|

市場調查報告書

商品編碼

1644807

北美電動驅動器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)NA Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

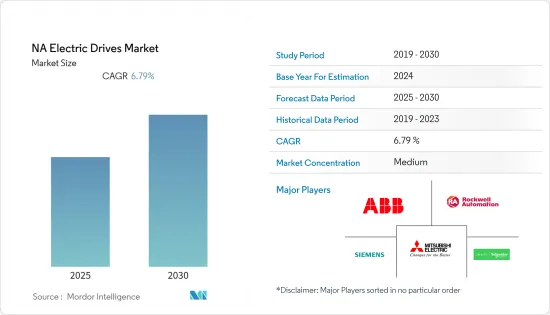

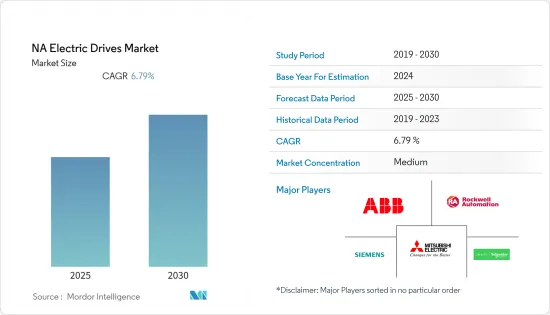

預計預測期內北美電動驅動器市場複合年成長率將達到 6.79%。

主要亮點

- 可以使用電動驅動馬達和控制馬達旋轉軸的複雜控制系統來建構電力驅動裝置。這一切都可以透過軟體來控制。結果是控制更加精確並且驅動概念更易於使用。電力驅動裝置是工業應用中的關鍵部件,推動著技術進步並受到許多資訊來源的關注。

- 該地區自動化程度的不斷提高對電力驅動市場的需求做出了巨大的貢獻。由於貿易緊張和新冠疫情,製造業正在離客戶更近。公司正在尋求透過自動化進行近岸外包來解決供應鏈問題。

- 美國統計數據顯示自動化如何幫助企業恢復工作。根據美國先進自動化協會(A3)統計,2021年第三季美國機器人訂單較2020年同期成長了35%。非汽車領域訂單佔比超過一半。

- 在預測期內,電力驅動的高初始成本被視為市場面臨的挑戰。

北美電力驅動市場趨勢

伺服驅動器預計將佔據很大的市場佔有率

- 伺服驅動器的作用是將控制器發出的低功率指令訊號轉換為馬達的高功率電壓和電流。伺服驅動器可根據應用調整和適當調整馬達的所需位置、速度、扭矩和其他參數。伺服馬達用於各種機器人應用,透過在機器人焊接臂的每個關節處放置伺服馬達,可以提高移動性和靈活性。

- 機械臂需要馬達才能移動。機器人有時會採用伺服驅動,這意味著馬達由伺服驅動器控制。能夠控制機器人的移動性非常重要。伺服驅動機器人比AC馬達或DC馬達更精確地控制其運動。所有這些都有助於機器人移動和運動,但是如果機器人的運動出現任何問題,伺服驅動的機器人系統也可以從機器人那裡獲得回饋。伺服驅動器常見於機器人、工廠自動化和數控加工。

- 例如,美國的RobotWorx是FANUC、Motoman、ABB、Universal Robots和KUKA的認證整合商,提供伺服驅動機器人。這些機器人速度快、精度高,可以作為馬達的一部分製造,也可以單獨製造。

- 即使在自動化尚屬新興的領域,機器人也正在被迅速採用。公司正在滿足消費者對產品和交付個人化的需求。美國、加拿大和墨西哥的企業訂購了11,595台工業機器人,較2021年第一季成長28%。該地區的銷售額成長了 43%,達到 6.64 億美元(資料來源:國際機器人聯合會)。

預計美國將實現最快成長

- 美國是 2021 年市場的主要股東,由於擁有各種製造業,預計在整個預測期內將保持其地位。

- 2018年,美國超越沙烏地阿拉伯,成為世界最大的原油生產國,並保持這一地位到2020年。美國和其他國家生產的原油均由美國精製獲得。原油由多家公司供應至全球市場。

