|

市場調查報告書

商品編碼

1635468

中東和非洲的 AUV 和 ROV:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030 年)Middle-East and Africa AUV & ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

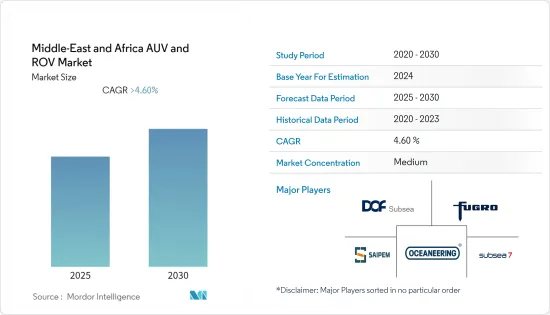

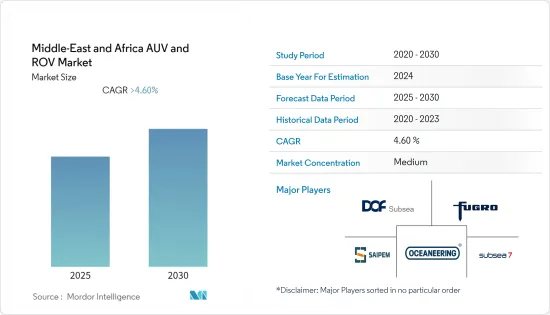

中東和非洲的 AUV 和 ROV 市場預計在預測期內複合年成長率將超過 4.6%。

COVID-19大流行對2020年的市場產生了負面影響。目前市場處於大流行前的水平。

主要亮點

- 在沙烏地阿拉伯、阿拉伯聯合大公國、阿曼、加納和象牙海岸共和國等中東和非洲國家,石油和天然氣生產活動的增加以及石油和天然氣退役活動的增加預計將在預測期內推動市場。

- 同時,波斯灣盆地海上鑽機數量和海上油氣活動的下降預計將抑制市場。

- 持續進行的深水和超深水石油和天然氣發現以及頁岩氣探勘預計將在預測期內為中東和非洲 AUV 和 ROV 市場提供巨大機會。

- 隨著全國石油和天然氣活動的增加,沙烏地阿拉伯預計將在預測期內主導市場。

中東和非洲AUV和ROV市場趨勢

石油和天然氣領域預計將主導市場

- 中東和非洲是世界重要地區,已探明天然氣田蘊藏量。該地區科威特、沙烏地阿拉伯、伊朗、卡達、奈及利亞、喀麥隆和阿拉伯聯合大公國的海上蘊藏量仍未開發,所有這些國家都計劃進行大規模石油開發。

- 截至2021年,中東石油總產量已達2,815.6萬桶/日。隨著世界能源需求的快速成長,海上石油生產已成為一種有吸引力的能源來源。因此,地區實力雄厚的國家都將重點放在海上油氣天然氣田的探勘和生產。

- 例如,今年,阿布達比國家石油公司(ADNOC)啟動了工程、採購、施工和安裝合約競標程序,以進一步開發巨型下札庫姆海上油田。該油田的開發將包括多項服務,包括基礎設施、海底管線和海底系統的建設。所有這些服務都需要 ROV 或 AUV 進行安裝和監控。

- 此外,2022 年 6 月,沙烏地阿拉伯阿卜杜拉國王科技大學 (KAUST) 宣布與遠洋自主水下和水面機器人 (AUV) 製造服務供應商Ocean Aero 達成新的合作協議。 Ocean Aero 和 Shelf Subsea 旨在將 AUV 引入沙烏地阿拉伯,並加強 KAUST 對紅海的研究。

- 此外,從2021年到2025年,中東地區已核准了超過77個上游計劃,非洲地區已批准了27個上游項目。這些計劃大多是海上油田計劃,需要 ROV 和 AUV 來提供各種服務。預計這將在預測期內推動受調查市場的發展。

