|

市場調查報告書

商品編碼

1635478

歐洲 AUV 和 ROV:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe AUV and ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

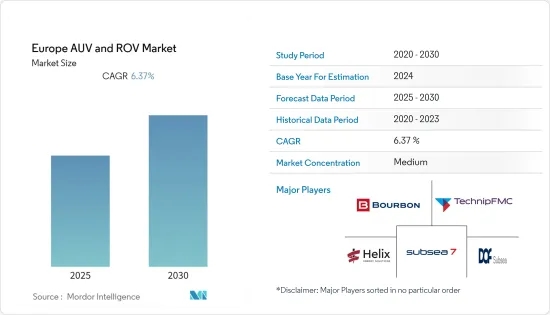

預計歐洲 AUV 和 ROV 市場在預測期內的複合年成長率為 6.37%。

COVID-19 對 2020 年市場產生了負面影響。目前市場已達到疫情前的水準。

主要亮點

- 推動市場的關鍵因素是海上石油和天然氣發現量的增加以及離岸風力發電裝置的增加。

- 另一方面,由於石化燃料使用的增加導致環境破壞日益惡化,歐洲禁止海上石油和天然氣探勘。因此,預計市場在預測期內將放緩。

- AUV 和 ROV 市場的技術進步預計很快就會在歐洲創造巨大的機會。

- 在預測期內,由於英國的上游活動高度發展和自動化,預計英國的調查市場將顯著成長。

歐洲AUV和ROV市場趨勢

ROV車型預計將大幅成長

- 遠端操作水下機器人 (ROV) 是代表與 ROV 相連的地勤人員執行水下任務的機器人。主要ROV作業包括設備維修、科學通訊、疏浚/挖溝、電纜安裝、潛水員觀察、平台檢查、管道檢查、測量、鑽井支援、施工支援、碎片清除、呼叫操作、平台清潔和海底安裝。物體定位和恢復等等。

- ROV 非常複雜,服務於各個領域,包括搜救、軍事、水產養殖、休閒、發現、石油和天然氣、海上能源、水下基礎設施和海上運輸。推動市場的關鍵因素包括石油和天然氣生產活動的增加、離岸風力發電行業的成長以及海上石油和天然氣退役活動的增加。

- 此外,ROV還具有在極端深度作業的優勢,可以長時間保持在水下。即使在正常駕駛條件下難以做到的惡劣條件下,它也能準確地執行重複性任務。與載人車輛相比,ROV 體積更小且相對便宜。

- 與北海相比,地中海的石油和天然氣鑽探活動相對較低。然而,該地區的海上活動主要是跨地中海管道、液化天然氣基礎設施和向歐洲運輸貨物的大型海運貨櫃。因此,石油和天然氣的投資相對較低。儘管有這些因素,碳氫化合物探勘與生產領域仍在進行多項投資。 2022 年 2 月,Reach Subsea 獲得了在地中海開展海底節點 (OBN)宣傳活動的契約,預計將於 2022 年開始營運。

- 該地區的大部分 ROV 合約都是 IRM 服務契約,涉及從北非向歐洲供應天然氣的跨大陸管道。阿爾及利亞和摩洛哥等北非天然氣生產國也在增加液化天然氣出口能力。歐洲地中海國家也正在投資液化天然氣處理基礎設施。

- 自2022年2月俄羅斯入侵烏克蘭以來,大多數歐洲國家對烏克蘭實施了經濟制裁,並尋求俄羅斯能源進口的可行替代方案。此外,天然氣仍然是大多數歐洲國家能源轉型策略的關鍵要素,因為歐盟致力於透過減少碳排放來實現重大環境目標。因此,義大利、西班牙和巴爾幹半島等南歐地中海沿岸國家的進口能力對歐洲當地的能源安全至關重要。例如,來自歐洲的液化天然氣進口量已從 2015 年的 560 億立方公尺 (bcm) 大幅增加至 2021 年的約 1,082 bcm。

- 為了減少俄羅斯天然氣消耗並增加進口能力,德國政府指示公用事業公司 RWE 和 Uniper 從希臘 Dynagas 和挪威 Hoegh 租賃了三個浮體式儲存和再氣化裝置 (FSRU)。浮體式儲存和再氣化裝置 (FSRU) 通常可重複使用來再氣化大量液化天然氣,從而大幅減少投資和建設時間。它的運作所需要的只是一個深海港。液化天然氣進口需求的不斷成長導致海上 ROV 服務的使用量增加,以進行檢查,預計將在預測期內推動市場發展。

