|

市場調查報告書

商品編碼

1635396

英國穿戴式科技:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)UK Wearable Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

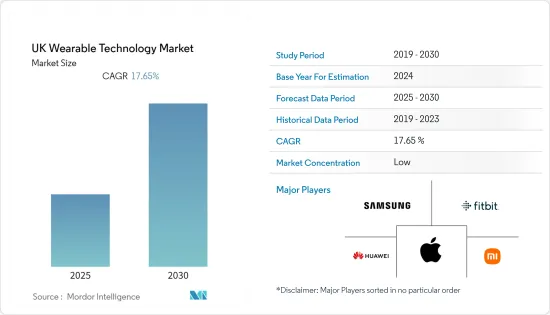

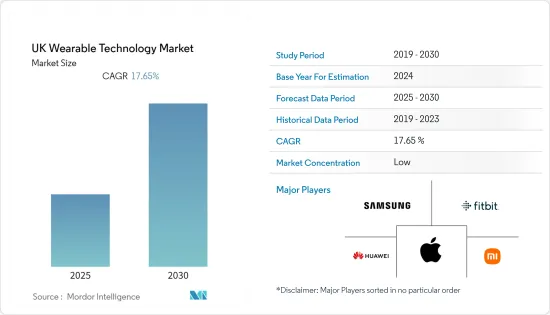

英國穿戴式科技市場預計在預測期內複合年成長率為 17.65%。

主要亮點

- 智慧型手錶、頭戴式顯示器、腕帶、耳戴式裝置和其他裝置類型(智慧服飾)等穿戴式技術正在推動穿戴式科技市場的顯著成長。智慧型手錶和健身追蹤器正在改善消費者的健康和健身。

- 英國政府預計,2024年英國物聯網(IoT)設備數量將增加超過1.5億台。白色家電市場和消費者穿戴式裝置佔所有物聯網 (IoT) 連線的 40% 以上。智慧型手錶、健康和健身追蹤器以及耳掛型設備可能是最主要的類別。許多人廣泛使用智慧型手錶來監測他們的健康狀況並追蹤心率。

- 穿戴式科技的採用正在不斷成長,尤其是在醫療保健領域。患者擴大採用穿戴式科技和行動應用程式來持續監測自己的健康狀況,並透過早期療育和行為改變來減少與健康相關的問題。例如,根據英國政府的說法,國防和安全加速器(DASA)為英國軍方提供了一個重要的機會,可以透過使用穿戴式技術來減少現役士兵的傷害。

- 然而,缺乏高效可靠的電池系統來讓用戶長時間使用穿戴式裝置而不影響其緊湊性是限制所研究市場成長的主要因素。

- 疫情對英國穿戴式科技市場產生了顯著影響。 COVID-19 大流行對供應鏈造成了許多干擾。此外,各種限制也延遲了這些設備的交付。然而,隨著疫情提高了人們對數位技術的認知,這些設備的採用可能會增加。

英國穿戴式科技市場趨勢

智慧型手錶實現巨大成長

- 物聯網主導的智慧型手錶正在推動穿戴式裝置市場的成長。這款智慧型手錶作為獨立技術運行,並與其他 IoT(物聯網)設備交互,可顯著提高消費者的生活品質。這些智慧型手錶在騎自行車或跑步時的無線連接允許用戶追蹤他們的健身,並幫助他們監控他們在參與活動時遇到的情況。

- 資料科學技術和物聯網等技術進步正在推動該市場的需求。智慧型手錶還使用各種應用程式追蹤健身,並在儀表板上顯示用戶的健康相關問題。

- 5G 等高速通訊技術的日益普及預計將推動英國智慧型手錶產業的進一步成長,因為它可以實現更快的連接並進一步擴展智慧型手錶的使用案例。例如,2021年4月,該國所有通訊業者增加了700MHz和3.6-3.8GHz頻段的頻譜持有。

- 2022年2月,Virgin Media O2宣布其5G網路覆蓋首都三分之二,使倫敦成為該集團最大的5G足跡。

- 考慮到不斷成長的需求,多家智慧型手錶製造商已在該國推出了產品。例如,2021 年 10 月,蘋果在英國推出了最新的 Watch Series 7。據該公司稱,Apple Watch Series 7 採用 Watch OS 8、快速充電、更大且改進的顯示器以及新的鋁製外殼顏色。

