|

市場調查報告書

商品編碼

1635359

全球流量控制 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Global Flow Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

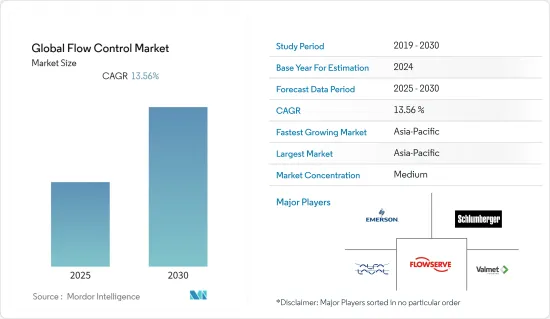

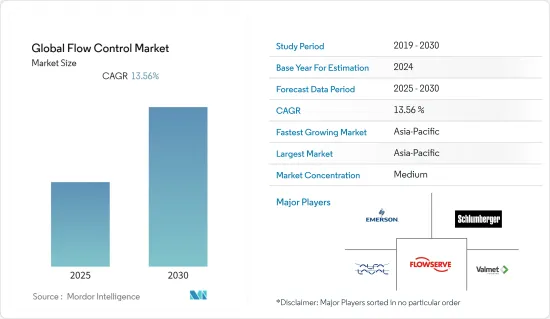

全球流量控制市場預計在預測期間內複合年成長率為13.56%

主要亮點

- 由於各行業工業自動化的上升趨勢,流量控制解決方案的市場也不斷成長。新興市場發電量的增加和電力消耗的增加正在推動市場擴張。

- 物聯網解決方案降低了設備運作成本,同時降低了致命事故的風險。例如,在引入小型智慧感測器之前,維護和維修專業人員很少預測設備故障,只有在看到問題發生時才知道。導致採購(等待備件)浪費大量時間,多個業務流程中斷,生產效率大幅降低。石油和天然氣產業現在有潛力利用物聯網功能來預見和預防問題。

- COVID-19 大流行對石油和天然氣、化學、電力、金屬和採礦等工業領域產生了重大影響。結果,對這些產業生產的商品的需求下降。然而,服務於製藥、能源和公共產業應用的各個行業領域的市場顯著成長。此外,疫情大大加速了工業自動化,導致產品創新激增。

- 例如,2022 年 2 月,Circor International, Inc. 推出了具有多種內部選項的新型閥門,適用於各種常見、關鍵和惡劣應用,包括石油和天然氣、發電、加工業、海事和可再生能源主體CIR 3100控制閥已發布。

- 閥門製造商必須遵循多項標準和規則。就閥門而言,不同的地點有不同的認證和政策。對閥門的需求多種多樣,因為它們用於許多行業,包括石油和天然氣、食品和飲料、製藥、能源和電力、水和污水處理、建築、化學品以及紙漿和造紙。然而,這種差異正在阻礙閥門市場的成長,因為製造商必須調整相同的產品以匹配當地政策,這使得閥門製造商很難獲得理想的安裝成本。

流量控制市場趨勢

據分析,石油和天然氣產業佔有很大佔有率。

- 在石油和天然氣行業,即使是最輕微的洩漏也會造成嚴重破壞。流量控制在保護您的工廠免受災難和最大限度地提高各種產品的產量方面發揮著重要作用。閥門在控制過程中的流量方面發揮著重要作用。石油和天然氣產業預計將主導最終用戶市場。碳氫化合物流體和氣體的處理、生產、分配和加工是石油和天然氣領域的一部分,市場正受益於新興經濟體對汽油和柴油需求的不斷成長。由於人口成長以及乘用車和烹飪燃氣使用的增加,市場也在擴大。流量控制用於各種石油和天然氣應用,包括上游生產、管道檢測和天然氣處理。

