全球直流電驅動市場在預測期間內複合年成長率為 5.1%

主要亮點

- 直流電驅動器是一種速度控制系統,可為直流馬達提供必要的電壓,使其以所需的速度運作。直流電驅動器可透過調節馬達速度降低營業成本並提高能源效率。

- 隨著都市化的快速發展,對電力的需求不斷增加。不斷上漲的電費也增加了對節能系統和設備的需求。例如,根據 IEA 的數據,全球能源強度(經濟體能源效率的關鍵指標)在 2020 年僅提高了 0.5%,但預計 2021 年將提高 1.9%。這些趨勢預計將支持所研究市場的成長。

- 根據歐盟統計局數據,2022年1月歐盟工業生產季增0.4%。此外,總產量水準比2020年2月高出2.5%。由於自動化的引入和生產設備的現代化,對可變扭矩應用中使用的直流驅動器的需求預計將會增加。

- 然而,較低的營業成本和更快的速度變化等優點正在增加交流變頻器在各種類型的運動控制應用中的普及,預計將對預測期內的市場成長構成挑戰。

- 直流電驅動器主要用於石油和天然氣、製造業、金屬和採礦等行業,因此政府為遏制病毒傳播而實施的各種限制加劇了該領域的活動。 。

直流 (DC) 電力驅動市場趨勢

石油和天然氣產業佔主要市場佔有率

- 石油和天然氣產業是具有出色控制能力的直流電驅動器的主要消費者。透過調節速度和控制流量,可以避免節流閥浪費能量。石油和天然氣領域使用多台大型機器,每年可能節省數千美元的電力。

- 據 Maxon Group 稱,全球約 85% 的能源使用是基於煤炭、石油和天然氣等石化燃料。此外,根據 IEA 的數據,到 2026 年,全球石油消費量預計將達到 1.041 億桶/日。這些趨勢預計將支持受訪市場的成長。

- 該領域的成長正在推動對DC馬達和直流驅動器的需求。 maxon 集團提供地下鑽孔和定向鑽孔的無刷直流馬達。此外,這些馬達也用於各種鑽井應用、液壓閥控制、通訊機制和儀器儀表。

- 此外,管線將石油產品從開採點運送到精製,再從精製運送到需求點。直流驅動控制石油產品的流動,由於全球石油和天然氣行業活動的增加,預計需求將會成長。

亞太地區佔很大佔有率

- 在預測期內,工業和製造業的成長,尤其是中國、印度和台灣等國家的工業和製造業的成長,預計將推動對直流電驅動器的需求。例如,根據IBEF的數據,2022年1月印度天然氣成長11.7%,精製成長3.7%,煤炭成長8.2%,鋼鐵成長2.8%,水泥成長13.6%,電力成長0.5%。

- 印度製造業的成長預計也將受到多項措施和外國直接投資流入量增加的推動。例如,根據工業和國內貿易促進部(DPIIT)的數據,2000年4月至2021年6月,流入子部門的外國直接投資累計達到1,003.5億美元。

- 同樣,中國的工業和製造業在過去幾十年中經歷了巨大的成長。例如,根據國家統計局的數據,製造業產值成長9.8%,採礦業產值成長5.3%。

- 用水和污水是另一個推動泵站和污水處理廠使用直流驅動器需求的最終用戶產業。亞太國家對用水和污水管理基礎設施的投資不斷增加,預計將進一步推動該市場的成長。例如,據ITA稱,到2025年,中國工業污水市場預計將達到194億美元。預計這種趨勢將為預測期內直流電驅動市場的成長創造有利的市場前景。

直流 (DC) 電力驅動產業概覽

直流 (DC) 電力驅動市場的競爭較為溫和。競爭優勢可以透過技術創新獲得。因此,供應商必須在新產品開發和收購方面投入大量資金。市場上一些主要的供應商包括 ABB Ltd、Kirloskar Electric Company Limited、羅克韋爾自動化和 Parker Hannifin Corp。

- 2022馬達3 月 - 西門子宣布推出一款名為 Simatic Micro-Drive 的新型伺服驅動系統,以擴展其在 24-48V EC馬達安全超低電壓範圍內的驅動產品組合。 Simatic Micro-Drive 提供 100 瓦至 1 千瓦的單元,可並排導軌安裝。 SIMATIC 產品組合中的相容控制器補充了該產品的運動控制功能。

- 2021 年 10 月 - 羅克韋爾自動化和 NHP 推出採用通用控制架構和 TotalFORCE 技術的 PowerFlex 6,000T 高壓 (MV) 變頻器。該產品可在 Studio 5,000 設計環境中輕鬆配置、整合和視覺化。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 工業和製造業的成長

- 電動車的採用率增加

- 市場限制因素

- 交流技術的採用增加

第6章 市場細分

- 按電壓

- 低電壓

- 中壓

- 按額定輸出

- 低的

- 中等的

- 高的

- 按最終用戶產業

- 石油和天然氣

- 發電

- 化工/石化

- 用水和污水

- 金屬/礦業

- 飲食

- 離散製造業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Kirloskar Electric Company Limited

- Rockwell Automation

- Nidec Motor Corporation

- Parker Hannifin Corp

- Eurotherm(Schneider Electric SE)

- SRI Electronics

- Siemens AG

- Sprint Electric Limited

- Renown Electric

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91197

The Global Direct Current Electric Drives Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- Direct Current electric drive is a speed control system for a DC motor that supplies the required voltage to help it operate at the desired speed. These drives also help to reduce operational costs and achieve energy efficiency by regulating the speed of the motor and thereby its power consumption.