- 因此,石油和天然氣領域預計將在預測期內主導市場。

沙烏地阿拉伯可望主導市場

- 沙烏地阿拉伯擁有豐富的石油和天然氣蘊藏量。該地區擁有最發達的石油和天然氣工業之一,其中波斯灣的巨大蘊藏量是主要焦點。隨著鑽井深度逐年增加,技術可採蘊藏量也大幅增加,導致投資增加。

- ROV 和 AUV 技術變得越來越便宜。因此,沙烏地阿拉伯石油和天然氣生產商正在投資 ROV 和 AUV 服務,用於海底資產和海面資料收集以及日常維護作業。儘管 ROV 和 AUV 的初始成本比潛水作業更高,但完成相同工作量所需的時間更少,從而降低了整體計劃營運成本。

- 沙烏地阿拉伯正在擴大其現有的石油和天然氣田。主要擴建計劃包括貝裡油田和馬里安油田。貝裡油田部分位於沙烏地阿拉伯東海岸陸上,部分位於海上。貝裡增產計畫 (BIP) 正在進行擴建,到 2023 年,原油產能將加倍,達到 50 萬桶/日。該計劃計劃明年運作,預計投資60億美元。該計劃預計將推動 ROV 和 AUV 市場的未來需求。截至2021年,沙烏地阿拉伯的原油產量約為10,954(1,000桶/天)。

- 此外,2021 年 12 月,Fugro NV 在沙烏地阿拉伯海岸部署了兩個新的自主環境登陸器,以收集紅海深處偏遠地區的海洋學資料。該計劃旨在支持沙烏地阿拉伯 2030 年願景。

- 此外,2022 年 9 月,沙烏地阿拉伯政府宣布計畫採購中國先進的隱形 AUV,用於石油、天然氣和國防行動。

- 因此,鑑於上述幾點,預計沙烏地阿拉伯在預測期內將主導中東和非洲AUV和ROV市場。

中東和非洲 AUV 和 ROV 產業概況

中東和非洲 AUV 和 ROV 市場因其性質而適度細分。市場的主要企業包括(排名不分先後)DOF Subsea AS、Fugro NV、Subsea 7 SA、Saipem SpA 和 Oceaneering International Inc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 政府法規和措施

- 最新趨勢和發展

- 市場動態

- 促進因素

- 抑制因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按車型

- ROV

- AUV

- 最終用戶使用情況

- 石油和天然氣

- 防禦

- 研究

- 其他最終用戶用途

- 按地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- DOF Subsea AS

- Fugro NV

- Subsea 7 SA

- Saipem SpA

- Oceaneering International Inc.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92804

The Middle-East and Africa AUV & ROV Market is expected to register a CAGR of greater than 4.6% during the forecast period.

The COVID-19 pandemic negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Rising oil and gas production activities, along with increasing oil and gas decommissioning activities in various Middle Eastern and African countries, such as Saudi Arabia, United Arab Emirates, Oman, Ghana, and Ivory Coast, are expected to drive the market during the forecast period.

- On the other hand, the declining number of offshore rigs and offshore oil and gas activities in the Persian Gulf Basin is expected to restrain the market.

- Nevertheless, the ongoing deepwater and ultra-deepwater oil and gas discoveries and shale gas explorations are expected to create enormous opportunities for the Middle East and Africa AUV and ROV market during the forecast period.

- Due to increasing oil and gas activities across the country, Saudi Arabia is expected to dominate the market during the forecast period.

MEA AUV & ROV Market Trends

Oil and Gas Segment is Expected to Dominate the Market

- The Middle East and Africa are significant regions of proven oil and gas field reserves worldwide. The region's offshore reserves remain underdeveloped in Kuwait, Saudi Arabia, Iran, Qatar, Nigeria, Cameroon, and the United Arab Emirates, all of which have significant field developments in trains.