健康管理的應用預計將顯著促進市場成長

- 智慧型手錶正在徹底改變醫療保健產業,因為它們幫助個人在健康上投入時間,並像醫療感測器一樣發揮作用。這些設備可以收集資料,並在監測心率、血氧水平和活動水平方面發揮重要作用。蘋果、Fitbit、三星和 Fossil 是在該國提供具有醫療保健追蹤功能的智慧型手錶的主要智慧型手錶品牌。

- 此外,健身追蹤器也為穿戴式裝置市場的成長做出了重大貢獻。借助這些設備,使用者可以監控卡路里消耗、睡眠、運動和計步器。健身追蹤器還收集使用者資料,幫助醫生分析患者的健康狀況並提供及時的藥物治療。自 COVID-19 爆發以來,對這些設備的需求大幅增加。這些設備允許醫生遠端記錄使用者的體溫和其他屬性,例如心率。

- 這些設備中的新技術使血糖監測變得更加容易。借助這些設備也可以輕鬆追蹤心血管疾病的增加。隨著人們擴大使用這些設備,電子商務產業正在見證這個市場的巨大成長。

- 考慮到智慧型手錶和其他穿戴式裝置所帶來的好處,尤其是對老年人來說,隨著人口老化,中國對這些裝置的需求正在顯著增加。例如,Fitbit UK 提供 Sense智慧型手錶,該公司稱該手錶使用創新的 EDA 感測器來幫助用戶管理壓力。

英國穿戴科技產業概況

研究的市場高度分散。該市場的主要企業包括蘋果、三星電子、Fitbit、華為科技公司、小米公司和Garmin公司。公司正在透過多個聯盟和合併、計劃投資以及將新產品推向市場來增加市場佔有率。

- 2021 年 5 月 - 最近更名為 Facebook 的母公司 Meta Platforms, Inc. 在倫敦啟動了名為計劃 Aria 的擴增實境(AR) 智慧眼鏡的開發,旨在開發下一代元宇宙解決方案。該公司將開始試驗智慧眼鏡,透過頭戴式顯示器(HMD)中的感測器記錄環境資料。

- 2022 年 4 月 - 中國擴增實境(AR)新興企業Nreal 宣布計劃將其智慧眼鏡引入英國。該公司宣布,將從今年春季開始,透過與當地通訊業者EE 的獨家合作,在英國推出 AR 眼鏡 Nreal Air。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 對穿戴式科技市場的影響

第5章市場動態

- 市場促進因素

- 穿戴式裝置市場的技術不斷進步

- 提高消費者健康意識

- 市場挑戰

- 穿戴式裝置的複雜性不斷增加、功能有限且安全風險增加

第6章 市場細分

- 依設備類型

- 智慧型手錶

- 頭戴式顯示器

- 腕帶

- 耳戴式

- 其他設備類型(智慧服飾)

第7章 競爭格局

- 公司簡介

- Apple Inc.

- Samsung

- Fitbit Inc.

- Huawei Technologies Co. Ltd

- Xiaomi

- Garmin Ltd.

- Fossil Group Inc.

- OnePlus

- Sekonda

- Honor Device Co., Ltd

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91647

The UK Wearable Technology Market is expected to register a CAGR of 17.65% during the forecast period.

Key Highlights

- Wearable technology such as Smart Watches, Head-mounted Displays, Wristbands, Ear-wearables, and Other Device Types (Smart Clothing) are propelling the significant growth of the wearable technology market. Smartwatches, Fitness trackers are enhancing the consumer's wellness and fitness.

- According to UK Government, the number of IoT(Internet of Things) devices in the UK is projected to grow by over 150 million in 2024. The white goods market and consumer wearables account for over 40% of all IoT(Internet of Things) connections. Smartwatches, health and fitness trackers with ear-worn devices will become the most dominant category. Smartwatches are widely used as many people monitor their health and track heart rate.

- The adoption of wearable Technology is growing, especially across the healthcare sector as patients are increasingly adopting wearable technology and mobile apps to monitor their health constantly and mitigate health-related problems through early intervention and behavioral change. For instance, according to the Government of the United Kingdom, Defence and Security Accelerator (DASA) is using wearable technology to present a significant opportunity for the UK Armed Forces to reduce injury to in-service personnel.

- However, the absence of efficient and reliable battery system that can enable the users to use the wearable devices for an extended period without compromising the compactness of the devices is a major factor restraining the growth of the studied market.

- A notable impact of the pandemic has been observed on the UK's wearable technology market. Due to the COVID-19 pandemic, there were many disruptions in the supply chain. Additionally, due to various restrictions, the deliveries of these devices were delayed. However, the adoption of these devices is set to increase as the pandemic has raised awareness of digital technologies.