- 近 100 個國家都生產原油。但在2021年,五個國家佔全球原油產量的51%左右,其中美國佔14.5%。美國32 州和沿海水域均產有原油。 2021年,五個州的原油產量占美國原油總產量的71%以上。 (資料來源:美國能源資訊署)

- 在石油和天然氣工業中,電動裝置用於控制馬達的速度並操作泵浦、風扇和壓縮機等關鍵部件。交流電和直流驅動器均有使用,其中交流驅動器最為常見。在石油和天然氣工業中,高功率驅動器用於鑽井和泵桿操作等關鍵任務應用。

- 系統經常需要進行調整以滿足特定要求。這些應用需要獨特的驅動器,以增加智慧並控制速度和扭力以外的特性。此外,功率和電壓要求因應用而異。因此,驅動器通常必須客製化設計和製造。

- 此外,美國是該地區工業機器人的最大消費國,佔該地區總安裝量的79%。預計這些因素將在預測期內大幅推動該國的市場成長率。

北美電驅動產業概況

由於市場參與企業擴大轉向專注於克服現有缺點的新產品開發,預計電動驅動市場在預測期內仍將保持高度競爭。參與者也致力於透過夥伴關係、合併和收購來擴大消費群。市場的主要企業包括羅克韋爾自動化、ABB 有限公司、Schneider電氣、西門子股份公司、艾默生電氣等。

- 2021 年 1 月 - 羅克韋爾自動化的 Kinetix 5100伺服驅動器配備 Kinetix TLP伺服馬達(獨立運動解決方案),電壓為 480V,適用於包裝、加工、印刷、捲筒紙、機械、組裝和生命科學領域的OEM應用。 Kinetix 5100伺服系統透過為多功能、自主型機器提供具有市場競爭力的運動控制,滿足了消費者對產品多功能性日益成長的需求。 OEM可以採用 Kinetix 5100伺服驅動器設計電動或自動化系統,以協助加快轉換速度。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 提高自動化採用率

- 製造業顯著成長

- 市場限制

- 電力驅動成本高

第6章 市場細分

- 按類型

- 交流變頻器

- 直流驅動

- 伺服驅動器

- 按電壓

- 低電壓

- 中壓

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 飲食

- 用水和污水

- 發電

- 金屬與礦業

- 紙漿和造紙

- HVAC

- 離散製造業

- 其他最終用戶產業

- 按國家

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Mitsubishi Electric Corporation

- Rockwell Automation

- Schneider Electric

- ABB Ltd.

- Siemens AG

- Danfoss

- Nidec Corporation

- Toshiba International Corporation

- Emerson Electric Co.

- Fuji Electric Co. Ltd.

第8章投資分析

第 9 章:未來趨勢

The NA Electric Drives Market is expected to register a CAGR of 6.79% during the forecast period.

Key Highlights

- An electric drive can be constructed using an electric drive motor and a complex control system to control the rotation shaft of the motor. This can be controlled entirely by software. As a result, the controlling becomes more precise, and this drive concept is simple to use. Electrical drives are a critical component in industrial applications, driving technological advancements and gaining attention from a multitude of sources.

- The growing adoption of automation in the region is majorly contributing to the demand for the electric drives market. Manufacturing is moving closer to the customer as a result of trade tensions and COVID-19. Companies are considering nearshoring with automation as a solution to supply-chain concerns.

- One particular statistic from the United States demonstrates how automation is assisting firms in resuming operations. Robot orders in the third quarter of 2021 in the United States were up 35% over the same period in 2020, according to the Association for Advancing Automation (A3). Non-automotive sectors account for more than half of the orders.

- The primary cost of the electric drives is high, hence is considered a challenge for the market during the forecast period.

North America Electric Drives Market Trends

Servo Drives are Analyzed to Hold Significant Share

- The servo drive's function is to convert low power instruction signals from the controller into high power voltage and current for the motor. The servo drive can regulate and properly coordinate the motor's desired location, speed, torque, and other parameters depending on the application. They're employed in a variety of robotic applications, including Servo motors installed in every joint of a robotic welding arm, allowing for mobility and increased dexterity.

- Motors are required for robotic arms to move. Robots are sometimes servo-driven, which means that the motors are controlled by a servo-drive. It's critical to be able to control robot mobility. Servo-driven robots can regulate motion more precisely than AC or DC motors. All of these will assist the robot in moving and operating, but the servo-driven robotic system will also get feedback from the robot in the event of a motion problem. Servo-drives are commonly seen in robots, and they are also found in factory automation and CNC machining.