- 2022年3月,斯倫貝謝宣布訂單沙烏地阿美天然氣鑽井計劃綜合鑽井和建井服務的大合約。鑽頭、隨鑽測量(MWD)、隨鑽測井(LWD)、鑽井泥漿、固井和完井等鑽機、技術和服務都在綜合計劃範圍內。斯倫貝謝提供數位解決方案來提高綜合鑽井性能,包括其 DrillOps 目標井交付解決方案,該解決方案採用資料分析、學習系統和自動化來執行數位井規劃並提高鑽井效率、一致性和性能。

- 2022年1月,印度石油公司(IOCL)宣布計畫投資700億盧比發展城市燃氣發行(CGD)業務。印度石油公司 (IOC) 於 2021 年 8 月宣布,將投資 1 兆盧比,在未來四到五年內將精製能力提高近兩倍。

- 2022年4月,日本石油天然氣部計劃加強對上游液化天然氣(LNG)計劃的投資,以刺激新的發展並鼓勵國內公司承購該燃料。

- 此外,每種發電應用類型都需要一組不同的流量控制需求。因此,發電廠中的特定管道系統可能包含多種閥門。發電廠中的工業閥門還必須根據管道系統特定區域中發生的操作發揮不同的作用。核能發電廠經常採用控制閥來控制流體流量,一座核能發電廠的主迴路包含1500多個控制閥。

亞太地區預計將創下最快成長率

- 亞太地區成為流量控制市場的關鍵區域。快速工業化正在推動中國、印度、日本和韓國等新興經濟體的市場成長。該地區不斷成長的製造業以及石油和天然氣使用量的增加推動了該行業的發展。中國計劃在2025年將其龐大的天然氣管網擴展至16.3萬公里,需要投資1.9兆美元。

- IBEF預測,印度將為全球非經合組織國家石油消費量的成長做出重大貢獻。原油進口額從2017會計年度的707.2億美元大幅增加至2022會計年度(4月至1月)的943億美元。截至2021年9月1日,印度的精製能力為2.489億噸/年(MMTPA),使其成為亞洲第二大精製國。私營公司約佔總精製能力的35%。 IOC 的產能為 69.7 MMTPA,是該國最大的煉油廠。

- 2022 年 1 月,阿達尼集團和 TotalEnergies 的合資企業阿達尼天然氣有限公司 (ATGL) 獲得許可,將其城市燃氣發行(CGD) 網路擴展到 14 個新地區,投資額為 2,000 億印度盧比。

- 2021 年 9 月,韓國精製和能源集團 SK 的天然氣子公司 SK E&S 宣布,計劃到 2025 年每年主要生產藍色氫氣,作為將其企業價值擴大五倍至 35 兆韓元計畫的一部分。產28萬噸、供應1000萬噸環保液化天然氣、運作可再生能源7GW的目標。

- 此外,電力產業的強勁需求也是市場的促進因素。例如,2021年,中國發電量8.11兆千瓦時(KWh),比上年成長8.1%。 (國家統計局)

流量控制行業概況

全球流量控制市場適度細分,競爭適度,有大量區域和全球參與企業。供應商專注於擴大海外基本客群。公司正在利用戰略合作計劃來增加市場佔有率和盈利。

- 2022 年 4 月 - Neles 與維美德合併完成後,維美德旗下的流量控制業務線將接手 Neles 的營運。合併完成登記後,Neles 解散。

- 2022 年 3 月 - TotalEnergies 授予斯倫貝謝一份廣泛契約,為烏干達 Tilenga 陸上石油開發項目提供鑽井、完井和生產服務。該合約涵蓋 Tilenga 開發案的定向鑽井、頂部和底部完井、人工採油系統和井口,該開發案由 6 個油田組成,總合426 口井分佈在 31 個井墊片。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

- 技術簡介

- 流入控制設備(ICD)

- 流出控制設備(OCD)

- 自主流入控制設備(AICD)

第5章市場動態

- 市場促進因素

- 工業設備維護和監控對連接網路的需求日益成長

- 在工廠中利用 IIoT 和工業 4.0

- 市場限制因素

- 缺乏標準化認證和政府措施

第6章 市場細分

- 依設備類型

- 泵浦

- 閥門

- 穩壓器

- 儀表

- 其他

- 按用途

- 石油和天然氣

- 電力

- 海洋

- 礦業

- 電子產品

- 用水和污水

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Rotork Plc

- Valmet Oyj

- KITZ Corporation

- IMI Critical Engineering

- Samson Controls Inc.