- 因此,基於上述因素,ROV車輛類型預計在預測期內在歐洲AUV和ROV市場上表現出巨大的需求。

英國看到龐大的需求

- 預計英國將增加北海的生產和探勘活動,特別是為了減少對俄羅斯天然氣和石油進口的依賴。此外,根據英國能源統計文摘,原油產量已從 2014 年的 37,474,000 噸大幅增加至 2021 年的約 38,239,000 噸。

- 在國家能源危機的呼聲中,由於天然氣價格飆升和長期能源不安全的威脅,英國氣候變遷委員會不反對為北海進一步石油和天然氣探勘頒發新許可證。預計這將成為 AUV 和 ROV 市場的主要驅動力之一。

- 北海大部分油田已成熟,不少已達到或即將達到退役階段,退役服務需求仍高。海上 AUV 和 ROV 的需求仍然很高,因為海洋退役對於人類潛水員來說是一項具有挑戰性和危險的任務。

- 例如,2021年12月,馬士基供應服務公司(MSS)贏得了海王星能源公司的一份契約,將英國北海的朱麗葉油田退役。合約的主要活動包括使用公共事業ROV 服務系統 (UTROV) 拆除管軸和供應連系管,UTROV 是一種遠端操作工具載體,配備多個用於海底設備回收的附件。退役市場的需求預計將成為預測期內市場的主要驅動力。

- 因此,基於上述因素,預計英國在預測期內將對歐洲AUV和ROV市場表現出巨大的需求。

歐洲AUV和ROV產業概況

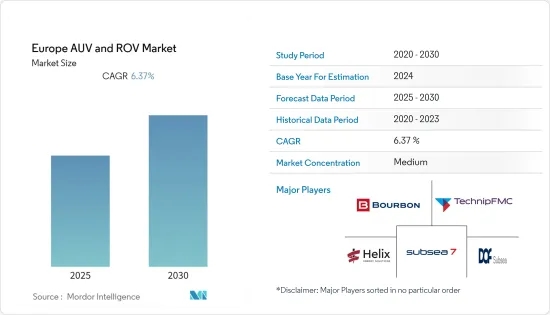

歐洲 AUV/ROV 市場適度整合。市場的主要企業包括(排名不分先後)DOF Subsea AS、Helix Energy Solutions Group Inc.、TechnipFMC PLC、Bourbon Offshore 和 Subsea 7 SA。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按車型

- ROV

- AUV

- 按車輛類別

- 工作班

- 觀察班

- 按用途

- 石油和天然氣

- 防禦

- 其他

- 按活動

- 鑽探和開發

- 建造

- 檢查、修理、保養

- 退休

- 其他活動

- 按地區

- 英國

- 挪威

- 丹麥

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- DOF Subsea AS

- Helix Energy Solutions Group Inc.

- TechnipFMC PLC

- Bourbon Offshore

- Subsea 7 SA

- Saipem SpA

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92829

The Europe AUV and ROV Market is expected to register a CAGR of 6.37% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently, the market has reached the pre-pandemic level.

Key Highlights

- The major driving factors of the market are increasing offshore oil and gas discoveries and growing offshore wind energy installations.

- On the flip side, escalating environmental damages due to the increasing use of fossil fuels have led to a ban on offshore exploration of oil and gas in the European region. This is expected to slow down the market during the forecast period.

- Nevertheless, technological advancements in the AUV and ROV market are expected to create enormous opportunities for the European region soon.

- During the forecast period, the United Kingdom is expected to witness significant growth in the market studied, as the country's upstream activities are highly developed and automated.

Europe AUV & ROV Market Trends

ROV Vehicle Type Expected to Witness Significant Growth

- Remotely-operated underwater vehicles (ROVs) are robots that complete functions underwater on behalf of a crew located on the surface, with whom the ROV is tethered. Some of the significant tasks of ROV include - equipment repair, scientific analysis, dredging/trenching, cable-laying, diver observation, platform inspection, pipeline inspection, surveys, drilling support, construction support, debris removal, call-out work, platform cleaning, subsea installations, telecommunications support, and object location and recovery.

- ROVs are incredibly complex and serve various sectors, such as search and rescue, military, aquaculture, recreation, discovery, oil and gas industry, offshore energy, submerged infrastructure, and shipping. Major factors driving the market studied include rising offshore oil and gas production activities, growing offshore wind power industry, and increasing offshore oil and gas decommissioning activities.

- Furthermore, ROV offers the advantage of being operated at extreme depths and can remain underwater for extended periods. Repeated tasks can be completed accurately and under harsh conditions that would hamper general driving conditions. Also, ROVs are less bulky compared to human-crewed vehicles and are relatively inexpensive.