- For instance, US-based RobotWorx, a FANUC, Motoman, ABB, Universal Robots, and KUKA certified integrator, offers servo-driven robots. These robots are fast and precise, and they can be manufactured as part of or apart from motors.

- Robots are rapidly being adopted by segments that are new to automation. Companies are responding to consumer demand for the personalization of both products and delivery. The North American robotics market had its strongest quarter to start the year, with companies from the United States, Canada, and Mexico ordering 11,595 industrial robots, a 28% increase over the first quarter of 2021. The region's revenue increased by 43% to USD 664 million (source: International Federation of Robotics).

United States is Expected to Register the Fastest Growth Rate

- The United States is the major shareholder of the market in 2021 and is analyzed to maintain its position throughout the forecast period owing to the presence of various manufacturing industries.

- In 2018, the United States surpassed Saudi Arabia as the world's leading crude oil producer, a position it held until 2020. Crude oil generated in the United States and other countries is obtained by US oil refineries. Crude oil is supplied to the global market by a variety of companies.

- Crude oil is produced by almost 100 countries. In 2021, however, five countries accounted for around 51% of global crude oil production, with the United States holding 14.5% of the share. Crude oil is produced in 32 states and coastal waters off the coast of the United States. Five states accounted for over 71% of total crude oil output in the United States in 2021. (Source: US Energy Information Administration).

- In the oil and gas industry, electric drives are used to control motor speeds and operate key components such as pumps, fans, and compressors. Although both AC and DC drives are utilized, AC drives are the most common. High-powered drives are used in the oil and gas industry for essential applications such as drilling and pump rod usage.

- In many cases, systems must be tailored to meet specific requirements. Such applications necessitate unique drives with additional intelligence or controls for characteristics other than speed and torque. Furthermore, power and voltage requirements vary depending on the application. Therefore drives must often be custom-designed and produced.

- Further, with 79% of the region's total installations, the United States is the region's top industrial robot consumer. These factors are significantly boosting the market growth rate in the country during the forecast period.

North America Electric Drives Industry Overview

The market for electric drives is estimated to be highly competitive over the forecast period, as the players in the market are increasingly working on new product development with a sharp focus on overcoming the shortcomings of the prosecutor. The players are also focusing on partnerships, mergers, and acquisitions to expand their consumer base. Major players in the market include Rockwell Automation, ABB Ltd., Schneider Electric, Siemens AG, and Emerson Electric, among others.

- January 2021 - The Kinetix 5100 servo drive with Kinetix TLP servo motor standalone motion solution from Rockwell Automation is launched in 480V for applications in packaging, converting, print, and web, machine and assembly, and life sciences OEM applications. By providing a market-competitive motion-control capability for versatile, freestanding machines, the Kinetix 5100 servo system addresses growing consumer demand for more product variety. OEMs can design a motorized or automated system with the Kinetix 5100 servo drive to assist speed up changeovers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Automation

- 5.1.2 Signficant Growth in Manufacturing Sector

- 5.2 Market Restraints

- 5.2.1 High Costs of Electric Drive

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 AC Drives

- 6.1.2 DC Drives

- 6.1.3 Servo Drives

- 6.2 By Voltage

- 6.2.1 Low

- 6.2.2 Medium

- 6.3 By End-user Industry

- 6.3.1 Oil & Gas

- 6.3.2 Chemical & Petrochemical

- 6.3.3 Food & Beverage

- 6.3.4 Water & Wastewater

- 6.3.5 Power Generation

- 6.3.6 Metal & Mining

- 6.3.7 Pulp & Paper

- 6.3.8 HVAC

- 6.3.9 Discrete Industries

- 6.3.10 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mitsubishi Electric Corporation

- 7.1.2 Rockwell Automation

- 7.1.3 Schneider Electric

- 7.1.4 ABB Ltd.

- 7.1.5 Siemens AG

- 7.1.6 Danfoss

- 7.1.7 Nidec Corporation

- 7.1.8 Toshiba International Corporation

- 7.1.9 Emerson Electric Co.

- 7.1.10 Fuji Electric Co. Ltd.