第8章投資分析

第9章 未來趨勢

簡介目錄

Product Code: 91537

The Global Flow Control Market is expected to register a CAGR of 13.56% during the forecast period.

Key Highlights

- The market for flow control solutions is also rising due to the growing trend of industrial automation across various industries. An increasing number of power-producing units, and rising power consumption in developing nations, are boosting market expansion.

- IoT solutions lower the cost of equipment operations while also lowering the danger of fatalities. Maintenance and repair specialists, for instance, seldom forecast equipment failure before the introduction of small smart sensors and only realized there was an issue when seen, which resulted in a substantial amount of time wasted on procurement (waiting for spare parts to arrive), disruption of several business processes, and a major drop in production efficiency. Oil and gas industries may now foresee and avoid problems utilizing IoT capabilities.

- The Covid-19 pandemic significantly impacted industrial sectors such as oil and gas, chemicals, power, metals, and mining. As a result, demand for the goods produced by these industries declined. The market, however, significantly increased in various industrial sectors serving the pharmaceutical, energy, and utility applications. Additionally, the pandemic dramatically accelerated industrial automation, leading to a surge in product innovations.

- For instance, in February 2022, Circor International, Inc. launched the CIR 3100 control valve, a new valve body with a variety of internal options for a wide range of general, critical, and severe applications, including oil and gas, power generation, processing industries, maritime, and renewables.

- Valve makers must follow several standards and rules. When it comes to valves, different locations have distinct certifications and policies. As valves are used in many industries, such as oil & gas, food & beverage, pharmaceuticals, energy & power, water & wastewater treatment, building & construction, chemicals, and pulp & paper, demand is diverse. However, such variation impedes the valves market's growth because manufacturers must adopt the same product to regional policies, making it difficult for valve makers to obtain an ideal installation cost.

Flow Control Market Trends

Oil and Gas Industry is Analyzed to Hold Major Share

- In the oil and gas industry, the smallest leakages could cause a disaster; flow control plays a critical role in safeguarding plants from catastrophe and maximizing the production of the different products. Valves play a crucial role in the flow control of the processes. The oil and gas industry is expected to dominate the end-user market. Treatment, production, distribution, and processing of hydrocarbon fluids and gases are part of the oil and gas sector-the market benefits from the rising demand for petrol and diesel in developed economies. The market is also expanding due to the rising population and increased use of passenger automobiles and cooking gas. Flow controls are utilized in various oil and gas applications, including upstream production, pipeline detection, and gas processing.

- Schlumberger announced in March 2022 that Saudi Aramco had awarded it a substantial contract for integrated drilling and well-building services in a gas drilling project. Drilling rigs, technologies, and services, such as drill bits, measurement while drilling (MWD) and logging while drilling (LWD), drilling fluids, cementing, and completing wells, are all included in the integrated project scope. Schlumberger will use digital solutions to improve integrated drilling performance, such as the DrillOps on-target well delivery solution, which employs data analysis, learning systems, and automation to execute a digital well plan, resulting in increased drilling efficiency, consistency, and performance.

- In January 2022, Indian Oil Corp. Ltd. (IOCL) announced plans to invest INR 7,000 crore in its city gas distribution (CGD) business. Indian Oil Corp (IOC) announced an INR 1 lakh crore investment in August 2021 to nearly triple its refining capacity over the next 4-5 years.

- In April 2022, the Japan Ministry of Oil and Gas stated that country plans to step up its investment role in upstream projects for liquefied natural gas (LNG) to spur new development and boost fuel offtake by its companies.