- As of 2021, the total oil production in the Middle East reached 28,156 thousand barrels daily. With the rapidly increasing global energy needs, offshore oil production has become an attractive energy source. Therefore, countries with significant regional players are focusing on exploring and producing offshore oil and gas fields.

- For instance, this year, Abu Dhabi National Oil Company (ADNOC) kicked off a bid process for engineering, procurement, construction, and installation contract for further development at its giant Lower Zakum offshore oilfield. The development of the field includes several services, such as the construction of infrastructure, subsea pipelines, and subsea systems. All these services require ROV and AUV for installation and monitoring.

- Moreover, in June 2022, Saudi's King Abdullah University of Science and Technology (KAUST) announced a new collaboration agreement with Ocean Aero, a manufacturer and service provider of ocean-going Autonomous Underwater and Surface Vehicles (AUVs). Ocean Aero and Shelf Subsea aim to bring the AUVs into Saudi Arabia, enhancing KAUST research on the Red Sea.

- Furthermore, as of 2021-2025, there are more than 77 approved upstream projects in the Middle East and 27 approved upstream projects in the African region. Most of these projects are offshore field projects requiring ROVs and AUVs for various services. This, in turn, is expected to drive the market studied during the forecast period.

- Therefore, the oil and gas segment is expected to dominate the market during the forecast period.

Saudi Arabia is Expected to Dominate the Market

- Saudi Arabia is rich in oil and gas reserves. The region has one of the most well-developed oil and gas industries, with the primary areas of focus being the vast reserves in the Persian Gulf. As drilling depths have increased over the years, the volume of technically recoverable reserves has increased significantly, which has attracted growing investments.

- ROV and AUV technologies have become increasingly affordable. Therefore, oil and gas producers in Saudi Arabia have invested in ROV and AUV services for obtaining data and carrying out routine maintenance work on subsea assets and surfaces. Despite higher upfront costs than those of the diving crews, ROVs and AUVs need less time to complete the same amount of work, reducing overall project OPEX.

- Saudi Arabia is in the process of expanding its existing oil & gas fields. Major expansion projects include the Berri field and the Marjan Oil field. The Berri field is located partly onshore and partly offshore on the east coast of Saudi Arabia. It is being expanded under the Berri Increment Program (BIP) to double its crude oil production capacity to 500,000 barrels per day by 2023. The project is scheduled to commission next year, with an estimated investment of USD 6 billion. It is expected to drive future demand for the ROV and AUV market. As of 2021, Saudi Arabia had crude oil production of about 10,954 in thousand barrels per day.

- Moreover, in December 2021, Fugro NV deployed two new autonomous environmental landers off the coast of Saudi Arabia to collect oceanographic data in deep remote areas of the Red Sea. The project aims to support Saudi Vision 2030.

- Furthermore, in September 2022, the Government of Saudi Arabia announced its plan to procure highly advanced stealth Chinese AUVs for oil and gas and defense operations.

- Therefore, owing to the above points, Saudi Arabia is expected to dominate the Middle East and Africa AUV & ROV market during the forecast period.

MEA AUV & ROV Industry Overview

The Middle East and Africa AUV & ROV market is moderately fragmented in nature. Some of the market's key players (in no particular order) include DOF Subsea AS, Fugro NV, Subsea 7 SA, Saipem SpA, and Oceaneering International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Billion, Till 2027

- 4.3 Government Policies And Regulations

- 4.4 Recent Trends And Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 ROV

- 5.1.2 AUV

- 5.2 End-user Application

- 5.2.1 Oil and Gas

- 5.2.2 Defense

- 5.2.3 Research

- 5.2.4 Other End-user Applications

- 5.3 By Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Strategies Adopted By Leading Players

- 6.3 Company Profiles

- 6.3.1 DOF Subsea AS

- 6.3.2 Fugro NV

- 6.3.3 Subsea 7 SA

- 6.3.4 Saipem SpA

- 6.3.5 Oceaneering International Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219