- Owing to rapid urbanization, the electricity demand has been increasing. The rising electricity costs have also raised the need for energy-efficient systems and equipment. For instance, according to IEA, global energy intensity - a key measure of the economy's energy efficiency - was forecasted to improve by 1.9% in 2021 after improving by only 0.5% in 2020. Such trends are expected to support the growth of the studied market.

- According to Eurostat, in January 2022, industrial production in the EU increased by 0.4% compared to the month before. Additionally, the total production level was 2.5% above February 2020. The increasing adoption of automation and modernization of production facilities is expected to drive the demand for DC drives as they are used for variable torque applications.

- However, the increasing popularity of AC drives across various types of motion control applications owing to several benefits such as lower operating cost and their ability to change speed more rapidly are expected to challenge the growth of the studied market during the forecast period.

- As DC electric drives are used mostly across industries such as oil & gas, manufacturing, metal & mining, etc., the outbreak of COVID-19 had a notable impact on the studied market, as activities across this sector were significantly reduced due to various restrictions imposed by the governments to curb the spread of the virus.

Direct Current (DC) Electric Drives Market Trends

Oil & Gas Sector to Hold Significant Market Share

- The oil & gas sector is among the major consumer of DC electric drives as they offer excellent controlling capabilities. Controlling flow by adjusting speed avoids energy wasted in the throttling valves. With several large machines involved in the oil & gas sector, the electrical power savings may amount to thousands of dollars annually.

- According to Maxon Group, about 85 percent of the world's energy use is based on fossil fuel sources such as coal, oil, and gas. Furthermore, according to IEA, by 2026, global oil consumption is projected to reach 104.1 mb/d. Such trends are expected to support the growth of the studied market.

- The sector's growth is driving the demand for DC motors and, in turn, for DC drives. Maxon Group offers brushless DC motors for downhole and directional drilling. Furthermore, these motors are utilized in various drilling applications, hydraulic valve control, communication mechanisms, and measuring instrumentation.

- Furthermore, pipelines transport petroleum products from the extraction point to refineries and from refineries to demand areas. As DC drives control of the flow of petroleum products, the demand is expected to grow due to increased activities in the oil and gas industries globally.

Asia Pacific to Holds Significant Share

- The growth of industrial and manufacturing sectors, especially across countries such as China, India, and Taiwan, is expected to drive the demand for DC electric drives during the forecast period. For instance, according to IBEF, in India, outputs increased for natural gas by 11.7%, petroleum refinery production (3.7%), coal (8.2%), steel (2.8%), cement (13.6%), electricity (0.5%), in January 2022.

- The growth of the manufacturing sector in India is also expected to be driven by several initiatives and an increasing inflow of FDIs. For instance, according to the Department for Promotion of Industry and Internal Trade (DPIIT), between April 2000 and June 2021, cumulative FDI inflows in the manufacturing subsectors amounted to USD 100.35 billion.

- Similarly, China's industrial and manufacturing sector has witnessed exponential growth in the past few decades. For instance, according to the National Bureau of Statistics (NBS), the manufacturing sector's output increased 9.8 percent, while the mining output rose 5.3 percent.

- Water and Wastewater are another end-user industry driving the demand for DC drives as they are used at pumping stations and wastewater treatment plants. Increasing investment in water & wastewater management infrastructure across various Asia Pacific countries is expected to further drive the growth of the studied market. For instance, according to ITA, the industrial wastewater market in China is expected to reach USD 19.4 billion by 2025. Such trends are expected to create a favorable market scenario for the DC electric drives market growth during the forecast period.

Direct Current (DC) Electric Drives Industry Overview

The Direct Current (DC) Electric Drives Market is moderately competitive. Competitive advantage can be attained through innovation. Hence, the vendors must invest significantly in new product development and acquisitions. Some major vendors operating in the market include ABB Ltd, Kirloskar Electric Company Limited, Rockwell Automation, and Parker Hannifin Corp.

- March 2022 - To extend its drive portfolio in the safety extra-low-voltage range for 24-48V EC motors, Siemens introduced a new servo drive system named Simatic Micro-Drive. The Simatic Micro-Drive will offer units from 100 watts to 1 kilowatt and allow side-by-side rail mounting. Compatible controllers from the SIMATIC portfolio complement the motion control functionalities of this product.

- October 2021 - Rockwell Automation and NHP launched the PowerFlex 6000T medium voltage (MV) drives, featuring common control architecture and TotalFORCE technology. The product offers easy configuration, integration, and visualization in the Studio 5000 design environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the Industrial & Manufacturing Sector

- 5.1.2 Increasing Adoption of Evs

- 5.2 Market Restraints

- 5.2.1 Increasing Adoption of AC Technology

6 MARKET SEGMENTATION

- 6.1 By Voltage

- 6.1.1 Low Voltage

- 6.1.2 Medium Voltage

- 6.2 By Power Rating

- 6.2.1 Low

- 6.2.2 Medium

- 6.2.3 High

- 6.3 By End-User Industry

- 6.3.1 Oil & Gas

- 6.3.2 Power Generation

- 6.3.3 Chemical & Petrochemical

- 6.3.4 Water & Wastewater

- 6.3.5 Metal & Mining

- 6.3.6 Food & Beverage

- 6.3.7 Discrete Industries

- 6.3.8 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Kirloskar Electric Company Limited

- 7.1.3 Rockwell Automation

- 7.1.4 Nidec Motor Corporation

- 7.1.5 Parker Hannifin Corp

- 7.1.6 Eurotherm (Schneider Electric SE)

- 7.1.7 SRI Electronics

- 7.1.8 Siemens AG

- 7.1.9 Sprint Electric Limited

- 7.1.10 Renown Electric

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219