- Further, A different set of flow control requirements are needed for each kind of power generation application. That so, a power plant's particular pipeline system may contain a wide variety of valves. Industrial valves for power plants also need to play diverse roles depending on the operations occurring in a specific area of the pipe system. In nuclear power plants, control valves are frequently employed to control fluid flux, and the principal circuit of one nuclear power plant contains more than 1500 control valves.

Asia Pacific is Expected to Register the Fastest Growth Rate

- In the market for flow control, Asia Pacific will emerge as a major region. Rapid industrialization is increasing market growth in rising economies such as China, India, Japan, and South Korea. The industry is being propelled forward by the region's growing manufacturing sector and the increasing use of oil and gas. China plans to extend its giant gas pipeline grids to 163,000 kilometers by 2025, necessitating a USD1.9 trillion investment.

- IBEF states that India is anticipated to contribute to global non-OECD petroleum consumption growth significantly. Crude oil imports increased dramatically from USD 70.72 billion in FY17 to USD 94.3 billion in FY22 (April to January). India's oil refining capacity was 248.9 million metric tonnes per annum (MMTPA) on September 1, 2021, making it Asia's second-largest refiner. Private businesses controlled about 35% of the total refining capacity. With a capacity of 69.7 MMTPA, IOC is the largest domestic refiner.

- In January 2022, Adani Total Gas Ltd (ATGL), a joint venture between the Adani Group and TotalEnergies, acquired permits to expand its City Gas Distribution (CGD) network to 14 new geographical areas with an investment of INR 20,000 crore.

- In September 2021, SK E&S, the natural gas arm of South Korean refiner and energy conglomerate SK, set a target of producing 280,000 t/yr of mostly blue hydrogen, supplying 10 million t/yr of eco-friendly LNG, and operating 7GW of renewable energy by 2025, as part of a plan to increase the company's value fivefold to KRW 35 trillion.

- Moreover, the significant demand from the power sector is also a driving factor for the market. For instance, in 2021, China generated 8.11 trillion kilowatt-hours (KWh), an increase of 8.1 percent from the previous year. (National Bureau of Statistics (NBS))

Flow Control Industry Overview

The Global Flow control market is moderately competitive, with a considerable number of regional and global players, and moderately fragmented. The market vendors are focusing on expanding their customer base across foreign countries. The companies are leveraging strategic collaborative initiatives to increase market share and profitability.

- April 2022 - Following the completion of the merger between Neles and Valmet, the Flow Control Business Line under Valmet will carry on Neles' operations. Neles has been dissolved as a result of the registration of the Merger's completion.

- March 2022-TotalEnergies awarded Schlumberger an extensive contract for drilling, completions, and production services for its Tilenga onshore oil development in Uganda. The agreement covers directional drilling, upper and lower completions, artificial lift systems, and wellheads for the Tilenga development, which consists of six fields with a total of 426 wells spread across 31 well pads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

- 4.5 Technology Snapshot

- 4.5.1 Inflow control devices(ICDs)

- 4.5.2 Outflow control devices(OCDs)

- 4.5.3 Autonomous inflow control devices(AICDs)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing need for connected networks to maintain and monitor industrial equipment

- 5.1.2 Utilization of IIoT and Industry 4.0 in industrial plants

- 5.2 Market Restraints

- 5.2.1 Lack of standardized certifications and government policies

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Pumps

- 6.1.2 Valves

- 6.1.3 Regulators

- 6.1.4 Meters

- 6.1.5 Others

- 6.2 By Application

- 6.2.1 Oil & gas

- 6.2.2 Power

- 6.2.3 Marine

- 6.2.4 Mining

- 6.2.5 Electronics

- 6.2.6 Water and Wastewater

- 6.2.7 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Alfa Laval Corporate AB

- 7.1.4 Flowserve Corporation

- 7.1.5 Crane Co.

- 7.1.6 Rotork Plc

- 7.1.7 Valmet Oyj

- 7.1.8 KITZ Corporation

- 7.1.9 IMI Critical Engineering

- 7.1.10 Samson Controls Inc.

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219