UK Wearable Technology Market Trends

Smartwatches to Witness Significant Growth

- IoT-driven smartwatches are driving the wearables market growth that will operate as a standalone technology and interact with other IoT(Internet of Things) devices to vastly improve a consumer's quality of life. The wireless connections of these smartwatches while cycling and running enable the users to track their fitness and help them monitor the conditions they encounter while involved in the activities.

- Technological advancements like data science techniques and IoT propel the demand for this market. Smartwatches also track fitness using various applications and display the user's health-related issues on the dashboards.

- The increasing penetration of high-speed telecommunication technologies such as 5G is expected to further the growth of the smartwatches segment in the United Kingdom as they offer high-speed connectivity, which will further expand the use cases of smartwatches. For instance, in April 2021, every operator in the country boosted their spectrum holdings across the 700 MHz and 3.6-3.8 GHz spectrum bands.

- In February 2022, Virgin Media O2 announced that its 5G network had hit two-thirds of the capital, giving London the largest 5G footprint within the group.

- Considering the growing demand, several smartwatch manufacturers are launching their products in the country. For instance, in October 2021, Apple launched its latest Watch Series 7 in the United Kingdom. According to the company, the Apple Watch Series 7 features Watch OS 8, faster charging, a larger and more advanced display, and new aluminum case colors.

Application For Tracking Health Is Expected To Majorly Contribute For Market's Growth

- Smartwatches are revolutionizing the healthcare industry as they help individuals invest time toward their well-being and act like medical sensors. These devices allow data collection and play a vital role in monitoring heart rate, blood oxygen levels, and activity levels. Apple, Fitbit, Samsung, and Fossil are among the leading smartwatch brands offering smartwatches with healthcare tracking features in the country.

- Additionally, fitness trackers also contribute significantly to wearables market growth. With the help of these devices, users can monitor the calories burnt, sleep, exercises, and the step counter. Fitness Trackers also collects the user's data, which helps the doctors analyze the patient's health to offer quick medication. The demand for these devices has increased significantly since the outbreak of Covid-19 as these devices enabled the doctors to record users' body temperature and other attributes such as heart rate remotely.

- With the adoption of new technologies in these devices, glucose monitoring is made easy. The rising cardiovascular cases can also be easily tracked with the help of these devices. The e-commerce industry is witnessing significant growth in this market as people are inclined toward more usage of these devices.

- Considering the benefits smartwatches and other wearables provide, especially to old people, the demand for these devices is increasing significantly in the country along with the aging population. For instance, Fitbit UK offers a Sense smartwatch, which according to the company, enables the users to manage stress with an innovative EDA sensor.

UK Wearable Technology Industry Overview

The market studied is highly fragmented. Some of the significant players in the market are Apple Inc., Samsung Electronics Co. Ltd., Fitbit Inc., Huawei Technologies Co. Ltd., Xiaomi Corporation, and Garmin Ltd. The companies are increasing their market share by forming multiple partnerships and mergers, investing in projects, and launching new products in the market.

- May 2021 - Meta Platforms Inc, the parent company of recently-rebranded Facebook, in a bid to develop the next generation of Metaverse solutions, kicked off the research for its Project Aria augmented reality (AR) smart glasses in London. The company will begin trialling its smart glasses by recording data from environments via the head-mounted display's (HMDs) sensors.

- April 2022 - Nreal, a Chinese augmented reality start-up, unveiled their plans to bring its smart glasses to the U.K. The company announced that it would launch its Nreal Air AR glasses in Britain later this spring through an exclusive deal with local carrier EE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Wearable Technology Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancements in the Wearables Market

- 5.1.2 Increase in Health Awareness among the Consumers

- 5.2 Market Challenges

- 5.2.1 Growing Complexity of Wearable Devices and Limited Use of Features, augmented With Security Risks

6 MARKET SEGMENTATION

- 6.1 By Type of Device

- 6.1.1 Smart Watches

- 6.1.2 Head-mounted Displays

- 6.1.3 Wristbands

- 6.1.4 Ear-wearables

- 6.1.5 Other Device Types (Smart Clothing)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc.

- 7.1.2 Samsung

- 7.1.3 Fitbit Inc.

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 Xiaomi

- 7.1.6 Garmin Ltd.

- 7.1.7 Fossil Group Inc.

- 7.1.8 OnePlus

- 7.1.9 Sekonda

- 7.1.10 Honor Device Co., Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219