- Oil and gas drilling activity in the Mediterranean Sea is relatively lower than in the North Sea. However, the marine activity in the region is dominated by trans-Mediterranean pipelines, LNG infrastructure, and large marine containers shipping goods to Europe. Due to this, oil and gas investments are relatively low. Despite these factors, some investments are being made in the hydrocarbon E&P sector. In February 2022, Reach Subsea won a contract to perform an ocean bottom node (OBN) campaign in the Mediterranean Sea, expecting to begin operations in 2022.

- Majority ROV contracts in the region are for the IRM service contracts for the trans-continental pipeline supplying gas from North Africa to Europe. Gas producers in North Africa, such as Algeria and Morocco, have also increased their LNG export capacities. Countries on the Mediterranean coast in Europe are also investing in LNG handling infrastructure.

- Since Russia's invasion of Ukraine in February 2022, most European countries have placed economic sanctions on the country and want to find a viable alternative to Russian energy imports. Additionally, as the EU has pledged to achieve significant environmental targets by reducing carbon emissions, natural gas remains the main component of the Energy Transition strategy of most European nations. Due to this, the import capabilities of Southern European Nations along the Mediterranean coast, such as Italy, Spain, and the Balkans, are critical to the energy security of mainland Europe. For instance, LNG imports from the European region have increased significantly from 56 billion cubic meters (bcm) in 2015 to about 108.2 bcm in 2021.

- To reduce the consumption of Russian gas and increase import capacity, the German government instructed utilities RWE and Uniper to rent 3 Floating Storage and Regasification Units (FSRUs) from the Greek company Dynagas and the Norwegian Hoegh. As Floating Storage and Regasification Units (FRSUs) are often former supertankers repurposed to regasify significant quantities of LNG, they need significantly less investment and construction time. They only require a deep sea port for operation. The increased demand for LNG imports mandates the increased use of offshore ROV services for inspection, which is expected to drive the market during the forecast period.

- Therefore, based on the above-mentioned factors, the ROV vehicle type is expected to witness significant demand in the European AUV and ROV market during the forecast period.

United Kingdom to Witness Significant Demand

- To reduce the dependence on the import of natural gas and crude oil, especially from Russia, the North Sea production and exploration activities are expected to increase in the United Kingdom. Further, according to the Digest of United Kingdom Energy Statistics, crude oil production volume has increased significantly from 37,474 thousand metric tons in 2014 to about 38,239 thousand metric tons in 2021.

- Amid the energy crisis in the country, the United Kingdom's Committee on Climate Change has reported that due to the escalating natural gas prices and threat to long-term energy insecurity, it would not object to issuing new licenses for further oil and gas exploration in the North Sea. It will be one of the primary drivers for the AUV and ROV market.

- As most fields in the North Sea are mature, and many fields have either reached or are about to reach their decommissioning phase, the demand for decommissioning services remains high. As marine decommissioning is a challenging and dangerous operation for human divers, the demand for offshore AUVs and ROVs remains high.

- For instance, in December 2021, Maersk Supply Service (MSS) won a decommissioning contract from Neptune Energy for the Juliet field in the United Kingdom's North Sea marine territory. The contract's primary operation included removing piping spools and umbilicals using the utility ROV services system (UTROV), a remotely-operated tool carrier equipped with multiple attachments for the recovery of subsea equipment. The demand from the decommissioning market is expected to be a significant driving factor for the market during the forecast period.

- Therefore, based on the above-mentioned factors, United Kingdom is expected to witness significant demand for the AUV and ROV market in European region during the forecast period.

Europe AUV & ROV Industry Overview

The European AUV and ROV market is moderately consolidated. Some of the major players in the market (in no particular order) include DOF Subsea AS, Helix Energy Solutions Group Inc., TechnipFMC PLC, Bourbon Offshore, and Subsea 7 SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Million, Till 2027

- 4.3 Recent Trends And Developments

- 4.4 Government Policies And Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 ROV

- 5.1.2 AUV

- 5.2 By Vehicle Class

- 5.2.1 Work Class Vehicle

- 5.2.2 Observatory Class Vehicle

- 5.3 By Application

- 5.3.1 Oil and Gas

- 5.3.2 Defense

- 5.3.3 Other Application Types

- 5.4 By Activity

- 5.4.1 Drilling and Development

- 5.4.2 Construction

- 5.4.3 Inspection, Repair, and Maintenance

- 5.4.4 Decommisioning

- 5.4.5 Other Activity Types

- 5.5 By Geography

- 5.5.1 United Kingdom

- 5.5.2 Norway

- 5.5.3 Denmark

- 5.5.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Strategies Adopted By Leading Players

- 6.3 Company Profiles

- 6.3.1

DOF Subsea AS

- 6.3.2 Helix Energy Solutions Group Inc.

- 6.3.3 TechnipFMC PLC

- 6.3.4 Bourbon Offshore

- 6.3.5 Subsea 7 SA

- 6.3.6 Saipem SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219